Financial Accounting

14th Edition

ISBN: 9781305088436

Author: Carl Warren, Jim Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 25E

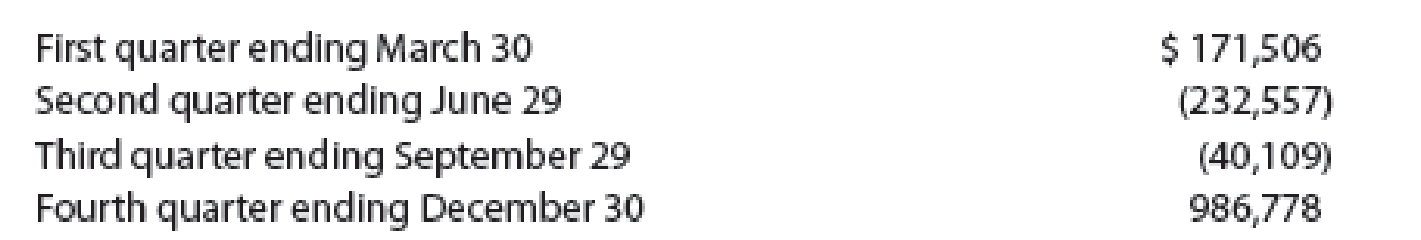

Mattel, Inc., designs, manufactures, and markets toy products worldwide. Mattel’s toys include Barbie™ fashion dolls and accessories, Hot Wheels™, and Fisher-Price brands. For a recent year, Mattel reported the following net

Explain why Mattel reported negative net cash flows from operating activities during the second and third quarters and a large positive cash flow for the fourth quarter, with overall net positive cash flow for the year.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

None

Can you solve this general accounting problem with appropriate steps and explanations?

What is the pension expenses for 2023 ?

Chapter 8 Solutions

Financial Accounting

Ch. 8 - Prob. 1DQCh. 8 - Why should the employee who handles cash receipts...Ch. 8 - Prob. 3DQCh. 8 - Why should the responsibility for maintaining the...Ch. 8 - Assume that Brooke Miles, accounts payable clerk...Ch. 8 - Prob. 6DQCh. 8 - Prob. 7DQCh. 8 - Prob. 8DQCh. 8 - Prob. 9DQCh. 8 - Prob. 10DQ

Ch. 8 - Prob. 1PEACh. 8 - Prob. 1PEBCh. 8 - Prob. 2PEACh. 8 - Prob. 2PEBCh. 8 - Prob. 3PEACh. 8 - Prob. 3PEBCh. 8 - Prob. 4PEACh. 8 - Prob. 4PEBCh. 8 - Financial data for Otto Company follow: a....Ch. 8 - Prob. 5PEBCh. 8 - Prob. 1ECh. 8 - Prob. 2ECh. 8 - Prob. 3ECh. 8 - Pacific Bank provides loans to businesses in the...Ch. 8 - Prob. 5ECh. 8 - An employee of JHT Holdings, Inc., a trucking...Ch. 8 - Prob. 7ECh. 8 - Prob. 8ECh. 8 - Prob. 9ECh. 8 - Prob. 10ECh. 8 - Prob. 11ECh. 8 - Prob. 12ECh. 8 - Prob. 13ECh. 8 - Abbe Co. is a small merchandising company with a...Ch. 8 - Prob. 15ECh. 8 - Prob. 16ECh. 8 - Prob. 17ECh. 8 - Prob. 18ECh. 8 - Prob. 19ECh. 8 - Prob. 20ECh. 8 - Prob. 21ECh. 8 - Prob. 22ECh. 8 - Prob. 23ECh. 8 - Prob. 24ECh. 8 - Mattel, Inc., designs, manufactures, and markets...Ch. 8 - El Dorado Inc. has monthly cash expenses of...Ch. 8 - Prob. 27ECh. 8 - Amicus Therapeutics, Inc., is a biopharmaceutical...Ch. 8 - Prob. 1PACh. 8 - Cactus Restoration Company completed the following...Ch. 8 - Prob. 3PACh. 8 - Prob. 4PACh. 8 - Prob. 5PACh. 8 - Prob. 1PBCh. 8 - Cedar Springs Company completed the following...Ch. 8 - Prob. 3PBCh. 8 - Prob. 4PBCh. 8 - Prob. 5PBCh. 8 - During the preparation of the bank reconciliation...Ch. 8 - Prob. 2CPCh. 8 - Prob. 3CPCh. 8 - Prob. 4CPCh. 8 - Prob. 5CPCh. 8 - TearLab Corp. is a health care company that...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please provide the answer to this general accounting question with proper steps.arrow_forwardI need guidance in solving this financial accounting problem using standard procedures.arrow_forwardCan you show me the correct approach to solve this financial accounting problem using suitable standards?arrow_forward

- Lee Corporation had a Work-in-Process balance of $95,000 on January 1, 2023. The year-end balance of Work-in-Process was $110,000, and the Cost of Goods Manufactured was $680,000. Use this information to determine the total manufacturing costs incurred during the fiscal year 2023.arrow_forwardNovus Advisory Group expects its consultants to work 40,000 direct labor hours per year. The company's estimated total indirect costs are $360,000. The direct labor rate is $95 per hour. The company uses direct labor hours as the allocation base for indirect costs. If Novus performs a job requiring 30 hours of direct labor, what is the total job cost?arrow_forwardTONY Corporation makes a product whose direct labor standard are 1.3 hours per unit and $14 per hour. In April, the company produced 5,400 units using 7,440 direct labor hours. The actual direct labor cost was $97,550. The labor rate variance for April is _.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License