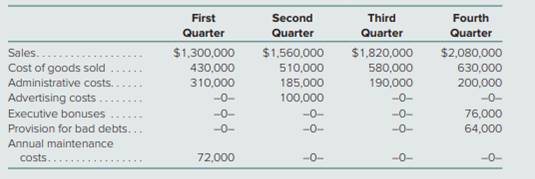

Noventis Corporation prepared the following estimates for the four quarters of the current year:

Additional Information

• First-quarter administrative costs include the $160,000 annual insurance premium.

• Advertising costs paid in the second quarter relate to television advertisements that will be broadcast throughout the entire year.

• No special items affect income during the year.

• Noventis estimates an effective income tax rate for the year of 40 percent.

a. Assuming that actual results do not vary from the estimates provided, determine the amount of net income to be reported each quarter of the current year.

b. Assume that actual results do not vary from the estimates provided except for that in the third quarter, the estimated annual effective income tax rate is revised downward to 38 percent. Determine the amount of net income to be reported each quarter of the current year.

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

ADVANCED ACCOUNTING W/ACCESS >CUSTOM<

- If a company records an expense that was actually a capital expenditure, what will be the result?A. Assets overstatedB. Net income overstatedC. Expenses understatedD. Net income understated need helparrow_forwardIf a company records an expense that was actually a capital expenditure, what will be the result?A. Assets overstatedB. Net income overstatedC. Expenses understatedD. Net income understated correctarrow_forwardIf a company records an expense that was actually a capital expenditure, what will be the result?A. Assets overstatedB. Net income overstatedC. Expenses understatedD. Net income understatedarrow_forward

- If a company records an expense that was actually a capital expenditure, what will be the result?A. Assets overstatedB. Net income overstatedC. Expenses understatedD. Net income understatedneed helparrow_forwardIf a company records an expense that was actually a capital expenditure, what will be the result?A. Assets overstatedB. Net income overstatedC. Expenses understatedD. Net income understatedcorrectarrow_forwardIf a company records an expense that was actually a capital expenditure, what will be the result?A. Assets overstatedB. Net income overstatedC. Expenses understatedD. Net income understated corre solutionarrow_forward

- If a company records an expense that was actually a capital expenditure, what will be the result?A. Assets overstatedB. Net income overstatedC. Expenses understatedD. Net income understatedarrow_forwardWhich of the following transactions would increase owner's equity?A. Paying rentB. Buying equipment with cashC. Earning service revenueD. Paying dividendsarrow_forwardWhich of the following transactions would increase owner's equity?A. Paying rentB. Buying equipment with cashC. Earning service revenueD. Paying dividendsneed helparrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning