Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 2PA

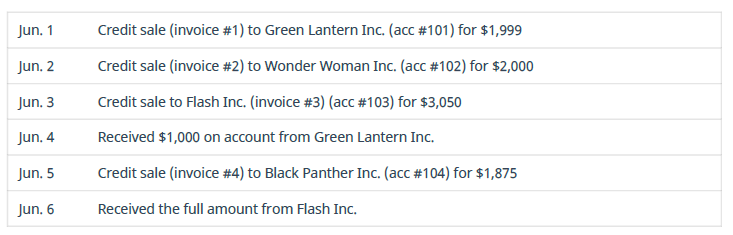

Evie Inc. has the following transactions during its first month of business. Journalize the transactions that go in the sales journal.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

What is meant by compensated absences for employees of a company, and what does this even have to do with reporting of current liabilities? Also, what is vested rights of an employee?

A company paid $12,000 for a one-year insurance policy on October 1. What amount should be reported as Prepaid Insurance on the December 31 balance sheet?

A. $3,000B. $9,000C. $12,000D. $0need help

Financial Accounting Question please answer

Chapter 7 Solutions

Principles of Accounting Volume 1

Ch. 7 - So far, computer systems cannot yet ________. A....Ch. 7 - Any device used to provide the results of...Ch. 7 - Source documents ________. A. are input devices B....Ch. 7 - All of the following can provide source data...Ch. 7 - A document that asks you to return an identifying...Ch. 7 - Which of the following is false about accounting...Ch. 7 - An unhappy customer just returned $50 of the items...Ch. 7 - A customer just charged $150 of merchandise on the...Ch. 7 - A customer just charged $150 of merchandise using...Ch. 7 - The company just took a physical count of...

Ch. 7 - Your company paid rent of $1,000 for the month...Ch. 7 - On January 1, Incredible Infants sold goods to...Ch. 7 - Received a check for $72 from a customer, Mr....Ch. 7 - You returned damaged goods you had previously...Ch. 7 - Sold goods for $650 cash. Which journal would the...Ch. 7 - Sandren Co. purchased inventory on credit from...Ch. 7 - Sold goods for $650, credit terms net 30 days....Ch. 7 - You returned damaged goods to C.C. Rogers Inc. and...Ch. 7 - The sum of all the accounts in the accounts...Ch. 7 - AB Inc. purchased inventory on account from YZ...Ch. 7 - You just posted a debit to ABC Co. in the accounts...Ch. 7 - You just posted a credit to Stars Inc. in the...Ch. 7 - You just posted a debit to Cash in the general...Ch. 7 - You just posted a credit to Accounts Receivable....Ch. 7 - You just posted a credit to Sales and a debit to...Ch. 7 - An enterprise resource planning (ERP) system...Ch. 7 - Which of the following is not a way to prevent...Ch. 7 - Big data is mined ________. A. to find business...Ch. 7 - Artificial intelligence refers to ________. A....Ch. 7 - Blockchain is a technology that ________. A. is in...Ch. 7 - Which of the following is not true about...Ch. 7 - Why does a student need to understand how to use a...Ch. 7 - Provide an example of how paper-based accounting...Ch. 7 - Why are scanners better than keyboards?Ch. 7 - Why are there so many different accounting...Ch. 7 - Which area of accounting needs a computerized...Ch. 7 - The American Institute of Certified Public...Ch. 7 - Which special journals also require an entry to a...Ch. 7 - What is a schedule of accounts receivable?Ch. 7 - How often do we post the cash column in the cash...Ch. 7 - The schedule of accounts payable should equal...Ch. 7 - Which amounts do we post daily and which do we...Ch. 7 - Why are special journals used?Ch. 7 - Name the four main special journals.Ch. 7 - A journal entry that requires a debit to Accounts...Ch. 7 - The purchase of equipment for cash would be...Ch. 7 - Can a sales journal be used to record sales on...Ch. 7 - When should entries from the sales journal be...Ch. 7 - We record a sale on account that involves sales...Ch. 7 - We record purchases of inventory for cash in which...Ch. 7 - Should the purchases journal have a column that is...Ch. 7 - Forensic means suitable for use in a court of law....Ch. 7 - For each of the following, indicate if the...Ch. 7 - All of the following information pertains to...Ch. 7 - Match the special journal you would use to record...Ch. 7 - For each of the transactions, state which special...Ch. 7 - Catherines Cookies has a beginning balance in the...Ch. 7 - Record the following transactions in the sales...Ch. 7 - Record the following transactions in the cash...Ch. 7 - Maddie Inc. has the following transactions for its...Ch. 7 - For each of the following, indicate if the...Ch. 7 - The following information pertains to Crossroads...Ch. 7 - Match the special journal you would use to record...Ch. 7 - For each of the following transactions, state...Ch. 7 - Catherines Cookies has a beginning balance in the...Ch. 7 - Record the following transactions in the purchases...Ch. 7 - Record the following transactions in the cash...Ch. 7 - Piedmont Inc. has the following transactions for...Ch. 7 - On June 30, Oscar Inc.s bookkeeper is preparing to...Ch. 7 - Evie Inc. has the following transactions during...Ch. 7 - Use the journals and ledgers that follow. Total...Ch. 7 - Brown Inc. records purchases in a purchases...Ch. 7 - On June 30, Isner Inc.s bookkeeper is preparing to...Ch. 7 - Use the journals and ledgers that follows. Total...Ch. 7 - Why must the Accounts Receivable account in the...Ch. 7 - Why would a company use a subsidiary ledger for...Ch. 7 - If a customer owed your company $100 on the first...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Why is the capital-budgeting process so important?

Foundations Of Finance

E2-13 Identifying increases and decreases in accounts and normal balances

Learning Objective 2

Insert the mis...

Horngren's Accounting (12th Edition)

Communication Activity 9-1

In 150 words or fewer, explain the different methods that can be used to calculate d...

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

An experimental composite engine block for an automobile will trim 20 pounds of weight compared with a traditio...

Engineering Economy (17th Edition)

1-13. Identify a product, either a good or a service, that will take advantage of this opportunity. Although yo...

Business Essentials (12th Edition) (What's New in Intro to Business)

Comparison of projects using Net Present Value. Reasons for the conflicts in ranking using Net Present Value an...

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Knowledge Booster

Similar questions

- A company paid $12,000 for a one-year insurance policy on October 1. What amount should be reported as Prepaid Insurance on the December 31 balance sheet? A. $3,000B. $9,000C. $12,000D. $0arrow_forwardNo chatgpt 9. In a perpetual inventory system, what happens when goods are sold?A. Only sales revenue is recordedB. Inventory and cost of goods sold are updated immediatelyC. Inventory is updated at the end of the accounting periodD. Only cost of goods sold is recordedAnswer: Barrow_forward9. In a perpetual inventory system, what happens when goods are sold?A. Only sales revenue is recordedB. Inventory and cost of goods sold are updated immediatelyC. Inventory is updated at the end of the accounting periodD. Only cost of goods sold is recordedneed helparrow_forward

- Can you demonstrate the accurate method for solving this financial accounting question?arrow_forwardWhat effect does recording depreciation expense have on the accounting equation?A. Increases assets and increases equityB. Decreases assets and decreases equityC. Increases liabilities and decreases equityD. No effect on assets or equity No AIarrow_forwardNo ai 9. In a perpetual inventory system, what happens when goods are sold?A. Only sales revenue is recordedB. Inventory and cost of goods sold are updated immediatelyC. Inventory is updated at the end of the accounting periodD. Only cost of goods sold is recordedAnswer: Barrow_forward

- Solve this question with accounting questionarrow_forwardHello tutor solve this situation with accounting questionarrow_forwardWhat effect does recording depreciation expense have on the accounting equation?A. Increases assets and increases equityB. Decreases assets and decreases equityC. Increases liabilities and decreases equityD. No effect on assets or equity helparrow_forward

- What effect does recording depreciation expense have on the accounting equation?A. Increases assets and increases equityB. Decreases assets and decreases equityC. Increases liabilities and decreases equityD. No effect on assets or equityarrow_forwardFinancial accounting questionarrow_forwardCan you demonstrate the proper approach for solving this financial accounting question with valid techniques?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning  Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage