To calculate: The MIRR (Modified

Introduction:

MIRR is the Modified Internal Rate of Return; it is a financial measure of attracting investments. It is utilized in capital budgeting to rank the alternative investments of the same size.

Answer to Problem 22QP

The MIRR for the project using the discounted approach is 19.21%, reinvestment approach is 14.49%, and combination approach is 14.14%.

Explanation of Solution

Given information:

Company M is assessing a project where the cash flows are $10,430, $13,850, $11,270, $9,830, and -$4,050 for year 1, 2, 3, 4, and 5 respectively. The initial cost is $27,500.

Discounted approach:

In this approach, compute the negative cash outflows value at year 0. On the other hand, the positive cash flows remain at its time of occurrence. Hence, discount the cash outflows to year 0.

Time 0 cash flow=Initial cost+−Cash outflows(1+r)t=−$27,500+−$4,050(1+0.10)5=−$30,014.73

Hence, the discounted cash flow at time 0 is -$30,014.73.

Equation of MIRR in a discounted approach:

0=−$30,014.73+$10,430(1+MIRR)+$13,850(1+MIRR)2+$11,270(1+MIRR)3+$9,830(1+MIRR)4

Compute MIRR using a spreadsheet:

Step 1:

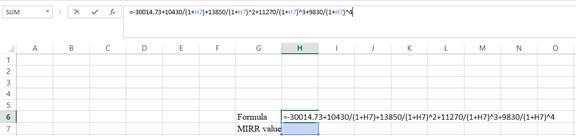

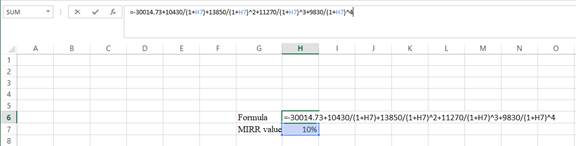

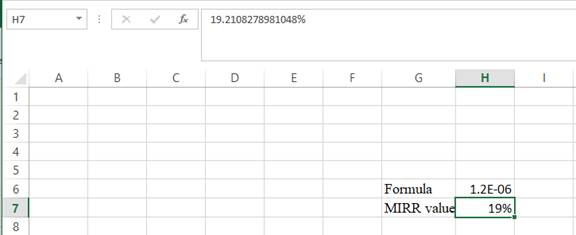

- Type the equation of

NPV in H6 in the spreadsheet and consider the MIRR value as H7.

Step 2:

- Assume the MIRR value as 0.10%.

Step 3:

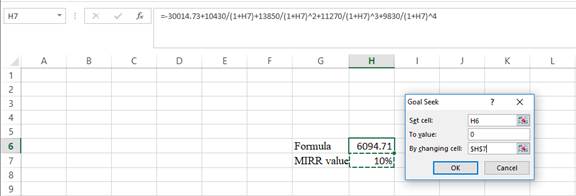

- In the spreadsheet, go to data and select the what-if analysis.

- In the what-if analysis, select goal seek.

- In set cell, select H6 (the formula).

- The “To value” is considered as 0 (the assumption value for NPV).

- The H7 cell is selected for the by changing cell.

Step 4:

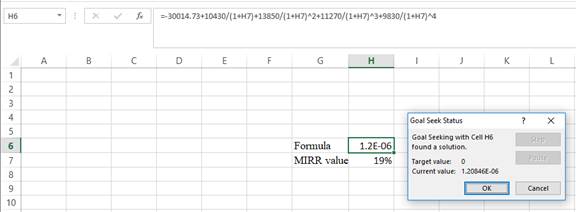

- Following the previous step click OK in the goal seek. The goal seek status appears with the MIRR value.

Step 5:

- Thevalue appears to be 19.2108278981048%.

Hence, the MIRR value is 19.21%.

Reinvestment approach:

In this approach, compute the

Time 5 cash flow=Cash flows (year 1(1+r)4+year 2(1+r)3+year 3(1+r)2+year 4(1+r)+year 5)=($10,430(1+0.10)4+$13,850(1+0.10)3+$11,270(1+0.10)2+$9,830(1+0.10)−$4,050)=$10,430(1.4641)+$13,850(1.331)+$11,270(1.21)+$9,830(1.10)−$4,050=$54,104.61

Hence, the reinvesting cash flow at time 5 is $54,104.61.

Equation of MIRR in reinvestment approach:

0=−$27,500+$54,104.61(1+MIRR)5

Compute the MIRR:

0=−$27,500+$54,104.61(1+MIRR)5$54,104.61$27,500=(1+MIRR)5MIRR=($54,104.61$27,500)1/5−1MIRR=0.1449 or 14.49%

Hence, the MIRR is 14.49%.

Combination approach:

In this approach, compute all the cash outflows at year 0 and all the

Time 0 cash flow=Initial cost+−Cash outflows(1+r)t=−$27,500+−$4,050(1+0.10)5=−$30,014.73

Hence, the total cash outflow at year 0 is -$30,014.73.

Time 5 cash flow=Cash flows (year1(1+r)4+year2(1+r)3+year3(1+r)2+year4(1+r)+year5)=($10,430(1+0.10)4+$13,850(1+0.10)3+$11,270(1+0.10)2+$9,830(1+0.10))=$10,430(1.4641)+$13,850(1.331)+$11,270(1.21)+$9,830(1.10)=$58,154.61

Hence, the value of total cash inflows is $58,154.61.

Equation of MIRR in combination approach:

0=−$30,014.73+$58,154.61(1+MIRR)5

Compute the MIRR:

0=−$30,014.73+$58,154.61(1+MIRR)5$58,154.61$30,014.73=(1+MIRR)5MIRR=($58,154.61$30,014.73)1/5−1MIRR=0.1414 or 14.14%

Hence, the MIRR is $14.14%.

Want to see more full solutions like this?

Chapter 8 Solutions

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College