1.

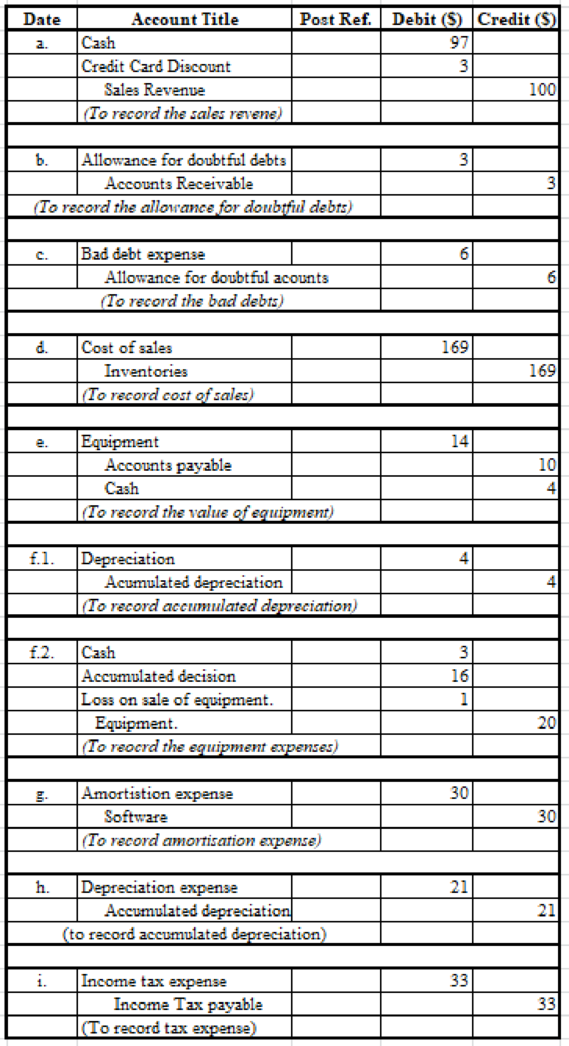

Pass necessary journal entries to record the transactions.

1.

Explanation of Solution

Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Accounting rules for Journal entries:

- To record increase balance of account: Debit assets, expenses, losses and credit liabilities, capital, revenue and gains.

- To record decrease balance of account: Credit assets, expenses, losses and debit liabilities, capital, revenue and gains.

Pass necessary journal entries to record the transactions.

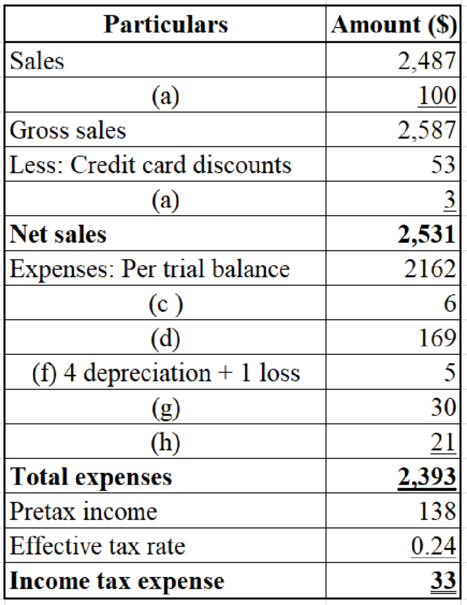

Table (2)

Table (2)

2.

Prepare T accounts using the

2.

Explanation of Solution

Prepare T accounts using the trial balance information and an adjusted trial balance.

| Cash | ||

| Beginning balance 570 | ||

| ||

| f.2 3 | e. 4 | |

| Ending balance 666 | ||

Table (3)

| Accounts Receivable | ||

| Beginning balance 373 |

| |

| Ending balance 370 | ||

Table (3)

| Allowance for doubtful accounts | ||

| Balance 570 | ||

| b 3 | c 6 | |

| Balance 21 | ||

Table (3)

| Inventories | ||

| Beginning balance 539 |

| |

| Ending balance 370 | ||

Table (4)

| Prepaid Expenses | ||

| Beginning balance 59 | ||

| Ending balance 59 | ||

Table (5)

| Land | ||

| Beginning balance 22 | ||

| Ending balance 22 | ||

Table (6)

| Building | ||

| Beginning balance 189 | ||

| Ending balance 189 | ||

Table (7)

| Equipment | ||

|

Beginning balance 360

| f.2. 20 | |

| Ending balance 354 | ||

Table (8)

| Balance 222 | ||

| f.1. 4 | ||

| f.2 16 | h. 21 | |

| Balance 231 | ||

Table (9)

| Software | ||

| Beginning balance 90 |

| |

| Ending balance 60 | ||

Table (10)

| Patents | ||

| Beginning balance 1 | ||

| Ending balance 1 | ||

Table (11)

| Beginning balance 161 | ||

| Ending balance 161 | ||

Table (12)

| Accounts Payable | ||

| Balance 252 | ||

| e. 10 | ||

| Balance 262 | ||

Table (13)

| Accrued Liabilities | ||

| Balance 182 | ||

| Balance 182 | ||

Table (14)

| Income Tax Payable | ||

| Balance 16 | ||

| i. 33 | ||

| Balance 49 | ||

Table (15)

| Long term Debt | ||

| Balance 49 | ||

| Balance 49 | ||

Table (16)

| Common Stock | ||

| Balance 3 | ||

| Balance 3 | ||

Table (17)

| Additional paid in capital | ||

| Balance 243 | ||

| Balance 243 | ||

Table (18)

| Balance 1,107 | ||

| Balance 1,107 | ||

Table (19)

| Sales Revenue | ||

|

Balance 2,847 a. 100 | ||

| Balance 2,587 | ||

Table (20)

| Credit Card Discounts | ||

|

Beginning balance 53

| ||

| Ending balance 56 | ||

Table (21)

| Cost of sales | ||

|

Beginning balance 1,306 d. 169 | ||

| Ending balance 1,475 | ||

Table (22)

| Advertising Expense | ||

| Beginning balance 145 | ||

| Ending balance 145 | ||

Table (23)

| Utilities Expense | ||

| Beginning balance 85 | ||

| Ending balance 85 | ||

Table (24)

| Wages Expense | ||

| Beginning balance 625 | ||

| Ending balance 625 | ||

Table (25)

| Depreciation Expense | ||

|

Beginning balance 0 f.1. 4 h. 21 | ||

| Ending balance 25 | ||

Table (26)

| Amortisation Expense | ||

|

Beginning balance 0 g. 30 | ||

| Ending balance 30 | ||

Table (27)

| Interest Expense | ||

| Beginning balance 1 | ||

| Ending balance 1 | ||

Table (28)

|

Beginning balance 0 C 6 | ||

| Ending balance 6 | ||

Table (28)

| Loss of sale of equipment | ||

|

Beginning balance 0 f.2. 1 | ||

| Ending balance 1 | ||

Table (29)

| Income Tax Expense | ||

|

Beginning balance 0 f.2. 33 | ||

| Ending balance 33 | ||

Table (30)

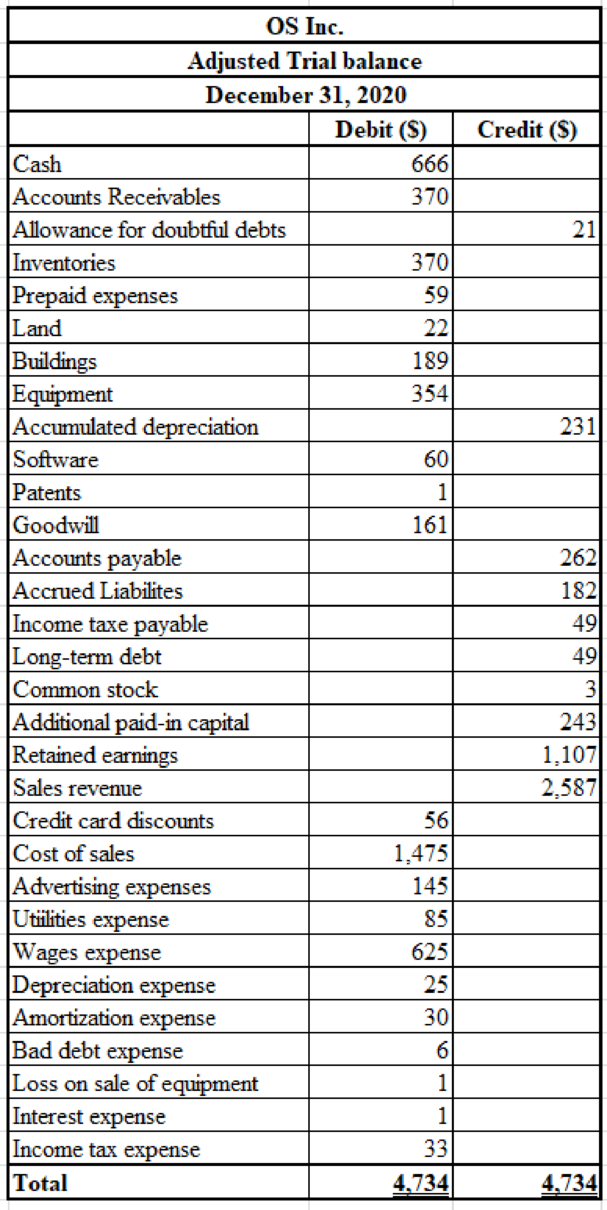

Table (31)

3.

Prepare an income statement, statement of

3.

Explanation of Solution

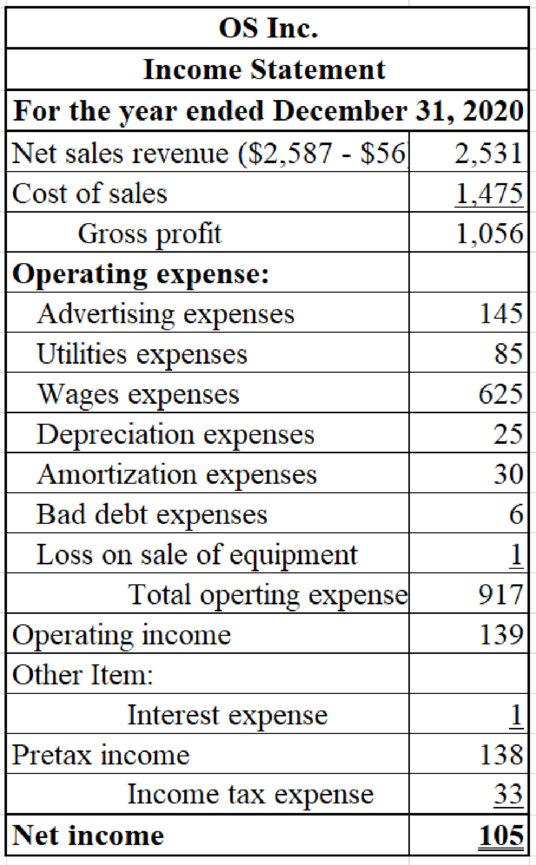

Prepare an income statement for OS Inc.

Table (32)

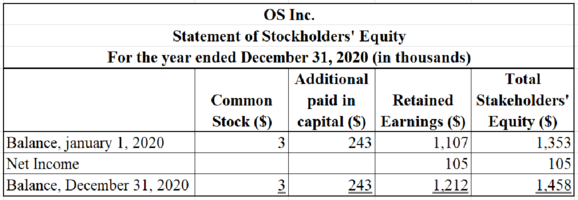

Prepare a statement of stockholders’ equity for OS Inc.

Table (33)

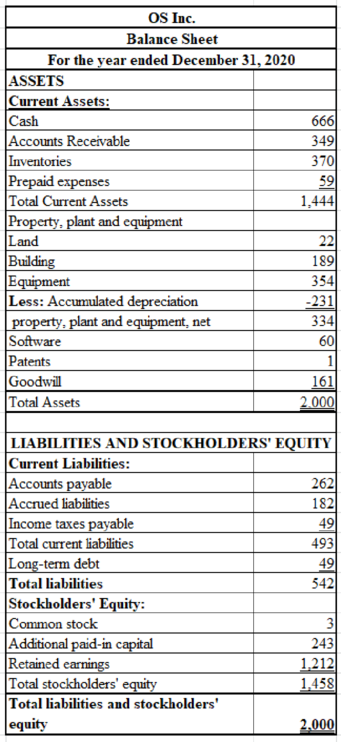

Prepare a balance sheet for OS Inc.

Table (34)

Want to see more full solutions like this?

Chapter 8 Solutions

FINANCIAL ACCOUNTING

- Help pleasearrow_forwardPlease provide problem with accounting questionarrow_forwardJuan Leon Martinez posted Apr 7, 2025 11:25 AM Subscribe Hello everyone, Esteban is not performing in a professional manner in this scene. In fact, he is showing extreme unprofessional manners and unethical work ethic. Under no circumstance should he be using a company's tools or assets for his own benefit. You can also see he is trying not to get caught by any upper management due to him doing these actions after hours of work. As a manager, a great change I would do differently to make sure Esteban is not using the company's assets for their own benefit, would be coachings and sit down conversations. A sit down conversation can have the employee get an idea on how bad his actions are towards the company. This disciplinary of a coaching would be a written down statement from both manager and employee stating that he or she understands the actions they have done, which could lead to suspension or possibly termination. These unethical actions could lead to a great deal of financial loss…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education