Gen Combo Ll Financial Accounting Fundamentals; Connect Access Card

7th Edition

ISBN: 9781260581256

Author: John Wild

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 3PSA

Aging

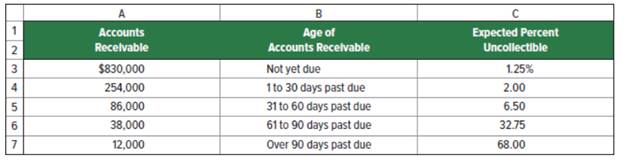

On December 31, Jarden Co.’s Allowance for Doubtful Accounts has an unadjusted credit balance of $14,500. Jarden prepares a schedule of its December 31 accounts receivable by age.

Required

- Compute the required balance of the Allowance for Doubtful Accounts at December 31 using an aging of accounts receivable.

- Prepare the

adjusting entry to record bad debts expense at December 31.

Check (2) Dr. Bad Debts Expense, $27,150 Analysis component

- On June 30 of the next year, Jarden concludes that a customer’s $4,750 receivable isuncollectible and the account is written off. Does this write-off directly affect Jarden’s net income?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Can you explain the correct methodology to solve this financial accounting problem?

Can you help me solve this general accounting problem with the correct methodology?

Please provide the solution to this general accounting question using proper accounting principles.

Chapter 7 Solutions

Gen Combo Ll Financial Accounting Fundamentals; Connect Access Card

Ch. 7 - Prob. 1MCQCh. 7 - Prob. 2MCQCh. 7 - Prob. 3MCQCh. 7 - Prob. 4MCQCh. 7 - Prob. 5MCQCh. 7 - Prob. 1DQCh. 7 - Prob. 2DQCh. 7 - Prob. 3DQCh. 7 - Prob. 4DQCh. 7 - Prob. 5DQ

Ch. 7 - Prob. 6DQCh. 7 - Prob. 7DQCh. 7 - Prob. 8DQCh. 7 - Prob. 9DQCh. 7 - Prob. 10DQCh. 7 - Prob. 1QSCh. 7 - Prob. 2QSCh. 7 - Prob. 3QSCh. 7 - Prob. 4QSCh. 7 - Allowance method for bad debts P2 Gomez Corp. uses...Ch. 7 - Prob. 6QSCh. 7 - Prob. 7QSCh. 7 - Prob. 8QSCh. 7 - Prob. 9QSCh. 7 - Prob. 10QSCh. 7 - Prob. 11QSCh. 7 - Prob. 12QSCh. 7 - Prob. 13QSCh. 7 - Prob. 14QSCh. 7 - Prob. 15QSCh. 7 - Prob. 16QSCh. 7 - Prob. 17QSCh. 7 - Accounts receivable subsidiary ledger; schedule of...Ch. 7 - Prob. 2ECh. 7 - Prob. 3ECh. 7 - Prob. 4ECh. 7 - Prob. 5ECh. 7 - Percent of sales method; write-off P3 At year-end...Ch. 7 - Prob. 7ECh. 7 - Prob. 8ECh. 7 - Prob. 9ECh. 7 - Prob. 10ECh. 7 - Prob. 11ECh. 7 - Prob. 12ECh. 7 - Prob. 13ECh. 7 - Prob. 14ECh. 7 - Prob. 15ECh. 7 - Prob. 16ECh. 7 - Prob. 17ECh. 7 - Prob. 1PSACh. 7 - Prob. 2PSACh. 7 - Aging accounts receivable and accounting for bad...Ch. 7 - Prob. 4PSACh. 7 - Prob. 5PSACh. 7 - Sales on account and credit card sales C1 Archer...Ch. 7 - Prob. 2PSBCh. 7 - Prob. 3PSBCh. 7 - Prob. 4PSBCh. 7 - Prob. 5PSBCh. 7 - Prob. 7SPCh. 7 - Prob. 1GLPCh. 7 - Prob. 1AACh. 7 - Prob. 2AACh. 7 - Prob. 3AACh. 7 - Prob. 1BTNCh. 7 - Prob. 2BTNCh. 7 - Prob. 3BTNCh. 7 - Prob. 4BTNCh. 7 - Prob. 5BTNCh. 7 - Prob. 6BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardI need help with this financial accounting question using standard accounting techniques.arrow_forwardI need help with this general accounting question using standard accounting techniques.arrow_forward

- I am trying to find the accurate solution to this financial accounting problem with the correct explanation.arrow_forwardPlease help me solve this financial accounting question using the right financial principles.arrow_forwardPlease explain the solution to this financial accounting problem with accurate explanations.arrow_forward

- Please explain the correct approach for solving this financial accounting question.arrow_forwardPlease provide the answer to this financial accounting question with proper steps.arrow_forwardI am searching for the correct answer to this financial accounting problem with proper accounting rules.arrow_forward

- I need help finding the accurate solution to this financial accounting problem with valid methods.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forwardCan you explain this financial accounting question using accurate calculation methods?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Accounts Receivable and Accounts Payable; Author: The Finance Storyteller;https://www.youtube.com/watch?v=x_aUWbQa878;License: Standard Youtube License