To discuss:

Annual average return and standard deviation.

Introduction:

Return: In financial context, return is seen as percentage that represents the profit in an investment.

Explanation of Solution

The annual average

Using equation (1) the annual average return of Miller’s Fund (MF) is calculated as follows:

The annual average return of Miller’s Fund (MF) is 24.325%..

Using equation (1) the annual average return of S&P is calculated as follows:

The annual average return of S&P is 14.925%.

By the annual average returns, Miller’s Fund performed better than the S&P over the given period of time.

If money investment of $1,000 is made in Miller’s Fund in 2009, the money reaped at the end of 2012 would be $1,243.25

If money investment of $1,000 is made in S&P in 2009, the money reaped at the end of 2012 would be $1,149.25

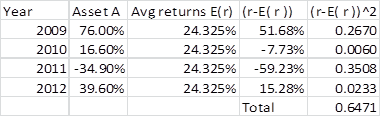

The standard deviation of Miller’s Fund can be calculated as follows using excel functions as in table1.

Table 1

The standard deviation of Miller’s Fund is calculated as follows:

The standard deviation of Miller’s Fund is 46.44%.

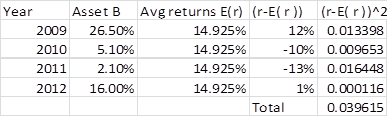

The standard deviation of S&P can be calculated as follows using excel functions as in table 2.

Table 2

The standard deviation of S&P is calculated as follows:

The standard deviation of S&P is 11.5%.

By the value of standard deviation, Millers Fund is more volatile than S&P.

Want to see more full solutions like this?

Chapter 8 Solutions

MyLab Finance with Pearson eText -- Access Card -- for Principles of Managerial Finance

- Ends Apr 27 Explain why we start with Sales forecasts when we do our financial forecasting. What are the limitations of the Percent of Sales Forecasting method?arrow_forwardDescribe in detail what exactly is the Cash Conversion Cycle, how is it computed and what is the purpose of this calculation (how is it used).arrow_forwardExplain what Interest Rate Parity is, how it is calculated, and why it is important to a company operating internationally.arrow_forward

- Compare and contrast the three core means of adding shareholder wealth; Cash Dividends, Stock Dividends and Stock Splits, and Stock Repurchases. Include the various advantages and disadvantages of each one.arrow_forwardHow to calculate the future value?arrow_forwardhow to caculate the future value?arrow_forward

- what are some of the question can i asek my prinsiple of finance teache?arrow_forwardA critical discussion of the hockey stick model of start-up financing should be presented, supported by recent in-text citations. Provide a detailed explanation of the model. Describe each of the three stages of the hockey stick model of start-up financing, including a detailed characterisation of each stage. The characterisation of each stage should detail the growth, risk, and funding expectations. Present a critical evaluation and an insightful conclu sion.arrow_forwardQuestion Workspace Check My Work New-Project Analysis The president of your company, MorChuck Enterprises, has asked you to evaluate the proposed acquisition of a new chromatograph for the firm's R&D department. The equipment's basic price is $64,000, and it would cost another $18,000 to modify it for special use by your firm. The chromatograph, which falls into the MACRS 3-year class, would be sold after 3 years for $28,400. The MACRS rates for the first three years are 0.3333, 0.4445 and 0.1481. (Ignore the half-year convention for the straight-line method.) Use of the equipment would require an increase in net working capital (spare parts inventory) of $3,000. The machine would have no effect on revenues, but it is expected to save the firm $24,760 per year in before-tax operating costs, mainly labor. The firm's marginal federal-plus-state tax rate is 25%. Cash outflows and negative NPV value, if any, should be indicated by a minus sign. Do not round intermediate…arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning