Concept explainers

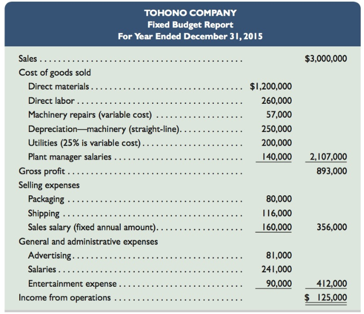

Tohono Company’s 2015

Required

1. Classify all items listed in the fixed budget as variable or fixed. Also determine their amounts per unit or their amounts for the year, as appropriate.

2. Prepare flexible budgets (see Exhibit 8.3) for the company at sales volumes of 18,000 and 24,000 units.

3. The company’s business conditions are improving. One possible result is a sales volume of 28,000 units. The company president is confident that this volume is within the relevant range of existing capacity. How much would operating income increase over the 2015 budgeted amount of $125,000 if this level is reached without increasing capacity?

4. An unfavorable change in business is remotely possible; in this case, production and sales volume for

2015 could fall to 14,000 units. How much income (or loss) from operations would occur if sales volume falls to this level?

Concept introduction:

Fixed Budget:

A fixed budget, also known as static budget does not adjust throughout the budget period and is prepared on the assumption that specific amount of goods would be sold in the concerned period.

Requirement 1:

Classification of items of fixed budget as fixed or variable and their amounts per unit or their amounts for the year.

Answer to Problem 1PSB

Classification of fixed budget items as fixed or variable (Amount in $):

| Particulars | Total amount | Amount per unit |

| Variable costs: | ||

| Direct materials | 12, 00, 000 | 60 |

| Direct labor | 2, 60, 000 | 13 |

| Machinery repairs | 57, 000 | 2.85 |

| Utilities | 50, 000 | 2.5 |

| Packaging | 80, 000 | 4 |

| Shipping | 1, 16, 000 | 5.8 |

| Total variable costs | 88.15 | |

| Fixed costs: | ||

| Depreciation- machinery | 2, 50, 000 | |

| Utilities | 1, 50, 000 | |

| Plant manager salaries | 1, 40, 000 | |

| Sales salaries | 1, 60, 000 | |

| Advertising | 81, 000 | |

| Salaries | 2, 41, 000 | |

| Entertainment expense | 90, 000 | |

| Total fixed costs | 11, 12, 000 |

Explanation of Solution

The items laid in fixed budget of the company in the given problem can be classified into variable or fixed based on their nature i.e. on the basis of their behavior and traceability as explained below:

Variable costs vary directly with the production level i.e. company’s variable cost increases as the production increases and vice-a-versa. Therefore, following costs would be classified as Variable:

- Direct materials: The direct materials would be relate to the amount paid for procurement of materials which would vary

- Direct labor: The payment made to direct labor would vary depending upon the production

- Machinery repairs: The repairs done on machinery would be varied depending upon the usage of machinery for production of output

- Utilities: Utilities would be acquired depending on their requirement which would vary

- Packaging: The amount spent on packaging would be in relation to products produced which would vary

- Shipping: Expenses incurred on shipping would be incurred based on the number of products produced

Fixed costs do not vary with the level of production. They do not change with the amount of goods or services a company produces. Therefore, those costs which are fixed in nature would be covered under fixed costs as given below:

- Depreciation- Machinery: The depreciation charged on machinery is straight- line and would remain fixed

- Utilities: Utilities other than variable in nature would be covered under fixed cost

- Plant manager salaries: The salaries paid for managing would be fixed in nature

- Sales salaries: Salaries paid to sales staff would remain fixed in nature

- Advertising: The expenses on advertising would be covered under fixed cost

- Salaries: Salaries paid to staff would remain fixed in nature and would not change with the level of production

- Entertainment expense: Expenses on entertainment are fixed irrespective of the level of production

Further, it is given in the problem that sales volume is 20, 000 units and Sales are $3, 000, 0000. Therefore, calculation of Variable cost per unit has been calculated using the following formula:

Following would be the per unit amounts:

Thus, the total variable costs would be the following:

Also, fixed costs would include the following;

Therefore, classification of fixed budget items as asked in the given problem is shown below in the tabular manner:

Classification of fixed budget items as fixed or variable (Amount in $):

| Particulars | Total amount | Amount per unit |

| Variable costs: | ||

| Direct materials | 12, 00, 000 | 60 |

| Direct labor | 2, 60, 000 | 13 |

| Machinery repairs | 57, 000 | 2.85 |

| Utilities | 50, 000 | 2.5 |

| Packaging | 80, 000 | 4 |

| Shipping | 1, 16, 000 | 5.8 |

| Total variable costs | 88.15 | |

| Fixed costs: | ||

| Depreciation- machinery | 2, 50, 000 | |

| Utilities | 1, 50, 000 | |

| Plant manager salaries | 1, 40, 000 | |

| Sales salaries | 1, 60, 000 | |

| Advertising | 81, 000 | |

| Salaries | 2, 41, 000 | |

| Entertainment expense | 90, 000 | |

| Total fixed costs | 11, 12, 000 |

Concept introduction:

Flexible Budget:

A flexible budget, also known as variation budget adjusts to changes in volume or activity. Flexible budgets are prepared for comparing actual to budgeted performances at many levels of activity during the previous year. In order to accurately predict the changes in costs, management identifies them into fixed or variable costs.

Fixed cost:

These costs do not vary with the level of production. They do not change with the amount of goods or services a company produces. They remain same even if the company does not produce any product or provide any service during an accounting period.

Variable cost:

These costs vary with the level of production. They are usually shown in the budget as either a percentage of total revenue or at a constant rate per unit produced.

Requirement 2:

Flexible budget for the company at sales volume of 18, 000 units and 24, 000 units.

Answer to Problem 1PSB

Flexible budget for the company for the year ended December 31, 2015 (Amount in $):

| Company | ||||

| Flexible budget | ||||

| For year ended December 31, 2015 | ||||

| Particulars | Flexible budget | Flexible budget for 18, 000 units sold | Flexible budget for 24, 000 units sold | |

| Variable amount per unit | Total fixed cost | |||

| Sales | 150 | 27, 00, 000 | 36, 00, 000 | |

| Variable costs: | ||||

| Direct materials | 60 | 10, 80, 000 | 14, 40, 000 | |

| Direct labor | 13 | 2, 34, 000 | 3, 12, 000 | |

| Machinery repairs | 2.85 | 51, 300 | 68, 400 | |

| Utilities | 2.5 | 45, 000 | 60, 000 | |

| Packaging | 4 | 72, 000 | 96, 000 | |

| Shipping | 5.8 | 1, 04, 400 | 1, 39, 200 | |

| Total variable costs | 88.15 | 15, 86, 700 | 21, 15, 600 | |

| Contribution margin | 61.85 | 11, 13, 300 | 14, 84, 400 | |

| Fixed costs: | ||||

| Depreciation- machinery | 2, 50, 000 | 2, 50, 000 | 2, 50, 000 | |

| Utilities | 1, 50, 000 | 1, 50, 000 | 1, 50, 000 | |

| Plant manager salaries | 1, 40, 000 | 1, 40, 000 | 1, 40, 000 | |

| Sales salary | 1, 60, 000 | 1, 60, 000 | 1, 60, 000 | |

| Advertising | 81, 000 | 81, 000 | 81, 000 | |

| Salaries | 2, 41, 000 | 2, 41, 000 | 2, 41, 000 | |

| Entertainment expense | 90, 000 | 90, 000 | 90, 000 | |

| Total fixed costs | 11, 12, 000 | 11, 12, 000 | 11, 12, 000 | |

| Income from operations | 1, 300 | 3, 72, 400 | ||

Explanation of Solution

For preparation of flexible budget of the company, following formulas would be used:

In the given problem, it is given that sales are $30, 00, 000 and sales volume is 20, 000 units.

Flexible budget has to be prepared at sales volume of 14, 000 and 16, 000 units. We have already calculated variable cost per unit of all the items. Now, calculations for variable cost have been made in the following manner:

| Particulars | Variable amount per unit (Amount in $) | For 18, 000 units sold | For 24, 000 units sold |

| Sales | 150 | $150*18, 000 = 27, 00, 000 | $150*24, 000 = 36, 00, 000 |

| Variable costs: | |||

| Direct materials | 60 | $60*18, 000 = 10, 80, 000 | $60*24, 000 = 14, 40, 000 |

| Direct labor | 13 | $13*18, 000 = 2, 34, 000 | $13*24, 000 = 3, 12, 000 |

| Machinery repairs | 2.85 | $2.85*18, 000 = 51, 300 | $2.85*24, 000 = 68, 400 |

| Utilities | 2.5 | $2.5*18, 000 = 45, 000 | $2.5*24, 000 = 60, 000 |

| Packaging | 4 | $4*18, 000 = 72, 000 | $4*24, 000 = 96, 000 |

| Shipping | 5.8 | $5.8*18, 000 = 1, 04, 400 | $5.8*24, 000 = 1, 39, 200 |

| Total variable costs | 61.85 | 11, 13, 300 | 14, 84, 400 |

Further, contribution margin can be calculated using the below- mentioned formulas:

Thus, contribution margin would be:

Fixed costs would remain same irrespective of the changes in sales volume. Also, Income from operations can be computed using the following formula:

Therefore, flexible budget asked in the given problem at 18, 000 and 24, 000 units is given below:

Flexible budget for the company for the year ended December 31, 2015 (Amount in $):

| Company | ||||

| Flexible budget | ||||

| For year ended December 31, 2015 | ||||

| Particulars | Flexible budget | Flexible budget for 18, 000 units sold | Flexible budget for 24, 000 units sold | |

| Variable amount per unit | Total fixed cost | |||

| Sales | 150 | 27, 00, 000 | 36, 00, 000 | |

| Variable costs: | ||||

| Direct materials | 60 | 10, 80, 000 | 14, 40, 000 | |

| Direct labor | 13 | 2, 34, 000 | 3, 12, 000 | |

| Machinery repairs | 2.85 | 51, 300 | 68, 400 | |

| Utilities | 2.5 | 45, 000 | 60, 000 | |

| Packaging | 4 | 72, 000 | 96, 000 | |

| Shipping | 5.8 | 1, 04, 400 | 1, 39, 200 | |

| Total variable costs | 88.15 | 15, 86, 700 | 21, 15, 600 | |

| Contribution margin | 61.85 | 11, 13, 300 | 14, 84, 400 | |

| Fixed costs: | ||||

| Depreciation- machinery | 2, 50, 000 | 2, 50, 000 | 2, 50, 000 | |

| Utilities | 1, 50, 000 | 1, 50, 000 | 1, 50, 000 | |

| Plant manager salaries | 1, 40, 000 | 1, 40, 000 | 1, 40, 000 | |

| Sales salary | 1, 60, 000 | 1, 60, 000 | 1, 60, 000 | |

| Advertising | 81, 000 | 81, 000 | 81, 000 | |

| Salaries | 2, 41, 000 | 2, 41, 000 | 2, 41, 000 | |

| Entertainment expense | 90, 000 | 90, 000 | 90, 000 | |

| Total fixed costs | 11, 12, 000 | 11, 12, 000 | 11, 12, 000 | |

| Income from operations | 1, 300 | 3, 72, 400 | ||

Thus, the income from operations of company at sales volume of 18, 000 and 24, 000 units are $1, 300 and $3, 72, 400 respectively.

Concept introduction:

Fixed cost:

These costs do not vary with the level of production. They do not change with the amount of goods or services a company produces. They remain same even if the company does not produce any product or provide any service during an accounting period.

Variable cost:

These costs vary with the level of production. They are usually shown in the budget as either a percentage of total revenue or at a constant rate per unit produced.

Requirement 3:

Increase in operating income at 28, 000 units without increasing capacity.

Answer to Problem 1PSB

Increase in operating income at 28, 000 units without increasing capacity = $4, 94, 800

Explanation of Solution

Sales volume has been increased to 28, 000 units from 20, 000 units, thereby increasing 8, 000 units sold (28, 000 units- 20, 000 units). For calculating increase in operating income with existing capacity and fixed costs, firstly total contribution margin would be calculated using the following formula:

Contribution margin per unit has already been calculated as $61.85 per unit. Thus,

Total fixed costs are calculated as $11, 12, 000. Therefore, all the calculations have been shown in the table below:

| Particulars | Amount |

| Total contribution margin | $61.85* 28, 000 units = $17, 31, 800 |

| Less: Fixed costs | ($11, 12, 000) |

| Potential operating loss | $6, 19, 800 |

| Budgeted income of 2015 | ($1, 25, 000) |

| Increase in operational income | $4, 94, 800 |

Therefore, Increase in operating income at 28, 000 units without increasing capacity is coming out to be $4, 94, 800.

Concept introduction:

Fixed cost:

These costs do not vary with the level of production. They do not change with the amount of goods or services a company produces. They remain same even if the company does not produce any product or provide any service during an accounting period.

Variable cost:

These costs vary with the level of production. They are usually shown in the budget as either a percentage of total revenue or at a constant rate per unit produced.

Requirement 4:

Income (or loss) from operations if sales volume fall to 14, 000 units.

Answer to Problem 1PSB

Potential operating loss at sales volume of 14, 000 units = $2, 46, 100

Explanation of Solution

Sales volume has fallen to 14, 000 units from 20, 000 units, thereby decreasing 6, 000 units sold (20, 000 units- 14, 000 units). For calculating income (or loss) from operations, firstly total contribution margin would be calculated using the following formula:

Contribution margin per unit has already been calculated as $61.85 per unit. Thus,

Total fixed costs are calculated as $11, 12, 000. Therefore, all the calculations have been shown in the table below:

| Particulars | Amount |

| Total contribution margin | $61.85* 14, 000 units = $8, 65, 900 |

| Less: Fixed costs | ($11, 12, 000) |

| Potential operating loss | $2, 46, 100 |

Therefore, the potential operating loss at 14, 000 units is coming out to be $2, 46, 100.

Want to see more full solutions like this?

Chapter 8 Solutions

Managerial Accounting

- Tutor please provide answerarrow_forwardAfter a comprehensive review of accounts receivable, Parkview Medical Center found that their accounts receivable balance stands at $415,000. Based on historical collection patterns and an aging analysis, the finance team estimates that 6.5% of these receivables will ultimately prove uncollectible. Currently, the Allowance for Doubtful Accounts has a credit balance of $4,200. The finance director has asked you to calculate the necessary bad debt expense for accurate financial reporting and to ensure the company maintains appropriate reserves for potential losses. What amount should Parkview Medical Center record as bad debt expense?arrow_forwardClemson Corporation can give up one unit of future consumption and as a result increase its current consumption by 0.92 units. What must be its real rate of interest?arrow_forward

- I need guidance on solving this financial accounting problem with appropriate financial standards.arrow_forwardTheir total fixed expenses are $18,000 and their total operating income is $30,000.arrow_forwardPlease provide the correct answer to this financial accounting problem using accurate calculations.arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning