To calculate: The investment opportunity set of the two risky funds is to be tabulated along with the graph.

Introduction: The portfolio risk is defined as the combination of assets which carries its own risk with each investment.

The standard deviation is used to determine that in which manner the values from a data set vary from its mean value. This is calculated by the square root of the variance.

The expected return is defined as the return which is obtained on the risky asset that is expected in future.

Answer to Problem 5PS

Expected return for the portfolio = 13.39%

Standard deviation for the portfolio =

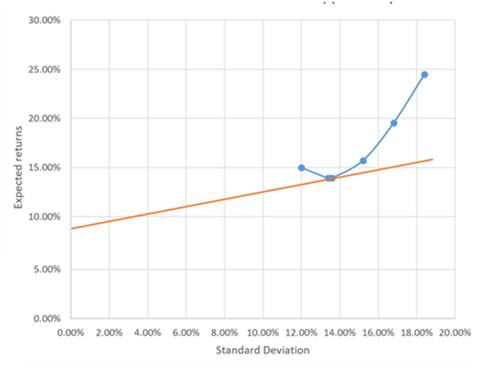

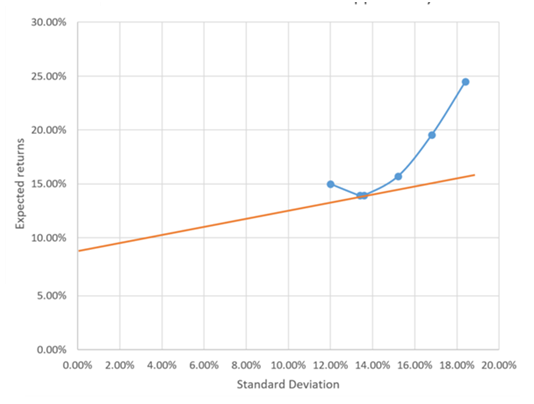

The graph is represented as −

Explanation of Solution

The following formula will be used to calculate the expected return of the portfolio for different proportions of stock and bond-

Where,

The following formula will be used to calculate the standard deviation of the portfolio for different proportions of stock and bond-

The three mutual funds are −

- Stock fund

- Long term government and corporate bond fund

- T-bill money market fund with yield 8%

The probability distribution of the risk fund is given as −

| Expected return | Standard deviation | |

| Stock fund (S) | 20% | 30% |

| Bond fund (B) | 12 | 15 |

The correlation between fund return = 0.10

The minimum variance portfolio is calculated as-

The weight of the stock fund in minimum variance portfolio is calculated as-

For bonds funds:

Put the calculated values in Equ (1) for expected return −

Put the calculated values in Equ (2) for the standard deviation-

The graph between expected return and standard deviation is called as investment opportunity set which is represented as −

Want to see more full solutions like this?

Chapter 7 Solutions

EBK INVESTMENTS

- Question 6 A five-year $50,000 endowment insurance for (60) has $1,000 underwriting expenses, 25% of the first premium is commission for the agent of record and renewal expenses are 5% of subsequent premiums. Write the gross future loss random variable: Presuming a portfolio of 10,000 identical and independent policies, the expected loss and the variance of the loss of the portfolio are given below (note that the premium basis is not given or needed): E[L] = 10,000(36,956.49 - 3.8786P) V[L] 10,000 (50,000 + 14.52P)². 0.00095 Find the premium that results in a 97.5% probability of profit (i.e. ¹ (0.975) = 1.96). Premium: Please show your work belowarrow_forwardWhat corporate finance?? can you explain this? fully no aiarrow_forwardWhat is corporate finance? how this is usefull?arrow_forward

- Pam and Jim are saving money for their two children who they plan to send to university.The eldest child will enter university in 5 years while the younger will enter in 7 years. Each child is expected spend four years at university. University fees are currently R20 000 per year and are expected to grow at 5% per year. These fees are paid at the beginning of each year.Pam and Jim currently have R40 000 in their savings and their plan is to save a fixed amount each year for the next 5 years. The first deposit taking place at the end of the current year and the last deposit at the date the first university fees are paid.Pam and Jim expect to earn 10% per year on their investments.What amount should they invest each year to meet the cost of their children’s university fees?arrow_forwardPam and Jim are saving money for their two children who they plan to send to university.The eldest child will enter university in 5 years while the younger will enter in 7 years. Each child is expected spend four years at university. University fees are currently R20 000 per year and are expected to grow at 5% per year. These fees are paid at the beginning of each year.Pam and Jim currently have R40 000 in their savings and their plan is to save a fixed amount each year for the next 5 years. The first deposit taking place at the end of the current year and the last deposit at the date the first university fees are paid.Pam and Jim expect to earn 10% per year on their investments.What amount should they invest each year to meet the cost of their children’s university fees?arrow_forwardYou make a loan of R100 000, with annual payments being made at the end of each year for the next 5 years at a 10% interest rate. How much interest is paid in the second year?arrow_forward

- Dr Z. Mthembu is the owner of Mr Granite, a business in the Western Cape. After more than 28 years of operation, the business is thinking about taking on a new project that would provide a profitable new clientele. With only R1.5 million in resources, the company is now working on two competing projects. The starting costs for Project X and Project Y are R625,000 and R600000, respectively. These projected are estimated for the next 7 years timeframe. According to SARS, the tax rate is 28%, and a discount rate of 11.25% is applied.Projects X Project YProject X Project Y129000 145000154000 145000312000 145000168000 14500098250 14500088750 14500016050 145000arrow_forwardDr Z. Mthembu is the owner of Mr Granite, a business in the Western Cape. After more than 28 years of operation, the business is thinking about taking on a new project that would provide a profitable new clientele. With only R1.5 million in resources, the company is now working on two competing projects. The starting costs for Project X and Project Y are R625,000 and R600000, respectively. These projected are estimated for the next 7 years timeframe. According to SARS, the tax rate is 28%, and a discount rate of 11.25% is applied.Projects X Project YProject X Project Y129000 145000154000 145000312000 145000168000 14500098250 14500088750 14500016050 145000arrow_forwardDr Z. Mthembu is the owner of Mr Granite, a business in the Western Cape. After more than 28 years of operation, the business is thinking about taking on a new project that would provide a profitable new clientele. With only R1.5 million in resources, the company is now working on two competing projects. The starting costs for Project X and Project Y are R625,000 and R600000, respectively. These projected are estimated for the next 7 years timeframe. According to SARS, the tax rate is 28%, and a discount rate of 11.25% is applied.Projects X Project YProject X Project Y129000 145000154000 145000312000 145000168000 14500098250 14500088750 14500016050 145000arrow_forward

- Dr Z. Mthembu is the owner of Mr Granite, a business in the Western Cape. After more than 28 years of operation, the business is thinking about taking on a new project that would provide a profitable new clientele. With only R1.5 million in resources, the company is now working on two competing projects. The starting costs for Project X and Project Y are R625,000 and R600000, respectively. These projected are estimated for the next 7 years timeframe. According to SARS, the tax rate is 28%, and a discount rate of 11.25% is applied.Projects X Project YProject X Project Y129000 145000154000 145000312000 145000168000 14500098250 14500088750 14500016050 145000arrow_forwardAn investor buys 100 shares of a $40 stock that pays an annual cash dividend of $2 a share (a 5 percent dividend yield) and signs up for the DRIP. a. If neither the dividend nor the price changes, how many shares will the investor have at the end of 10 years? How much will the position in the stock be worth? Answer: 5.000 shares purchased in year 1 5.250 shares purchased in year 2 6.078 shares purchased in year 5 62.889 total shares purchased b. If the price of the stock rises by 6 percent annually but the dividend remains at $2 a share, how many shares are purchased each year for the next 10 years? How much is the total position worth at the end of 10 years? Answer: 4.717 shares purchased in year 1 4.592 shares in year 3 3.898 shares in year 10 Value of position: $10,280 c. If the price of the stock rises by 6 percent annually but the dividend rises by only 3 percent annually, how many shares are purchased each year for the next 10 years? How much is the total position worth at the…arrow_forwardDr Z. Mthembu is the owner of Mr Granite, a business in the Western Cape. After more than 28 years of operation, the business is thinking about taking on a new project that would provide a profitable new clientele. With only R1.5 million in resources, the company is now working on two competing projects. The starting costs for Project X and Project Y are R625,000 and R600000, respectively. These projected are estimated for the next 7 years timeframe. According to SARS, the tax rate is 28%, and a discount rate of 11.25% is applied.Projects X Project YProject X Project Y129000 145000154000 145000312000 145000168000 14500098250 14500088750 14500016050 145000 Calculate the IRR for the two proposed Projectsarrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education