Concept explainers

The beginning inventory for Dunne Co. and data on purchases and sales for a three-month period are shown in Problem 7-1B.

Instructions

- 1. Determine the inventory on June 30 and the cost of merchandise sold for the three-month period, using the first-in, first-out method and the periodic inventory system.

- 2. Determine the inventory on June 30 and the cost of merchandise sold for the three-month period, using the last-in, first-out method and the periodic inventory system.

- 3. Determine the inventory on June 30 and the cost of merchandise sold for the three-month period, using the weighted average cost method and the periodic inventory system. Round the weighted average unit cost to the dollar.

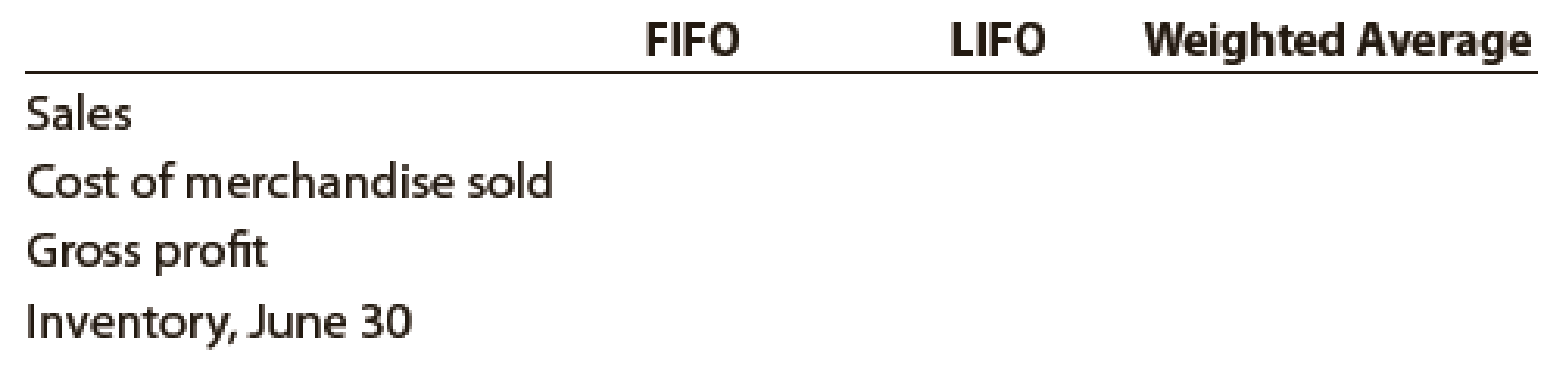

- 4. Compare the gross profit and June 30 inventories using the following column headings:

(1)

Determine the value of inventory and cost of merchandise sold using first in first out method under periodic inventory system.

Explanation of Solution

Periodic Inventory System: Periodic inventory system is a system, in which the inventory is updated in the accounting records on a periodic basis such as at the end of each month, quarter or year. In other words, it is an accounting method which is used to determine the amount of inventory at the end of each accounting period.

First-in-First-Out: In First-in-First-Out method, the costs of the initially purchased items are considered as cost of goods sold, for the items which are sold first. The value of the ending inventory consists of the recent purchased items.

Last-in-Last-Out: In Last-in-First-Out method, the costs of last purchased items are considered as the cost of goods sold, for the items which are sold first. The value of the closing stock consists of the initial purchased items.

Weighted-average cost method: Under Weighted average cost method, the company calculates a new average cost after every purchase is made. It is determined by dividing the cost of goods available for sale by the units on hand.

The value of ending inventory is calculated as follows:

Calculate the cost of merchandise sold is as follows:

| Amount ($) | |

| Beginning inventory, April 1 | 30,000 |

| Add: Purchases Table (3) | 313,640 |

| Merchandise available for sale | 343,640 |

| Less: Ending inventory, June 31 | 32,864 |

| Cost of merchandise sold | 310,776 |

Table (1)

Working notes:

Calculate the units in ending inventory as follows:

| Units | |

| Units in beginning inventory and purchased | 275 |

| Less: Units sold | 249 |

| Units in ending inventory | 26 |

Table (2)

Calculate the merchandise purchases as follows:

| Purchases | |||

| Date | Quantity | Unit cost | Total |

| 08-Apr | 75 | $1,240 | $93,000 |

| 08-May | 60 | $1,260 | $75,600 |

| 28-May | 80 | $1,260 | $100,800 |

| 21-Jun | 35 | $1,264 | $44,240 |

| $313,640 | |||

Table (3)

Hence, the ending inventory under First in First out Method is $32,864 and cost of merchandise sold is $310,776.

(2)

Determine value of inventory and cost of merchandise sold using last in first out method under periodic inventory system.

Explanation of Solution

The value of ending inventory is calculated as follows:

Calculate the cost of merchandise sold is as follows:

| Amount ($) | |

| Beginning inventory, April 1 | 30,000 |

| Add: Purchases Table (3) | 313,640 |

| Merchandise available for sale | 343,640 |

| Less: Ending inventory, June 31 | 31,240 |

| Cost of merchandise sold | 312,400 |

Table (4)

Hence, the ending inventory under Last in First out Method is $31,240 and cost of merchandise sold is $312,400.

(3)

Determine value of inventory and cost of merchandise sold using weighted average method under periodic inventory system.

Explanation of Solution

The value of ending inventory is calculated by multiplying ending inventory with weighted average cost per unit.

Calculate the cost of merchandise sold is as follows:

| Amount ($) | |

| Beginning inventory, January 1 | 562,500 |

| Add: Purchases Table (3) | 11,340,000 |

| Merchandise available for sale | 11,902,500 |

| Less: Ending inventory, March 31 | 981,000 |

| Cost of merchandise sold | 10,921,500 |

Table (5)

Working note 1:

The weighted average unit cost is calculated as follows:

(4)

Compare gross profit and ending inventories of all the three methods.

Explanation of Solution

The table showing all the three methods of inventory is as follows:

| FIFO($) | LIFO($) | Weighted average ($) | |

| Sales | $ 525,250 | $ 525,250 | $ 525,250 |

| Less: Cost of merchandise sold | $ 310,776 | $ 312,400 | $ 311,140 |

| Gross Profit | $ 214,474 | $ 212,850 | $ 214,110 |

| Ending Inventory, June 31 | $ 32,864 | $ 31,240 | $ 32,500 |

Table (6)

Working notes: Calculate the total sales for the three-month period:

| Sales | |||

| Date | Quantity | Unit cost | Total |

| 11-Apr | 40 | $2,000 | $80,000 |

| 30-Apr | 30 | $2,000 | $60,000 |

| 10-May | 50 | $2,000 | $100,000 |

| 19-May | 20 | $2,000 | $40,000 |

| 5-Jun | 40 | $2,250 | $90,000 |

| 16-Jun | 25 | $2,250 | $56,250 |

| 28-Jun | 44 | $2,250 | $99,000 |

| Total | $525,250 | ||

Table (7)

Want to see more full solutions like this?

Chapter 7 Solutions

Financial Accounting

- Please explain the solution to this general accounting problem with accurate principles.arrow_forwardKindly help me with this General accounting questions not use chart gpt please fast given solutionarrow_forwardI am searching for the correct answer to this Financial accounting problem with proper accounting rules.arrow_forward

- I am looking for the correct answer to this Financial accounting question with appropriate explanations.arrow_forwardEcho Tone Technologies reports annual sales of $90,000, and it expects sales to increase to $135,000 next year. The company has a degree of operating leverage (DOL) of 4.2. By what percentage should net income increase? A. 70% B. 189% C. 150% D. 210%arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forward

- No chatgpt Which account will appear in the post-closing trial balance?A. Rent ExpenseB. Sales RevenueC. DividendsD. Capitalarrow_forwardI need help with this financial accounting question using the proper accounting approach.arrow_forwardI need help Which account will appear in the post-closing trial balance?A. Rent ExpenseB. Sales RevenueC. DividendsD. Capitalarrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College