Concept explainers

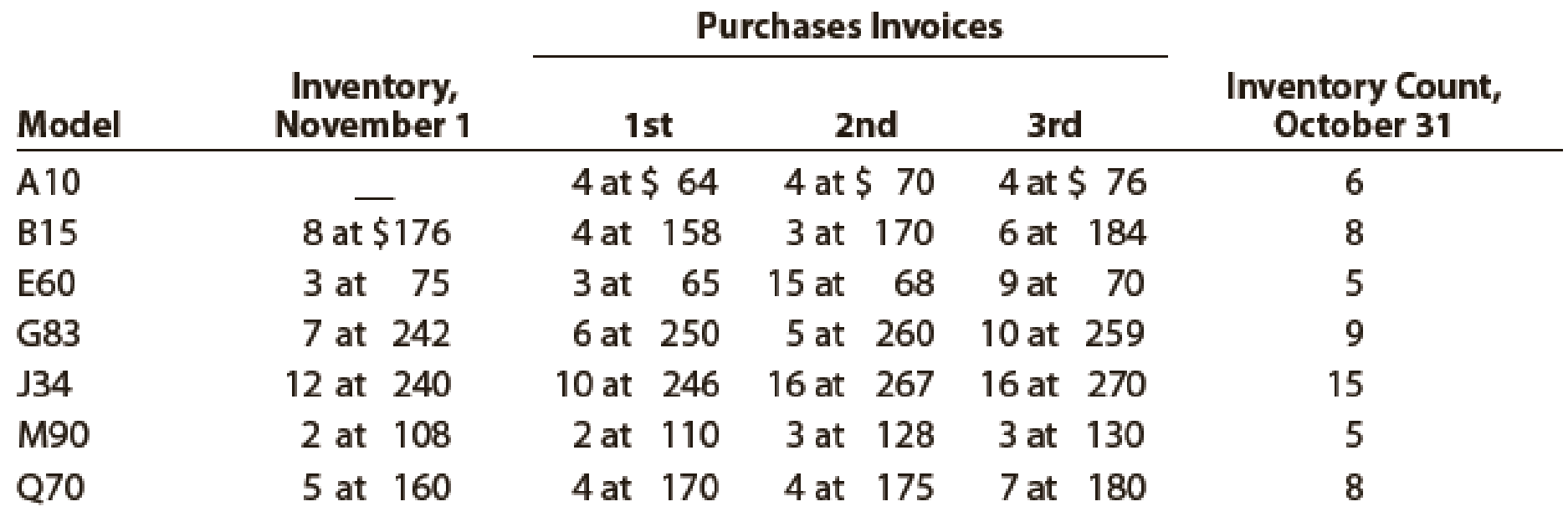

Dymac Appliances uses the periodic inventory system. Details regarding the inventory of appliances at January 1, purchases invoices during the next 12 months, and the inventory count at December 31 are summarized as follows:

Instructions

- 1. Determine the cost of the inventory on December 31 by the first-in, first-out method. Present data in columnar form, using the following headings:

If the inventory of a particular model comprises one entire purchase plus a portion of another purchase acquired at a different unit cost, use a separate line for each purchase.

- 2. Determine the cost of the inventory on December 31 by the last-in, first-out method, following the procedures indicated in (1).

- 3. Determine the cost of the inventory on December 31 by the weighted average cost method, using the columnar headings indicated in (1).

- 4.

Discuss which method (FIFO or LIFO) would be preferred for income tax purposes in periods of (a) rising prices and (b) declining prices.

Discuss which method (FIFO or LIFO) would be preferred for income tax purposes in periods of (a) rising prices and (b) declining prices.

(1)

Determine the value of inventory using first in first out method under periodic inventory system.

Explanation of Solution

Periodic Inventory System: Periodic inventory system is a system, in which the inventory is updated in the accounting records on a periodic basis such as at the end of each month, quarter or year. In other words, it is an accounting method which is used to determine the amount of inventory at the end of each accounting period.

First-in-First-Out: In First-in-First-Out method, the costs of the initially purchased items are considered as cost of goods sold, for the items which are sold first. The value of the ending inventory consists of the recent purchased items.

Last-in-Last-Out: In Last-in-First-Out method, the costs of last purchased items are considered as the cost of goods sold, for the items which are sold first. The value of the closing stock consists of the initial purchased items.

Weighted-average cost method: Under Weighted average cost method, the company calculates a new average cost after every purchase is made. It is determined by dividing the cost of goods available for sale by the units on hand.

The tabular column showing inventory cost is presented as follows:

| Model | Quantity ($) | Unit cost ($) | Total cost ($) |

| A10 | 4 | 76 | 304 |

| 2 | 70 | 140 | |

| B15 | 6 | 184 | 1,104 |

| 2 | 170 | 340 | |

| E60 | 5 | 70 | 350 |

| G83 | 9 | 259 | 2,331 |

| J34 | 15 | 270 | 4,050 |

| M90 | 3 | 130 | 390 |

| 2 | 128 | 256 | |

| Q70 | 7 | 180 | 1,260 |

| 1 | 175 | 175 | |

| Total | 10,700 |

Hence, the ending inventory under First in First out Method is $10,700.

(2)

Determine the value of inventory using last in first out method under periodic inventory system.

Explanation of Solution

The tabular column showing inventory cost is presented as follows:

| Model | Quantity ($) | Unit cost ($) | Total cost ($) |

| A10 | 4 | 64 | 256 |

| 2 | 70 | 140 | |

| B15 | 8 | 176 | 1,408 |

| E60 | 3 | 75 | 225 |

| 1 | 65 | 130 | |

| G83 | 7 | 242 | 1,694 |

| 2 | 250 | 500 | |

| J34 | 12 | 240 | 2,880 |

| 3 | 246 | 738 | |

| M90 | 2 | 108 | 216 |

| 2 | 110 | 220 | |

| 1 | 128 | 128 | |

| Q70 | 5 | 160 | 800 |

| 3 | 170 | 510 | |

| Total | 9,845 |

Hence, the ending inventory under Last in First out Method is $9,845.

(3)

Determine the value of inventory using weighted average method under periodic inventory system.

Explanation of Solution

The tabular column showing inventory cost is presented as follows:

| Model | Quantity ($) | Unit cost ($) | Total cost ($) |

| A10 | 6 | 70 (1) | 256 |

| B15 | 8 | 174 (2) | 1,392 |

| E60 | 5 | 69 (3) | 345 |

| G83 | 9 | 253 (4) | 2,277 |

| J34 | 15 | 258 (5) | 3,870 |

| M90 | 5 | 121 (6) | 605 |

| Q70 | 8 | 172 (7) | 1,376 |

| 10,285 |

Working note 1:

Computation of unit cost for Model A10:

Working note 2:

Computation of unit cost for Model B15:

Working note 3:

Computation of unit cost for Model E60:

Working note 4:

Computation of unit cost for Model G83:

Working note 5:

Computation of unit cost for Model J34:

Working note 6:

Computation of unit cost for Model M90:

Working note 7:

Computation of unit cost for Model Q70:

Hence, the ending inventory under weighted average cost Method is $10,285.

(4.a)

Discuss the method that would be preferred for income tax purposes in the period of rising prices.

Explanation of Solution

During the period of rising prices, the last in first out method will result in lower cost of inventory, the cost of merchandise sold will be higher, and net income would be lower than other two methods. Therefore, the LIFO method would be preferred for the current year because it would effect in lower income tax.

(4.b)

Discuss the method that would be preferred for income tax purposes in the period of declining prices.

Explanation of Solution

During the period of declining prices, the first in first out method (FIFO) will result in lower cost of inventory, the cost of merchandise sold will be higher, and net income would be lower than other two methods. Therefore, the FIFO method would be preferred for the current year because it would effect in lower income tax.

Want to see more full solutions like this?

Chapter 7 Solutions

Cengagenowv2, 1 Term Printed Access Card For Warren/reeve/duchac's Financial Accounting, 15th

- Can you help me solve this general accounting question using valid accounting techniques?arrow_forwardI am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardCan you explain the correct approach to solve this general accounting question?arrow_forward

- Please help me solve this general accounting problem with the correct financial process.arrow_forwardPlease provide the answer to this general accounting question using the right approach.arrow_forwardI need help with this general accounting question using standard accounting techniques.arrow_forward

- managerial accounting questionarrow_forwardA firm is considering making a change to its capital structure to reduce its cost of capital and increase firm value. Right now, it has a capital structure that consists of 20% debt and 80% equity, based on market value. The risk-free rate is 6% and the market risk premium is 5%. Currently the company's costs of equity, which is based on the CAP<, is 12.5% and its tax rate is 40%. What would be Carwright's estimated cost of equity if it were to change its capital structure to 60% debt and 40% equity?arrow_forwardA company has the following data, in thousands. Assuming a 365-day year, what is the firm's cash conversion cycle? Annual Sales = $45,000 Annual cost of goods sold = $31,500 Inventories = $4,250 Accounts receivable = $2,000 Accounts payable = $3,400arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College