PROBLEM 8—23 schedule or Expected cash collections;

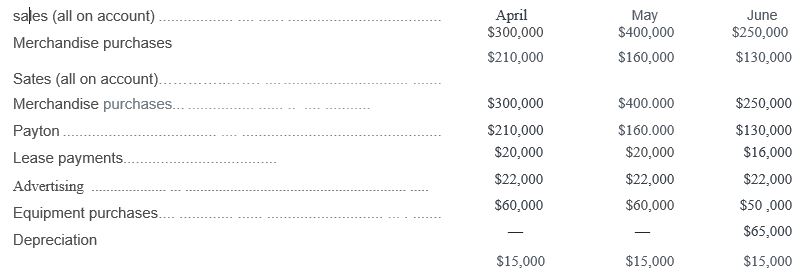

The president of the retailer Prime Products has just approached the company’s bank with a request for a $30,000. 90-day loan. The purpose of the loan is to assist the company in acquiring inventories. Because the company has had some difficulty in paying off its loans in the past the loan officer has asked for a cash budget to help determine whether the loan should be made. The following data are available for the months April through June, during which the loan will be used:

a. On April 1, the start of the loan period, die cash balance will be $24,000.

b. Past experience shows that 30% of a mouth's sales are collected in the mouth of sale, 60% in the month following sale, and 8% in the second month following sale. The other 2% is

c. Merchandise purchases are paid in full during the month following purchase. Accounts payable for merchandise purchases during March, which will be paid in April, total $140,000.

d. In preparing the cash budget, assume that the $30,000 loan will he mode in April and repaid in June Interest on the loan will total $1,200.

Required:

- Calculate the expected cash collections for April, May, and Tune, and for the three months in total.

- Prepare a cash budget, by month and in total, for the three-month period.

- If the company needs a minimum cash balance of $20,000 to start each month, can the loan be repaid as planned? Explain.

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

MANAGERIAL ACCOUNTING ACCESS CARD

- Calculate the standard cost per unit for direct materials direct labor and variable manufacturing overheadarrow_forwardI am trying to find the accurate solution to this financial accounting problem with appropriate explanations.arrow_forwardCan you show me the correct approach to solve this financial accounting problem using suitable standards?arrow_forward

- Please explain the correct approach for solving this general accounting question.arrow_forwardZebrix Ltd. has an inventory period of 55 days, an accounts receivable period of 10 days, and an accounts payable period of 6 days. The company's annual sales are $208,400. How many times per year does the company turn over its accounts receivable?arrow_forwardLika company issues 2,000 shares of $10 par value common stock for $25 per share. What amount should be credited to the Common Stock account and to the Additional Paid-in Capital account?arrow_forward

- Can you help me solve this general accounting question using the correct accounting procedures?arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning