a)

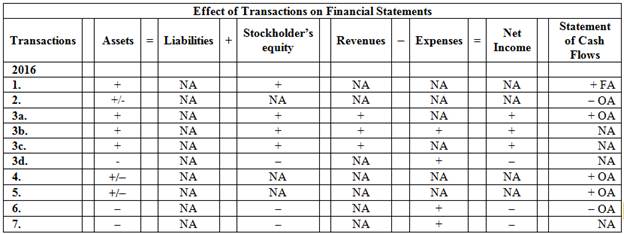

Show the effects of each of the transactions on the elements of the financial statements, using a horizontal statements model. Indicate (+) for increase, (−) for decrease, and NA for not affected.

a)

Explanation of Solution

Show the effect of each event on the financial statements using a horizontal statement model.

Table (1)

Note:

OA refers to operating activities.

FA refers to financing activities.

NA refers to does not affected.

3a. this transaction records the cash sale.

3b. this transaction records the credit card sale.

3c. this transaction records the sales made on account.

3d. this transaction records the cost of merchandise sold.

b)

Prepare general

b)

Explanation of Solution

Credit card sales: Credit card is an electronic card, which allows the credit card holders to buy something on credit conveniently, and without paying immediate cash.

Percentage-of-receivables basis: It is a method of estimating the

Prepare journal entries for Company NS.

| Date | Account title and Explanation | Post ref. | Amount | |

| Debit | Credit | |||

| 2016 | ||||

| 1. | Cash | $200,000 | ||

| Common stock | $200,000 | |||

| (To record the issuance of common stock ) | ||||

| 2. | Merchandise inventory | $900,000 | ||

| Cash | $900,000 | |||

| (To record the purchase of inventory for cash) | ||||

| 3a. | Cash | $520,000 | ||

| Sales revenue | $520,000 | |||

| (To record the cash sales) | ||||

| 3b. | $364,800 | |||

| Credit Card Expense | $15,200 | |||

| Sales revenue | $380,000 | |||

| (To record the credit card sales) | ||||

| 3c. | Accounts receivable | $300,000 | ||

| Sales revenue | $300,000 | |||

| (To record the sales on account) | ||||

| 3d. | Cost of goods sold | $710,000 | ||

| Merchandise inventory | $710,000 | |||

| (To record the cost of merchandise sold) | ||||

| 4. | Cash | $364,800 | ||

| Accounts receivable - Credit card | $364,800 | |||

| (To record the cash collected from credit card company) | ||||

| 5. | Cash | $210,000 | ||

| Accounts receivable | $210,000 | |||

| (To record the cash collected from accounts receivable) | ||||

| 6. | Selling and administrative expenses | $190,000 | ||

| Cash | $190,000 | |||

| (To record the cash paid for selling and administrative expenses ) | ||||

| 7. | Uncollectible accounts expense (1) | $4,500 | ||

| Allowance for doubtful accounts | $4,500 | |||

| (To record the uncollectible accounts expense) | ||||

Table (2)

| Cash | |||

| 1. Common stock | $200,000 | 2. | $900,000 |

| 3a. | $520,000 | 6. | $190,000 |

| 4. | $364,800 | ||

| 5. | $210,000 | ||

| Balance | $204,800 | ||

| Accounts Receivable | |||

| 3c. | $300,000 | 5. | $210,000 |

| Balance | $90,000 | ||

| Accounts Receivable – Credit Card | |||

| 3b. | $364,800 | 4. | $364,800 |

| Balance | $0 | ||

| Allowance for Doubtful Accounts | |||

| 7. | $4,500 | ||

| Balance | $4,500 | ||

| Merchandise Inventory | |||

| 2. | $900,000 | 3d. | $710,000 |

| Balance | $190,000 | ||

| Common Stock | |||

| 1. | $200,000 | ||

| Balance | $200,000 | ||

| Sales Revenue | |||

| 3a. | $520,000 | ||

| 3b. | $380,000 | ||

| 3c. | $300,000 | ||

| Balance | $1,200,000 | ||

| Cost of Goods Sold | |||

| 3d. | $710,000 | ||

| Balance | $710,000 | ||

| Credit Card Expense | |||

| 3b. | $15,200 | ||

| Balance | $15,200 | ||

| Selling & Administration Expense | |||

| 6. | $190,000 | ||

| Balance | $190,000 | ||

| Uncollectible Accounts Expense | |||

| 7. | (1) $4,500 | ||

| Balance | $4,500 | ||

Working Note:

Determine the amount of uncollectible account expense.

c)

Prepare income statement, statement of changes in

c)

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and stockholders’ equity.

Statement of changes in the stockholders’ equity: This statement reflects whether the components of stockholders’ equity have increased or decreased during the period.

Statement of Cash flows: Statement of cash flows is a statement reports the source and application of cash between two balance sheet dates. It shows how the cash is sourced and used for the company’s operating, investing, and financing activities.

Prepare the income statement for Company NS for the year ended 2016.

| Company NS | ||

| Statement of income | ||

| For the year ended 2016 | ||

| Particulars | Amount | Amount |

| Service revenue | $1,200,000 | |

| Less: Cost of goods sold | ($710,000) | |

| Gross margin | $490,000 | |

| Operating expenses | ||

| Credit card expense | $15,200 | |

| Selling and administrative expenses | $190,000 | |

| Uncollectible accounts expense | $4,500 | |

| Total operating expenses | ($209,700) | |

| Net income | $280,300 | |

Table (3)

Hence, the net income of Company NS for the year ended December 31, 2016 is $280,300.

Prepare the statement of changes in stockholders’ equity of Company NS for the year ended December 31, 2016.

| Company NS | ||

| Statement of changes in stockholders' equity | ||

| For the year ended December 31, 2016 | ||

| Particulars | Amount | Amount |

| Beginning Common Stock | $0 | |

| Add: Stock Issued | $200,000 | |

| Ending Common Stock | $200,000 | |

| Beginning retained earnings | $0 | |

| Add/Less: Net Income (Loss) | $280,300 | |

| Ending Retained Earnings | $280,300 | |

| Total stockholder's equity | $480,300 | |

Table (4)

Hence, the total stockholders’ equity of Company NS for the year ended December 31, 2016 is $480,300.

Prepare the balance sheet of Company NS as on December 31, 2016.

| Company NS | ||

| Balance sheet | ||

| As on December 31, 2016 | ||

| Assets | Amount | Amount |

| Cash | $204,800 | |

| Accounts Receivable | $90,000 | |

| Less: Allowance for doubtful accounts | ($4,500) | $85,500 |

| Merchandise Inventory | $190,000 | |

| Total Assets | $480,300 | |

| Liabilities and stockholders' equity | ||

| Liabilities | ||

| Total Liabilities | $0 | |

| Stockholders’ Equity | ||

| Common Stock | $200,000 | |

| Retained Earnings | $280,300 | |

| Total Stockholders’ Equity | $480,300 | |

| Total liabilities and stockholders' equity | $480,300 | |

Table (5)

Hence, the total of assets and liabilities and stockholders’ equity of Company NS as on December 31, 2016 is $480,300.

Prepare the statement of cash flows of Company NS for the year ended December 31, 2016.

| Company NS | ||

| Statement of cash flows | ||

| For the year ended December 31, 2016 | ||

| Particulars | Amount | Amount |

| Cash flow from operating activities: | ||

| Cash Receipts from Customers (2) | $1,094,800 | |

| Outflow for inventory | ($900,000) | |

| Outflow for expenses | ($190,000) | |

| Net Cash Flow from Operating Activities | $4,800 | |

| Cash Flows From Investing Activities: | ||

| Net Cash Flow From Investing Activities | $0 | |

| Cash Flows From Financing Activities: | ||

| Cash Receipts from Stock Issue | $200,000 | |

| Net Cash Flow From Financing Activities | $200,000 | |

| Net Change in Cash | $204,800 | |

| Add: Beginning Cash Balance | $0 | |

| Ending Cash Balance | $204,800 | |

Table (6)

Working note:

Determine the amount of cash collected from customers.

Hence, the net change in cash of Company NS during 2016 is $204,800.

Want to see more full solutions like this?

Chapter 7 Solutions

Fundamental Financial Accounting Concepts, 9th Edition

- During 2018, the band Maroon 5 is touring across the U.S. on its "Red Pill Blues Tour 2018." Two of those concerts, on October 14 and 15, will be held at Madison Square Garden in New York City. Madison Square Garden has a seating capacity for concerts of approximately 19,000. According to a Business Insider article in December 2016, Maroon 5 had an average concert ticket price of $165.Assume that these two Madison Square Garden concerts were sold out on the first day the tickets were available for sale to the public, November 4, 2017. Also assume, for the sake of simplicity, that all tickets are sold directly by Maroon5.Question:How will Maroon 5's balance sheet and income statement be impacted by the sale of the Madison Square Garden tickets on November 4, 2017 and what specific accounts will be impacted and will it be increased or decreased?arrow_forwardAnalysts are projecting that Capital Railways will have earnings per share of $4.20. If the average industry P/E ratio is 22, what is the current price of Capital Railways?arrow_forward???!arrow_forward

- What are the proceeds from the note on July 1?arrow_forwardDuring 2018, the band Maroon 5 is touring across the U.S. on its "Red Pill Blues Tour 2018." Two of those concerts, on October 14 and 15, will be held at Madison Square Garden in New York City. Madison Square Garden has a seating capacity for concerts of approximately 19,000. According to a Business Insider article in December 2016, Maroon 5 had an average concert ticket price of $165.Assume that these two Madison Square Garden concerts were sold out on the first day the tickets were available for sale to the public, November 4, 2017. Also assume, for the sake of simplicity, that all tickets are sold directly by Maroon 5.Question:How will Maroon 5's balance sheet and income statement be impacted by the performance of the October 14, 2018, concert at the Madison Square Garden tickets?arrow_forwardRequirement $1; During its first month of operation, the True Consulting Corporation, which specializes in management consulting, completed the following transactions. July 1 Gruod 15,000 shares of the company's commanstack in exchange for $15,000. July 3 Purchased a truck for $8,000. A down payment of $3,000 war made, with the balance on account. July 5 Paid $1,200 to cover rent from July 1 through September 30. July 7 Purcharod $2,000 af supplier an account. July 10 Billed customers for consulting servicos porfarmed, $3,700. July 14 Paid $500 toward the amount owed for the supplies purchased on July 7. July 15 Paid $1750 in cash for employee uages. July 19 Callected $1600 in cash from customers that were billed on July 10. July 21 Received $4,200 cash from customers for services performed. July 31 Paid $350 in cash for truck repairs. July 31 Declared and Paid $700 in cash dividends. Propuro journal entries to record the July transactions in the General Journal boluu. Ground Bote…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education