1.

Compute cost equation for maintenance costs.

1.

Explanation of Solution

The model to fit the cost is given below:

Maintenance costs:

The months 5 and 10 are the highest and lowest points.

High-low method:

Calculate the change in total maintenance costs.

Calculate the change in total maintenance hours.

Calculate slope (b).

Calculate the constant (a).

Calculate the maintenance costs.

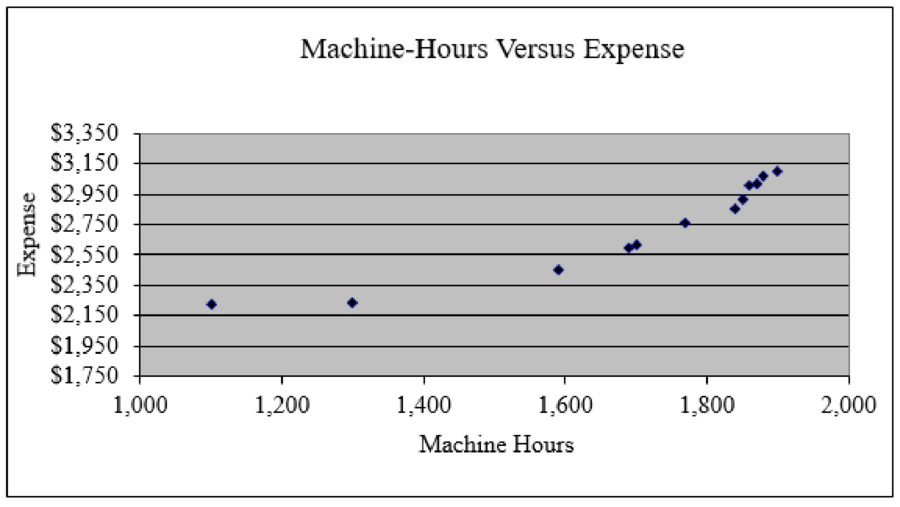

An alternative solution is preferred. A view of graph of machine hours versus maintenance expense, as chosen lowest data point is not characteristic of the relationships in the data for the 11th month.

The 10th month point is far (left) from the remaining data points whereas, 11th month is slightly closer to the remaining data points.

Recalculation of high-low method with 11th month:

Calculate the change in total maintenance costs.

Calculate the change in total maintenance hours.

Calculate slope (b).

Calculate the constant (a).

Calculate the maintenance costs.

2.

Compute mean absolute percentage error for the cost equation developed in part 1.

2.

Explanation of Solution

The graph of expense versus hours shows the point for 10th month to possibly be an outlier. The point for 11th month is also an outlier but the 12th month data has to be used instead.

Compute expense.

The graph drawn below shows the relationship between machine-hours and maintenance expense and also the position of 10th, 11th and 12th month’s points.

Figure (1)

Compute of the mean absolute percentage error for high low model.

| S.No | Machine Hours |

Maintenance Costs ($) |

High-low Estimate ($) |

Absolute Value of Difference ($) |

| 1 | 1,690 | 2,600 | 2,869 | 269 |

| 2 | 1,770 | 2,760 | 2,957 | 197 |

| 3 | 1,850 | 2,910 | 3,045 | 135 |

| 4 | 1,870 | 3,020 | 3,067 | 47 |

| 5 | 1,900 | 3,100 | 3,100 | 0 |

| 6 | 1,880 | 3,070 | 3,078 | 8 |

| 7 | 1,860 | 3,010 | 3,056 | 46 |

| 8 | 1,840 | 2,850 | 3,034 | 184 |

| 9 | 1,700 | 2,620 | 2,880 | 260 |

| 10 | 1,100 | 2,220 | 2,220 | 0 |

| 11 | 1,300 | 2,230 | 2,440 | 210 |

| 12 | 1,590 | 2,450 | 2,759 | 309 |

| Total | 32,840 | 1,665 |

Table (1)

Want to see more full solutions like this?

Chapter 8 Solutions

COST MANAGEMENT LOOSELEAF CUSTOM

- Hello tutor please given General accounting question answer do fast and properly explain all answerarrow_forwardOn March 1, 20X1, your company,which uses Units-of-Production (UOP) Depreciation, purchases a machine for $300,000.arrow_forwardPlease provide the accurate answer to this general accounting problem using valid techniques.arrow_forward

- Can you explain the correct methodology to solve this general accounting problem?arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forwardI am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education