Flexible budgeting, performance measurement, and ethics

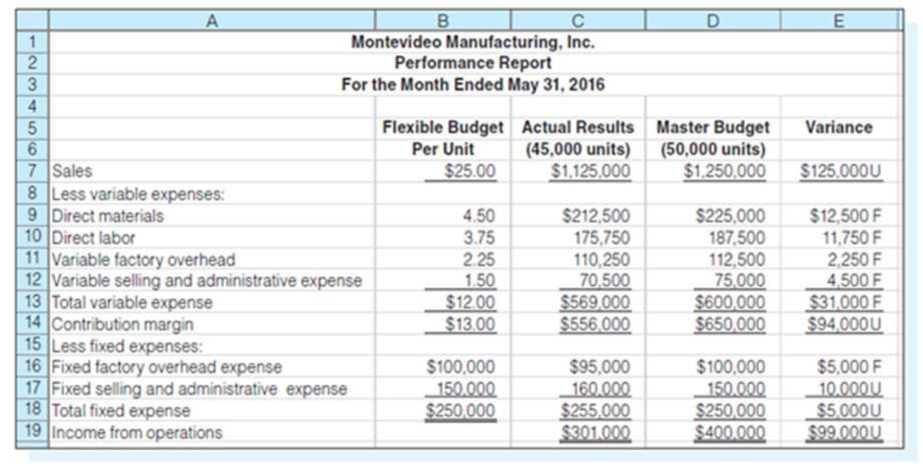

Montevideo Manufacturing, Inc. produces a single type of small motor. The bookkeeper who does not have an in-depth understanding of accounting principles prepared the following performance report with the help of the production manager.

In a conversation with the sales manager, the production manager was overheard saying, “You sales guys really messed up our May performance, and it is only because production did such a great

Required:

- 1. Do you agree with the production manager that the manufacturing area did a good job of controlling costs?

- 2. Prepare a flexible budget for Montevideo Manufacturing’s expenses at the following activity levels: 45,000 units, 50,000 units, and 55,000 units.

- 3. Prepare a revised performance report, using the most appropriate flexible budget from (2) above.

- 4. Now what is your response to the production manager’s claim?

- 5. Assume that you have just been hired as the new accountant. You observe that the production manager is about to receive a large bonus based on the favorable materials, labor, and factory

overhead variances indicated in the flexible budget prepared by the bookkeeper. Using the IMA Statement of Ethical Professional Practice as your guide, what standards, if any, apply to your responsibilities in this matter?

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Principles of Cost Accounting

Additional Business Textbook Solutions

Accounting Information Systems (14th Edition)

Intermediate Accounting (2nd Edition)

Horngren's Accounting (12th Edition)

Marketing: An Introduction (13th Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,