a.

Prepare the journal entries to record cost of goods sold under (1) specific identification method, (2) average-cost method, (3) FIFO method, and (4) LIFO method, and discuss the financial reporting differences that may arise from choosing the FIFO method over the LIFO method.

a.

Explanation of Solution

Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, and expenses.

Perpetual inventory system: The method or system of maintaining, recording, and adjusting the inventory perpetually throughout the year, is referred to as perpetual inventory system.

First-in-First-Out (FIFO): In this method, items purchased initially are sold first. So, the value of the ending inventory consist the recent cost for the remaining unsold items.

Last-in-First-Out (LIFO): In this method, items purchased recently are sold first. So, the value of the ending inventory consist the initial cost for the remaining unsold items.

Average Cost method: In this method, the inventories are priced at the average rate of goods available for sales.

Prepare the journal entries to record cost of goods sold under specific identification method as follows:

| Date | Account Title and Explanation | Post Ref. | Debit | Credit |

| Cost of goods sold (1) | $14,800 | |||

| Inventory | $14,800 | |||

| (To record the cost of goods sold incurred) |

Table (1)

- Cost of goods sold is an operating expense account and decreases the

stockholders’ equity account by $14,800. Therefore, debit cost of goods account with $14,800. - Inventory is an asset account, and it decreases the value of assets by $14,800. Therefore, credit inventory account with $14,800.

Working note:

Calculate the value of cost of goods sold under separate identification method

Table (2)

(1)

Prepare the journal entries to record cost of goods sold under average cost method as follows:

| Date | Account Title and Explanation | Post Ref. | Debit | Credit |

| Cost of goods sold (3) | $15,050 | |||

| Inventory | $15,050 | |||

| (To record the cost of goods sold incurred) |

Table (3)

- Cost of goods sold is an operating expense account and decreases the stockholders’ equity account by $15,050. Therefore, debit cost of goods account with $15,050.

- Inventory is an asset account, and it decreases the value of assets by $15,050. Therefore, credit inventory account with $15,050.

Working note:

Calculate average cost per unit

Calculate the value of cost of goods sold under average cost method

Table (4)

(3)

Prepare the journal entries to record cost of goods sold under FIFO method as follows:

| Date | Account Title and Explanation | Post Ref. | Debit | Credit |

| Cost of goods sold (4) | $14,600 | |||

| Inventory | $14,600 | |||

| (To record the cost of goods sold incurred) |

Table (5)

- Cost of goods sold is an operating expense account and decreases the stockholders’ equity account by $14,600. Therefore, debit cost of goods account with $14,600.

- Inventory is an asset account, and it decreases the value of assets by $14,600. Therefore, credit inventory account with $14,600.

Working note:

Calculate the value of cost of goods sold under FIFO assets

Table (6)

(4)

Prepare the journal entries to record cost of goods sold under LIFO method as follows:

| Date | Account Title and Explanation | Post Ref. | Debit | Credit |

| Cost of goods sold (5) | $15,400 | |||

| Inventory | $15,400 | |||

| (To record the cost of goods sold incurred) |

Table (7)

- Cost of goods sold is an operating expense account and decreases the stockholders’ equity account by $15,400. Therefore, debit cost of goods account with $15,400.

- Inventory is an asset account, and it decreases the value of assets by $15,400. Therefore, credit inventory account with $15,400.

Working note:

Calculate the value of cost of goods sold under LIFO assets

Table (8)

(5)

b.

Prepare the subsidiary ledger record for Company under the four inventory method valuation.

b.

Explanation of Solution

Subsidiary ledger:

Subsidiary ledger refers to the ledger that provides the detailed information of the account already recorded in the general ledger such as

Prepare the subsidiary ledger record for Company under the four inventory method valuation as follows:

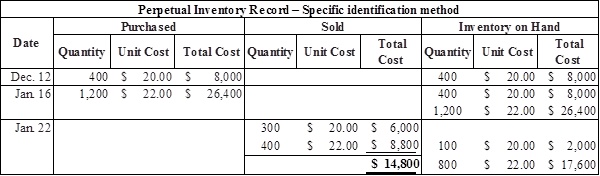

(1) Specific identification method:

| PURCHASED | SOLD | BALANCE | |||||||

| Date | Units | Unit Cost | Total | Units | Unit Cost | Cost of Goods Sold | Units | Unit Cost | Balance |

| Dec 12 | 400 | 20 | 8,000 | 400 | 20 | 8,000 | |||

| Jan 16 | 1,200 | 22 | 26,400 | 400 | 20 | ||||

| 1,200 | 22 | 34,400 | |||||||

| Jan 22 | 300 | 20 | 100 | 20 | |||||

| 400 | 22 | 14,800 | 800 | 22 | 19,600 | ||||

Table (9)

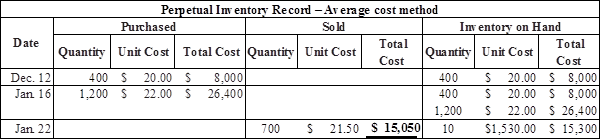

(2) Average-cost method:

| PURCHASED | SOLD | BALANCE | |||||||

| Date | Units | Cost | Total | Units | Cost | Cost of Goods Sold | Units | Cost | Balance |

| Dec 12 | 400 | 20 | 8,000 | 400 | 20.00 | 8,000 | |||

| Jan 16 | 1,200 | 22 | 26,400 | 1,600 | 21.50 | 34,400 | |||

| Jan 22 | 700 | $ 21.50 | $ 15,050 | 900 | 21.50 | 19,350 | |||

Table (10)

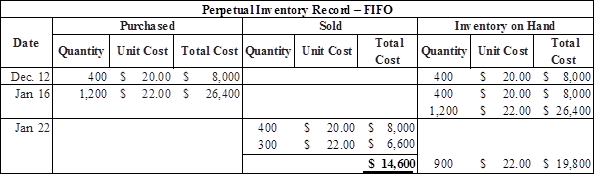

(3) First-in, first-out (FIFO) method:

| PURCHASED | SOLD | BALANCE | |||||||

| Date | Units | Unit Cost | Total | Units | Unit Cost | Cost of Goods Sold | Units | Unit Cost | Balance |

| Dec 12 | 400 | 20 | 8,000 | 400 | 20 | $ 8,000 | |||

| Jan 16 | 1,200 | 22 | 26,400 | 400 | 20 | ||||

| 1,200 | 22 | 34,400 | |||||||

| Jan 22 | 400 | 20 | |||||||

| 300 | 22 | 14,600 | 900 | 22 | 19,800 | ||||

Table (11)

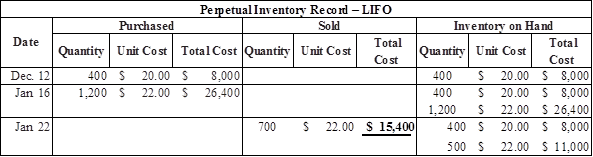

(4) Last-in, first-out (LIFO) method:

| PURCHASED | SOLD | BALANCE | |||||||

| Date | Units | Unit Cost | Total | Units | Unit Cost | Cost of Goods Sold | Units | Unit Cost | Balance |

| Dec 12 | 400 | 20 | 8,000 | 400 | 20 | 8,000 | |||

| Jan 16 | 1,200 | 22 | 26,400 | 400 | 20 | ||||

| 1,200 | 22 | 34,400 | |||||||

| Jan 22 | 700 | 22 | 15,400 | 400 | 20 | ||||

| 500 | 22 | 19,000 | |||||||

Table (12)

c.

Explain whether the

c.

Explanation of Solution

Explain whether the inventory valuation method gives lowest cost of goods sold or not, and the valuation method that gives highest cost of goods sold for the tax purposes as follows:

In this case, the cost of goods sold under FIFO and LIFO is $14,600, and $15,400 respectively. Hence, the LIFO method has highest cost of goods sold whereas the FIFO method has the lowest cost of goods sold.

The inventory method that would be preferable for financial statements is FIFO, because FIFO method would produce higher net income, lower cost of goods sold, and higher ending inventory (total assets). At the same time, the higher amount of net income produces the more income tax expense, so LIFO method is preferred for income tax reporting. When a company uses LIFO method it would produce lower amount of tax obligation and higher amount of

Want to see more full solutions like this?

Chapter 8 Solutions

Financial & Managerial Accounting With Connect Plus Access Code: The Basis For Business Decisions

- What is the current stock price? Accounting questionarrow_forwardPlease solve this financial accounting question not use aiarrow_forwardThe beginning inventory at Smith Co. and data on purchases and sales for a three-month period ending June 30 are... Date Transaction Numberof Units Per Unit Total Apr. 3 Inventory 48 $450 $21,600 8 Purchase 96 540 51,840 11 Sale 64 1,500 96,000 30 Sale 40 1,500 60,000 May 8 Purchase 80 600 48,000 10 Sale 48 1,500 72,000 19 Sale 24 1,500 36,000 28 Purchase 80 660 52,800 June 5 Sale 48 1,575 75,600 16 Sale 64 1,575 100,800 21 Purchase 144 720 103,680 28 Sale 72 1,575 113,400 Record inventory, purchases, cost of merchandise sold data in perpetual invetory record similar to the one illutrated in exhibit 3 using FIFO. Under FIFO if units at two different costs eneter the units with the lower unit cost first in the cost of goods sold unit cost column and in the inventory unit cost column. There is only a total of 4 blanks for Purchases (each 4 of qty, Unit, total) There is only 9 blanks for costs of goods sold (each 9 of qty, Unit, total) There is only 16…arrow_forward

- Electronica Ltd. sells home appliances online. The budgeted cost of the sales order processing activity for the next period is $720,000, and the company estimates 80,000 sales orders will be processed. a) Determine the activity rate of the sales order processing activity. b) If Electronica Ltd. processes 55,000 sales orders, what is the total sales order processing cost?arrow_forwardCalculate the bond discount amortization for the six months ended June 30, 2025 ?? Accountingarrow_forwardPlease need answer the general accounting question not use aiarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education