Concept explainers

Problem 8-23 Recording and reporting stock transactions and cash dividends across two accounting cycles

Sun Corporation received a charter that authorized the issuance of 100,000 shares of $10 par common stock and 50,000 shares of $50 par, 5 percent cumulative

2018

Jan. 5 Sold 6,000 shares of the $10 par common stock for $15 per share.

12 Sold 1,000 shares of the 5 percent preferred stock for $55 per share.

Apr. 5 Sold 30,000 shares of the $10 par common stock for $21 per share.

Dec. 31 During the year, earned $150,000 in cash revenue and paid $88,000 for cash operating expenses.

31 Declared the cash dividend on the outstanding shares of preferred stock for 2018. The dividend will be paid on February 15 to stockholders of record on January 10, 2019.

2019

Feb. 15 Paid the cash dividend declared on December 31, 2018.

Mar. 3 Sold 15,000 shares of the $50 par preferred stock for $53 per share.

May 5 Purchased 900 shares of the common stock as

Dec. 31 During the year, earned $210,000 in cash revenues and paid $98,000 for cash operating expenses.

31 Declared the annual dividend on the preferred stock and a $0.50 per share dividend on the

common stock.

Required

- a. Organize the transaction data in accounts under an

accounting equation. - b. Prepare the stockholders’ equity section of the

balance sheet at December 31, 2018. - c. Prepare the balance sheet at December 31, 2019.

a)

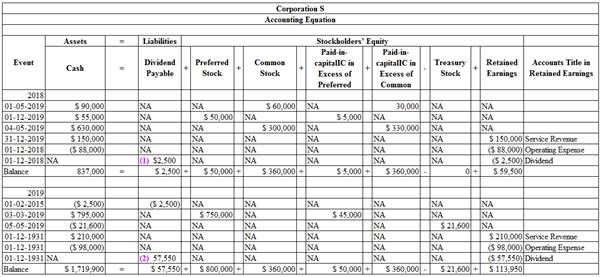

Organize the transactions data in accounts under an accounting equation..

Explanation of Solution

Organize the transactions data in accounts under an accounting equation:

Table (1)

Working note:

1. Calculate the preferred dividend amount of dividend declared in 2018.

1, 000, 5% preferred shares are outstanding at $50 par.

2. Calculate the amount of total dividend declared in 2019.

First calculate the amount of cash dividend declared for preferred stock in 2019:

Then calculate the amount of cash dividend declared for common stock in 2019:

Now, calculate the amount of total dividend declared in 2019:

b)

Prepare the stockholders’ equity section of the balance sheet at December 31, 2018.

Explanation of Solution

Stockholders’ equity section: It is a part of the balance sheet. It reports the stockholders’ equity balances as on the balance sheet date.

Prepare the stockholders’ equity section of the balance sheet at December 31, 2018:

| Corporation S | ||

| December 31, 2018 | ||

| Particulars | Amount ($) | Amount ($) |

| Stockholders’ Equity: | ||

| Preferred Stock, $50 par value, 5% cumulative, 50,000 shares authorized, 1,000 shares issued and outstanding | $50,000 | |

| Common Stock, $10 par value, 100,000 shares authorized, 36,000 shares issued and outstanding | 360,000 | |

| Paid-In Capital in Excess of Par-Preferred Stock | 5,000 | |

| Paid-In Capital in Excess of Par-Common Stock | 360,000 | |

| Total Paid-In Capital | 775,000 | |

| Retained Earnings | 59,500 | |

| Total Stockholders’ Equity | $834,500 | |

Table (2)

c)

Prepare the balance sheet at December 31, 2019.

Explanation of Solution

Balance sheet: Balance Sheet is one of the financial statements which summarize the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Prepare the balance sheet at December 31, 2019:

| Corporation S | ||

| Balance Sheet | ||

| As of December 31, 2019 | ||

| Assets | Amount | Amount |

| Cash | $1,719,900 | |

| Total Assets | $1,719,900 | |

| Liabilities and stockholders' equity | ||

| Liabilities: | ||

| Dividends Payable | $57,550 | |

| Total Liabilities | $57,550 | |

| Stockholders’ Equity: | ||

| Preferred Stock, $50 par value, 5% cumulative, 50,000 shares authorized, 16,000 shares issued and outstanding | $800,000 | |

| Common Stock, $10 par value, 100,000 shares authorized, 36,000 shares issued and 35,100 (3) outstanding | 360,000 | |

| Paid-In Capital in Excess of Par-Preferred Stock | 50,000 | |

| Paid-In Capital in Excess of Par-Common Stock | 360,000 | |

| Total Paid-In Capital | 1,570,000 | |

| Retained Earnings | 113,950 | |

| Less: Treasury stock | (21,600) | |

| Total Stockholders’ Equity | 1,662,350 | |

| Total Liabilities and Stockholders’ Equity | $1,719,900 | |

Table (5)

Working note:

3. Determine the number of shares has been issued and outstanding at the end of 2018 and 2019.

| Schedule of Number of Shares of Common Stock | ||

| Shares Issued | Shares Outstanding | |

| 2018 | ||

| January 5 | 6,000 | 6,000 |

| April 5 | 30,000 | 30,000 |

| Totals | 36,000 | 36,000 |

| 2019 | ||

| May 5 | (900) | |

| Totals | 36,000 | 35,100 |

Table (5)

Want to see more full solutions like this?

Chapter 8 Solutions

SURVEY OF ACCOUNT.(LL)-W/ACCESS>CUSTOM<

- Please provide the solution to this general accounting question using proper accounting principles.arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardI need help with this financial accounting question using standard accounting techniques.arrow_forward

- I need help with this general accounting question using standard accounting techniques.arrow_forwardI am trying to find the accurate solution to this financial accounting problem with the correct explanation.arrow_forwardPlease help me solve this financial accounting question using the right financial principles.arrow_forward

- I am searching for the correct answer to this financial accounting problem with proper accounting rules.arrow_forwardI need help finding the accurate solution to this financial accounting problem with valid methods.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning