Concept explainers

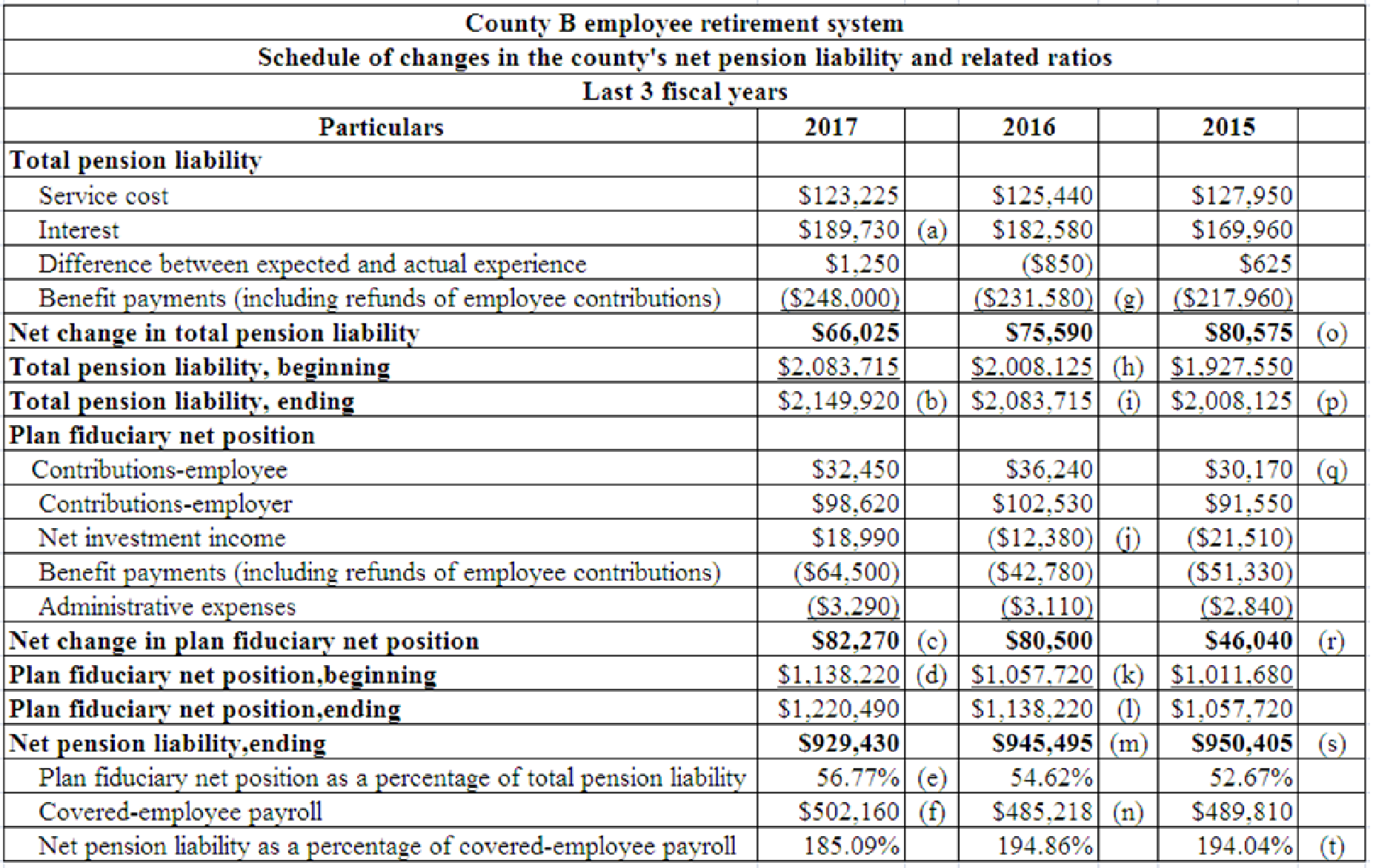

Compute the missing amount of “schedule of changes in the County’s Net pension liability and related ratios”.

Explanation of Solution

Fiduciary activities: Fiduciary activities are those activities done by persons or organizations to another parties with utmost good faith and trust. A fiduciary activity may involve managing funds, assets and other valuables of a person or a group of people.

The person or organization involved in fiduciary activities need to act ethically in the best interest of others. Government also involve in fiduciary activities by holding the assets of individuals or organization to benefit them.

Prepare the financial statement of County B:

Table (1)

Working note (a): Calculate interest during the year 2017:

Interest amount is calculated by deducting all other pension liabilities from net change in total pension liability. Total pension liabilities except interest includes service costs, difference between expected and experience, and benefit payments. The amount of service cost is $123,225, difference between expected and experience are $1,250, and benefit payment is -$248,000. The net change in total pension liability is $66,205.

Calculation of interest is as follows:

Hence, the interest amount is $189,730.

Working note (b): Calculate net change in plan fiduciary net position:

Net change in plan fiduciary net position is the difference between plan fiduciary net position at the end of the year and plan fiduciary net position at the beginning of the year. Plan fiduciary net position at the ending is $1,057,720. Plan fiduciary net position at the beginning is $1,011,680.

Calculation of net change in plan fiduciary net position is as follows:

Hence, the net change in plan fiduciary net position is $46,040.

Working note (c): Calculate net change in plan fiduciary net position:

Net change in plan fiduciary net position is the difference between plan fiduciary net position incomes and plan fiduciary net position expenses. Plan fiduciary net position income includes contribution from employee $32,450, contribution from employers $98,620, and net investment income $18,990. Plan fiduciary net position expenses include benefit payments of $64,500 and administrative expenses of $3,290.

Calculation of net change in plan fiduciary net position is as follows:

Hence, the net change in plan fiduciary net position is $82,270.

Working note (d): Calculate plan fiduciary net position at the beginning of the year 2017:

Plan fiduciary net position at the beginning is computed as the difference between plan fiduciary net position at the end of the year and net change in plan fiduciary net position. Plan fiduciary net position at the end of the year is $1,220,490.

Calculation of plan fiduciary net position at the beginning is as given below:

Hence, the plan fiduciary net position at the beginning of the year 2017 is $1,138,220.

Working note (e): Calculate plan fiduciary net position as the percentage of total pension liability:

Plan fiduciary net position as a percentage of total pension liability is calculated by dividing plan fiduciary net position at the end of the year by total pension liability at the end of the year. Plan fiduciary net position at the end of the year is given as $1,220,490 and total pension liability at the end of the year is calculated as $2,149,920.

Calculate plan fiduciary net position as the percentage of total pension liability:

Hence, the plan fiduciary net position as percentage of total pension liability is 56.77%.

Working note (f): Calculate covered-employee payroll:

The calculation of covered-employee payroll is by dividing net pension liability at the ending by net pension liability as a percentage of covered-employee payrolls. Net pension liability at the ending is given as $929,430 and net pension liability as a percentage of covered-employee payrolls is 185.09%.

Calculate covered-employee payroll:

Hence, the covered-employee payroll is $502,150.

Working note (g): Calculate benefit payment for the year 2016:

Benefit payment is calculated by deducting all other pension liabilities from net change in total pension liability. Total pension liabilities except benefit payment includes service costs, interest, and difference between expected and experience. The amount of service cost is $125,440, interest amount is $182,580, and difference between expected and experience is -$850, and benefit payment is -$248,000. The net change in total pension liability is $75,590.

Calculate benefit payment for the year 2016:

Hence, the benefit payment for the year 2016 is ($231,580).

Working note (h): Calculate total pension liability at the beginning of the year 2016:

Total pension liability at the beginning of the year is computed as the difference between total pension liability at the end of the year and net change in total pension liability. The total pension liability at the ending is $2,083,715. The calculation is as follows:

Calculate total pension liability at the beginning of the year 2016:

Hence, the total pension liability at the beginning of the year is $2,008,125.

Working note (i): Calculate total pension liability at the end of the year 2016:

The total pension liability at the end of the year 2016 will be the same as the total pension liability at the beginning of the year 2017. The total pension liability at the beginning of the year 2017 is $2,083,715. Hence, the total pension liability at the end of the year 2016 is also $2,083,175.

Working note (j): Calculate net investment income for 2016:

Net investment income is the difference between net change in plan fiduciary net position and the difference between plan fiduciary net position incomes and plan fiduciary net position expenses. Plan fiduciary net position income includes contribution from employee $36,240, contribution from employers $102,530. Plan fiduciary net position expenses include benefit payments of -$42,780 and administrative expenses of -$3,110. The net change in plan fiduciary net position is given as $80,500.

Calculate net investment income for 2016:

Hence, the net investment income for 2016 is ($12,380).

Working note (k): Calculate plan fiduciary net position at the beginning of 2016:

The plan fiduciary net position at the beginning of the year 2016 will be the same as the plan fiduciary net position at the end of the year 2015. The plan fiduciary net position at the end of the year 2015 is $1,057,720. Hence, the plan fiduciary net position at the beginning of the year 2016 is also $1,057,720.

Working note (l): Calculate plan fiduciary net position at the end of the year 2016:

Plan fiduciary net position at the ending is computed as the sum of plan fiduciary net position at the beginning of the year and net change in plan fiduciary net position. Plan fiduciary net position at the beginning of the year is $1,057,720.

Calculation of plan fiduciary net position at the beginning is as given below:

Hence, the plan fiduciary net position at the end of the year 2016 is $1,138,220.

Working note (m): Calculate net pension liability at the end of the year 2016:

Net pension liability at the end of the year 2016 is calculated as the difference between total pension liability at the ending of 2016 and plan fiduciary net position at the ending. Total pension liability at the ending of 2016 is calculated as $2,083,715 and plan fiduciary net position at the ending of 2016 is $1,138,220.

Calculate net pension liability at the end of the year 2016:

Hence, the net pension liability at the end of the year 2016 is $945,495.

Working note (n): Calculate covered-employee payroll:

The calculation of covered-employee payroll is by dividing net pension liability at the ending by net pension liability as a percentage of covered-employee payrolls. Net pension liability at the ending is given as $945,495 and net pension liability as a percentage of covered-employee payrolls is 194.86%.

Calculate covered-employee payroll:

Hence, the covered-employee payroll is $485,218.

Working note (o): Calculate net change in total pension liability for the year 2015:

Net change in total pension liability is calculated by deducting benefit payment from all other pension liabilities. Total pension liabilities except benefit payment includes service costs, interest, and difference between expected and experience. The amount of service cost is $127,950, interest amount is $169,960, and difference between expected and experience is $625. The benefit payment is given as -$217,960.

Calculate net change in total pension liability for the year 2015:

Hence, the net change in total pension liability for the year 2015 is $80,575.

Working note (p): Calculate total pension liability at the end of the year 2015:

The total pension liability at the end of the year 2015 will be the same as the total pension liability at the beginning of the year 2016. The total pension liability at the beginning of the year 2016 is $2,008,125. Hence, the total pension liability at the end of the year 2015 is also $2,008,125.

Working note (q): Calculate contribution from employees for 2015:

Contribution from employees is calculated as the difference between net change in plan fiduciary net position and the difference between plan fiduciary net position incomes and plan fiduciary net position expenses. Plan fiduciary net position income includes contribution from employers $91,550 and net investment income is -$21,510. Plan fiduciary net position expenses include benefit payments of -$51,330 and administrative expenses of -$2,840. The net change in plan fiduciary net position is calculated as $46,040.

Calculate contribution from employees for 2015:

Hence, the contribution from employee for 2015 is $30,170.

Working note (r): Calculate net change in plan fiduciary net position:

Net change in plan fiduciary net position is the difference between plan fiduciary net position at the end of the year and plan fiduciary net position at the beginning of the year. Plan fiduciary net position at the ending is $1,057,720. Plan fiduciary net position at the beginning is $1,011,680.

Calculation of net change in plan fiduciary net position is as follows:

Hence, the net change in plan fiduciary net position is $46,040.

Working note (s): Calculate net pension liability at the end of the year 2015:

Net pension liability at the end of the year 2015 is calculated as the difference between total pension liability at the ending of 2015 and plan fiduciary net position at the ending. Total pension liability at the ending of 2015 is calculated as $2,008,125 and plan fiduciary net position at the ending of 2015 is $1,057,720.

Calculation of net pension liability at the end of the year 2015 is as given below:

Hence, the net pension liability at the end of the year 2015 is $950,405.

Working note (t): Calculate net pension liability as a percentage of covered-employee payrolls:

The calculation of net pension liability as a percentage of covered-employee payroll is by dividing net pension liability at the ending by covered-employee payroll. Net pension liability at the ending is given as $950,405 and covered-employee payroll is $489,810. The calculation of covered-employee payroll is as follows:

Hence, the net pension liability as a percentage of covered-employee payrolls is 194.04%.

Want to see more full solutions like this?

Chapter 8 Solutions

Accounting For Governmental And Not For Profit Entities

- Can you solve this general accounting problem with appropriate steps and explanations?arrow_forwardCan you solve this financial accounting question with accurate accounting calculations?arrow_forwardI am looking for a reliable way to solve this financial accounting problem using accurate principles.arrow_forward

- I am searching for the accurate solution to this general accounting problem with the right approach.arrow_forwardPlease provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardPlease show me the correct approach to solving this financial accounting question with proper techniques.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education