Concept explainers

In this problem we have to get the data from yahoo finance for Alcoa and S&P 500 for 60 months and calculate their returns by using this formula:

Returns = ln(Return in current year/return in previous year)

Here ln stands for natural logarithm.

Explanation of Solution

The data is shown below:

| Date | Returns Alcoa | Returns S&P |

| 12/1/2013 | 0 | 0 |

| 1/1/2014 | 0 | 0 |

| 2/1/2014 | 0.019785587 | 0.042213375 |

| 3/1/2014 | 0.094520691 | 0.006908249 |

| 4/1/2014 | 0.045565745 | 0.006181643 |

| 5/1/2014 | 0.010340052 | 0.020812196 |

| 6/1/2014 | 0.09213958 | 0.018878997 |

| 7/1/2014 | 0.09598186 | -0.015194687 |

| 8/1/2014 | 0.013333413 | 0.036963644 |

| 9/1/2014 | -0.029980428 | -0.015635436 |

| 10/1/2014 | 0.040797065 | 0.022936399 |

| 11/1/2014 | 0.031133233 | 0.024237474 |

| 12/1/2014 | -0.088938172 | -0.004197385 |

| 1/1/2015 | -0.008906032 | -0.031532779 |

| 2/1/2015 | -0.056519624 | 0.053438876 |

| 3/1/2015 | -0.133367024 | -0.017549197 |

| 4/1/2015 | 0.037969704 | 0.008484722 |

| 5/1/2015 | -0.071017427 | 0.01043673 |

| 6/1/2015 | -0.112097041 | -0.021235559 |

| 7/1/2015 | -0.121939527 | 0.019549683 |

| 8/1/2015 | -0.043485446 | -0.064624731 |

| 9/1/2015 | 0.025067099 | -0.026798731 |

| 10/1/2015 | -0.078577301 | 0.079719379 |

| 11/1/2015 | 0.047029033 | 0.000504742 |

| 12/1/2015 | 0.056257819 | -0.017685659 |

| 1/1/2016 | -0.302996218 | -0.052067617 |

| 2/1/2016 | 0.202912827 | -0.004136906 |

| 3/1/2016 | 0.074574737 | 0.06390499 |

| 4/1/2016 | 0.153553957 | 0.002695762 |

| 5/1/2016 | -0.18644828 | 0.015208367 |

| 6/1/2016 | 0.002902807 | 0.000910506 |

| 7/1/2016 | 0.135955619 | 0.034990433 |

| 8/1/2016 | -0.052185714 | -0.001219987 |

| 9/1/2016 | 0.008845955 | -0.001235213 |

| 10/1/2016 | -0.12794767 | -0.019616837 |

| 11/1/2016 | 0.301002453 | 0.033603545 |

| 12/1/2016 | -0.027282474 | 0.018037111 |

| 1/1/2017 | 0.260883907 | 0.017726315 |

| 2/1/2017 | -0.052376863 | 0.036523001 |

| 3/1/2017 | -0.005508 | -0.000389273 |

| 4/1/2017 | -0.019668973 | 0.009050132 |

| 5/1/2017 | -0.023699955 | 0.011509759 |

| 6/1/2017 | -0.008842777 | 0.004802226 |

| 7/1/2017 | 0.108723913 | 0.019164018 |

| 8/1/2017 | 0.186889829 | 0.000546284 |

| 9/1/2017 | 0.060570954 | 0.019119039 |

| 10/1/2017 | 0.024577509 | 0.02194556 |

| 11/1/2017 | -0.121820059 | 0.003713141 |

| 12/1/2017 | 0.241786656 | 0.033766015 |

| 1/1/2018 | -0.034945458 | 0.054657399 |

| 2/1/2018 | -0.145632637 | -0.039726108 |

| 3/1/2018 | -0.00022244 | -0.027252497 |

| 4/1/2018 | 0.129966368 | 0.002715086 |

| 5/1/2018 | -0.06308127 | 0.021378191 |

| 6/1/2018 | -0.025067115 | 0.004830749 |

| 7/1/2018 | -0.080131612 | 0.035387951 |

| 8/1/2018 | 0.031842536 | 0.029814315 |

| 9/1/2018 | -0.100472256 | 0.004285093 |

| 10/1/2018 | -0.143767471 | -0.071929346 |

| 11/1/2018 | -0.095281689 | 0.017701752 |

| 12/1/2018 | -0.098711084 | -0.047137951 |

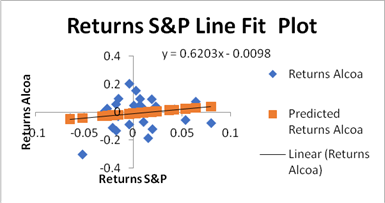

For First half of the data that is for 30 months, we run the regression between Alcoa and S&P to get this as an output.

Regression equation for the first 30 months is

Y = 0.6203X − 0.0098

From this equation the

Beta = slope of regression line = 0.6203

Alpha = intercept of regression line = 0.0098

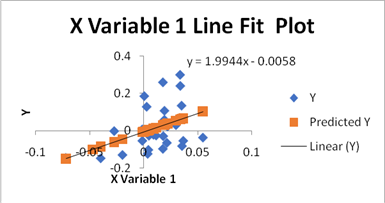

For next half of the data that is for 30 months, we run the regression between Alcoa and S&P to get this as an output.

Regression equation for the first 30 months is

Y = 1.9944X − 0.0058

From this equation the

Beta = slope of regression line = 0.1.9944

Alpha = intercept of regression line = 0.0058

From this we can interpret that the for the first 30 months beta is quite lower as compared to the next 30 months. Also Alpha increased from negative 0.0098 to negative 0.0058 for the last 30 months meaning that the stock became more volatile and riskier and was giving more returns.

Want to see more full solutions like this?

Chapter 7 Solutions

Essentials Of Investments

- King’s Park, Trinidad is owned and operated by a private company, Windy Sports Ltd. You work as the Facilities Manager of the Park and the CEO of the company has asked you to evaluate whether Windy should embark on the expansion of the facility given there are plans by the Government to host next cricket championship. The project seeks to increase the number of seats by building four new box seating areas for VIPs and an additional 5,000 seats for the general public. Each box seating area is expected to generate $400,000 in incremental annual revenue, while each of the new seats for the general public will generate $2,500 in incremental annual revenue. The incremental expenses associated with the new boxes and seating will amount to 60 percent of the revenues. These expenses include hiring additional personnel to handle concessions, ushering, and security. The new construction will cost $15 million and will be fully depreciated (to a value of zero dollars) on a straight-line basis over…arrow_forwardA brief introduction and overview of the company"s (a) uk vodaphone -300word history and current position in respective marketplace.A graphical illustration, together with a short written summary, of the five year trends in sales, profits,costs and dividends paid-100wordarrow_forwardA brief introduction and overview of the company"s (a) uk vodaphone (b) uk Hsbc bank, (c)uk coca-cola history and current position in respective marketplace.arrow_forward

- King’s Park, Trinidad is owned and operated by a private company,Windy Sports Ltd. You work as the Facilities Manager of the Park andthe CEO of the company has asked you to evaluate whether Windy shouldembark on the expansion of the facility given there are plans by theGovernment to host next cricket championship.The project seeks to increase the number of seats by building fournew box seating areas for VIPs and an additional 5,000 seats for thegeneral public. Each box seating area is expected to generate $400,000in incremental annual revenue, while each of the new seats for thegeneral public will generate $2,500 in incremental annual revenue.The incremental expenses associated with the new boxes and seatingwill amount to 60 percent of the revenues. These expenses includehiring additional personnel to handle concessions, ushering, andsecurity. The new construction will cost $15 million and will be fullydepreciated (to a value of zero dollars) on a straight-line basis overthe 5-year…arrow_forwardYou are called in as a financial analyst to appraise the bonds of Ollie’s Walking Stick Stores. The $5,000 par value bonds have a quoted annual interest rate of 8 percent, which is paid semiannually. The yield to maturity on the bonds is 12 percent annual interest. There are 12 years to maturity. a. Compute the price of the bonds based on semiannual analysis. b. With 8 years to maturity, if yield to maturity goes down substantially to 6 percent, what will be the new price of the bonds?arrow_forwardLonnie is considering an investment in the Cat Food Industries. The $10,000 par value bonds have a quoted annual interest rate of 12 percent and the interest is paid semiannually. The yield to maturity on the bonds is 14 percent annual interest. There are seven years to maturity. Compute the price of the bonds based on semiannual analysis.arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education