Concept explainers

CASE 8-33

You have just been hired as a new management trainee by Earrings Unlimited, a distributor of earrings to various retail outlets located in shopping malls across the country. In the past, the company has done very little in the way of budgeting and at certain times of the year has experienced a shortage of cash. Since you are well trained in budgeting, you have decided to prepare a master budget for the upcoming second quarter. To this end, you have worked with accounting and other areas to gather the information assembled below.

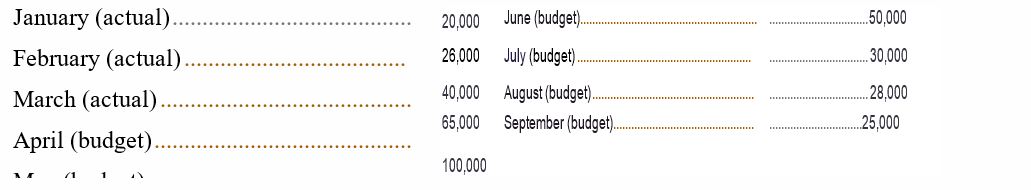

The company sells many styles of earrings, but all are sold for the same price—$10 per pair. Actual sales of earrings for the last three months and budgeted sales for the next six months follow (in pairs of earrings):

The concentration of sales before and during May is due to Mother's Day. Sufficient inventory should be on hand at the end of each month to supply 40% of the earrings sold in the following month. Suppliers are paid $4 for a pair of earrings. One-half of a month's purchases ispaid for in the month of purchase: the other half is paid for in the following month. .All sales are on credit. Only 20% of a month's sales are collected in the month of sale. .An additional 70% is collected in the following month, and the remaining 10% is collected in the second month following sale.

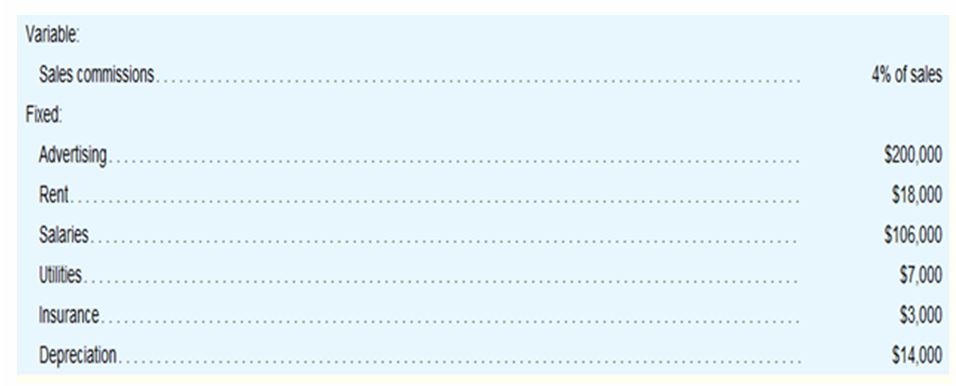

Monthly7operating expenses for the company are given below:

Insurance is paid on an annual basis, in November of each year.

The company plans to purchase $16,000 in new equipment during May and $40,000 in new equipment during June: both purchases will be for cash. The company declares dividends of $ 15,000 each quarter, payable in the first month of the following quarter.

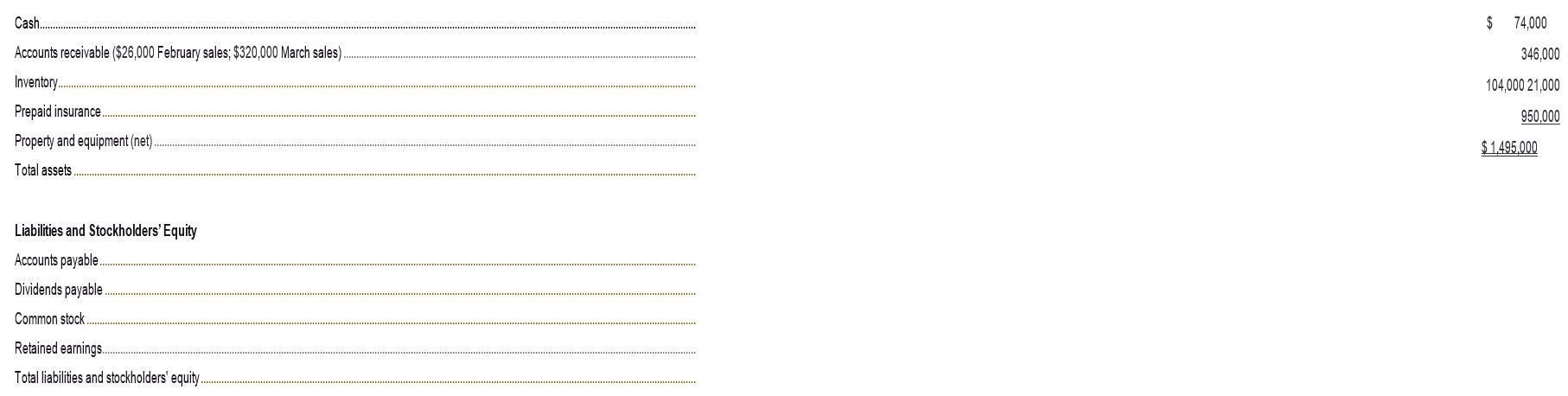

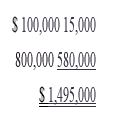

The company's

Assets

The company has an agreement with a bank that allows the company to borrow in increments of $1,000 at the beginning of each month. The interest rate on these loans

is1% per month and for simplicity we will assume that interest is not compounded. At the end of the quarter, the company would pay the bank all of the accumulated interest on the loan and as much of the loan as possible (in increments of $1,000), while still retaining at least $50,000 in cash.

Required:

Prepare a master budget for the three-month period ending June 30. Include the following detailed schedules:

- A sales budget, by month and in total.

- A schedule of expected cash collections, by month and in total.

- A merchandise purchases budget in units and in dollars. Show' the budget by month and in total.

- A schedule of expected cash disbursements for merchandise purchases, by month and in total.

- A

cash budget . Show the budget by month and in total. Determine any borrowing that would be needed to maintain the minimum cash balance of $50,000. - A

budgeted income statement for the three-month period ending June 30. Use the contribution approach.

- A budgeted balance sheet as of June 30. 1.While popsicle manufacturing is likely to involve other raw materials, such as popsicle sticks and packaging materials, for simplicitv, we have limited our scope to high fructose sugar.

- For simplicity, we assume that

depreciation on these newly acquired assets is included in the quarterly depreciation estimates included in the Budgeting Assumptions tab.

3.For simplicity, the beginning balance sheet and the ending finished goods inventory budget both report a unit product cost of $13. For purposes of answering “what-if’ questions, this schedule would assume a FIFO inventory7 flow. In other words, the ending inventory would consist solely of units that are produced during the budget year.

4.Other adjustments might need to be made for differences between

6.The format for the statement of cash flows, which is discussed in a later chapter, may also be used for the cash budget.

7. Cost of goods sold can also be computed using equations introduced in earlier chapters. Manufacturing companies can use the equation: Cost of goods sold = Beginning finished goods inventory + Cost of goods manufactured - Ending finished goods inventory. Merchandising companies can use the equation: Cost of goods sold = Beginning merchandise inventory - Purchases - Ending merchandise inventory.

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

MANAG.ACCOUNTING-CONNECT ACCESS >CUSTOM<

- I am searching for the accurate solution to this financial accounting problem with the right approach.arrow_forwardPlease provide the accurate answer to this financial accounting problem using valid techniques.arrow_forwardPlease provide the correct answer to this financial accounting problem using valid calculations.arrow_forward

- Please fill the empty cell in this problem. It is the only thing I need.arrow_forwardPlease explain the solution to this financial accounting problem with accurate principles.arrow_forwardWhat exactly are intangible assets and how are they defined? How are intangible assets different from plant assets?arrow_forward

- Answer this without using chatgtp or AIarrow_forwardNicole is a calendar-year taxpayer who accounts for her business using the cash method. On average, Nicole sends out bills for about $12,000 of her services on the first of each month. The bills are due by the end of the month, and typically 70 percent of the bills are paid on time and 98 percent are paid within 60 days. a. Suppose that Nicole is expecting a 2 percent reduction in her marginal tax rate next year. Ignoring the time value of money, estimate the tax savings for Nicole if she postpones mailing the December bills until January 1 of next year.arrow_forwardGeneral accountingarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub