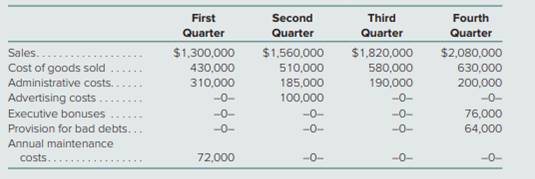

Noventis Corporation prepared the following estimates for the four quarters of the current year:

Additional Information

• First-quarter administrative costs include the $160,000 annual insurance premium.

• Advertising costs paid in the second quarter relate to television advertisements that will be broadcast throughout the entire year.

• No special items affect income during the year.

• Noventis estimates an effective income tax rate for the year of 40 percent.

a. Assuming that actual results do not vary from the estimates provided, determine the amount of net income to be reported each quarter of the current year.

b. Assume that actual results do not vary from the estimates provided except for that in the third quarter, the estimated annual effective income tax rate is revised downward to 38 percent. Determine the amount of net income to be reported each quarter of the current year.

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

ADVANCED ACCT.,SEL.CH.-W/ACCESS>CUSTOM<

- Can you help me solve this general accounting question using the correct accounting procedures?arrow_forwardPlease explain the correct approach for solving this general accounting question.arrow_forwardCan you explain the process for solving this financial accounting question accurately?arrow_forward

- Last year, Jupiter Systems earned an operating income of $32,500 with a contribution margin ratio of 0.35. Actual revenue was $270,000. Calculate the total fixed cost. Round your answer to the nearest dollar, if required.arrow_forwardI need help with this general accounting question using the proper accounting approach.arrow_forwardI need help solving this general accounting question with the proper methodology.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning