Concept explainers

a.

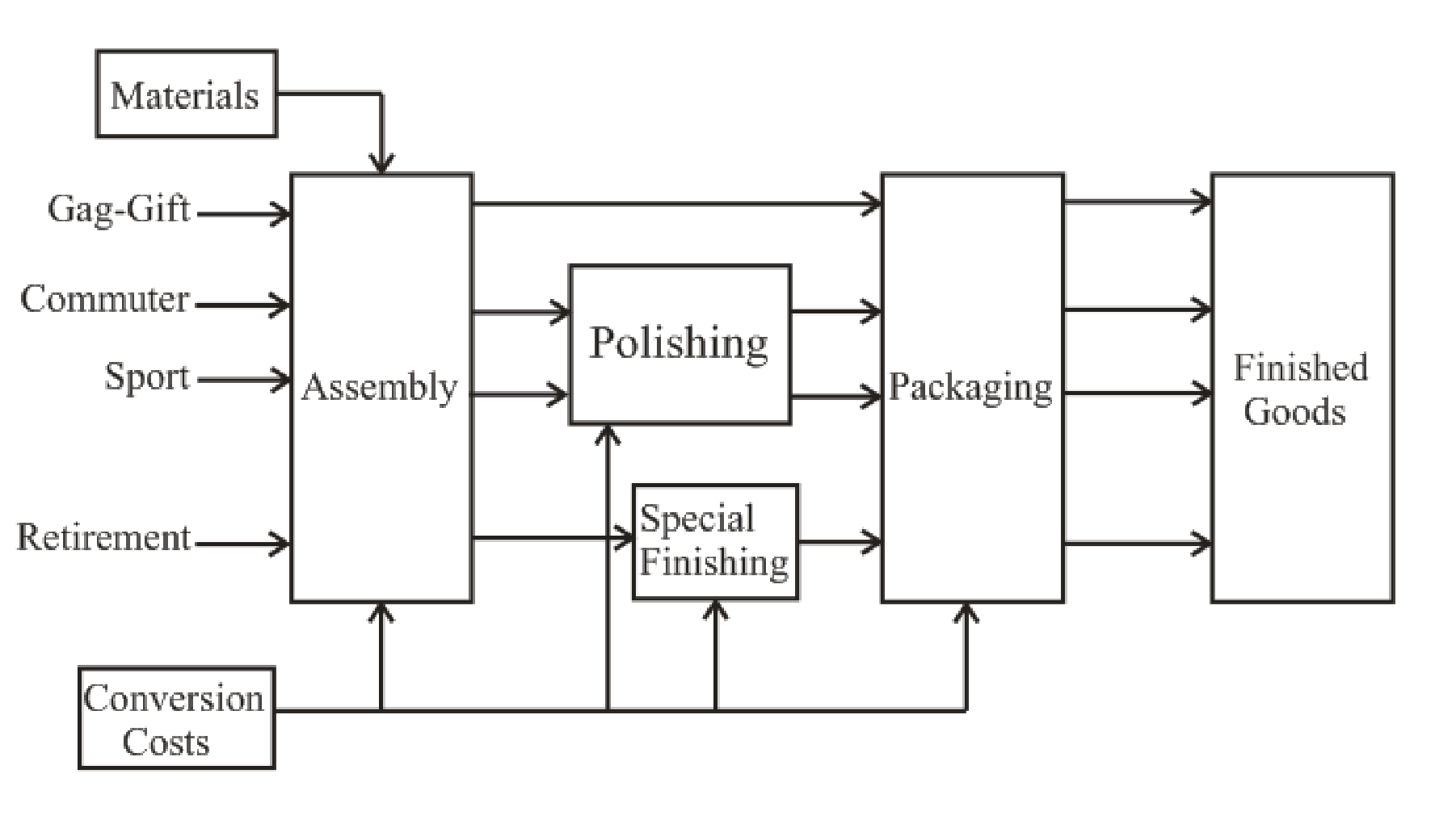

Draw the flow of the different models through the production process.

a.

Explanation of Solution

Production cost:

Production cost refers to the cost associated with the production process. Direct costs associated with the process and stages of completion are taken into consideration while computing the cost of the production of any product.

Description of the diagram:

The four products go through the process as drawn above. All the four products go through assembly line. Only the products commuter and sport go for polishing before going through packaging. Product retirement goes through special finishing process and not polishing. The only product that has been packaged straight away from assembly line is Gag-Gift. All the products are then converted into finished goods.

The cost will be different for every product as well. Gag-Gift will include assembly and packaging. Commuter and sport will include assembly, polishing and packaging. Retirement includes cost of assembly, special finishing and packaging.

b.

Determine the cost per unit transferred to finished goods inventory for each of the four watches.

b.

Explanation of Solution

Cost per unit:

Total amount accounted for and total units accounted are considered computation of cost per equivalent unit.

Compute the cost per unit transferred to finished goods inventory for each of the four watches:

| Particulars | Total | Gag-Gift | Commuter | Sport | Retirement |

| Materials | $ 321,000 | $ 15,000 | $ 90,000 | $ 156,000 | $ 60,000 |

| Conversion costs: | |||||

| Assembly | $ 120,000 | $ 20,000(1) | $ 40,000(2) | $ 52,000(3) | $ 8,000(4) |

| Polishing | $ 69,000 | $ 0 | $ 30,000(5) | $ 39,000(6) | $ 0 |

| Special finishing | $ 20,000 | $ 0 | $ 0 | $ 0 | $ 20,000(7) |

| Packaging | $ 90,000 | $ 15,000(8) | $ 30,000(9) | $ 39,000(10) | $ 6,000(11) |

| Total conversion costs | $ 299,000 | $ 35,000 | $ 100,000 | $ 130,000 | $ 34,000 |

| Total product cost | $ 620,000 | $ 50,000 | $ 190,000 | $ 286,000 | $ 94,000 |

| Number of units | 5,000 | 10,000 | 13,000 | 2,000 | |

| Cost per unit | $ 10.00(12) | $ 19.00(13) | $ 22.00(14) | $ 47.00(15) |

Working note 1:

Compute the conversion costs of assembly for Gag-gift:

Working note 2:

Compute the conversion costs of assembly for Commuter:

Working note 3:

Compute the conversion costs of assembly for Sport:

Working note 4:

Compute the conversion costs of assembly for Retirement:

Working note 5:

Compute the conversion costs of polishing for Commuter:

Working note 6:

Compute the conversion costs of polishing for Sport:

Working note 7:

Compute the conversion costs of special packaging for Retirement:

Working note 8:

Compute the conversion costs of packaging for Gag-gift:

Working note 9:

Compute the conversion costs of packaging for Commuter:

Working note 10:

Compute the conversion costs of packaging for Sport:

Working note 11:

Compute the conversion costs of packaging for Retirement:

Working note 12:

Compute the cost per unit transferred to finished goods for Gag-gift:

Working note 13:

Compute the cost per unit transferred to finished goods for Commuter:

Working note 14:

Compute the cost per unit transferred to finished goods for Gag-gift:

Working note 15:

Compute the cost per unit transferred to finished goods for Gag-gift:

Want to see more full solutions like this?

Chapter 8 Solutions

Gen Combo Fundamentals Of Cost Accounting; Connect Access Card

- Can you help me solve this general accounting question using the correct accounting procedures?arrow_forwardEcho Corporation had accounts receivable of $95,000 at January 1, 2023. At December 31, 2023, accounts receivable was $75,000. Sales for 2023 totaled $650,000. Compute Echo Corporation's 2023 cash receipts from customers.arrow_forwardProvide answerarrow_forward

- Please provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardNonearrow_forwardO'Keeffe Corporation's trial balance shows Accounts Receivable with a debit balance of $350,000. The company estimates that 3% of receivables will be uncollectible. If the Allowance for Doubtful Accounts has a credit balance of $4,200 before adjustment, what is the required adjusting entry for bad debt expense?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,