College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

thumb_up100%

Chapter 7, Problem 7SEB

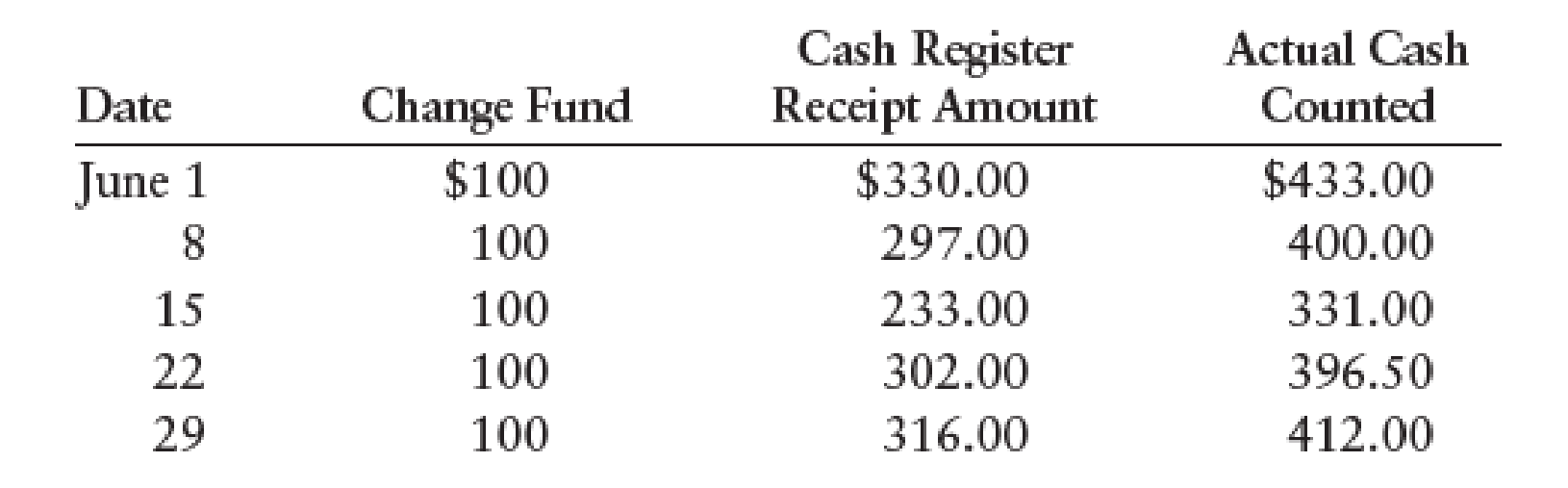

CASH SHORT AND OVER ENTRIES Based on the following information, prepare the weekly entries for cash receipts from service fees and cash short and over. A change fund of $100 is maintained.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Cost of Production Report

The debits to Work in Process-Roasting Department for Morning Brew Coffee Company for August, together with Information concerning production, are as follows:

Work in process, August 1, 700 pounds, 10% completed

*Direct materials (700 x $2.60)

Conversion (700 x 10% x $1.00)

Coffee beans added during August, 22,000 pounds

Conversion costs during August

Work in process, August 31, 1,100 pounds, 40% completed

Goods finished during August, 21,600 pounds

<

All direct materials are placed in process at the beginning of production.

$1,890*

$1,820

70

$1,890

56,100

24,167

?

?

a. Prepare a cost of production report, presenting the following computations:

1. Direct materials and conversion equivalent units of production for August

2. Direct materials and conversion costs per equivalent unit for August

3. Cost of goods finished during August

4. Cost of work in process at August 31

If an amount is zero, enter in "0". For the cost per equivalent unit, round your answer to…

Please provide the answer to this financial accounting question using the right approach.

Please help me solve this financial accounting problem with the correct financial process.

Chapter 7 Solutions

College Accounting, Chapters 1-27

Ch. 7 - Prob. 1TFCh. 7 - Prob. 2TFCh. 7 - Prob. 3TFCh. 7 - Prob. 4TFCh. 7 - Prob. 5TFCh. 7 - Prob. 1MCCh. 7 - Prob. 2MCCh. 7 - Prob. 3MCCh. 7 - Prob. 4MCCh. 7 - When the cash short and over account has a debit...

Ch. 7 - Match the following words with their definitions...Ch. 7 - Prob. 2CECh. 7 - Prob. 3CECh. 7 - Prob. 4CECh. 7 - Why must a signature card be filled out and signed...Ch. 7 - Prob. 2RQCh. 7 - Prob. 3RQCh. 7 - Prob. 4RQCh. 7 - What are the most common reasons for differences...Ch. 7 - Prob. 6RQCh. 7 - Prob. 7RQCh. 7 - Name five common uses of electronic funds...Ch. 7 - Prob. 9RQCh. 7 - What should be prepared every time a petty cash...Ch. 7 - At what two times should the petty cash fund be...Ch. 7 - Prob. 12RQCh. 7 - At what two times would an entry be made affecting...Ch. 7 - What does a debit balance in the cash short and...Ch. 7 - CHECKING ACCOUNT TERMS Match the following words...Ch. 7 - Prob. 2SEACh. 7 - Prob. 3SEACh. 7 - Prob. 4SEACh. 7 - Prob. 5SEACh. 7 - Prob. 6SEACh. 7 - CASH SHORT AND OVER ENTRIES Based on the following...Ch. 7 - Prob. 8SPACh. 7 - Prob. 9SPACh. 7 - Prob. 10SPACh. 7 - Prob. 11SPACh. 7 - CHECKING ACCOUNT TERMS Match the following words...Ch. 7 - Prob. 2SEBCh. 7 - Prob. 3SEBCh. 7 - Prob. 4SEBCh. 7 - Prob. 5SEBCh. 7 - Prob. 6SEBCh. 7 - CASH SHORT AND OVER ENTRIES Based on the following...Ch. 7 - Prob. 8SPBCh. 7 - Prob. 9SPBCh. 7 - Prob. 10SPBCh. 7 - CASH SHORT AND OVER ENTRIES Listed below are the...Ch. 7 - Prob. 1MYWCh. 7 - Prob. 1MPCh. 7 - Prob. 1CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- V The debits to Work In Process-Roasting Department for Morning Brew Coffee Company for August, together with Information concerning production, are as follows: Work in process, August 1, 700 pounds, 10% completed *Direct materials (700 x $2.60) Conversion (700 x 10% x $1.00) Coffee beans added during August, 22,000 pounds Conversion costs during August Work in process, August 31, 1,100 pounds, 40% completed Goods finished during August, 21,600 pounds All direct materials are placed in process at the beginning of production. a. Prepare a cost of production report, presenting the following computations: 1. Direct materials and conversion equivalent units of production for August 2. Direct materials and conversion costs per equivalent unit for August 3. Cost of goods finished during August 4. Cost of work in process at August 31 $1,890* $1,820 70 $1,890 56,100 24,167 ? ? If an amount is zero, enter in "0". For the cost per equivalent unit, round your answer to the near st cent. Morning…arrow_forwardCan you help me solve this general accounting problem with the correct methodology?arrow_forwardPlease help me solve this financial accounting problem with the correct financial process.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY