Concept explainers

In this problem we have to get the data from yahoo finance for Alcoa and S&P 500 for 60 months and calculate their returns by using this formula:

Returns = ln(Return in current year/return in previous year)

Here ln stands for natural logarithm.

Explanation of Solution

The data is shown below:

| Date | Returns Alcoa | Returns S&P |

| 12/1/2013 | 0 | 0 |

| 1/1/2014 | 0 | 0 |

| 2/1/2014 | 0.019785587 | 0.042213375 |

| 3/1/2014 | 0.094520691 | 0.006908249 |

| 4/1/2014 | 0.045565745 | 0.006181643 |

| 5/1/2014 | 0.010340052 | 0.020812196 |

| 6/1/2014 | 0.09213958 | 0.018878997 |

| 7/1/2014 | 0.09598186 | -0.015194687 |

| 8/1/2014 | 0.013333413 | 0.036963644 |

| 9/1/2014 | -0.029980428 | -0.015635436 |

| 10/1/2014 | 0.040797065 | 0.022936399 |

| 11/1/2014 | 0.031133233 | 0.024237474 |

| 12/1/2014 | -0.088938172 | -0.004197385 |

| 1/1/2015 | -0.008906032 | -0.031532779 |

| 2/1/2015 | -0.056519624 | 0.053438876 |

| 3/1/2015 | -0.133367024 | -0.017549197 |

| 4/1/2015 | 0.037969704 | 0.008484722 |

| 5/1/2015 | -0.071017427 | 0.01043673 |

| 6/1/2015 | -0.112097041 | -0.021235559 |

| 7/1/2015 | -0.121939527 | 0.019549683 |

| 8/1/2015 | -0.043485446 | -0.064624731 |

| 9/1/2015 | 0.025067099 | -0.026798731 |

| 10/1/2015 | -0.078577301 | 0.079719379 |

| 11/1/2015 | 0.047029033 | 0.000504742 |

| 12/1/2015 | 0.056257819 | -0.017685659 |

| 1/1/2016 | -0.302996218 | -0.052067617 |

| 2/1/2016 | 0.202912827 | -0.004136906 |

| 3/1/2016 | 0.074574737 | 0.06390499 |

| 4/1/2016 | 0.153553957 | 0.002695762 |

| 5/1/2016 | -0.18644828 | 0.015208367 |

| 6/1/2016 | 0.002902807 | 0.000910506 |

| 7/1/2016 | 0.135955619 | 0.034990433 |

| 8/1/2016 | -0.052185714 | -0.001219987 |

| 9/1/2016 | 0.008845955 | -0.001235213 |

| 10/1/2016 | -0.12794767 | -0.019616837 |

| 11/1/2016 | 0.301002453 | 0.033603545 |

| 12/1/2016 | -0.027282474 | 0.018037111 |

| 1/1/2017 | 0.260883907 | 0.017726315 |

| 2/1/2017 | -0.052376863 | 0.036523001 |

| 3/1/2017 | -0.005508 | -0.000389273 |

| 4/1/2017 | -0.019668973 | 0.009050132 |

| 5/1/2017 | -0.023699955 | 0.011509759 |

| 6/1/2017 | -0.008842777 | 0.004802226 |

| 7/1/2017 | 0.108723913 | 0.019164018 |

| 8/1/2017 | 0.186889829 | 0.000546284 |

| 9/1/2017 | 0.060570954 | 0.019119039 |

| 10/1/2017 | 0.024577509 | 0.02194556 |

| 11/1/2017 | -0.121820059 | 0.003713141 |

| 12/1/2017 | 0.241786656 | 0.033766015 |

| 1/1/2018 | -0.034945458 | 0.054657399 |

| 2/1/2018 | -0.145632637 | -0.039726108 |

| 3/1/2018 | -0.00022244 | -0.027252497 |

| 4/1/2018 | 0.129966368 | 0.002715086 |

| 5/1/2018 | -0.06308127 | 0.021378191 |

| 6/1/2018 | -0.025067115 | 0.004830749 |

| 7/1/2018 | -0.080131612 | 0.035387951 |

| 8/1/2018 | 0.031842536 | 0.029814315 |

| 9/1/2018 | -0.100472256 | 0.004285093 |

| 10/1/2018 | -0.143767471 | -0.071929346 |

| 11/1/2018 | -0.095281689 | 0.017701752 |

| 12/1/2018 | -0.098711084 | -0.047137951 |

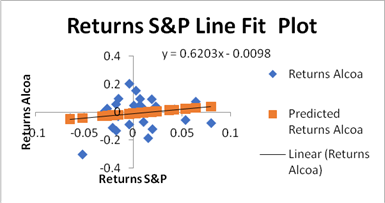

For First half of the data that is for 30 months, we run the regression between Alcoa and S&P to get this as an output.

Regression equation for the first 30 months is

Y = 0.6203X − 0.0098

From this equation the

Beta = slope of regression line = 0.6203

Alpha = intercept of regression line = 0.0098

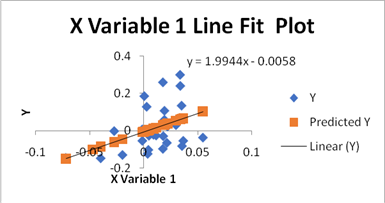

For next half of the data that is for 30 months, we run the regression between Alcoa and S&P to get this as an output.

Regression equation for the first 30 months is

Y = 1.9944X − 0.0058

From this equation the

Beta = slope of regression line = 0.1.9944

Alpha = intercept of regression line = 0.0058

From this we can interpret that the for the first 30 months beta is quite lower as compared to the next 30 months. Also Alpha increased from negative 0.0098 to negative 0.0058 for the last 30 months meaning that the stock became more volatile and riskier and was giving more returns.

Want to see more full solutions like this?

Chapter 7 Solutions

ESSEN OF INVESTMENTS CONNECT AC

- Take value of 1.01^-36=0.699 . step by steparrow_forwardsolve this question.Pat and Chris have identical interest-bearing bank accounts that pay them $15 interest per year. Pat leaves the $15 in the account each year, while Chris takes the $15 home to a jar and never spends any of it. After five years, who has more money?arrow_forwardWhat is corporate finance? explain all thingsarrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education