Fundamental Accounting Principles

23rd Edition

ISBN: 9781259536359

Author: John J Wild, Ken Shaw Accounting Professor, Barbara Chiappetta Fundamental Accounting Principles

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 7BTN

Refer to the chapter’s opening feature about Aaron, Dylan, Jeff, and Sam and their company, Box Their company deals with numerous and customers, and their cloud storage needs.

Required

1. Identify the special journals that Box would be likely to use in its operations. Also identify any subsidiary ledgers that it would likely use.

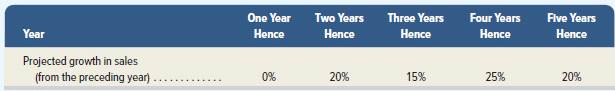

2. Box hopes to double yearly sales within five years from its current $10 million annual assumed amount. Also assume that its sales growth protections areas follows.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Do fast answer general accounting question

Fernando Traders has a balance date of 31 December.

Can you help me solve this general accounting question using the correct accounting procedures?

Chapter 7 Solutions

Fundamental Accounting Principles

Ch. 7 - Prob. 1DQCh. 7 - Prob. 2DQCh. 7 - What are the five fundamental principles of...Ch. 7 - Prob. 4DQCh. 7 - Prob. 5DQCh. 7 - Prob. 6DQCh. 7 - Prob. 7DQCh. 7 - Prob. 8DQCh. 7 - Prob. 9DQCh. 7 - Prob. 10DQ

Ch. 7 - Prob. 11DQCh. 7 - Prob. 12DQCh. 7 - Prob. 13DQCh. 7 - Prob. 14DQCh. 7 - Prob. 15DQCh. 7 - Prob. 1QSCh. 7 - Prob. 2QSCh. 7 - Prob. 3QSCh. 7 - Prob. 4QSCh. 7 - Controlling accounts and subsidiary ledgers C3...Ch. 7 - Prob. 6QSCh. 7 - Prob. 7QSCh. 7 - OS 7-8

Accounts receivable ledger posting from...Ch. 7 - Prob. 9QSCh. 7 - Prob. 10QSCh. 7 - Prob. 1ECh. 7 - Prob. 2ECh. 7 - Prob. 3ECh. 7 - Prob. 4ECh. 7 - Prob. 5ECh. 7 - Prob. 6ECh. 7 - Prob. 7ECh. 7 - Prob. 8ECh. 7 - Prob. 9ECh. 7 - Prob. 10ECh. 7 - Prob. 11ECh. 7 - Prob. 1APSACh. 7 - Prob. 2APSACh. 7 - Problem 7-3A

Special journals, subsidiary ledgers,...Ch. 7 - Prob. 1BPSBCh. 7 - Prob. 2BPSBCh. 7 - Problem 7-3B

Special journals, subsidiary ledgers,...Ch. 7 - Prob. 7SPCh. 7 - Prob. 1CPCh. 7 - Prob. 2CPCh. 7 - Prob. 3CPCh. 7 - Prob. 4CPCh. 7 - Prob. 1GLPCh. 7 - Prob. 1BTNCh. 7 - Prob. 2BTNCh. 7 - Prob. 3BTNCh. 7 - Prob. 4BTNCh. 7 - Prob. 5BTNCh. 7 - Prob. 6BTNCh. 7 - Refer to the chapter’s opening feature about...Ch. 7 - Prob. 8BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The predetermined overhead rate is___.arrow_forwardMeridian Projects has a beginning retained earnings balance of $285,400. For the year, the company earned a net income of $22,500 and paid dividends of $9,800. The company also issued $40,000 worth of new stock. What is the value of the retained earnings account at the end of the year?arrow_forwardHello tutor please given General accounting question answer do fast and properly explain all answerarrow_forward

- Liam Corporation had $8.5 million in gross income, operating expenses of $2.2 million, paid $1.8 million in interest on $15 million borrowed, and paid a dividend of $1.1 million. What is Liam Corporation's taxable income? a) $4.5 million b) $3.4 million c) $5.6 million d) $6.3 millionarrow_forwardQuick answer of this accountingarrow_forwardHow much $ oh should be assigned to desk material handling ?arrow_forward

- Henderson Manufacturing produces wooden furniture. It takes 3.5 hours of direct labor to produce a single chair. Henderson's standard labor cost is $18 per hour. During September, Henderson produced 9,800 units and used 35,600 hours of direct labor at a total cost of $623,000. What is Henderson's labor efficiency variance for September?arrow_forwardSullivan Industries' output for the current period was assigned a $420,000 standard direct materials cost. The direct materials variances included a $32,000 unfavorable price variance and a $18,000 favorable quantity variance. What is the actual total direct materials cost for the current period?arrow_forwardIdris Sound Systems purchased a one-year insurance policy in February 2023 for $60,000. The insurance coverage is effective from April 2023 through March 2024. If the company neglects to make the proper year-end adjustment for the expired insurance as of December 31, 2023:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY