Concept explainers

Sales, production, direct materials, direct labor, and factory

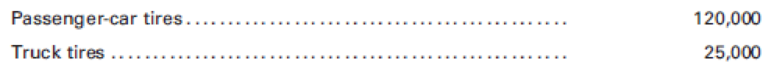

King Tire Co.’s budgeted unit sales for the year 2016 were:

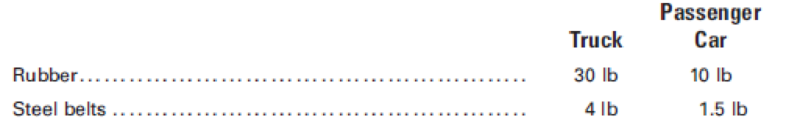

The budgeted selling price for truck tires was $200 per tire, and for passenger car tires it was $65 per tire. The beginning finished goods inventories were expected to be 2,000 truck tires and 5,000 passenger tires, for a total cost of $326,478, with desired ending inventories at 2,500 and 6,000, respectively, with a total cost of $400,510. There was no anticipated beginning or ending work-in- process inventory for either type of tire. The standard materials quantities for each type of tire were as follows:

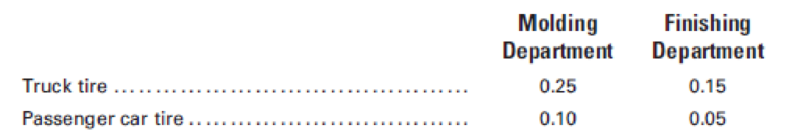

The purchase prices of rubber and steel were $2 and $3 per pound, respectively. The desired ending inventories for rubber and steel were 60,000 and 6,000 lb, respectively. The estimated beginning inventories for rubber and steel were 75,000 and 7,000 lb, respectively. The direct labor hours required for each type of tire were as follows:

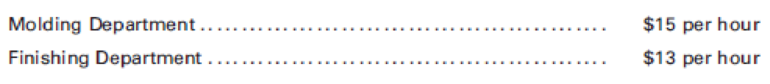

The direct labor rate for each department is as follows:

Budgeted

Required:

Prepare each of the following budgets for King for the year ended December 31, 2016:

- 1. Sales budget.

- 2. Production budget.

- 3. Direct material budget.

- 4. Direct labor budget.

- 5. Factory overhead budget.

- 6. Cost of goods sold budget.

1.

Prepare the sales budget for the year ended December 31, 2016.

Explanation of Solution

Prepare the sales budget for the year ended December 31, 2016.

| KT Company | |||

| Sales budget | |||

| For the year ended December 31, 2016 | |||

| Product | Sales volume (Unit) | Selling price (Unit) | Total sales |

| Passenger car entries | 120,000 | $65 | $7,800,000 |

| Truck tires | 25,000 | $200 | $5,000,000 |

| Total | 145,000 | $12,800,000 | |

Table (1)

2.

Prepare the production budget for the year ended December 31, 2016.

Explanation of Solution

Prepare the production budget for the year ended December 31, 2016.

| KT Company | ||

| Production budget | ||

| For the year ended December 31, 2016 | ||

| Particulars | Units | |

| Passenger car tires | Truck tires | |

| Sales (From sales budget) | 120,000 | 25,000 |

| Add: desired ending inventory, December 31 | 6,000 | 2,500 |

| Total | 126,000 | 27,500 |

| Less: Estimated beginning inventory, January 1 | 5,000 | 2,000 |

| Total production | 131,000 | 29,500 |

Table (2)

3.

Prepare the direct material budget for the year ended December 31, 2016.

Explanation of Solution

Prepare the direct material budget for the year ended December 31, 2016.

| KT Company | |||

| Direct materials budget | |||

| For the year ended December 31, 2016 | |||

| Particulars | Direct materials | Total | |

| Rubber | Steel Belts | ||

| Quantities required for production: | |||

| Passenger car tires: | |||

| | 1,210,000 | ||

| | 181,500 | ||

| Truck tires: | |||

| | 765,000 | ||

| | 102,000 | ||

| Add: Desired ending inventory, December 31 | 60,000 | 6,000 | |

| Total | 2,035,000 | 289,500 | |

| Less: Estimated beginning inventory, January 1 | 75,000 | 7,000 | |

| Total quantity to be purchased (A) | 1,960,000 | 282,500 | |

| Unit price (B) | $2 | $3 | |

| Total direct materials purchases | $3,920,000 | $847,500 | $4,767,500 |

Table (3)

4.

Prepare the direct labor budget for the year ended December 31, 2016.

Explanation of Solution

Prepare the direct labor budget for the year ended December 31, 2016.

| KT Company | |||

| Direct labor budget | |||

| For the year ended December 31, 2016 | |||

| Particulars | Department | Total | |

| Molding | Finishing | ||

| Hours required for production: | |||

| Passenger car tires: | |||

| | 12,100 | ||

| | 6,050 | ||

| Truck tires: | |||

| | 6,375 | ||

| | 3,825 | ||

| Total (A) | 18,475 | 9,875 | |

| Hourly rate (B) | $15 | $13 | |

| Total direct labor cost | $277,125 | $128,375 | $405,500 |

Table (4)

5.

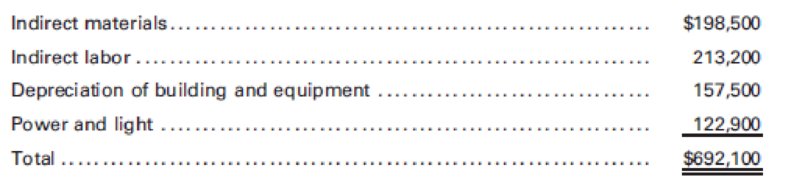

Prepare the factory overhead budget for the year ended December 31, 2016.

Explanation of Solution

Prepare the factory overhead budget for the year ended December 31, 2016.

| KT Company | ||

| Factory overhead budget | ||

| For the year ended December 31, 2016 | ||

| Particulars | Amount ($) | Amount ($) |

| Indirect materials | 198,500 | |

| Indirect labor | 213,200 | |

| Depreciation of building and equipment | 157,500 | |

| Power and light | 122,900 | |

| Total factory overhead cost | $692,100 | |

Table (5)

6.

Prepare the cost of goods sold budget for the year ended December 31, 2016.

Explanation of Solution

Prepare the cost of goods sold budget for the year ended December 31, 2016.

| KT Company | ||

| Cost of goods sold budget | ||

| For the year ended December 31, 2016 | ||

| Particulars | Amount ($) | Amount ($) |

| Finished goods inventory, January 1 | 326,478 | |

| Direct materials inventory, January 1 (1) | 171,000 | |

| Direct materials purchases | 4,767,500 | |

| Total direct materials available | 4,938,500 | |

| Less: Direct materials inventory, December 31 (2) | 138,000 | |

| Cost of direct materials used | 4,800,500 | |

| Direct labor | 405,500 | |

| Factory overhead | 692,100 | |

| Cost of goods manufactured | 5,898,100 | |

| Cost of goods available for sale | 6,224,578 | |

| Less: Finished goods inventory, December 31 | 400,510 | |

| Cost of goods sold | 5,824,068 | |

Table (6)

Working note (1):

Calculate the amount of direct materials inventory as on January 1:

| Particulars | Calculation | Amount ($) |

| Rubber | 150,000 | |

| Steel belts | 21,000 | |

| Total | 171,000 |

Table (7)

Working note (2):

Calculate the amount of direct materials inventory as on December 31:

| Particulars | Calculation | Amount ($) |

| Rubber | 120,000 | |

| Steel belts | 18,000 | |

| Total | 171,000 |

Table (8)

Want to see more full solutions like this?

Chapter 7 Solutions

PRINCIPLES OF COST ACCOUNTING

Additional Business Textbook Solutions

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Horngren's Accounting (12th Edition)

Intermediate Accounting (2nd Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

- Can you help me with General accounting question?arrow_forwardI am looking for help with this financial accounting question using proper accounting standards.arrow_forwardOn August 1, Natalie Inc. has retained earnings of $63,780. Revenues for August were $12,450. Expenses for August were $5,620. In August, the company paid out a total of $2,230 in dividends to its shareholders. What is the value of retained earnings on August 31?arrow_forward

- I need help with this general accounting question using standard accounting techniques.arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,