a.

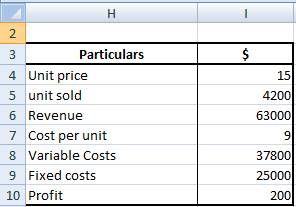

To prepare: The income statement and determine if it is profitable.

Introduction: Income Statement’ shows the revenue earned and expenses incurred over a period of time. It is used to compute the net income for a particular period.

a.

Explanation of Solution

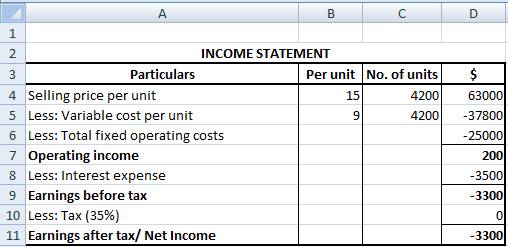

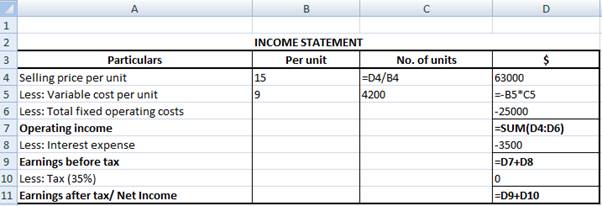

The income statement for the company has been prepared:

Working note: Preparation of income statement and computation of net income has been shown below:

b.

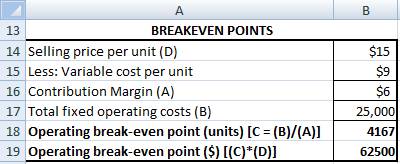

To compute: Operating breakeven point units and dollars.

Introduction: Income Statement’ shows the revenue earned and expenses incurred over a period of time. It is used to compute the net income for a particular period.

b.

Explanation of Solution

Breakeven point is the point at which the company neither earns

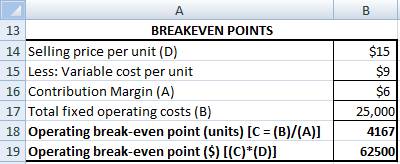

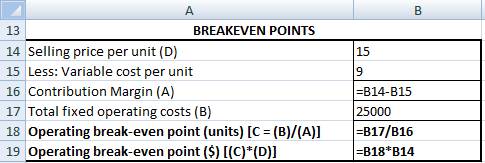

The operating break even for the company has been computed:

Working note: The computation of operating break even for the company has been computed has been shown below:

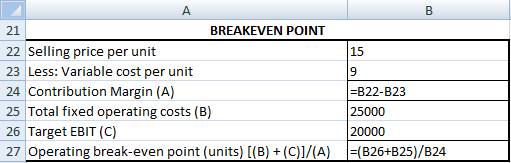

c.

To compute: Operating breakeven point units with target profit.

Introduction: Income Statement’ shows the revenue earned and expenses incurred over a period of time. It is used to compute the net income for a particular period.

c.

Explanation of Solution

Breakeven point is the point at which the company neither earns profit nor incurs loss. It is the minimal sales required to cover variable as well as fixed costs.

The operating break even with target profit for the company has been computed:

Working note: The computation of operating break even with target profit for the company has been computed has been shown below:

d.

To compute: Selling price that would lead to operating breakeven point using goal seek.

Introduction: Income Statement’ shows the revenue earned and expenses incurred over a period of time. It is used to compute the net income for a particular period.

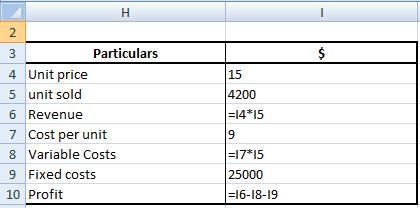

d.

Explanation of Solution

Breakeven point is the point at which the company neither earns profit nor incurs loss. It is the minimal sales required to cover variable as well as fixed costs.

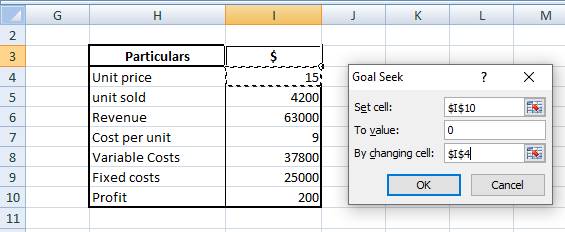

Step 1: Enter all the details using the formulas

Working notes: Its computation using formulas has been shown below:

Step 2: Go to ‘data’ tab and click on ‘what-if analysis’ to select ‘goal seek’ function. Set the value of profit as 0 by changing the selling price. It has been shown below:

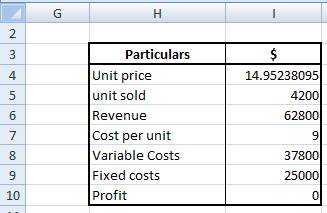

Step 3: Click on ‘OK’. The new selling price that would lead to operating profit would be computed.

e.

To compute: DOL, DFL and DCL.

Introduction: Income Statement’ shows the revenue earned and expenses incurred over a period of time. It is used to compute the net income for a particular period.

e.

Explanation of Solution

Breakeven point is the point at which the company neither earns profit nor incurs loss. It is the minimal sales required to cover variable as well as fixed costs.

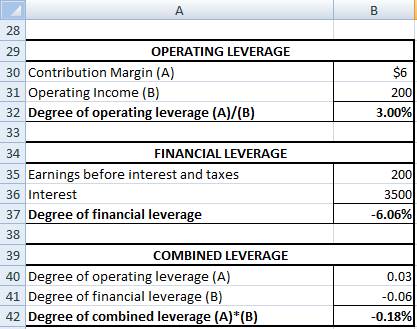

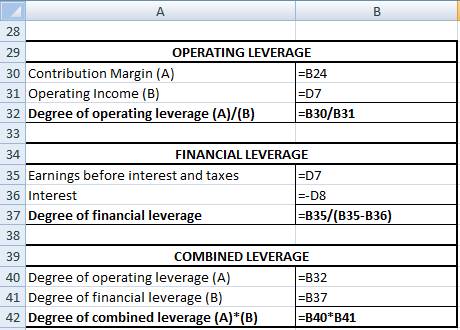

Leverage is the degree of change in component on the other component. It can be divided into three categories i.e. degree of operating leverage (DOL), degree of financial leverage (DFL) and degree of combined leverage (DCL).

Working notes: Calculation for each leverage has been shown below:

Want to see more full solutions like this?

Chapter 7 Solutions

EBK 3N3-EBK: FINANCIAL ANALYSIS WITH MI

- Beta Company Ltd issued 10% perpetual debt of Rs. 1,00,000. The company's tax rate is 50%. Determine the cost of capital (before tax as well as after tax) assuming the debt is issued at 10 percent premium. helparrow_forwardFinance subject qn solve.arrow_forwardPlease help with questionsarrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education