Concept explainers

a.

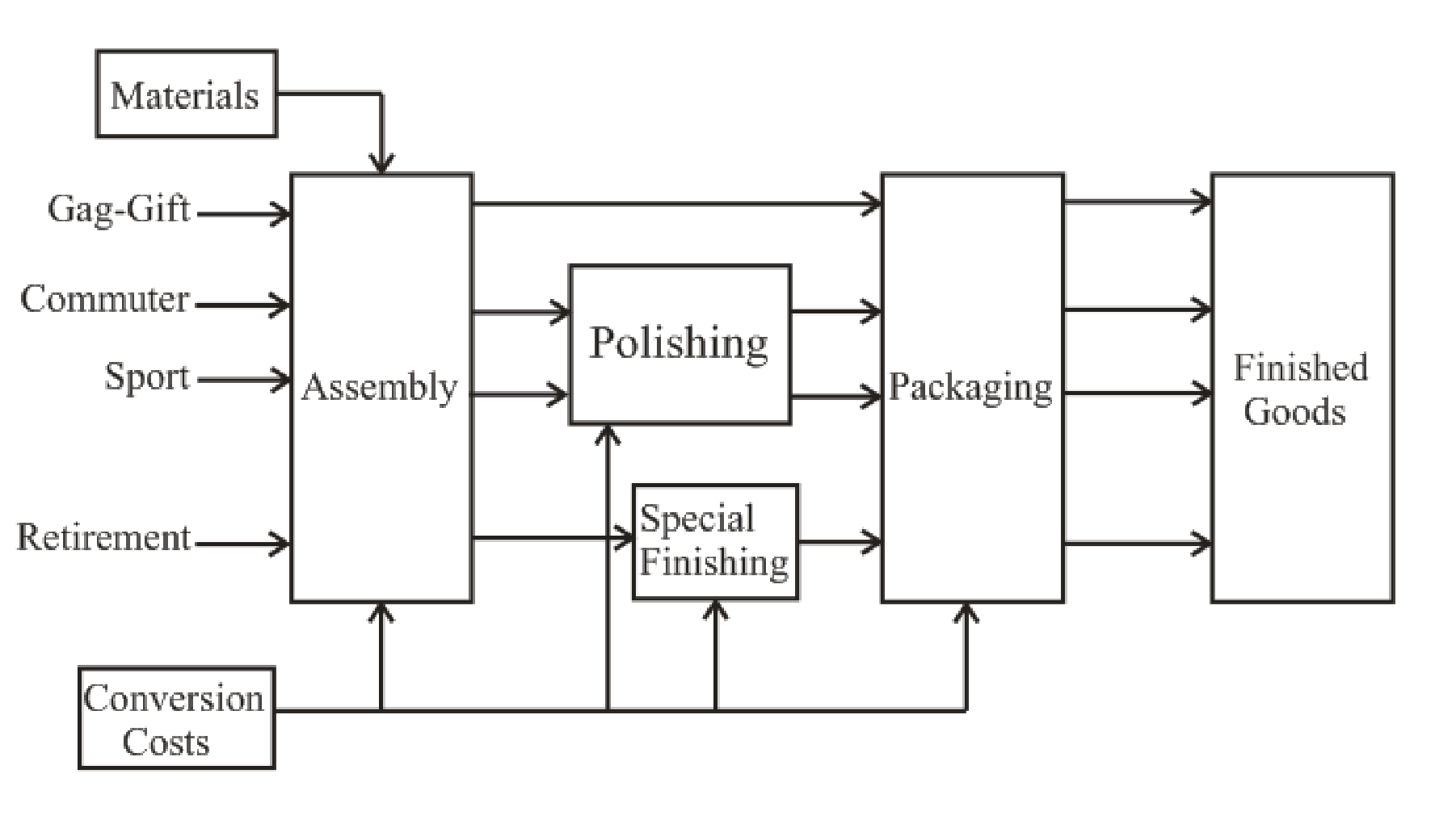

Draw the flow of the different models through the production process.

a.

Explanation of Solution

Production cost:

Production cost refers to the cost associated with the production process. Direct costs associated with the process and stages of completion are taken into consideration while computing the cost of the production of any product.

Description of the diagram:

The four products go through the process as drawn above. All the four products go through assembly line. Only the products commuter and sport go for polishing before going through packaging. Product retirement goes through special finishing process and not polishing. The only product that has been packaged straight away from assembly line is Gag-Gift. All the products are then converted into finished goods.

The cost will be different for every product as well. Gag-Gift will include assembly and packaging. Commuter and sport will include assembly, polishing and packaging. Retirement includes cost of assembly, special finishing and packaging.

b.

Determine the cost per unit transferred to finished goods inventory for each of the four watches.

b.

Explanation of Solution

Cost per unit:

Total amount accounted for and total units accounted are considered computation of cost per equivalent unit.

Compute the cost per unit transferred to finished goods inventory for each of the four watches:

| Particulars | Total | Gag-Gift | Commuter | Sport | Retirement |

| Materials | $ 321,000 | $ 15,000 | $ 90,000 | $ 156,000 | $ 60,000 |

| Conversion costs: | |||||

| Assembly | $ 120,000 | $ 20,000(1) | $ 40,000(2) | $ 52,000(3) | $ 8,000(4) |

| Polishing | $ 69,000 | $ 0 | $ 30,000(5) | $ 39,000(6) | $ 0 |

| Special finishing | $ 20,000 | $ 0 | $ 0 | $ 0 | $ 20,000(7) |

| Packaging | $ 90,000 | $ 15,000(8) | $ 30,000(9) | $ 39,000(10) | $ 6,000(11) |

| Total conversion costs | $ 299,000 | $ 35,000 | $ 100,000 | $ 130,000 | $ 34,000 |

| Total product cost | $ 620,000 | $ 50,000 | $ 190,000 | $ 286,000 | $ 94,000 |

| Number of units | 5,000 | 10,000 | 13,000 | 2,000 | |

| Cost per unit | $ 10.00(12) | $ 19.00(13) | $ 22.00(14) | $ 47.00(15) |

Working note 1:

Compute the conversion costs of assembly for Gag-gift:

Working note 2:

Compute the conversion costs of assembly for Commuter:

Working note 3:

Compute the conversion costs of assembly for Sport:

Working note 4:

Compute the conversion costs of assembly for Retirement:

Working note 5:

Compute the conversion costs of polishing for Commuter:

Working note 6:

Compute the conversion costs of polishing for Sport:

Working note 7:

Compute the conversion costs of special packaging for Retirement:

Working note 8:

Compute the conversion costs of packaging for Gag-gift:

Working note 9:

Compute the conversion costs of packaging for Commuter:

Working note 10:

Compute the conversion costs of packaging for Sport:

Working note 11:

Compute the conversion costs of packaging for Retirement:

Working note 12:

Compute the cost per unit transferred to finished goods for Gag-gift:

Working note 13:

Compute the cost per unit transferred to finished goods for Commuter:

Working note 14:

Compute the cost per unit transferred to finished goods for Gag-gift:

Working note 15:

Compute the cost per unit transferred to finished goods for Gag-gift:

Want to see more full solutions like this?

Chapter 8 Solutions

FUNDAMENTALS OF COST ACCOUNTING BUNDLE

- I am looking for the correct answer to this financial accounting problem using valid accounting standards.arrow_forwardThe insurance company reimburses MHC on a fee-for-service basis, with an average reimbursement rate of $12,000 per admission.arrow_forwardI need help with this general accounting problem using proper accounting guidelines.arrow_forward

- Salvador Manufacturing estimates that annual manufacturing overhead costs will be $842,400. Estimated annual operating activity bases are direct labor costs of $496,000, direct labor hours of 41,200, and machine hours of 90,400. Compute the predetermined overhead rate for each activity base: a. Overhead rate per direct labor cost b. Overhead rate per direct labor hour c. Overhead rate per machine hourarrow_forwardI need help in this question . accounting.arrow_forwardNeedarrow_forward

- Please give me answer with accounting questionarrow_forwardWhat is the correct answer with accounting questionarrow_forwardGrouper Corporation purchased machinery on January 1, 2025, at a cost of $264,000. The estimated useful life of the machinery is 4 years, with an estimated salvage value at the end of that period of $31,400. The company is considering different depreciation methods that could be used for financial reporting purposes. (a) Your answer is partially correct. Prepare separate depreciation schedules for the machinery using the straight-line method, and the declining-balance method using double the straight-line rate. STRAIGHT-LINE DEPRECIATION epreciation Rate 50 % do do % End of Year Annual Depreciation Expense Accumulated Depreciation Book Value +A 58150 $ +A % do do % 58150 58150 58150 +A $ 232600arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning