Concept explainers

Expected

Standard deviation is the financial measure of risk and stability on the

Coefficient of variance is a measure used to calculate the total risk per unit of return of an investment.

Explanation of Solution

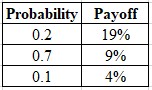

Calculate the expected return as follows:

Therefore, the expected return is

Calculate the standard deviation as follows:

Therefore, the standard deviation is

Calculate the coefficient of variance as follows:

Therefore, the coefficient of variance is

Want to see more full solutions like this?

Chapter 8 Solutions

CFIN -STUDENT EDITION-W/ACCESS >CUSTOM<

- What are the 4 areas of finance?arrow_forwardQuestion 1 Determine the price of a zero-coupon bond that has a par value of $8000 with a maturity date in 10 years that is priced to yield 5% compounded yearly. Question 2 A bond has a face value of $10,000 and matures in 10 years. The coupon rate is 3% compounded quarterly. a) What is the amount of the dividend each quarter? b) What is the price of the bond to yield a true interest rate of 2.5% compounded quarterly? c) How much will you make if you invest in this bond? Question 5 You want to have $50,000 in 5 years. A. How much must you deposit each QUARTER in an account paying 10% compounded quarterly to reach this goal in 5 years? Round to the nearest cent. B. How much is your total contribution? Round to the nearest cent. C. How much interest did you earn for this investment? Round to the nearest cent. Question 3 The amortization schedule below is based on a $150,000, 30-year mortgage, financed at 6.01%. It has partially filled in for you. Payment…arrow_forwardHow to answer “Why” finance interview questions?arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning