1.

To prepare:

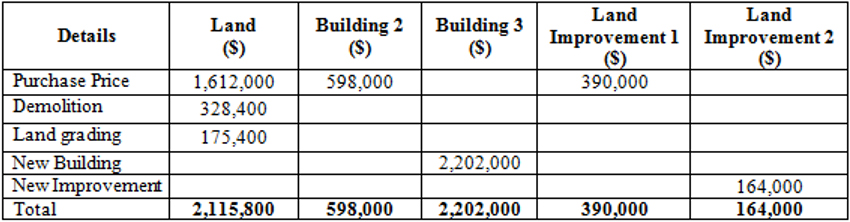

A table and to allocate the cost.

1.

Explanation of Solution

Prepare table to show allocation of cost:

Table (1)

Working Notes:

Computation of total appraised value:

Total appraised value is $2,800,000.

Land

Computation of percentage of land of the total appraised value:

Percentage of land is 62%.

Apportioned cost

Computation of apportioned cost:

Apportioned cost of land is $1,612,000.

Building

Computation of percentage of building of the total appraised value:

Percentage of building is 23%.

Apportioned cost

Apportioned cost of building is $598,000.

Land Improvements 1

Computation of percentage of land improvements 1 of the total appraised value:

Percentage of land improvement 1 is 15%.

Apportioned cost

Computation of apportioned cost:

Apportioned cost of land improvement 1 is $390,000.

2.

To prepare:

2.

Explanation of Solution

Record the entry for purchase of assets.

| Date | Account Title and Explanation | Post ref | Debit ($) |

Credit ($) |

|---|---|---|---|---|

| Jan1 | Land | 2,115,800 | ||

| Building 2 | 598,000 | |||

| Building 3 | 2,202,000 | |||

| Land improvements 1 | 390,000 | |||

| Land improvements 2 | 164,000 | |||

| Cash | 5,469,800 | |||

| (To record the purchase of assets) |

Table (2)

• Building is an asset account. Building account increases as the new building has been purchased. Hence, the Building account is debited.

• Land is an asset account. Land account increases as a new land is purchased and all the assets are debited as a new asset is purchased or if its value increases.

• Vehicle account is an asset account. Vehicles account increases as a new vehicle is purchased and all the assets are debited as a new asset is purchased or if its value increases.

• Land improvements are an asset account. Land improvement account increases as some improvements have been done on land to increase its useful life and all the assets are debited as their value increases.

• Cash account is an asset account. Cash account decreases as the amount paid for the purchase of all assets are made in cash and all the assets are credited as their values decreases.

3.

To prepare:

3.

Explanation of Solution

Building 2

Record

| Date | Account Title and Explanation | Post ref | Debit ($) |

Credit ($) |

|---|---|---|---|---|

| Depreciation | 26,900 | |||

| 26,900 | ||||

| (To record the depreciation) |

Table (3)

• Depreciation is an expense account. Depreciation account increases the balance of expense account and all the losses and expenses accounts are debited.

• Accumulated Depreciation account is a contra asset account. Accumulated depreciation has a credit balance and is increasing as the depreciation is transferred to this account. This is the reason it is credited.

Working Notes:

Computation of depreciation:

Depreciation that will charge to building is $26,900.

Building 3

Record entry for depreciation on building 3

| Date | Account Title and Explanation | Post ref | Debit ($) |

Credit ($) |

|---|---|---|---|---|

| Depreciation | 72,400 | |||

| Accumulated Depreciation | 72,400 | |||

| (To record the depreciation) |

Table (4)

• Depreciation is an expense account. Depreciation account increases the balance of expense account and all the losses and expenses accounts are debited.

• Accumulated Depreciation account is a contra asset account. Accumulated depreciation has a credit balance and is increasing as the depreciation is transferred to this account. This is the reason it is credited.

Working Notes:

Computation of depreciation:

Depreciation that will charge to building 3 is $72,400.

Land improvement 1

To record entry for depreciation on Land improvement 1,

| Date | Account Title and Explanation | Post ref | Debit ($) |

Credit ($) |

|---|---|---|---|---|

| Depreciation | 32,500 | |||

| Accumulated Depreciation | 32,500 | |||

| (To record the depreciation) |

Table (5)

• Depreciation is an expense account. Depreciation account increases the balance of expense account and all the losses and expenses accounts are debited.

• Accumulated Depreciation account is a contra asset account. Accumulated depreciation has a credit balance and is increasing as the depreciation is transferred to this account. This is the reason it is credited.

Working Notes:

Computation of depreciation:

Depreciation charged to improvement 1 $32,500.

Land improvement 2

To record entry for depreciation on Land improvement 2,

| Date | Account Title and Explanation | Post ref | Debit ($) |

Credit ($) |

|---|---|---|---|---|

| Depreciation | 8,200 | |||

| Accumulated Depreciation | 8,200 | |||

| (To record the depreciation) |

Table (6)

• Depreciation is an expense account. Depreciation account increases the balance of expense account and all the losses and expenses accounts are debited.

• Accumulated Depreciation account is a contra asset account. Accumulated depreciation has a credit balance and is increasing as the depreciation is transferred to this account. This is the reason it is credited.

Working Notes:

Computation of depreciation:

Depreciation that will charge to improvement 2 is $8200.

Want to see more full solutions like this?

Chapter 8 Solutions

Financial and Managerial Accounting: Information for Decisions

- What is the best estimate of total operating expensesarrow_forwardA warehouse with an appraisal value of $145,320 is made available at an offer price of $168,750. The purchaser acquires the property for $40,500 in cash, a 90-day note payable for $26,500, and a mortgage amounting to $62,900. What is the cost basis recorded in the buyer's accounting records to recognize this purchase? a) $168,750 b) $145,320 c) $129,900 d) $121,460 MCQarrow_forwardIf UPPA Company had net income of $561,600 in 2022 and it experienced a 17% increase in net income over 2021, what was its 2021 net income?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education