Concept explainers

CASE 8-33

You have just been hired as a new management trainee by Earrings Unlimited, a distributor of earrings to various retail outlets located in shopping malls across the country. In the past, the company has done very little in the way of budgeting and at certain times of the year has experienced a shortage of cash. Since you are well trained in budgeting, you have decided to prepare a master budget for the upcoming second quarter. To this end, you have worked with accounting and other areas to gather the information assembled below.

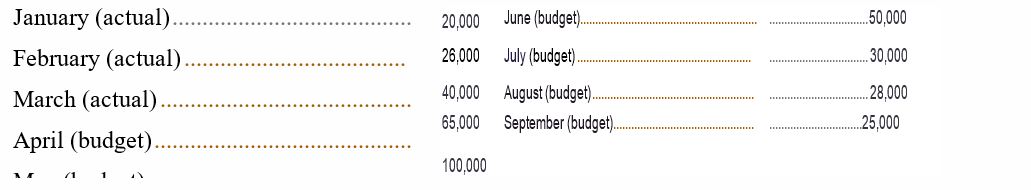

The company sells many styles of earrings, but all are sold for the same price—$10 per pair. Actual sales of earrings for the last three months and budgeted sales for the next six months follow (in pairs of earrings):

The concentration of sales before and during May is due to Mother's Day. Sufficient inventory should be on hand at the end of each month to supply 40% of the earrings sold in the following month. Suppliers are paid $4 for a pair of earrings. One-half of a month's purchases ispaid for in the month of purchase: the other half is paid for in the following month. .All sales are on credit. Only 20% of a month's sales are collected in the month of sale. .An additional 70% is collected in the following month, and the remaining 10% is collected in the second month following sale.

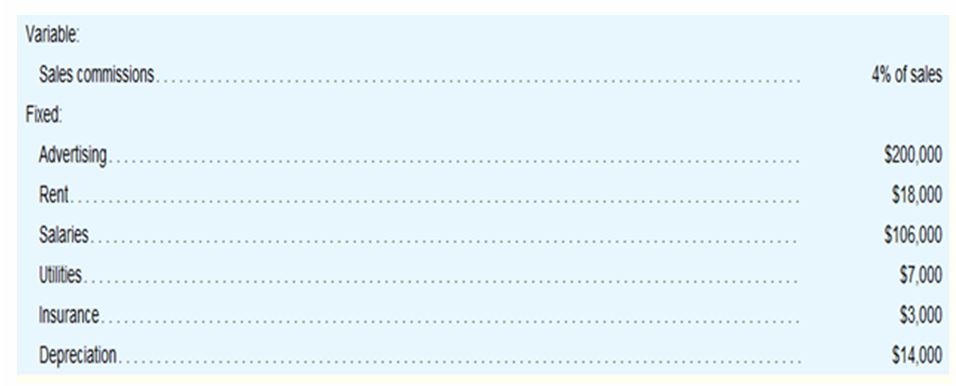

Monthly7operating expenses for the company are given below:

Insurance is paid on an annual basis, in November of each year.

The company plans to purchase $16,000 in new equipment during May and $40,000 in new equipment during June: both purchases will be for cash. The company declares dividends of $ 15,000 each quarter, payable in the first month of the following quarter.

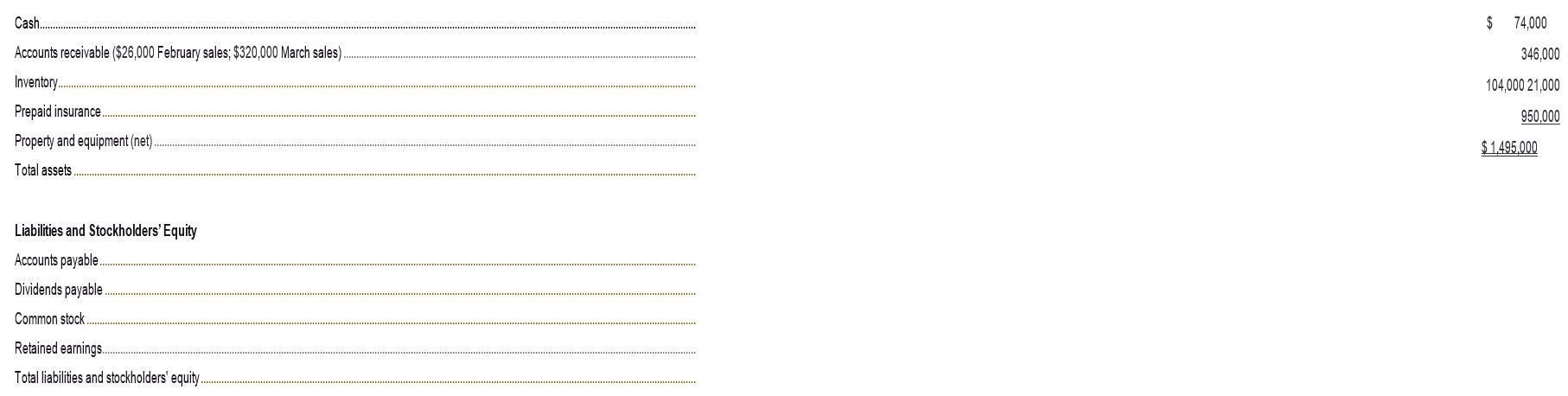

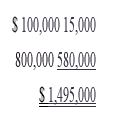

The company's

Assets

The company has an agreement with a bank that allows the company to borrow in increments of $1,000 at the beginning of each month. The interest rate on these loans

is1% per month and for simplicity we will assume that interest is not compounded. At the end of the quarter, the company would pay the bank all of the accumulated interest on the loan and as much of the loan as possible (in increments of $1,000), while still retaining at least $50,000 in cash.

Required:

Prepare a master budget for the three-month period ending June 30. Include the following detailed schedules:

- A sales budget, by month and in total.

- A schedule of expected cash collections, by month and in total.

- A merchandise purchases budget in units and in dollars. Show' the budget by month and in total.

- A schedule of expected cash disbursements for merchandise purchases, by month and in total.

- A

cash budget . Show the budget by month and in total. Determine any borrowing that would be needed to maintain the minimum cash balance of $50,000. - A

budgeted income statement for the three-month period ending June 30. Use the contribution approach.

- A budgeted balance sheet as of June 30. 1.While popsicle manufacturing is likely to involve other raw materials, such as popsicle sticks and packaging materials, for simplicitv, we have limited our scope to high fructose sugar.

- For simplicity, we assume that

depreciation on these newly acquired assets is included in the quarterly depreciation estimates included in the Budgeting Assumptions tab.

3.For simplicity, the beginning balance sheet and the ending finished goods inventory budget both report a unit product cost of $13. For purposes of answering “what-if’ questions, this schedule would assume a FIFO inventory7 flow. In other words, the ending inventory would consist solely of units that are produced during the budget year.

4.Other adjustments might need to be made for differences between cash flows on the one hand and revenues and expenses on the other hand. For example, if property taxes are paid twice a year in installments of $8,000 each, the expense for property tax would have to be 'backed out" of the total budgeted selling and administrative expenses and the cash installment payments added to the appropriate quarters to determine the cash disbursements. Similar adjustments might also need to be made in the manufacturing

6.The format for the statement of cash flows, which is discussed in a later chapter, may also be used for the cash budget.

7. Cost of goods sold can also be computed using equations introduced in earlier chapters. Manufacturing companies can use the equation: Cost of goods sold = Beginning finished goods inventory + Cost of goods manufactured - Ending finished goods inventory. Merchandising companies can use the equation: Cost of goods sold = Beginning merchandise inventory - Purchases - Ending merchandise inventory.

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

MANAGERIAL ACCOUNTING E-CARD W/ CONNECT

- No AI The accounting cycle begins with:A. Posting to the ledgerB. Journalizing transactionsC. Preparing the financial statementsD. Adjusting entriesarrow_forward4. The accounting cycle begins with:A. Posting to the ledgerB. Journalizing transactionsC. Preparing the financial statementsD. Adjusting entriesarrow_forwardGeneral Accounting Problem Solvearrow_forward

- Accounting Subject Solution Needarrow_forwardHii Answer This General Accounting Question Solution Pleasearrow_forwardIvanhoe Equipment Company sells computers for $1,620 each and also gives each customer a 2-year warranty that requires the company to perform periodic services and to replace defective parts. In 2025, the company sold 860 computers on account. Based on experience, the company has estimated the total 2-year warranty costs as $40 for parts and $60 for labor per unit. (Assume sales all occur at December 31, 2025.) In 2026, Ivanhoe incurred actual warranty costs relative to 2025 computer sales of $13,200 for parts and $19,800 for labor. Record the entries to reflect the above transactions (accrual method) for 2025 and 2026. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Date Account Titles and Explanation 2025 2026 2025 Cash Sales Revenue (To record sale of computers) Warranty Expense Warranty…arrow_forward

- Need Answer of this Accounting Subject Relevant Questionarrow_forwardHellow Dear Teacher Please Help to Solve This Financial Accounting Problemarrow_forwardWalthaus Corporation's standard cost sheet is as follows: Direct material 4 feet at $ 5.00 per foot Direct labor 3 hours at $ 10.00 per hour Variable overhead 3 hours at $ 2.00 per hour Fixed overhead 3 hours at $ 1.00 per hour Additional information: Actual results: purchased 30,000 feet of material at $5.25 per foot. (there were no beginning or ending material inventories); direct labor cost incurred was 26,000 hours at $9.75 per hour; actual variable overhead incurred, $50,000; and actual fixed overhead incurred $43,000. Overhead is applied to work-in-process on the basis of direct labor hours. The company produced 8,000 units of product during the period. The number of estimated hours for computing the fixed overhead application rate totaled 45,000 hours. What are the fixed overhead price and production volume variances? Multiple Choice $2,000 F; $23,000 U. $4,000 F; $25,000 U. $2,000 U; $23,000 F. None of the choices is correct.…arrow_forward

- No Ai 3. What is the purpose of depreciation?A. Track the market value of assetsB. Match the cost of an asset to the periods it benefitsC. Allocate cash flowsD. Record the decrease in asset liquidity need helparrow_forwardFinancial Accounting Question Solution with Detailed Explanation and Correct Answerarrow_forwardI need help 3. What is the purpose of depreciation?A. Track the market value of assetsB. Match the cost of an asset to the periods it benefitsC. Allocate cash flowsD. Record the decrease in asset liquidityarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education