Concept explainers

a.

To determine: The average

Risk and Return:

The risk and return are two closely related terms. The risk is the uncertainty attached to an event. In case of any investment, there is some amount of risk attached to it as there can be either gain or loss. While return in the financial term is that percentage which represents the profit in an investment.

Higher risk is associated with higher return and lower risk has a probability of lower return. The investor has to face a tradeoff between risk and return in terms of an investment.

Annual Rate of Return:

The annual rate of return refers to that return which is charged or is earned on an investment for a year. This rate is expressed in percentage.

a.

Answer to Problem 22SP

Explanation of Solution

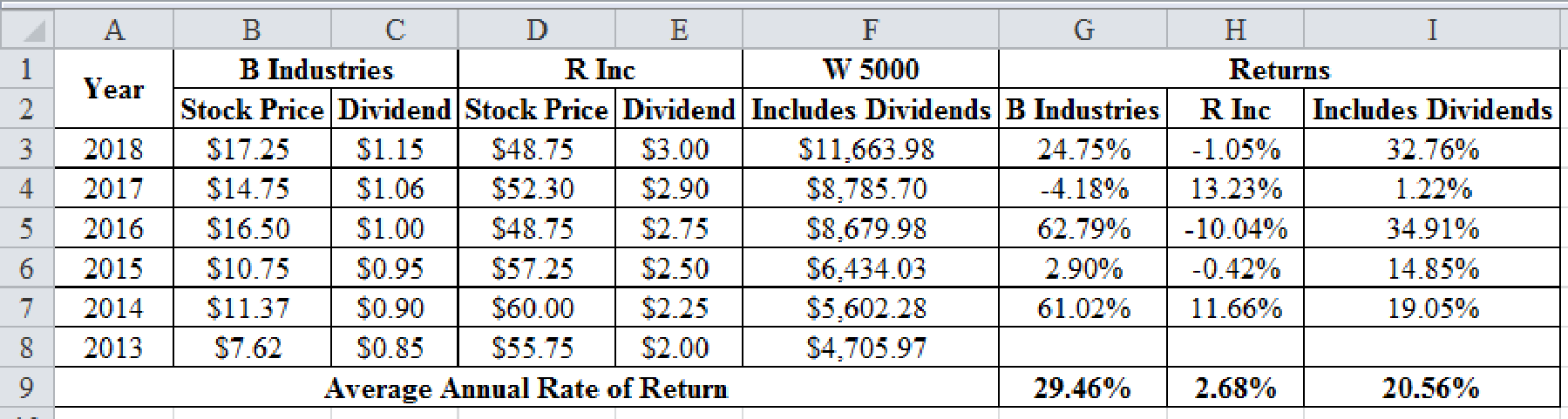

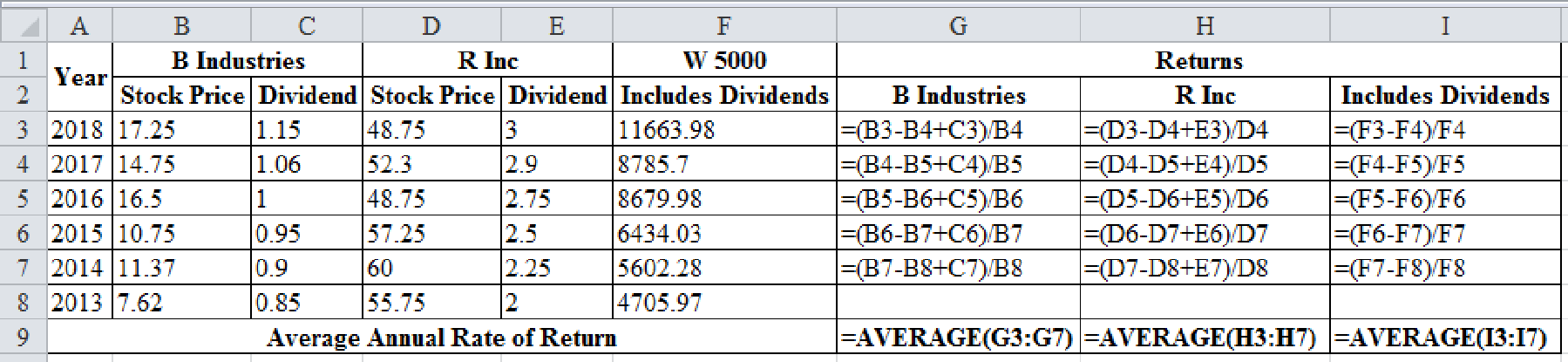

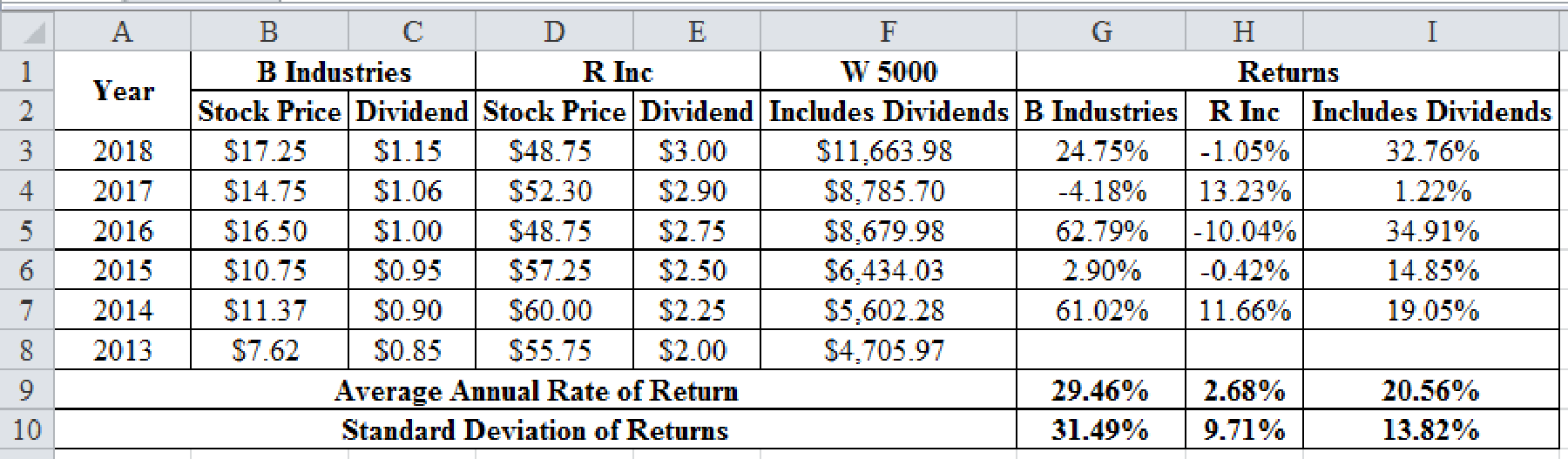

Calculation of annual rates of return in the excel spreadsheet:

Excel Spreadsheet:

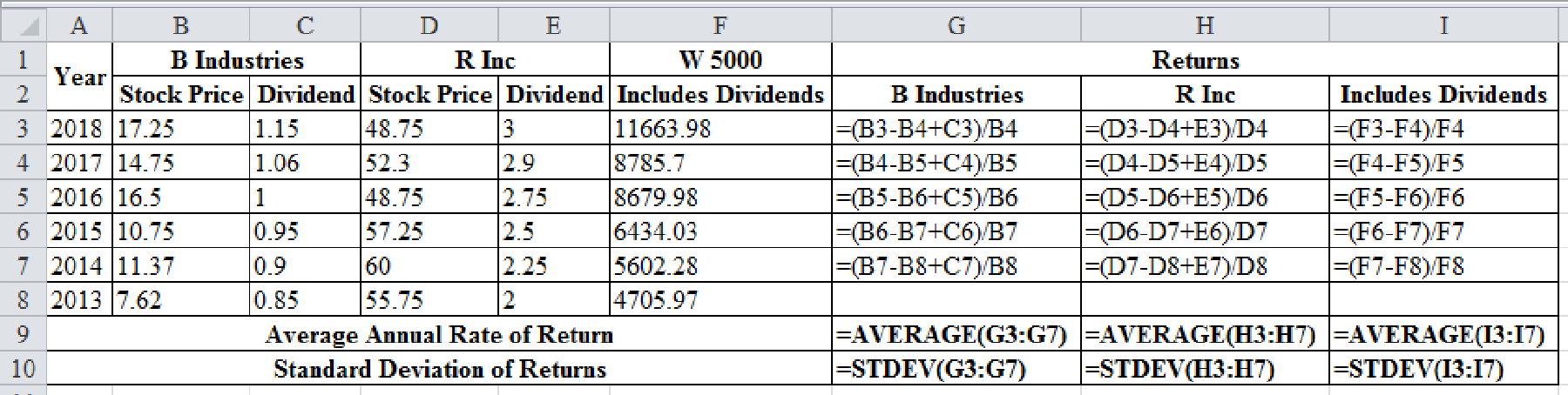

Excel Workings:

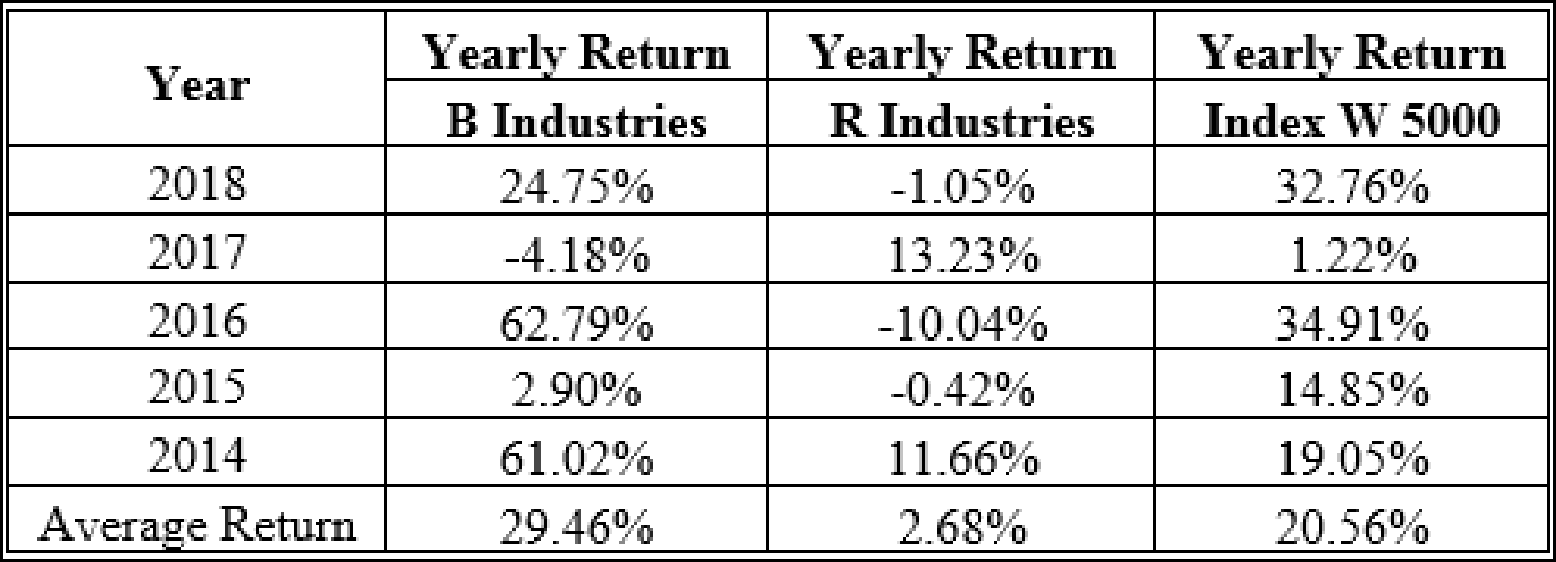

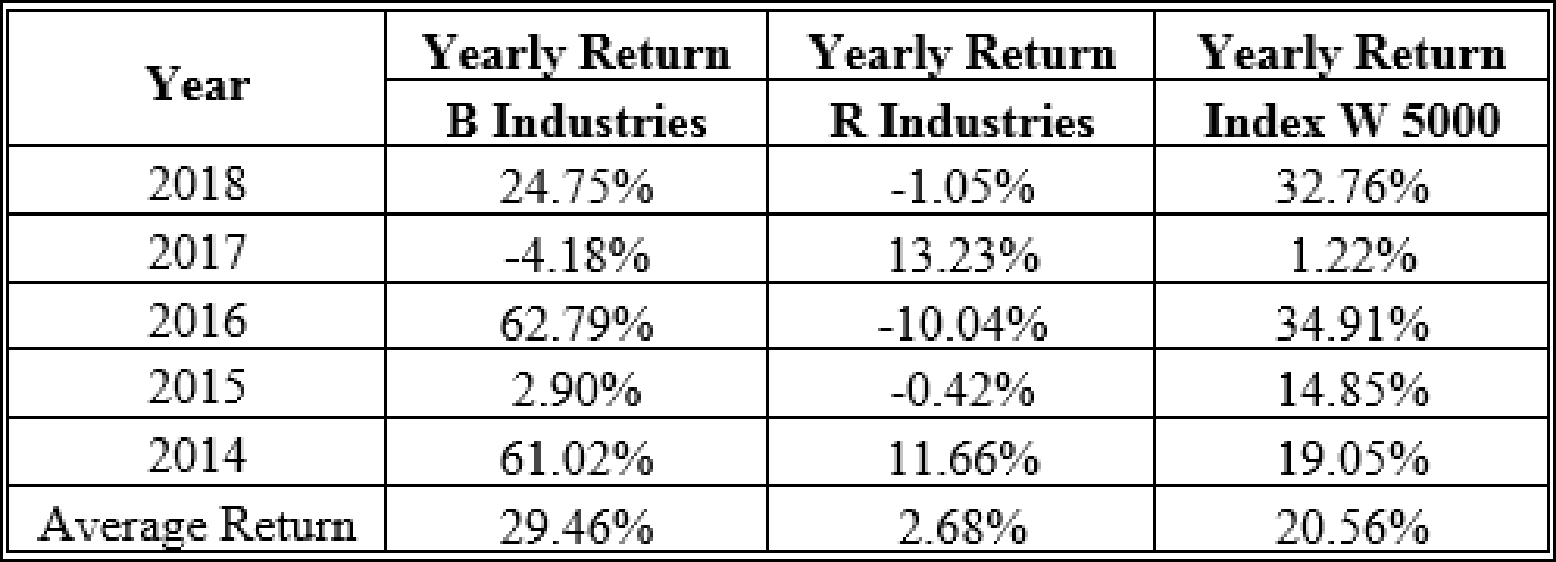

Therefore the yearly returns and average returns are as follows,

b.

To prepare: The standard deviation for the given data.

Standard deviation:

The standard deviation refers to the stand-alone risk associated with the securities. It measures how much a data is dispersed with its standard value. The Greek letter sigma represents the standard deviation.

b.

Answer to Problem 22SP

The standard deviation of B industries is 31.49%, R industries are 9.71% and Index W 5000 is 13.82%.

Explanation of Solution

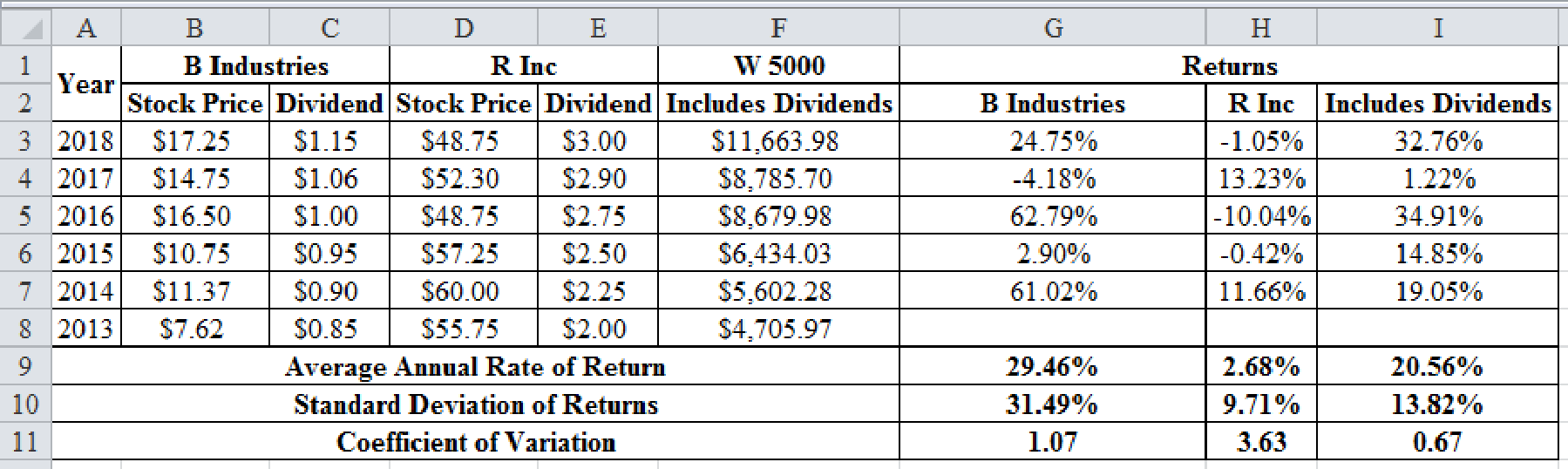

Calculation of standard deviation with a excel spreadsheet:

Excel Spreadsheet:

Excel Workings:

Therefore the standard deviation of B industries is 31.49%, R industries are 9.71% and Index W 5000 is 13.82%.

c.

To determine: The coefficient of variation.

The coefficient of variation:

The coefficient of variation is a tool to determine the risk. It determines the risk per unit of return. It is used for measurement when the expected returns are same for two data.

c.

Answer to Problem 22SP

The coefficient of variation of B industries is 1.07, R industries are 3.63 and Index W 5000 is 0.67.

Explanation of Solution

The calculations of the coefficient of variation for the given data is shown below using excel:

Excel Spreadsheet:

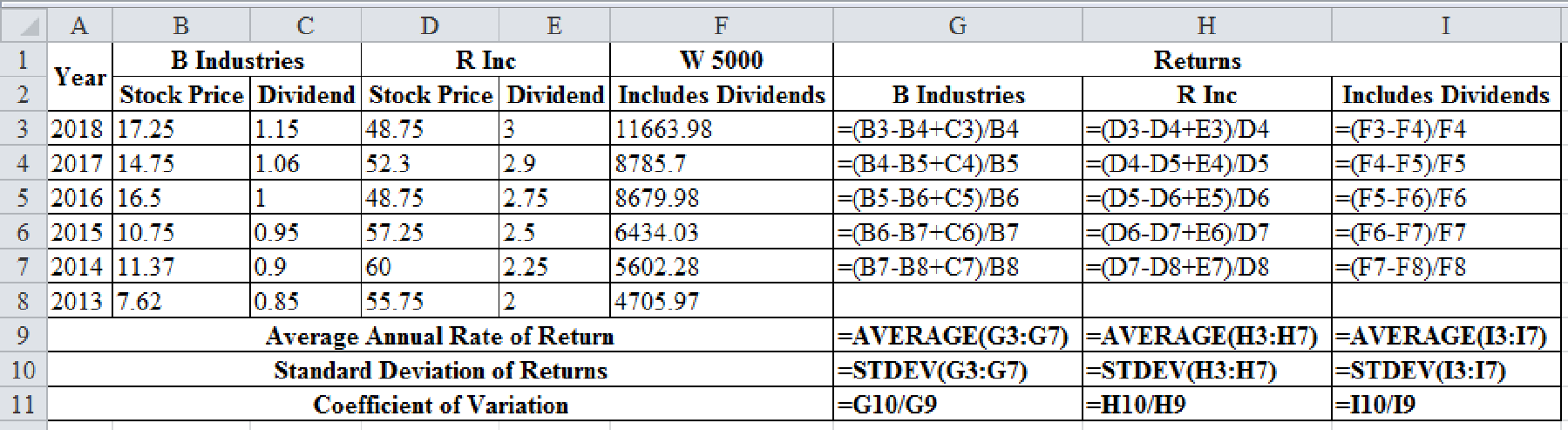

Excel Workings:

Therefore the coefficient of variation of B industries is 1.07, R industries are 3.63 and Index W 5000 is 0.67.

d.

To determine: The Sharpe ratio.

d.

Answer to Problem 22SP

The Sharpe ratio of B industries is 0.84, R industries are -0.03 and Index W 5000 is 1.27.

Explanation of Solution

Calculate the Sharpe Ratio for each company:

Therefore the Sharpe ratio of B industries is 0.84, R industries are -0.03 and Index W 5000 is 1.27.

e.

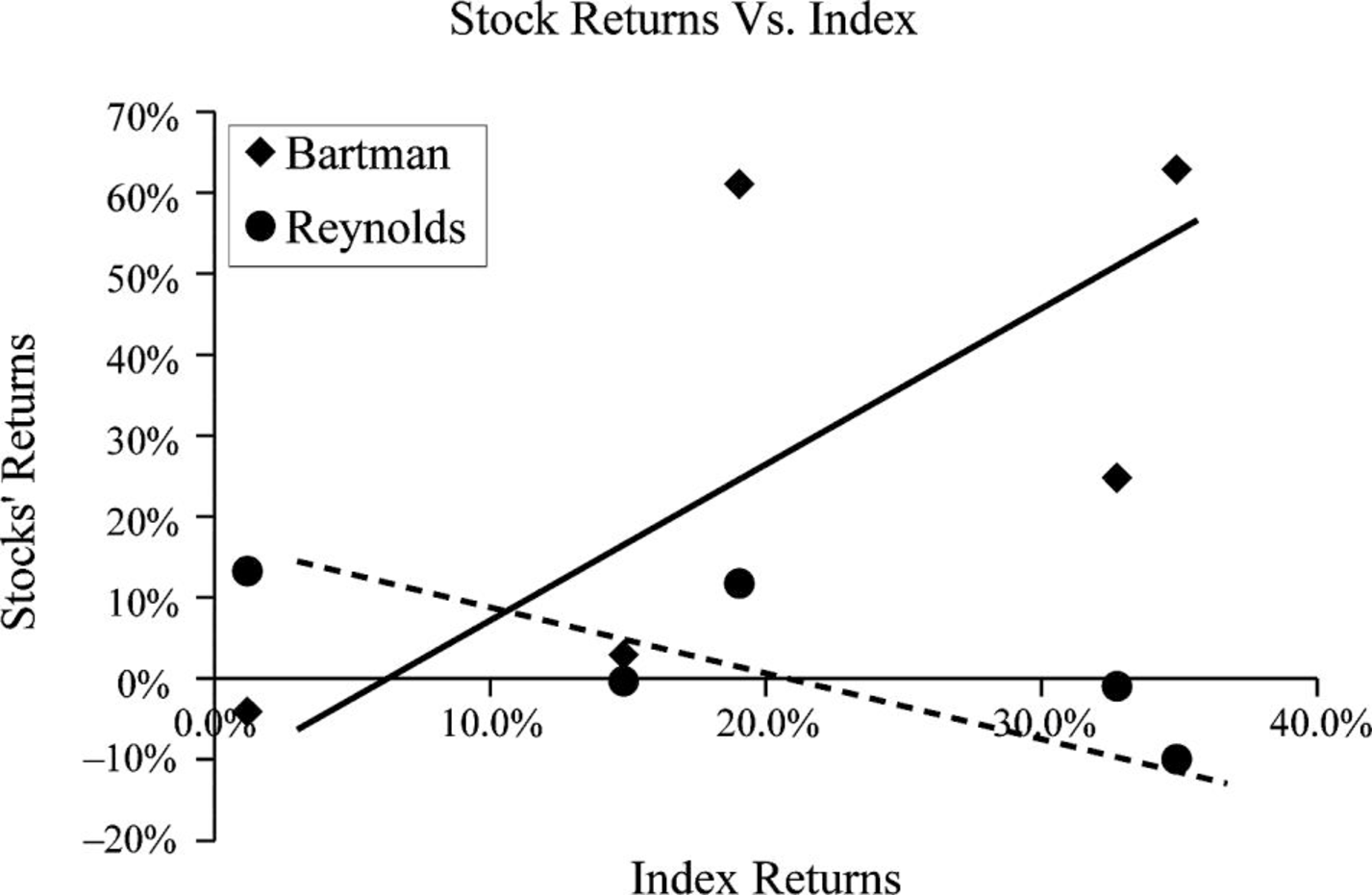

To prepare: A scatter diagram showing the company’s returns and the index returns.

e.

Explanation of Solution

The scatter diagram is as shown below:

Graph (1)

- The blue line represents the B Industries and the red line represents the R Inc. and green lone represents the Index W 5000.

f.

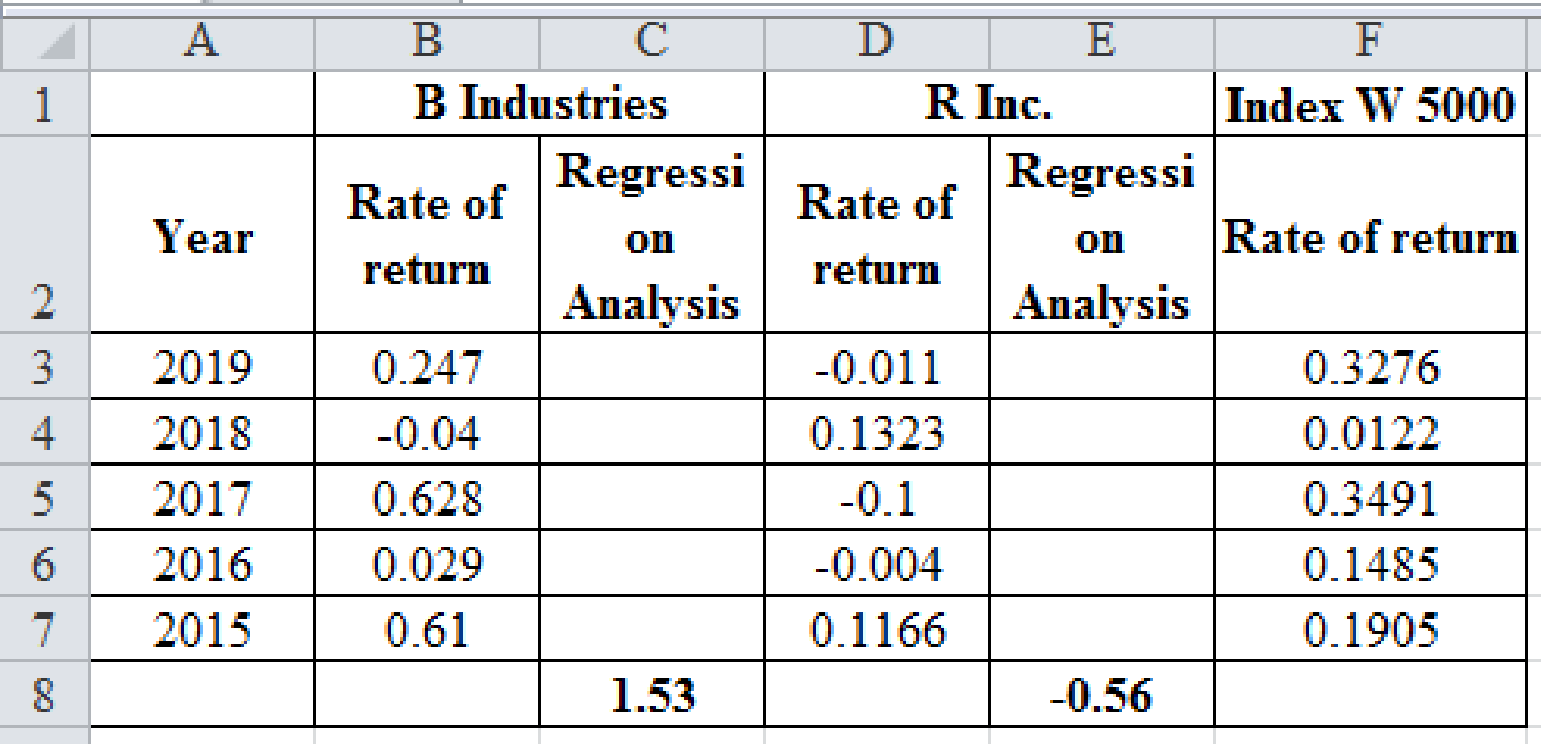

To determine: The beta of the B Industries and R Inc. by running regressions of their returns.

f.

Answer to Problem 22SP

The beta of B industries is 1.53, R industries are -0.56.

Explanation of Solution

The beta of the B Industries, R Inc. and W 5000 by running regressions of their returns is:

Therefore the beta of B industries is 1.53, R industries are -0.56.

g.

To determine: The required returns of the two companies by security market line equation.

g.

Answer to Problem 22SP

The required return of B industries is 13.67%, R industries are -3.26%.

Explanation of Solution

Given,

The risk-free rate is 4.5%.

The expected return on market is 10%.

Calculation of the required return:

Therefore the required return of B industries is 12.97%, R industries are 1.42%.

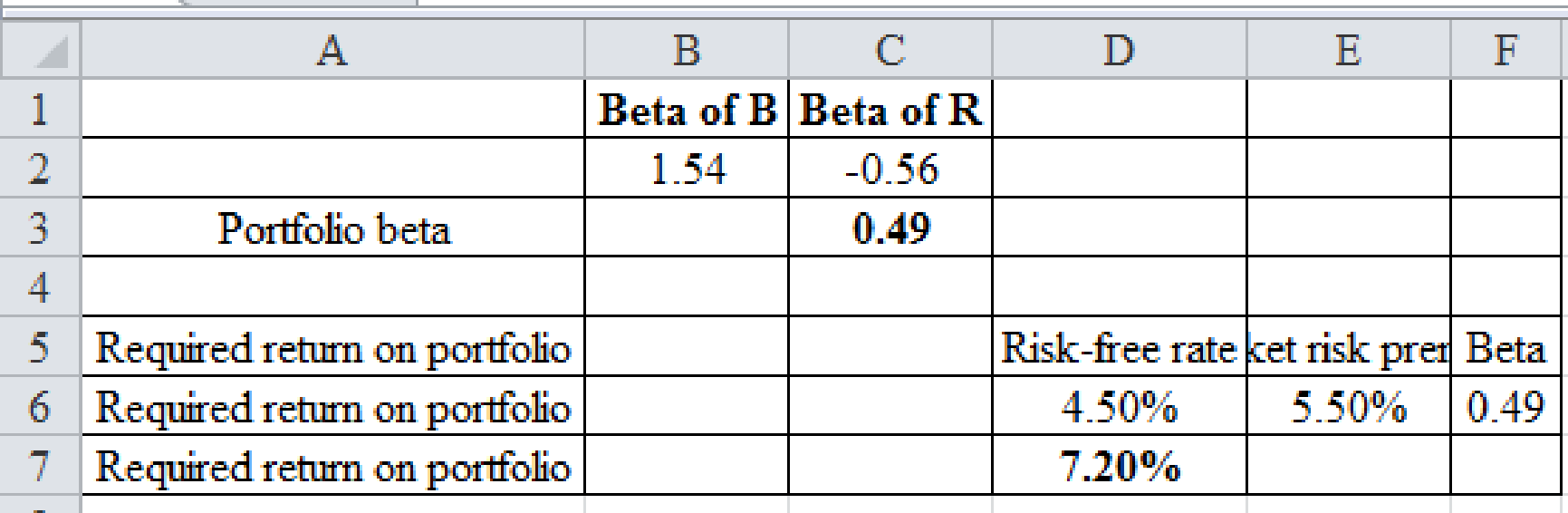

h.

To determine: The beta and the required return for a newly constructed portfolio.

h.

Answer to Problem 22SP

The required return of portfolio is 7.20% and the portfolio beta is 0.49.

Explanation of Solution

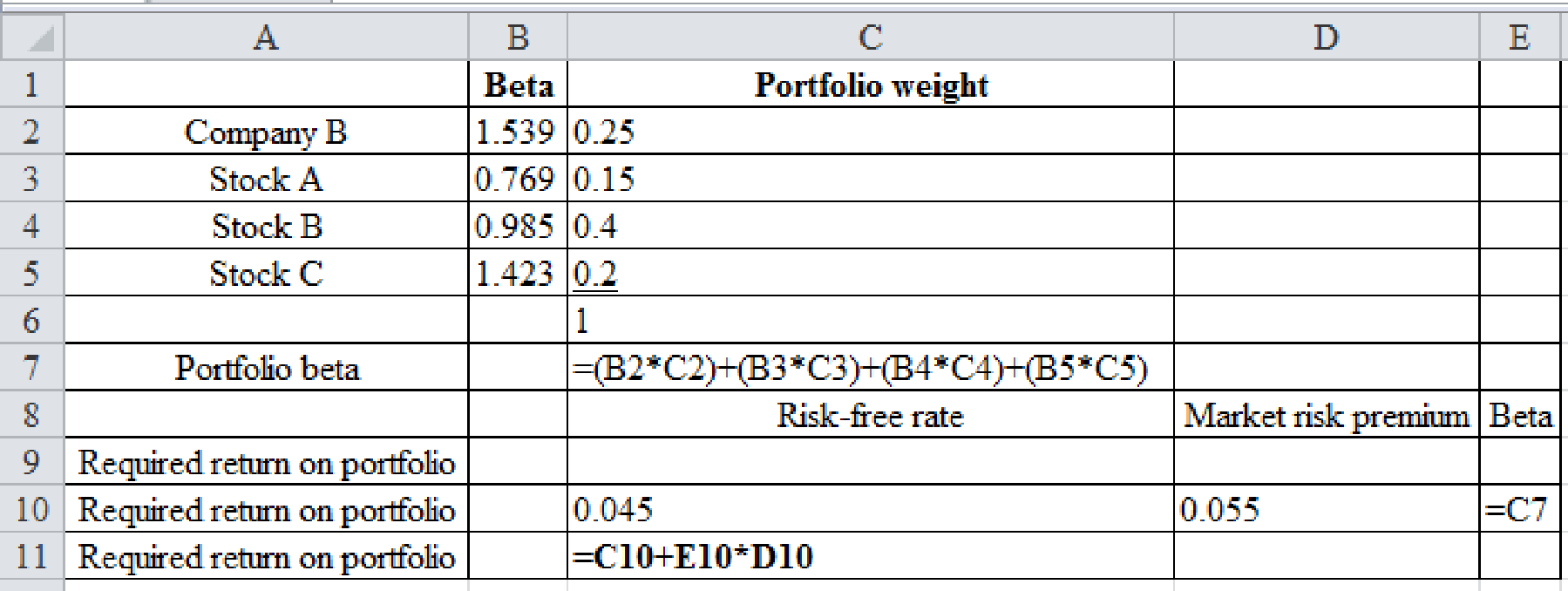

Calculation of the beta and the required return for the new portfolio:

Therefore the required return of portfolio is 7.20% and the portfolio beta is 0.49.

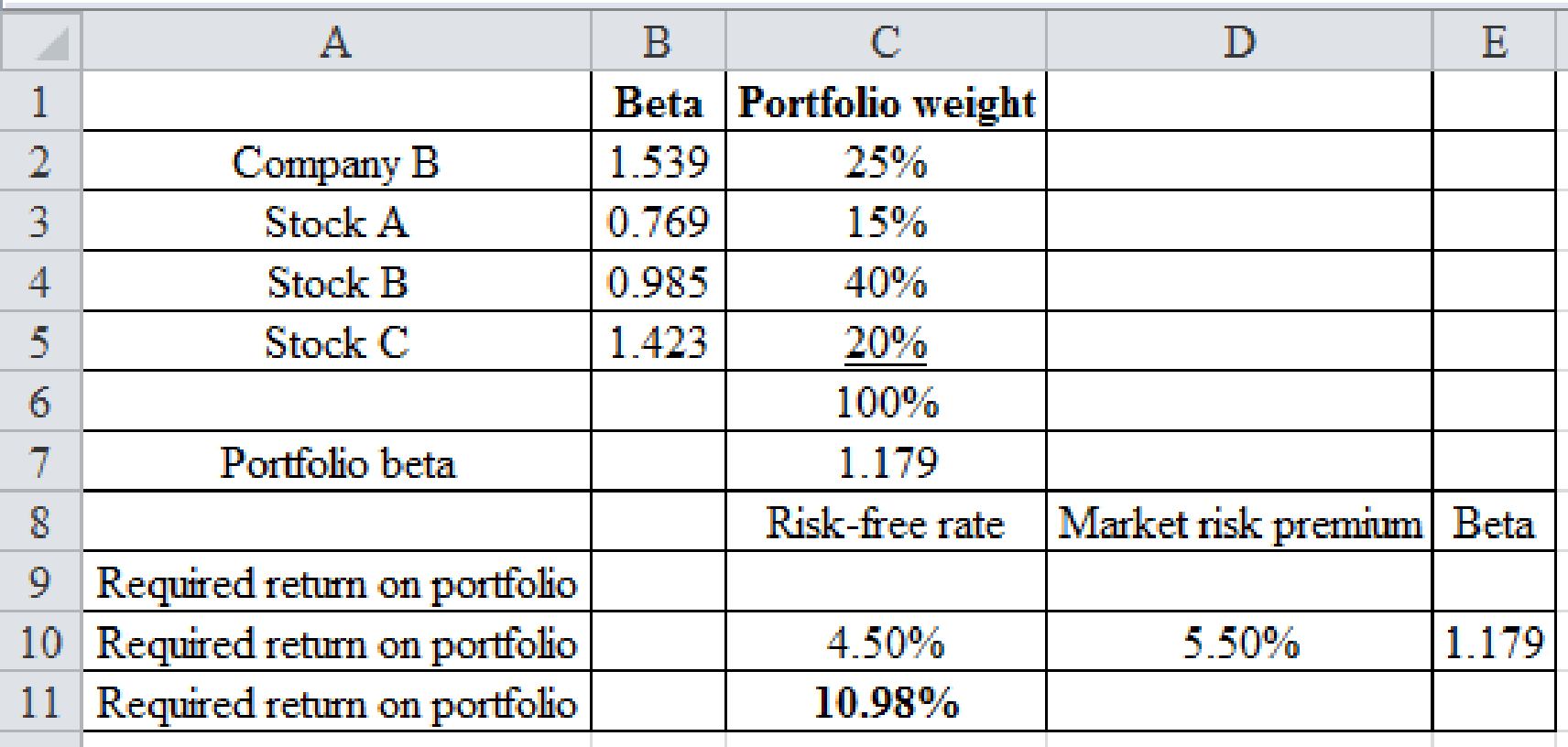

i.

To determine: The new portfolio’s required return.

i.

Answer to Problem 22SP

The new portfolio’s required return is 10.98%.

Explanation of Solution

Calculation of the required return on the portfolio:

Excel Spreadsheet:

Excel Workings:

Therefore the new portfolio’s required return is 10.98%.

Want to see more full solutions like this?

Chapter 8 Solutions

Fundamentals of Financial Management, Concise Edition

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning