Concept explainers

a.

To determine: The value of the common stock if the growth rate is 0.00% to infinity.

a.

Answer to Problem 7.1STP

Explanation of Solution

Given information:

Required rate: 12.00%

Annual dividend: $1.80

Formula used to calculate the stock price if the growth rate is 0.00% to infinity.

Calculation of the stock price:

Therefore, the stock price is $15.00.

b.

To determine: The value of the common stock if the growth rate is 5.00% to infinity.

b.

Answer to Problem 7.1STP

Explanation of Solution

Given information:

Required rate: 12.00%

Annual dividend: $1.80

Growth rate: 5.00%

Formula used to calculate the stock price

Calculation of the stock price if the growth rate is 5.00% to infinity:

Therefore, stock price is $27.00.

b.

To determine: The stock price if expected to grow at an annual rate of 5% for each of the next 3 years, followed by a constant annual growth rate of 4% in year 4 to infinity.

b.

Answer to Problem 7.1STP

Explanation of Solution

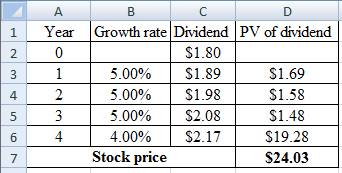

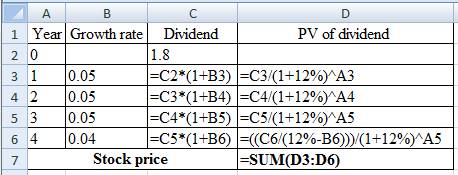

Calculation of the stock price:

Excel working:

Therefore, stock price is $24.03.

Want to see more full solutions like this?

Chapter 7 Solutions

EBK PEARSON ETEXT PRINCIPLES OF MANAGER

- No Chatgpt 2. Which of the following is a short-term source of finance? a) Bondsb) Equity sharesc) Trade creditd) Debenturesarrow_forward2. Which of the following is a short-term source of finance? a) Bondsb) Equity sharesc) Trade creditd) Debenturesno aiarrow_forward2. Which of the following is a short-term source of finance? a) Bondsb) Equity sharesc) Trade creditd) Debenturesarrow_forward

- Which of the following best describes the concept of leverage in finance? A) Using borrowed funds to increase the potential return on investment B) Reducing risk by diversifying assets C) A method to avoid paying taxes D) Increasing the company’s profit margin no aiarrow_forwardWhat does a ledger account represent? A) A detailed record of all business transactionsB) A summary of trial balancesC) An individual record for each accountD) The final balance of a financial statementarrow_forwardWhich of the following is a capital budgeting technique used to evaluate an investment project? A) Net Present Value (NPV) B) Return on Assets (ROA) C) Price-to-Earnings Ratio (P/E) D) Dividend Yield No aiarrow_forward

- What does the term 'liquidity' refer to in finance? A) The ability to quickly convert an asset into cash B) The total value of a company’s assets C) The volatility of a market D) The difference between liabilities and assets no aiarrow_forwardWhich of the following is a characteristic of a high-risk investment? A) Low returns B) Stable performance C) Potential for high returns with greater uncertainty D) Guaranteed returnsarrow_forwardWhat does the term 'liquidity' refer to in finance? A) The ability to quickly convert an asset into cash B) The total value of a company’s assets C) The volatility of a market D) The difference between liabilities and assets need help.arrow_forward

- I need help in this question now! What does a company’s price-to-earnings (P/E) ratio indicate? A) The return on investment for shareholders B) The company’s profitability relative to its stock price C) The company’s debt relative to its equity D) The company’s dividend payout ratioarrow_forwardI need answer quickly What does a company’s price-to-earnings (P/E) ratio indicate? A) The return on investment for shareholders B) The company’s profitability relative to its stock price C) The company’s debt relative to its equity D) The company’s dividend payout ratioarrow_forwardThe term 'beta' in stock market analysis measures: A) The total value of a company’s stocks B) A stock’s sensitivity to the overall market C) The dividend yield of a stock D) A stock’s price-to-earnings ratio i need help in this question!arrow_forward

PFIN (with PFIN Online, 1 term (6 months) Printed...FinanceISBN:9781337117005Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed...FinanceISBN:9781337117005Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning