PRINCIPLES OF COST ACCOUNTING

17th Edition

ISBN: 9781305280151

Author: Vanderbeck

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Chapter 8, Problem 15P

1.

To determine

Prepare the

1.

Expert Solution

Explanation of Solution

Prepare the journal entries to record the transactions.

| Particulars | Debit($) | Credit($) |

| Work in Process—Mixing | 4,400 | |

| Materials Quantity Variance— Mixing | 200(1) | |

| Materials Price Variance— Mixing | 115(1) | |

| Materials | 4,715 | |

| Work in Process-Blending | 1,900 | |

| Materials Price Variance— Blending | 37(2) | |

| Materials Quantity Variance—Blending | 50(2) | |

| Materials | 1,813 | |

| Factory overhead | 1,500 | |

| Materials | 1,500 | |

| Work in Process—Mixing | 22,000 | |

| Labor Rate Variance— Mixing | 430(3) | |

| Labor Efficiency Variance— Mixing | 500(3) | |

| Payroll | 21,930 | |

| Work in Process— Blending | 11,400 | |

| Labor Efficiency Variance— Blending | 600(4) | |

| Labor Rate Variance—Blending | 200(4) | |

| Payroll | 11,800 | |

| Factory overhead (indirect labor) | 2,300 | |

| Payroll | 2,300 | |

| Work in Process—Mixing | 6,600 | |

| Factory Overhead—Flexible-Budget Variance— Mixing | 500(5) | |

| Factory Overhead—Production-Volume Variance— Mixing | 400(5) | |

| Factory Overhead— Mixing | 6,700 | |

| Work in Process— Blending | 3,800 | |

| Factory Overhead—Production-Volume Variance— Blending | 50(6) | |

| Factory Overhead—Flexible-Budget Variance— Blending | 100(6) | |

| Factory Overhead—Blending | 3,750 | |

| Factory Overhead | 6,650 | |

| Various Credits | 6,650 | |

| Factory Overhead— Mixing | 6,700 | |

| Factory Overhead— Blending | 3,750 | |

| Factory Overhead | 10,450 | |

| Work in Process— Blending | 30,000 | |

| Work in Process— Mixing | 30,000 | |

| Finished Goods | 43,200 | |

| Work in Process—Dept. Blending | 43,200 | |

| Accounts Receivable | 51,000 | |

| Sales | 51,000 | |

| Cost of Goods Sold | 40,800 | |

| Finished Goods | 40,800 |

Table (1)

Working notes:

Variances are calculated as follows:

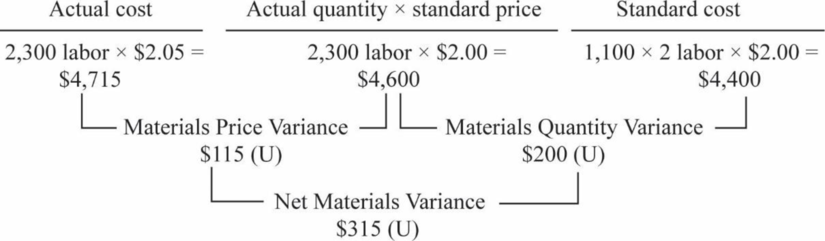

Materials:

- 1) Mixing:

Figure (1)

Equivalent units in mixing:

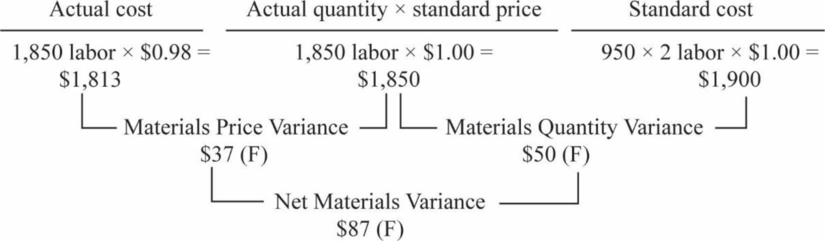

- 2) Blending:

Figure (2)

Equivalent units in blending:

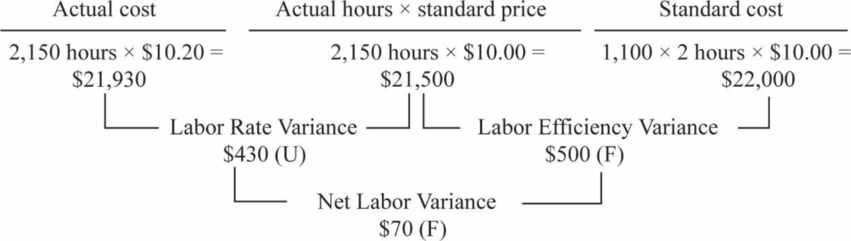

Labor

- 3) Mixing:

Figure (3)

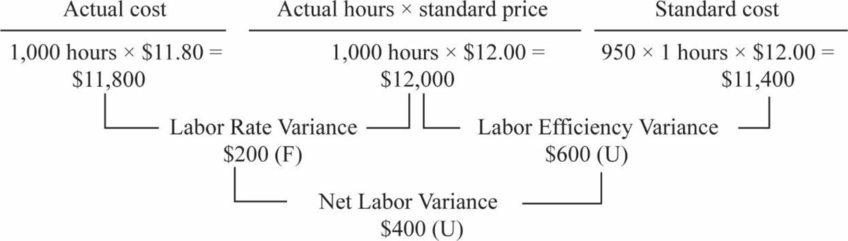

- 4) Blending:

Figure (4)

Factory overhead:

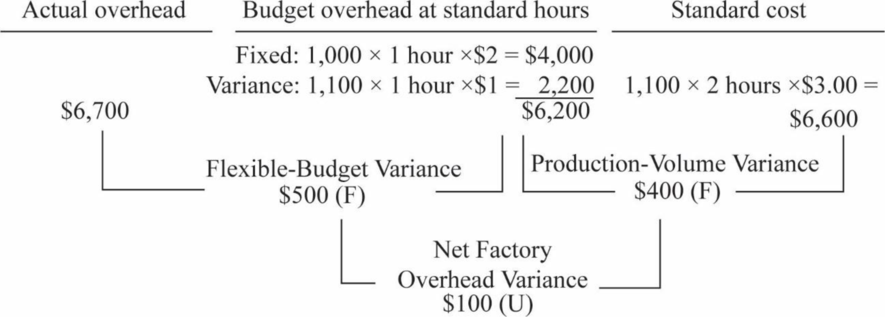

- 5) Mixing:

Figure (5)

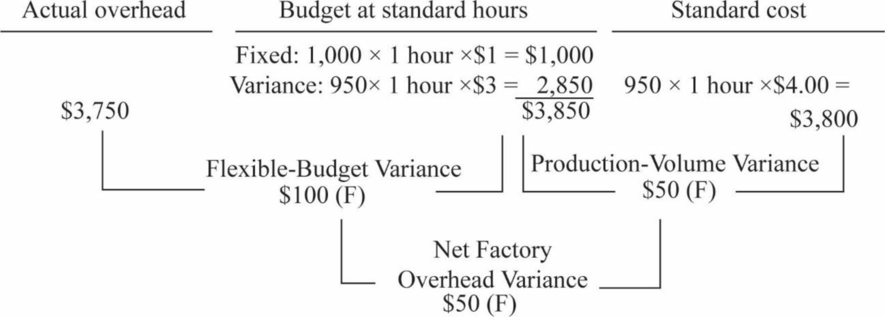

- 6) Blending:

Figure (6)

2.

To determine

Calculate the ending balance of work-in process for every department.

2.

Expert Solution

Explanation of Solution

Calculate the ending balance of work-in process for mixing department.

| Particulars | Amount($) |

| Materials | 400 |

| Labor | 2,000 |

| Factory overhead | 600 |

| Work-in process - Mixing | $3,000 |

Table (2)

Calculate the ending balance of work-in process for blending department.

| Particulars | Amount($) | Amount($) |

| Cost from mixing | $3,000 | |

| Cost in blending: | ||

| Materials | $100 | |

| Labor | 600 | |

| Factory overhead | 200 | 900 |

| Work-in process - Blending | $3,900 |

Table (3)

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

Quick answer of this accounting

Please show me the correct way to solve this financial accounting problem with accurate methods.

What are the budgeted total manufacturing costs in April?

Chapter 8 Solutions

PRINCIPLES OF COST ACCOUNTING

Ch. 8 - How does a standard cost accounting system work,...Ch. 8 - What is the difference between the standard cost...Ch. 8 - Prob. 3QCh. 8 - What are the specific procedures on which a...Ch. 8 - How are standards for materials and labor costs...Ch. 8 - What is a variance?Ch. 8 - How do price and quantity variances relate to...Ch. 8 - How do rate and efficiency variances relate to...Ch. 8 - Prob. 9QCh. 8 - How does a materials purchase price variance...

Ch. 8 - Prob. 11QCh. 8 - Prob. 12QCh. 8 - When a company uses a standard cost system, are...Ch. 8 - What two factors must be considered when breaking...Ch. 8 - What might cause the following materials...Ch. 8 - What might cause the following labor variances?

An...Ch. 8 - Prob. 17QCh. 8 - Prob. 18QCh. 8 - Prob. 19QCh. 8 - Prob. 20QCh. 8 - When does a flexible-budget variance occur?

Ch. 8 - Why is it important to determine flexible-budget...Ch. 8 - Prob. 23QCh. 8 - What is the significance of a production-volume...Ch. 8 - If production is more or less than the standard...Ch. 8 - At the end of the current fiscal year, the trial...Ch. 8 - What variances from the four-variance method are...Ch. 8 - What is the primary difference between the...Ch. 8 - What are the four variances in the four-variance...Ch. 8 - In all of the exercises involving variances, use F...Ch. 8 - Prob. 2ECh. 8 - Prob. 3ECh. 8 - Prob. 4ECh. 8 - Prob. 5ECh. 8 - Computing materials variances D-List Calendar Co....Ch. 8 - Computing labor variances LIFT Inc. manufactures...Ch. 8 - Standard cost summary; materials and labor cost...Ch. 8 - Computing labor variances Fill in the missing...Ch. 8 - Standard unit cost and journal entries The normal...Ch. 8 - Making journal entries Assume that during the...Ch. 8 - Using variance analysis and interpretation Last...Ch. 8 - Using variance analysis and interpretation Last...Ch. 8 - Journalizing standard costs in two departments...Ch. 8 - Calculating factory overhead The standard capacity...Ch. 8 - Determining Budgeted Overhead The overhead...Ch. 8 - Calculating factory overhead: two variances Munoz...Ch. 8 - Calculating factory overhead: two variances...Ch. 8 - The normal capacity of a manufacturing plant is...Ch. 8 - Calculating amount of factory overhead applied to...Ch. 8 - Georgia Gasket Co. budgets 8,000 direct labor...Ch. 8 - (Appendix) Calculating factory overhead: four...Ch. 8 - (Appendix) Calculating factory overhead: three...Ch. 8 - Materials and labor variances Branca Inspections...Ch. 8 - Materials and labor variances Fausto Fabricators...Ch. 8 - Zippy Inc. manufactures a fuel additive, Surge,...Ch. 8 - Calculation of materials and labor variances

Fritz...Ch. 8 - High-End Products Inc. uses a standard cost system...Ch. 8 - RDI Products Co. manufactures a variety of...Ch. 8 - The standard cost summary for the most popular...Ch. 8 - Carlo Lee Corp. has established the following...Ch. 8 - USD Inc. has established the following standard...Ch. 8 - Allocation of variances

Costa Brava Manufacturing...Ch. 8 - On May 1, Athens Inc. began the manufacture of a...Ch. 8 - The standard specifications for an electric motor...Ch. 8 - Cardiff Inc. manufactures men’s sport shirts for...Ch. 8 - Fargo Co. manufactures products in batches of 100...Ch. 8 - Prob. 15PCh. 8 - (Appendix) Overhead variances—four variance

Mobile...Ch. 8 - Shinto Corp. uses a standard cost system and...Ch. 8 - Kamen Manufacturing Co. estimates the following...Ch. 8 - Prob. 19PCh. 8 - Jillian Manufacturing Inc. manufactures a single...Ch. 8 - Cost and production data for Binghamton Beverages...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The tax savings from an expense item are $90,000 for a company that spends 30% of its income on taxes. How much does the item cost before tax?arrow_forwardI want Answerarrow_forwardThe actual cost of direct labor per hour is $38.75 and the standard cost of direct labor per hour is $35.40. The direct labor hours allowed per finished unit is 1.25 hours. During the current period, 5,200 units of finished goods were produced using 4,150 direct labor hours. How much is the direct labor rate variance?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY