Concept explainers

a.

Record the given events in the

a.

Explanation of Solution

Accounting equation is an accounting tool expressed in the form of equation, by creating a relationship between the resources or assets of a company, and claims on the resources by the creditors and the owners. Accounting equation is expressed as shown below.

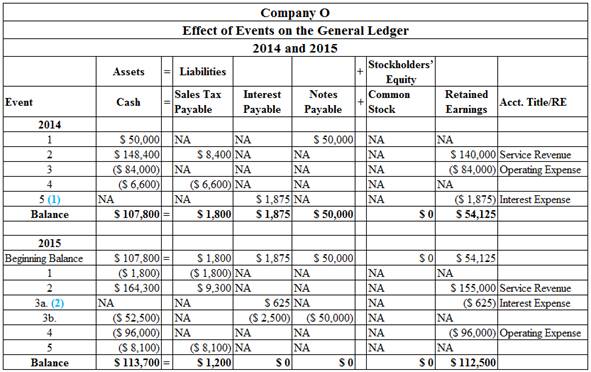

Record the given events in accounting equation:

Table (1)

Working note 1: Determine the sales tax payable on the service rendered in 2014.

Working note 2: Determine the sales tax due for the year 2014.

b.

Prepare an income statement, a statement of changes in

b.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Balance sheet: Balance Sheet is one of the financial statements which summarize the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Statement of changes in the stockholders’ equity: This statement reflects whether the components of stockholders’ equity have increased or decreased during the period.

Statement of cash flows: Statement of cash flow is a financial statement that shows the cash and cash equivalents of a company for a particular period of time. It shows the net changes in cash, by reporting the sources and uses of cash as a result of operating, investing, and financing activities of a company.

Prepare the income statement for Company O for the year ended December 31, 2014:

| Company O | ||

| Statement of income | ||

| For the year ended December 31, 2014 | ||

| Particulars | Amount $ | Amount $ |

| Service Revenue | 140,000 | |

| Expenses: | ||

| Operating Expenses | 84,000 | |

| Total operating expense | (84,000) | |

| Operating income | 56,000 | |

| Interest expense | (1,875) | |

| Net income | 54,125 | |

Table (2)

Prepare the statement of changes in stockholders’ equity of Company O for the year ended December 31, 2014:

| Company O | ||

| Statement of changes in stockholders' equity | ||

| For the year ended December 31, 2014 | ||

| Particulars | Amount $ | Amount $ |

| Common Stock | 0 | |

| Beginning | 0 | |

| Add/Less: Net Income (Loss) | 54,125 | |

| Ending Retained Earnings | 54,125 | |

| Total stockholder's equity | 54,125 | |

Table (3)

Prepare the balance sheet of Company O as on December 31, 2014:

| Company O | ||

| Balance sheet | ||

| As on December 31, 2014 | ||

| Assets | Amount $ | Amount $ |

| Cash | 107,800 | |

| Total Assets | 107,800 | |

| Liabilities and stockholders' equity | ||

| Liabilities | ||

| Sales tax Payable | 1,800 | |

| Interest Payable | 1,875 | |

| Notes Payable | 50,000 | |

| Total Liabilities | 53,675 | |

| Stockholders’ Equity | ||

| Retained Earnings | 54,125 | |

| Total Stockholders’ Equity | 54,125 | |

| Total liabilities and stockholders' equity | 107,800 | |

Table (4)

Prepare the statement of cash flows of Company O for the year ended December 31, 2014;

| Company O | ||

| Statement of cash flows | ||

| For the year ended December 31, 2014 | ||

| Particulars | Amount $ | Amount $ |

| Cash flow from operating activities: | ||

| Inflow from Customers | 140,000 | |

| Inflow from Sales Tax | 8,400 | |

| Outflow for Expenses | (84,000) | |

| Outflow for Sales Tax | (6,600) | |

| Net Cash Flow from Operating Activities | 57,800 | |

| Cash Flows From Investing Activities: | ||

| Net Cash Flow From Investing Activities | 0 | |

| Cash Flows From Financing Activities: | ||

| Inflow from loan | 50,000 | |

| Net Cash Flow From Financing Activities | 50,000 | |

| Net Change in Cash | 107,800 | |

| Add: Beginning Cash Balance | 0 | |

| Ending Cash Balance | 107,800 | |

Table (5)

Prepare the income statement for Company O for the year ended December 31, 2015;

| Company O | ||

| Statement of income | ||

| For the year ended December 31, 2015 | ||

| Particulars | Amount $ | Amount $ |

| Service Revenue | 155,000 | |

| Expenses: | ||

| Operating Expenses | 96,000 | |

| Total operating expense | (96,000) | |

| Operating income | 59,000 | |

| Interest expense | (625) | |

| Net income | 58,375 | |

Table (6)

Prepare the statement of changes in stockholders’ equity of Company O for the year ended December 31, 2015.

| Company O | ||

| Statement of changes in stockholders' equity | ||

| For the year ended December 31, 2015 | ||

| Particulars | Amount $ | Amount $ |

| Common Stock | 0 | |

| Beginning retained earnings | 54,125 | |

| Add/Less: Net Income (Loss) | 58,375 | |

| Ending Retained Earnings | 112,500 | |

| Total stockholder's equity | 112,500 | |

Table (7)

Prepare the balance sheet of Company O as on December 31, 2015.

| Company O | ||

| Balance sheet | ||

| As on December 31, 2015 | ||

| Assets | Amount $ | Amount $ |

| Cash | 113,700 | |

| Total Assets | 113,700 | |

| Liabilities and stockholders' equity | ||

| Liabilities | ||

| Sales tax Payable | 1,200 | |

| Total Liabilities | 1,200 | |

| Stockholders’ Equity | ||

| Retained Earnings | 112,500 | |

| Total Stockholders’ Equity | 112,500 | |

| Total liabilities and stockholders' equity | 113,700 | |

Table (8)

Prepare the statement of cash flows of Company O for the year ended December 31, 2015.

| Company O | ||

| Statement of cash flows | ||

| For the year ended December 31, 2015 | ||

| Particulars | Amount $ | Amount $ |

| Cash flow from operating activities: | ||

| Cash reeipts from Customers | $155,000 | |

| Inflow from Sales Tax | 9,300 | |

| Cash paid for Expenses | (96,000) | |

| Cash paid for Sales Tax expense | (9,900) | |

| Cash paid for Interest exepnse | (2,500) | |

| Net Cash Flow from Operating Activities | 55,900 | |

| Cash Flows From Investing Activities: | ||

| Net Cash Flow From Investing Activities | 0 | |

| Cash Flows From Financing Activities: | ||

| Repayment of loan | (50,000) | |

| Net Cash Flow From Financing Activities | (50,000) | |

| Net Change in Cash | 5,900 | |

| Add: Beginning Cash Balance | 107,800 | |

| Ending Cash Balance | 113,700 | |

Table (9)

Want to see more full solutions like this?

Chapter 7 Solutions

SURVEY OF ACCOUNTING-ACCESS

- Everlast Corp. has total maintenance department expenses of $40,200. The maintenance costs are allocated based on square footage, where the Processing department occupies 6,000 square feet, and the Packaging department occupies 3,000 square feet. Compute the amount of maintenance department expense allocated to Processing.arrow_forwardwanted general account questions answerarrow_forwardgeneral accountingarrow_forward

- Subject = Financial accountarrow_forwardWhat basis should he use for computing gain or lossarrow_forwardHamilton Textiles has the following data: • Beginning raw materials inventory = $90,000 Materials purchased = $55,000 Ending raw materials inventory = $75,000 Calculate the cost of raw materials used.arrow_forward

- ?!arrow_forwardFinancial Accounting MCQarrow_forwardWHICH OF THE FOLLOWING IS NOT AN ADVANTAGE OF USING STANDARD COSTS AND VARIANCES? A. USE AS A PERFORMANCE BENCHMARK FOR EVALUATION OF ACTUAL COSTS. B. USE AS A BASIS FOR COMPONENTS OF THE MASTER BUDGET. C. SIMPLIFICATION OF BOOKKEEPING. D. CHANGE IN BEHAVIOR OF MANAGERS TO OBTAIN DESIRED VARIANCES.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education