Book value of fixed assets

Apple. Inc., designs, manufactures, and markets personal computers (iPad’) and related software. Apple also manufactures and distributes music players (iPod’) along with related accessories and services, including the online distribution of third-party music. The following information was adapted from a recent annual report of Apple:

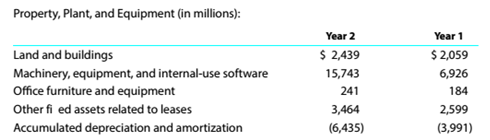

Property. Plant, and Equipment (In millions):

Compute the book value of the fixed asset for Years I and 2 and explain the differences, if any.

b. Would you normally expect the book value of fixed assets to increase or decrease during the year?

Trending nowThis is a popular solution!

Chapter 7 Solutions

Survey of Accounting - With CengageNOW 1Term

- I need help with this financial accounting problem using proper accounting guidelines.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forwardI am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forward

- Please provide the answer to this general accounting question with proper steps.arrow_forwardPlease explain the solution to this general accounting problem using the correct accounting principles.arrow_forwardPlease provide the accurate answer to this general accounting problem using valid techniques.arrow_forward

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning