LO 8 7-59 Cost savings: replacement decision Rossman Instruments, Inc., is considering leasing new state-of-the-art machinery at an annual cost of $900,000. The new machinery has a fouryear expected life. It will replace existing machinery leased one year earlier at an annual lease cost of $490,000 committed for five years. Early termination of this lease contract will incur a $280,000 penalty. There are no other fixed costs.

The new machinery is expected to decrease variable costs from $42 to $32 per unit sold because of improved materials yield, faster machine speed, and lower direct labor, supervision, materials handling, and quality inspection requirements. The sales price will remain at $56. Improvements in quality, production cycle time, and customer responsiveness are expected to increase annual sales from 36,000 units to 48,000 units.

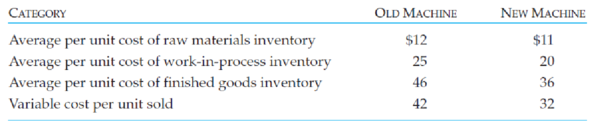

The variable costs stated earlier exclude the inventory carrying costs. Because the new machinery is expected to affect inventory levels, the following estimates are also provided. The enhanced

speed and accuracy of the new machinery are expected to decrease production cycle time by half and, consequently, lead to a decrease in work-in-process inventory level from 3 months to just 1.5 months of production. Increased flexibility with these new machines is expected to allow a reduction in finished goods inventory from 2 months of production to just 1 month. Improved yield rates and greater machine reliability will enable a reduction in raw materials inventory from 4 months of production to just 1.5 months. Annual inventory carrying cost is 20% of inventory value.

Required

(a) Determine the total value of annual benefits from the new machinery. Include changes in inventory carrying costs.

(b) Should Rossman replace its existing machinery with the new machinery? Present your reasoning with detailed steps identifying relevant costs and revenues.

(c) Discuss whether a manager evaluated on the basis of Rossman’s net income will have the incentive to make the right decision as evaluated in part b.

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Management Accounting: Information For Decision-making And Strategy Execution

- I need assistance with this financial accounting question using appropriate principles.arrow_forwardI need help with this general accounting question using the proper accounting approach.arrow_forwardI am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forward

- Please provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardPlease provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardPlease provide the solution to this financial accounting question using proper accounting principles.arrow_forward

- I need help finding the accurate solution to this financial accounting problem with valid methods.arrow_forwardPlease provide the correct answer to this general accounting problem using valid calculations.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning