CORP FIN--CONNECT ONLY+PROCTORIO+180 DAY

12th Edition

ISBN: 9781266118562

Author: Ross

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 13CQ

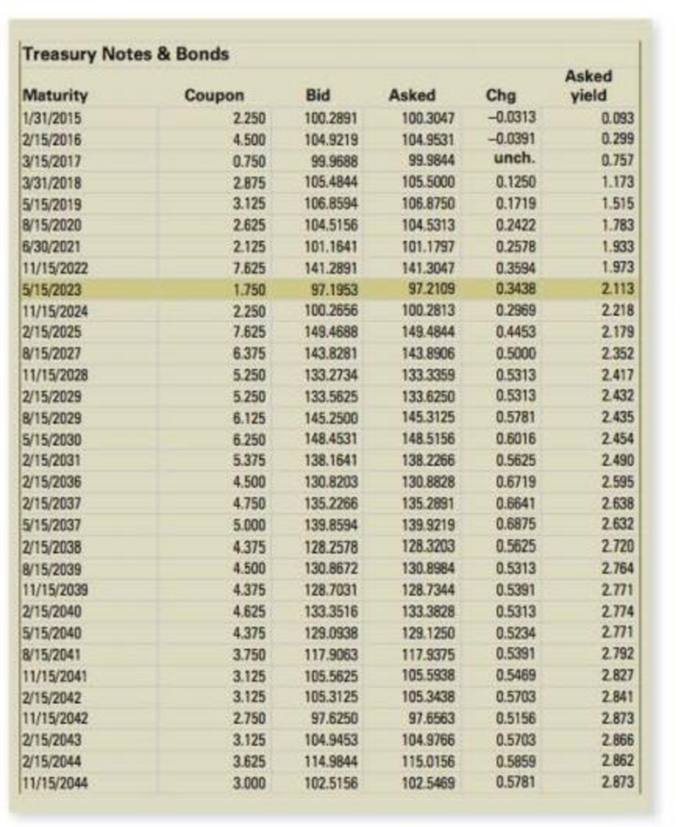

Treasury Market Take a look back at Figure 8.4. Notice the wide range of coupon rates. Why are they so different?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The beta of a stock measures:

A. Total riskB. Unsystematic riskC. Systematic riskD. Credit risk

finance pr

no chatgpt

The beta of a stock measures:

A. Total riskB. Unsystematic riskC. Systematic riskD. Credit risk

A bond with a face value of $1,000 and a 10% coupon pays:

A. $1,000 annuallyB. $10 annuallyC. $100 annuallyD. $110 annuallyneed help.

Chapter 8 Solutions

CORP FIN--CONNECT ONLY+PROCTORIO+180 DAY

Ch. 8 - Prob. 1CQCh. 8 - Prob. 2CQCh. 8 - Prob. 3CQCh. 8 - Yield to Maturity Treasury bid and ask quotes are...Ch. 8 - Coupon Rate How does a bond issuer decide on the...Ch. 8 - Real and Nominal Returns Are there any...Ch. 8 - Prob. 7CQCh. 8 - Prob. 8CQCh. 8 - Term Structure What is the difference between the...Ch. 8 - Crossover Bonds Looking back at the crossover...

Ch. 8 - Municipal Bonds Why is it that municipal bonds are...Ch. 8 - Prob. 12CQCh. 8 - Treasury Market Take a look back at Figure 8.4....Ch. 8 - Prob. 14CQCh. 8 - Bonds as Equity The 100-year bonds we discussed in...Ch. 8 - Bond Prices versus Yields a. What is the...Ch. 8 - Interest Rate Risk All else being the same, which...Ch. 8 - Prob. 1QAPCh. 8 - Prob. 2QAPCh. 8 - Prob. 3QAPCh. 8 - Prob. 4QAPCh. 8 - Prob. 5QAPCh. 8 - Prob. 6QAPCh. 8 - Prob. 7QAPCh. 8 - Prob. 8QAPCh. 8 - Prob. 9QAPCh. 8 - Prob. 10QAPCh. 8 - Prob. 11QAPCh. 8 - Prob. 12QAPCh. 8 - Prob. 13QAPCh. 8 - Prob. 14QAPCh. 8 - Prob. 15QAPCh. 8 - Prob. 16QAPCh. 8 - Prob. 17QAPCh. 8 - Prob. 18QAPCh. 8 - Prob. 19QAPCh. 8 - Prob. 20QAPCh. 8 - Prob. 21QAPCh. 8 - Prob. 22QAPCh. 8 - Prob. 23QAPCh. 8 - Prob. 24QAPCh. 8 - Prob. 25QAPCh. 8 - Prob. 26QAPCh. 8 - Prob. 27QAPCh. 8 - Prob. 28QAPCh. 8 - Prob. 29QAPCh. 8 - Prob. 30QAPCh. 8 - Prob. 31QAPCh. 8 - Prob. 32QAPCh. 8 - Prob. 33QAPCh. 8 - Prob. 34QAPCh. 8 - Prob. 35QAPCh. 8 - Prob. 1MCCh. 8 - Prob. 3MCCh. 8 - Prob. 5MCCh. 8 - Prob. 6MCCh. 8 - Prob. 7MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The beta of a stock measures: A. Total riskB. Unsystematic riskC. Systematic riskD. Credit riskarrow_forwardGive answer The beta of a stock measures: A. Total riskB. Unsystematic riskC. Systematic riskD. Credit riskarrow_forwardI need help A bond with a face value of $1,000 and a 10% coupon pays: A. $1,000 annuallyB. $10 annuallyC. $100 annuallyD. $110 annuallyarrow_forward

- I want the correct answer with financial accounting questionarrow_forwardAs a finance manager for a major utility company. Thinking about some of the capital budgeting techniques that I might use for some upcoming projects. I need help Discussing at least 2 capital budgeting techniques and how my company can benefit from the use of these tools.arrow_forwardI need assistance with this financial accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Portfolio return, variance, standard deviation; Author: MyFinanceTeacher;https://www.youtube.com/watch?v=RWT0kx36vZE;License: Standard YouTube License, CC-BY