Gulf Real Estate Properties

Gulf Real Estate Properties, Inc., is a real estate firm located in southwest Florida. The company, which advertises itself as “expert in the real estate market,” monitors condominium sales by collecting data on location, list price, sale price, and number of days it takes to sell each unit. Each condominium is classified as Gulf View if it is located directly on the Gulf of Mexico or No Gulf View if it is located on the bay or a golf course, near but not on the Gulf. Sample data from the Multiple Listing Service in Naples, Florida, provided recent sales data for 40 Gulf view condominiums and 18 No Gulf view condominiums. Prices are in thousands of dollars. The data are shown in Table 8.7.

Managerial Report

- 1. Use appropriate

descriptive statistics to summarize each of the three variables for the 40 Gulf View condominiums. - 2. Use appropriate descriptive statistics to summarize each of the three variables for the 18 No Gulf View condominiums.

- 3. Compare your summary results. Discuss any specific statistical results that would help a real estate agent understand the condominium market.

- 4. Develop a 95% confidence

interval estimate of the populationmean sales price and population mean number of days to sell for Gulf View condominiums. Interpret your results. - 5. Develop a 95% confidence interval estimate of the population mean sales price and population mean number of days to sell for No Gulf View condominiums. Interpret your results.

- 6. Assume the branch manager requested estimates of the mean selling price of Gulf View condominiums with a margin of error of $40,000 and the mean selling price of No Gulf View condominiums with a margin of error of $15,000. Using 95% confidence, how large should the

sample sizes be? - 7. Gulf Real Estate Properties just signed contracts for two new listings: a Gulf View condominium with a list price of $589,000 and a No Gulf View condominium with a list price of $285,000. What is your estimate of the final selling price and number of days required to sell each of these units?

1.

Find the appropriate descriptive statistics for Gulf View condominiums.

Answer to Problem 2CP

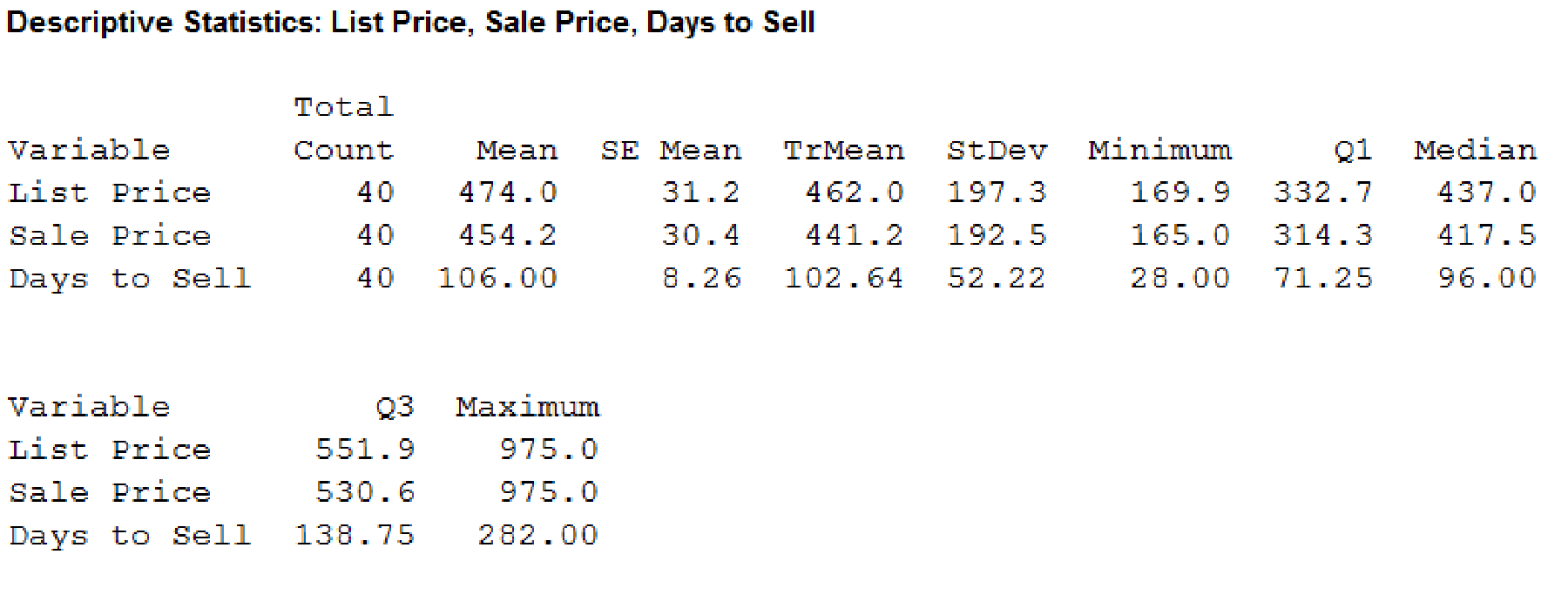

Output using the MINITAB software is given below:

Explanation of Solution

Calculation:

The given information is that the Gulf Real estate properties firm located in the Southwest Florida advertises itself as an “expert in the real estate market”. The data are collected on the sales on a particular location, list price, and the number of days it takes to sell each unit. The condominium is classified as gulf view and no gulf view.

Software Procedure:

Step by step procedure to obtain the descriptive statistics using the MINITAB software:

- Choose Stat > Basic Statistics > Display Descriptive Statistics.

- In Variables enter the columns List Price, Sale Price, and Days to Sell.

- In Statistics select Mean, Median, Trimmed Mean, Standard Deviation, Standard Error Mean, Minimum, Maximum, Quartile 1, Quartile 3, and Total.

- Click OK.

2.

Find the appropriate descriptive statistics for No Gulf View condominiums.

Answer to Problem 2CP

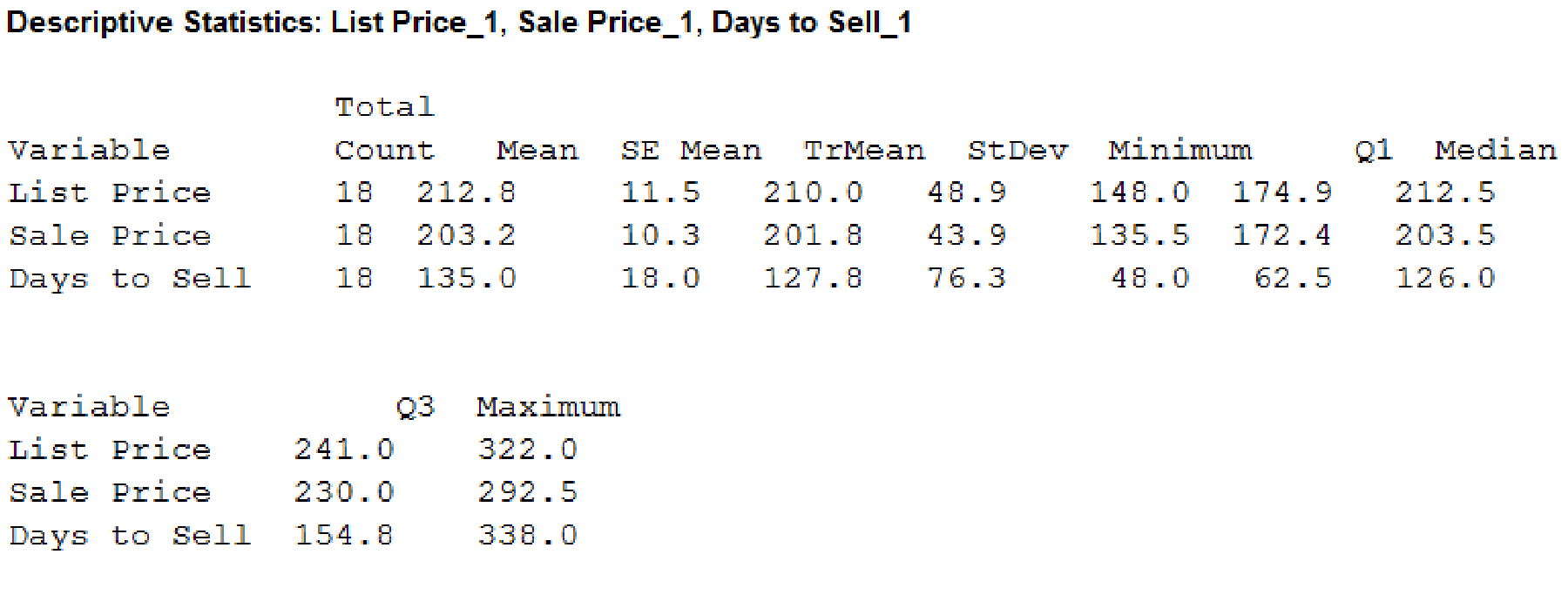

Output using the MINITAB software is given below:

Explanation of Solution

Calculation:

Calculate the appropriate descriptive statistics for No Gulf View condominiums:

Software Procedure:

Step by step procedure to obtain the descriptive statistics using the MINITAB software:

- Choose Stat > Basic Statistics > Display Descriptive Statistics.

- In Variables enter the columns List Price, Sale Price, and Days to Sell.

- In Statistics select Mean, Median, Trimmed Mean, Standard Deviation, Standard Error Mean, Minimum, Maximum, Quartile 1, Quartile 3, and Total.

- Click OK.

3.

Compare the results and explain any particular statistic that results to help the real estate agent to know the condominium market.

Explanation of Solution

Observation:

The mean price for the Gulf View condominium list is $474,000 and the median price is $437,000. The mean price for the No Gulf View condominium list is $21,800 and the median price is $212,500. It reflects that the Gulf View condominiums are most expensive and they are two times of the No Gulf Views.

The mean number of days to sell a condominium of Gulf view is slightly better than the No Gulf view condominium. It indicates that nearly three months will be taken to sell a Gulf View condominium and nearly four months will be taken to sell a No Gulf View condominium.

The most expensive list-price is for a Gulf view condominium and the least expensive list-price is for No Gulf view condominium.

The Gulf view condominiums with mean list price are $474,000 and a mean sale price is $454,200. It is sold on an average of $19,800 and it is 4.2% below list price.

The No Gulf view condominiums with mean list price are $212,800 and a mean sale price is $203,200. It is sold on an average of $9,600 and it is 4.5% below list price.

Gulf view condominiums are more expensive and tend to sell slightly faster than the No Gulf view.

4.

Find the 95% confidence interval for the population mean sales price and the population mean number of days to sell for Gulf view condominiums.

Interpret the results.

Answer to Problem 2CP

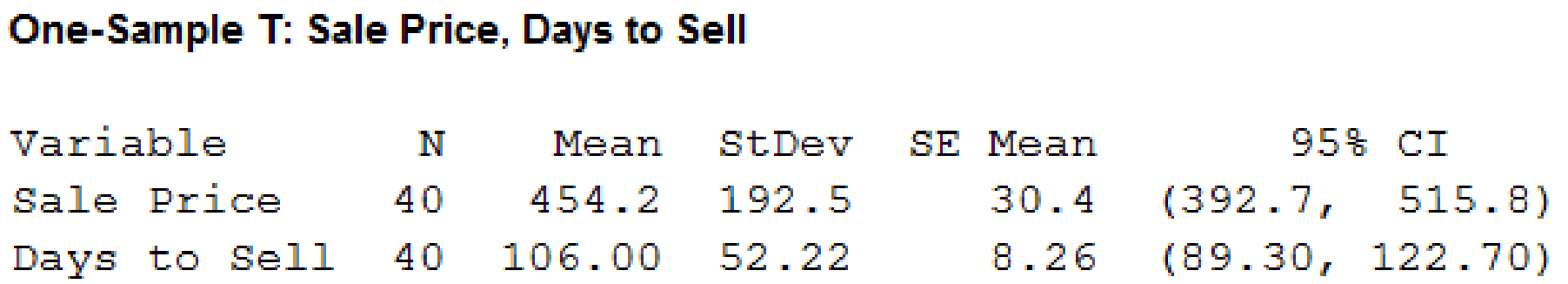

The 95% confidence interval for the population mean sales price for Gulf view condominiums is ($392,700, $515,800) and the population mean number of days to sell for Gulf view condominiums is (89 days, 123 days).

Explanation of Solution

Calculation:

Calculate the 95% confidence interval for the population mean sales price and the population mean number of days to sell for Gulf view condominiums.

Software Procedure:

Step-by-step procedure to obtain the confidence interval using the MINITAB software:

- Choose Stat > Basic Statistics > 1-Sample T.

- In Samples in columns, enter the variable sales price, days to sell.

- Check Options; enter Confidence level as 95%.

- Click OK.

Output using the MINITAB software is given below:

Observation:

The sales price of the Gulf View condominiums is from $392,700 to $515,800 and the days to sell Gulf View condominiums are 89 days to 123 days.

5.

Find the 95% confidence interval for the population mean sales price and the population mean number of days to sell for No Gulf view condominiums.

Interpret the results.

Answer to Problem 2CP

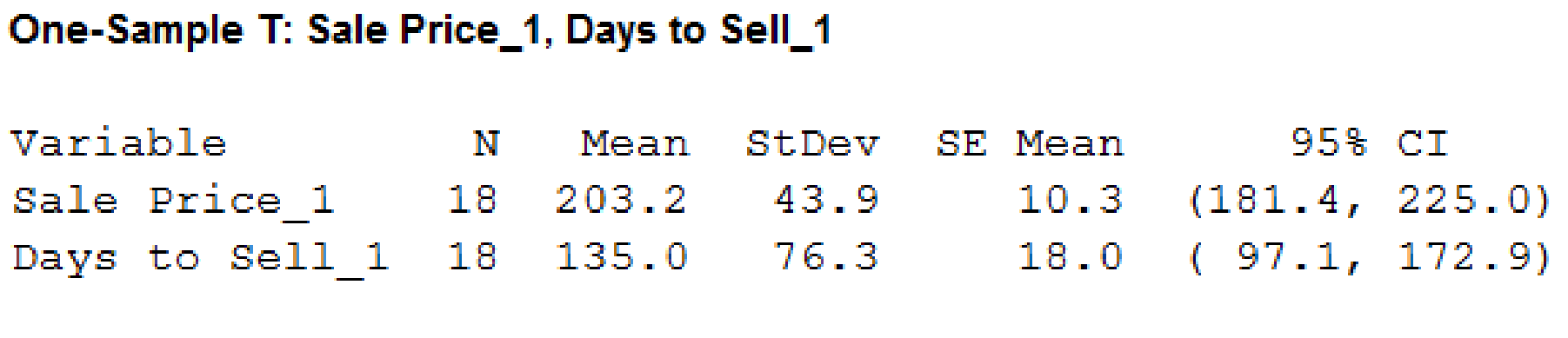

The 95% confidence interval for the population mean sales price for No Gulf view condominiums is ($181,400, $225,000) and the population mean number of days to sell for No Gulf view condominiums is (97 days, 173 days).

Explanation of Solution

Calculation:

Calculate the 95% confidence interval for the population mean sales price and the population mean number of days to sell for No Gulf view condominiums.

Software Procedure:

Step-by-step procedure to obtain the confidence interval using the MINITAB software:

- Choose Stat > Basic Statistics > 1-Sample T.

- In Samples in columns, enter the variable sales price, days to sell.

- Check Options; enter Confidence level as 95%.

- Click OK.

Output using the MINITAB software is given below:

Observation:

The sales price of the No Gulf View condominiums is from $181,400 to $225,000 and the days to sell No Gulf View condominiums are 97 days to 173 days.

6.

Find the sample size for the Gulf view and No Gulf view condominiums for estimating the mean selling price.

Answer to Problem 2CP

The sample size for the Gulf view for estimating the mean selling price is 89 and the sample size for the No Gulf view for estimating the mean selling price is 23.

Explanation of Solution

Calculation:

The sample size for the interval estimate of a population mean is as follows:

From “Table 8.1 value of

For Gulf view condominiums:

From Part (1), the standard deviation for Gulf view selling price is 192.5.

The sample size is as follows:

Thus, the sample size of 89 is required.

For No Gulf view condominiums:

From Part (2), the standard deviation for No Gulf view selling price is 43.9.

The sample size is as follows:

Thus, the sample size of 23 is required.

7.

Find the final selling price and the number of days required to sell each of the unit.

Answer to Problem 2CP

The final selling price and the number of days required to sell each of the unit are $564,262 and 106 days, respectively, for Gulf view condominium.

The final selling price and the number of days required to sell each of the unit are $272,175 and 135 days, respectively, for No Gulf view condominium.

Explanation of Solution

Calculation:

Here, a Gulf view condominium with a list price is $589,000 and a No Gulf view condominium with a list price is $285,000.

From Part (3), the Gulf view condominium is sold on an average of 4.2% below its list price.

The estimated selling price is as follows:

The estimated number of days to sell each of the unit is 106 days.

From Part (3), the No Gulf view condominium is sold on an average of 4.5% below its list price.

The estimated selling price is as follows:

The estimated number of days to sell each of the unit is 135 days.

Want to see more full solutions like this?

Chapter 8 Solutions

Statistics for Business & Economics, Revised (with XLSTAT Education Edition Printed Access Card)

- 5. Probability Distributions – Continuous Random Variables A factory machine produces metal rods whose lengths (in cm) follow a continuous uniform distribution on the interval [98, 102]. Questions: a) Define the probability density function (PDF) of the rod length.b) Calculate the probability that a randomly selected rod is shorter than 99 cm.c) Determine the expected value and variance of rod lengths.d) If a sample of 25 rods is selected, what is the probability that their average length is between 99.5 cm and 100.5 cm? Justify your answer using the appropriate distribution.arrow_forward2. Hypothesis Testing - Two Sample Means A nutritionist is investigating the effect of two different diet programs, A and B, on weight loss. Two independent samples of adults were randomly assigned to each diet for 12 weeks. The weight losses (in kg) are normally distributed. Sample A: n = 35, 4.8, s = 1.2 Sample B: n=40, 4.3, 8 = 1.0 Questions: a) State the null and alternative hypotheses to test whether there is a significant difference in mean weight loss between the two diet programs. b) Perform a hypothesis test at the 5% significance level and interpret the result. c) Compute a 95% confidence interval for the difference in means and interpret it. d) Discuss assumptions of this test and explain how violations of these assumptions could impact the results.arrow_forward1. Sampling Distribution and the Central Limit Theorem A company produces batteries with a mean lifetime of 300 hours and a standard deviation of 50 hours. The lifetimes are not normally distributed—they are right-skewed due to some batteries lasting unusually long. Suppose a quality control analyst selects a random sample of 64 batteries from a large production batch. Questions: a) Explain whether the distribution of sample means will be approximately normal. Justify your answer using the Central Limit Theorem. b) Compute the mean and standard deviation of the sampling distribution of the sample mean. c) What is the probability that the sample mean lifetime of the 64 batteries exceeds 310 hours? d) Discuss how the sample size affects the shape and variability of the sampling distribution.arrow_forward

- A biologist is investigating the effect of potential plant hormones by treating 20 stem segments. At the end of the observation period he computes the following length averages: Compound X = 1.18 Compound Y = 1.17 Based on these mean values he concludes that there are no treatment differences. 1) Are you satisfied with his conclusion? Why or why not? 2) If he asked you for help in analyzing these data, what statistical method would you suggest that he use to come to a meaningful conclusion about his data and why? 3) Are there any other questions you would ask him regarding his experiment, data collection, and analysis methods?arrow_forwardBusinessarrow_forwardWhat is the solution and answer to question?arrow_forward

- To: [Boss's Name] From: Nathaniel D Sain Date: 4/5/2025 Subject: Decision Analysis for Business Scenario Introduction to the Business Scenario Our delivery services business has been experiencing steady growth, leading to an increased demand for faster and more efficient deliveries. To meet this demand, we must decide on the best strategy to expand our fleet. The three possible alternatives under consideration are purchasing new delivery vehicles, leasing vehicles, or partnering with third-party drivers. The decision must account for various external factors, including fuel price fluctuations, demand stability, and competition growth, which we categorize as the states of nature. Each alternative presents unique advantages and challenges, and our goal is to select the most viable option using a structured decision-making approach. Alternatives and States of Nature The three alternatives for fleet expansion were chosen based on their cost implications, operational efficiency, and…arrow_forwardBusinessarrow_forwardWhy researchers are interested in describing measures of the center and measures of variation of a data set?arrow_forward

- WHAT IS THE SOLUTION?arrow_forwardThe following ordered data list shows the data speeds for cell phones used by a telephone company at an airport: A. Calculate the Measures of Central Tendency from the ungrouped data list. B. Group the data in an appropriate frequency table. C. Calculate the Measures of Central Tendency using the table in point B. 0.8 1.4 1.8 1.9 3.2 3.6 4.5 4.5 4.6 6.2 6.5 7.7 7.9 9.9 10.2 10.3 10.9 11.1 11.1 11.6 11.8 12.0 13.1 13.5 13.7 14.1 14.2 14.7 15.0 15.1 15.5 15.8 16.0 17.5 18.2 20.2 21.1 21.5 22.2 22.4 23.1 24.5 25.7 28.5 34.6 38.5 43.0 55.6 71.3 77.8arrow_forwardII Consider the following data matrix X: X1 X2 0.5 0.4 0.2 0.5 0.5 0.5 10.3 10 10.1 10.4 10.1 10.5 What will the resulting clusters be when using the k-Means method with k = 2. In your own words, explain why this result is indeed expected, i.e. why this clustering minimises the ESS map.arrow_forward

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL Functions and Change: A Modeling Approach to Coll...AlgebraISBN:9781337111348Author:Bruce Crauder, Benny Evans, Alan NoellPublisher:Cengage Learning

Functions and Change: A Modeling Approach to Coll...AlgebraISBN:9781337111348Author:Bruce Crauder, Benny Evans, Alan NoellPublisher:Cengage Learning Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt

Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt