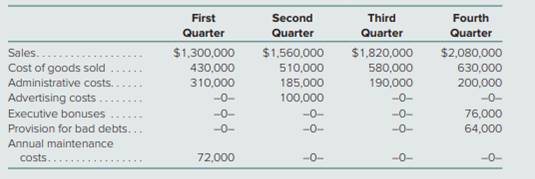

Noventis Corporation prepared the following estimates for the four quarters of the current year:

Additional Information

• First-quarter administrative costs include the $160,000 annual insurance premium.

• Advertising costs paid in the second quarter relate to television advertisements that will be broadcast throughout the entire year.

• No special items affect income during the year.

• Noventis estimates an effective income tax rate for the year of 40 percent.

a. Assuming that actual results do not vary from the estimates provided, determine the amount of net income to be reported each quarter of the current year.

b. Assume that actual results do not vary from the estimates provided except for that in the third quarter, the estimated annual effective income tax rate is revised downward to 38 percent. Determine the amount of net income to be reported each quarter of the current year.

a.

Determine the amount of net income to be reported each quarter of the current year assuming that actual results do not vary from the estimates provided.

Answer to Problem 39P

The amount of net income to be reported each quarter of the current year assuming that actual results do not vary from the estimates provided is $361200, $448,200, $559,200, $679,200 respectively.

Explanation of Solution

Amount of net income to be reported each quarter of the current year:

| Particulars | First quarter | Second quarter | Third quarter | Fourth quarter |

| Sales | $ 1,300,000 | $ 1,560,000 | $ 1,820,000 | $ 2,080,000 |

| Less: | ||||

| Cost of goods sold | $ 430,000 | $ 510,000 | $ 580,000 | $ 630,000 |

| Administrative costs | $ 190,000 | $ 225,000 | $ 230,000 | $ 240,000 |

| Advertising costs | $ 25,000 | $ 25,000 | $ 25,000 | $ 25,000 |

| Executive bonuses | $ 19,000 | $ 19,000 | $ 19,000 | $ 19,000 |

| Provision for bad debts | $ 16,000 | $ 16,000 | $ 16,000 | $ 16,000 |

| Annual maintenance costs | $ 18,000 | $ 18,000 | $ 18,000 | $ 18,000 |

| Pre-tax income | $ 602,000 | $ 747,000 | $ 932,000 | $ 1,132,000 |

| Less: Income tax | $ 240,800 | $ 298,800 | $ 372,800 | $ 452,800 |

| Net income | $ 361,200 | $ 448,200 | $ 559,200 | $ 679,200 |

Table: (1)

Working note

Calculate insurance premium per quarter

Thus, insurance premium per quarter is $40,000

Calculate administrative expenses for the first quarter

Thus, administrative expenses for the first quarter is $190,000

Insurance premium per quarter is added to the administrative expenses estimates given.

Advertising costs estimates are equally distributed in the four quarters.

Executive bonuses are equally distributed in four quarters.

Provision for bad debts is equally distributed in four quarters.

Annual maintenance costs are equally distributed in four quarters.

b.

Determine the amount of net income to be reported each quarter of the current year assuming that actual results do not vary from the estimates provided except for that in the third quarter, the estimated annual effective income tax rate is revised downward to 38 percent.

Answer to Problem 39P

The amount of net income to be reported each quarter of the current year assuming that actual results do not vary from the estimates provided except for that in the third quarter, the estimated annual effective income tax rate is revised downward to 38 percent is $361200, $448,200, $577,840, $701,840 respectively.

Explanation of Solution

Amount of net income to be reported each quarter of the current year:

| Particulars | First quarter | Second quarter | Third quarter | Fourth quarter |

| Sales | $ 1,300,000 | $ 1,560,000 | $ 1,820,000 | $ 2,080,000 |

| Less: | ||||

| Cost of goods sold | $ 430,000 | $ 510,000 | $ 580,000 | $ 630,000 |

| Administrative costs | $ 190,000 | $ 225,000 | $ 230,000 | $ 240,000 |

| Advertising costs | $ 25,000 | $ 25,000 | $ 25,000 | $ 25,000 |

| Executive bonuses | $ 19,000 | $ 19,000 | $ 19,000 | $ 19,000 |

| Provision for bad debts | $ 16,000 | $ 16,000 | $ 16,000 | $ 16,000 |

| Annual maintenance costs | $ 18,000 | $ 18,000 | $ 18,000 | $ 18,000 |

| Pre-tax income | $ 602,000 | $ 747,000 | $ 932,000 | $ 1,132,000 |

| Less: Income tax | $ 240,800 | $ 298,800 | $ 354,160 | $ 430,160 |

| Net income | $ 361,200 | $ 448,200 | $ 577,840 | $ 701,840 |

Table: (2)

Income tax rate is 40 percent for first and second quarter and it has changed to 38 percent in the third and fourth quarter.

Want to see more full solutions like this?

Chapter 8 Solutions

Advanced Accounting - Standalone book

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning