INTERMEDIATE FINANCIAL MANAGEMENT

14th Edition

ISBN: 9780357516669

Author: Brigham

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 13P

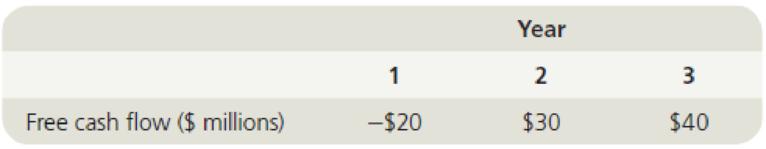

Dozier Corporation is a fast-growing supplier of office products. Analysts project the following free cash flows (FCFs) during the next 3 years, after which FCF is expected to grow at a constant 7% rate. Dozier’s weighted average cost of capital is WACC = 13%.

- a. What is Dozier’s horizon value? (Hint: Find the value of all free cash flows beyond Year 3 discounted back to Year 3.)

- b. What is the current value of operations for Dozier?

- c. Suppose Dozier has $10 million in marketable securities, $100 million in debt, and 10 million shares of stock. What is the intrinsic price per share?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the difference between a contra asset account and a liability?i need help.

What is the significance of a company’s price-to-earnings (P/E) ratio? i need answer.

What is the significance of a company’s price-to-earnings (P/E) ratio?

Chapter 8 Solutions

INTERMEDIATE FINANCIAL MANAGEMENT

Ch. 8 - Define each of the following terms: a. Proxy;...Ch. 8 - Two investors are evaluating General Electric’s...Ch. 8 - A bond that pays interest forever and has no...Ch. 8 - Explain how to use the free cash flow valuation...Ch. 8 - Thress Industries just paid a dividend of 1.50 a...Ch. 8 - Prob. 7PCh. 8 - Prob. 8PCh. 8 - A company currently pays a dividend of $2 per...Ch. 8 - Prob. 10PCh. 8 - Value of Operations

Kendra Enterprises has never...

Ch. 8 - Free Cash Flow Valuation

Dozier Corporation is a...Ch. 8 - Brushy Mountain Mining Companys coal reserves are...Ch. 8 - Constant Growth Valuation Crisp Cookwares common...Ch. 8 - Prob. 17PCh. 8 - Prob. 18PCh. 8 - Nonconstant Growth Stock Valuation Simpkins...Ch. 8 - Prob. 20PCh. 8 - Prob. 1MCCh. 8 - Prob. 2MCCh. 8 - Prob. 3MCCh. 8 - Prob. 4MCCh. 8 - Use B&M’s data and the free cash flow valuation...Ch. 8 - Prob. 6MCCh. 8 - Prob. 7MCCh. 8 - Prob. 8MCCh. 8 - Prob. 9MCCh. 8 - Prob. 10MCCh. 8 - Prob. 11MCCh. 8 - Prob. 13MCCh. 8 - (1) Write out a formula that can be used to value...Ch. 8 - Assume that Temp Force has a beta coefficient of...Ch. 8 - Prob. 16MCCh. 8 - Now assume that the stock is currently selling at...Ch. 8 - Prob. 19MCCh. 8 - Prob. 20MCCh. 8 - Prob. 21MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License