Principles of Financial Accounting.

24th Edition

ISBN: 9781260158601

Author: Wild

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 5E

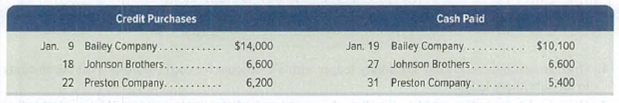

Following is information from Jesper Company for its first month of business.

- 1. Identify the balances listed in the accounts payable subsidiary ledger.

- 2. Identify the Accounts Payable balance listed in the general ledger at month’s end.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Can you solve this general accounting problem with appropriate steps and explanations?

General Accounting Question

Can you solve this financial accounting question with accurate accounting calculations?

Chapter 7 Solutions

Principles of Financial Accounting.

Ch. 7 - What are five basic components of an accounting...Ch. 7 - Prob. 2DQCh. 7 - 3. What are the five fundamental principles of...Ch. 7 - Prob. 4DQCh. 7 - Prob. 5DQCh. 7 - Prob. 6DQCh. 7 - Prob. 7DQCh. 7 - Prob. 8DQCh. 7 - Prob. 9DQCh. 7 - Prob. 10DQ

Ch. 7 - Prob. 11DQCh. 7 - Prob. 12DQCh. 7 - Prob. 13DQCh. 7 - Prob. 1QSCh. 7 - Prob. 2QSCh. 7 - Prob. 3QSCh. 7 - Prob. 4QSCh. 7 - Prob. 5QSCh. 7 - Prob. 6QSCh. 7 - Prob. 7QSCh. 7 - Prob. 8QSCh. 7 - Prob. 9QSCh. 7 - Prob. 10QSCh. 7 - Prob. 11QSCh. 7 - Prob. 12QSCh. 7 - Prob. 13QSCh. 7 - Prob. 1ECh. 7 - Prob. 2ECh. 7 - Prob. 3ECh. 7 - Prob. 4ECh. 7 - Following is information from Jesper Company for...Ch. 7 - Prob. 6ECh. 7 - Prob. 7ECh. 7 - Prob. 8ECh. 7 - Prob. 9ECh. 7 - Prob. 10ECh. 7 - Prob. 11ECh. 7 - Prob. 12ECh. 7 - Prob. 13ECh. 7 - Prob. 1AACh. 7 - Prob. 2AACh. 7 - Prob. 3AACh. 7 - Prob. 1BTNCh. 7 - Prob. 3BTNCh. 7 - Prob. 5BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please provide the solution to this general accounting question with accurate financial calculations.arrow_forwardCan you solve this general accounting problem using accurate calculation methods?arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning  College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

ACCOUNTING BASICS: Debits and Credits Explained; Author: Accounting Stuff;https://www.youtube.com/watch?v=VhwZ9t2b3Zk;License: Standard Youtube License