Working Papers, Chapters 18-26 for Warren/Reeve/Duchacâs Accounting, 27E

27th Edition

ISBN: 9781337272162

Author: Reeve, James M., Duchac, Jonathan, WARREN, Carl S.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 7.4CP

Communication

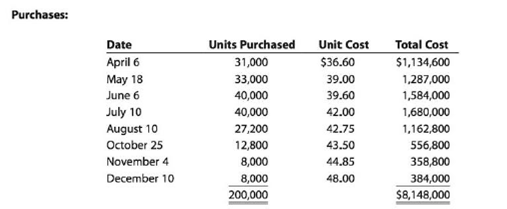

Golden Eagle Company began operations on April 1 by selling a single product. Data on purchases and sales for the year are as follows:

| Sales | ||

| April | 16,000 units | |

| May | 16,000 | |

| June | 20,000 | |

| July | 24,000 | |

| August | 28,000 | |

| September | 28,000 | |

| October | 18,000 | |

| November | 10,000 | |

| December | 8,000 | |

| Total units | 168,000 | |

| Total sales | $10,000,000 |

The president of the company, Connie Kilmer, has asked for your advice on which inventory cost flow method should be used for the 32,000-unit physical inventory that was taken on December 31. The company plans to expand its product line in the future and uses the periodic inventory system.

Write a brief memo to Ms. Kilmer comparing and contrasting the LIFO and FIFO inventory cost flow methods and their potential impacts on the company’s financial statements.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Need answer

The company's net operating income is:

Minal company uses the straight-line depreciation method for a machine purchased for $48,000 with an estimated salvage value of $6,000 and a useful life of 7 years. What is the annual depreciation expense?

Chapter 7 Solutions

Working Papers, Chapters 18-26 for Warren/Reeve/Duchacâs Accounting, 27E

Ch. 7 - Prob. 1DQCh. 7 - Why is it important to take a physical inventory...Ch. 7 - Do the terms FIFO, LIFO, and weighted average...Ch. 7 - If merchandise inventory is being valued at cost...Ch. 7 - Which of the three methods of inventory...Ch. 7 - If inventory is being valued at cost and the price...Ch. 7 - Using the following data, how should the...Ch. 7 - The inventory at the end of the year was...Ch. 7 - Hutch Co. sold merchandise to Bibbins Company on...Ch. 7 - A manufacturer shipped merchandise to a retailer...

Ch. 7 - Cost flow methods The following three identical...Ch. 7 - Cost flow methods The following three identical...Ch. 7 - Perpetual inventory using FIFO Beginning...Ch. 7 - Perpetual inventory using FIFO Beginning...Ch. 7 - Perpetual inventory using LIFO Beginning...Ch. 7 - Perpetual inventory using LIFO Beginning...Ch. 7 - Perpetual inventory using weighted average...Ch. 7 - Perpetual inventory using weighted average...Ch. 7 - Periodic inventory using FIFO, LIFO, and weighted...Ch. 7 - Periodic inventory using FIFO, LIFO, and weighted...Ch. 7 - Lower-of-cost-or-market method On the basis of the...Ch. 7 - Lower-of-cost-or-market method On the basis of the...Ch. 7 - Effect of inventory errors During the taking of...Ch. 7 - Effect of inventory errors During the taking of...Ch. 7 - Inventory turnover and days sales in inventory...Ch. 7 - Inventory turnover and days sales in inventory...Ch. 7 - Control of inventories Triple Creek Hardware Store...Ch. 7 - Control of inventories Hardcase Luggage Shop is a...Ch. 7 - Perpetual inventory using FIFO Beginning...Ch. 7 - Perpetual inventory using LIFO Assume that the...Ch. 7 - Perpetual inventory using LIFO Beginning...Ch. 7 - Perpetual inventory using FIFO Assume that the...Ch. 7 - FIFO and LIFO costs under perpetual inventory...Ch. 7 - Weighted average cost flow method under perpetual...Ch. 7 - Weighted average cost flow method under perpetual...Ch. 7 - Perpetual inventory using FIFO Assume that the...Ch. 7 - Perpetual inventory using LIFO Assume that the...Ch. 7 - Periodic inventory by three methods The units of...Ch. 7 - Periodic inventory by three methods; cost of...Ch. 7 - Comparing inventory methods Assume that a firm...Ch. 7 - Lower-of-cost-or-market inventory On the basis of...Ch. 7 - Merchandise inventory on the balance sheet Based...Ch. 7 - Effect of errors in physical inventory Missouri...Ch. 7 - Effect of errors in physical inventory Fonda...Ch. 7 - Error in inventory During 20Y5, the accountant...Ch. 7 - Inventory turnover The following data (in...Ch. 7 - Prob. 7.21EXCh. 7 - Retail method A business using the retail method...Ch. 7 - Retail method A business using the retail method...Ch. 7 - Retail method A business using the retail method...Ch. 7 - Retail method On the basis of the following data,...Ch. 7 - Gross profit method The merchandise inventory was...Ch. 7 - Gross profit method Based on the following data,...Ch. 7 - Gross profit method Based on the following data,...Ch. 7 - FIFO perpetual inventory The beginning inventory...Ch. 7 - LIFO perpetual inventory The beginning inventory...Ch. 7 - Weighted average cost method with perpetual...Ch. 7 - Periodic inventory by three methods The beginning...Ch. 7 - Periodic inventory by three methods Dymac...Ch. 7 - Lower-of-cost-or-market inventory Data on the...Ch. 7 - Retail method; gross profit method Selected data...Ch. 7 - FIFO perpetual inventory The beginning inventory...Ch. 7 - LIFO perpetual inventory The beginning inventory...Ch. 7 - Weighted average cost method with perpetual...Ch. 7 - Periodic inventory by three methods The beginning...Ch. 7 - Periodic inventory by three methods Pappas...Ch. 7 - Lower-of-cost-or-market inventory Data on the...Ch. 7 - Retail method; gross profit method Selected data...Ch. 7 - Ethics in Action Sizemo Elektroniks sells...Ch. 7 - Prob. 7.2CPCh. 7 - Communication Golden Eagle Company began...Ch. 7 - LIFO and inventory flows The following is an...Ch. 7 - Comparing inventory ratios for two companies...Ch. 7 - Comparing inventory ratios for three companies The...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please provide the answer to this general accounting question with proper steps.arrow_forwardI need guidance in solving this financial accounting problem using standard procedures.arrow_forwardCan you show me the correct approach to solve this financial accounting problem using suitable standards?arrow_forward

- Lee Corporation had a Work-in-Process balance of $95,000 on January 1, 2023. The year-end balance of Work-in-Process was $110,000, and the Cost of Goods Manufactured was $680,000. Use this information to determine the total manufacturing costs incurred during the fiscal year 2023.arrow_forwardNovus Advisory Group expects its consultants to work 40,000 direct labor hours per year. The company's estimated total indirect costs are $360,000. The direct labor rate is $95 per hour. The company uses direct labor hours as the allocation base for indirect costs. If Novus performs a job requiring 30 hours of direct labor, what is the total job cost?arrow_forwardTONY Corporation makes a product whose direct labor standard are 1.3 hours per unit and $14 per hour. In April, the company produced 5,400 units using 7,440 direct labor hours. The actual direct labor cost was $97,550. The labor rate variance for April is _.arrow_forward

- Meryl Manufacturing had a Work-in-Process balance of $168,000 on January 1, 2023. The year-end balance of Work-in-Process was $192,000, and the Cost of Goods Manufactured was $745,000. Use this information to determine the total manufacturing costs incurred during the fiscal year 2023.arrow_forwardCornell Corporation plans to generate $960,000 of sales revenue if a capital project is implemented. Assuming a 30% tax rate, the sales revenue should be reflected in the analysis by:arrow_forwardThe overhead at the end of the month would therefore be?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License