Concept explainers

(a)

Calculate

(a)

Explanation of Solution

Straight-line method: Under the straight-line method of depreciation, the same amount of depreciation is allocated every year over the estimated useful life of an asset. The following is the formula to calculate the depreciation.

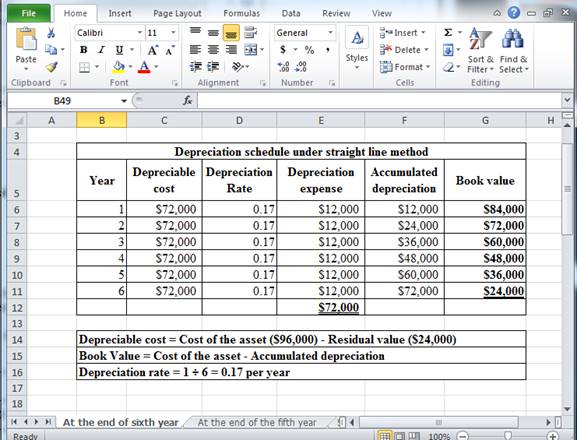

Determine depreciation expense, accumulated depreciation, and book value at the end of sixth year under straight line depreciation method.

Table (1)

Hence, the depreciation expense, accumulated depreciation, and book value at the end of the sixth year, under straight line method are $12,000, $72,000 and $24,000 respectively.

Record the adjusting entry for depreciation expense at the end of the third year under straight line depreciation method.

| Date | Accounts title and explanation | Post Ref. |

Debit ($) |

Credit ($) |

| Depreciation expense – Equipment (Refer table (1)) | 12,000 | |||

| Accumulated depreciation -Equipment | 12,000 | |||

| (To record the depreciation expense) |

Table (2)

To record the adjusting entry for depreciation expense at the end of the third year:

- Depreciation expense is an expense (decreases the

stockholders’ equity ) and it is increased by $12,000. Therefore, debit depreciation account with $12,000. - Accumulated depreciation is a contra-asset. Increase in the accumulated depreciation account decreases the related asset account. Therefore, credit accumulated depreciation account with $12,000.

Working Note:

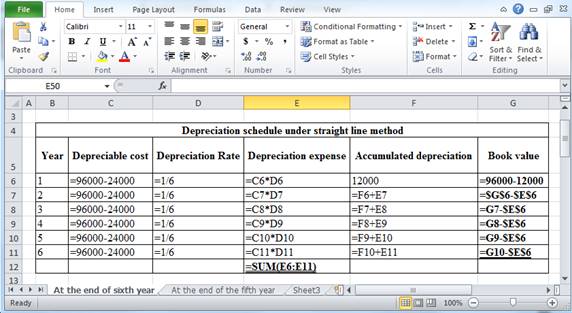

The above calculation is computed using spreadsheet as follows:

Table (3)

(b)

Calculate depreciation expense, accumulated depreciation, and book value for each of the six years using double-declining-balance method and record the adjusting entry for depreciation expense at the end of the third year under each method.

(b)

Explanation of Solution

Double-declining-balance method: The depreciation method which assumes that the consumption of economic benefits of long-term asset is high in the early years but gradually declines towards the end of its useful life is referred to as double-declining-balance method.

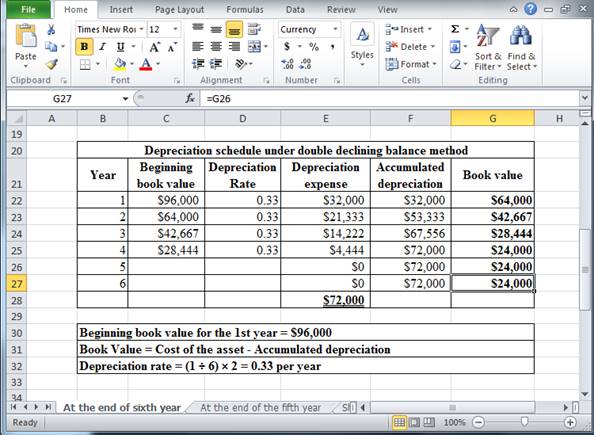

Determine depreciation expense, accumulated depreciation, and book value at the end of sixth year under double declining balance method.

Table (4)

Hence, the depreciation expense, accumulated depreciation, and book value at the end of the sixth year, under double declining balance method are $0, $72,000 and $24,000 respectively.

Record the adjusting entry for depreciation expense at the end of the third year under double declining balance method.

| Date | Accounts title and explanation | Post Ref. |

Debit ($) |

Credit ($) |

| Depreciation expense – Equipment (Refer table (4)) | 14,222 | |||

| Accumulated depreciation -Equipment | 14,222 | |||

| (To record the depreciation expense) |

Table (5)

To record the adjusting entry for depreciation expense at the end of the third year:

- Depreciation expense is an expense (decreases the stockholders’ equity) and it is increased by $14,222. Therefore, debit depreciation account with $14,222.

- Accumulated depreciation is a contra-asset. Increase in the accumulated depreciation account decreases the related asset account. Therefore, credit accumulated depreciation account with $14,222.

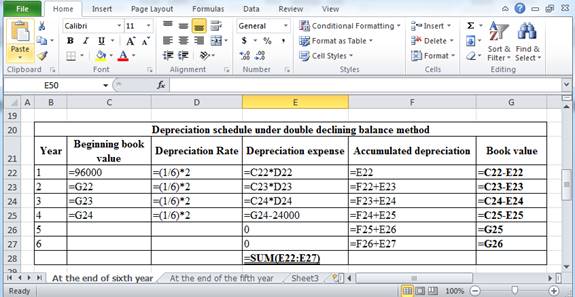

Working Note:

The above calculation is computed using spreadsheet as follows:

Table (6)

(c)

Calculate depreciation expense, accumulated depreciation, and book value for each of the six years using activity-based method and record the adjusting entry for depreciation expense at the end of the third year under each method.

(c)

Explanation of Solution

Activity based method: In this method of depreciation, the amount of depreciation is charged based on the units of production each year.

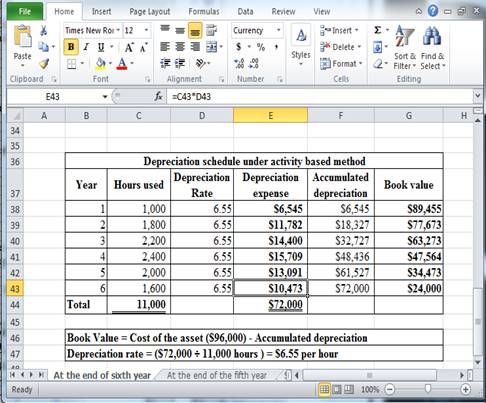

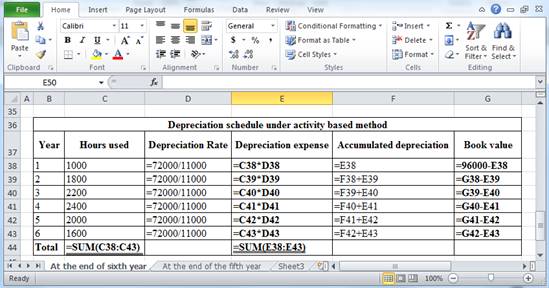

Determine depreciation expense, accumulated depreciation, and book value at the end of sixth year under activity based method.

Table (7)

Hence, the depreciation expense, accumulated depreciation, and book value at the end of the sixth year, under activity based method are $10,473, $72,000 and $24,000 respectively.

Record the adjusting entry for depreciation expense at the end of the third year under activity based method.

| Date | Accounts title and explanation | Post Ref. |

Debit ($) |

Credit ($) |

| Depreciation expense – Equipment (Refer table (7)) | 14,400 | |||

| Accumulated depreciation -Equipment | 14,400 | |||

| (To record the depreciation expense) |

Table (8)

To record the adjusting entry for depreciation expense at the end of the third year:

- Depreciation expense is an expense (decreases the stockholders’ equity) and it is increased by $14,400. Therefore, debit depreciation account with $14,400.

- Accumulated depreciation is a contra-asset. Increase in the accumulated depreciation account decreases the related asset account. Therefore, credit accumulated depreciation account with $14,400.

Working Note:

The above calculation is computed using spreadsheet as follows:

Table (9)

Calculate depreciation expense, accumulated depreciation, and book value for each of the fifth years using (a) straight-Line, (b) double-declining-balance, and (c) activity-based if the company had initially estimated the residual value to be $16,000 and the useful life to be five years.

Explanation of Solution

(a)

Straight-line method: Under the straight-line method of depreciation, the same amount of depreciation is allocated every year over the estimated useful life of an asset. The following is the formula to calculate the depreciation.

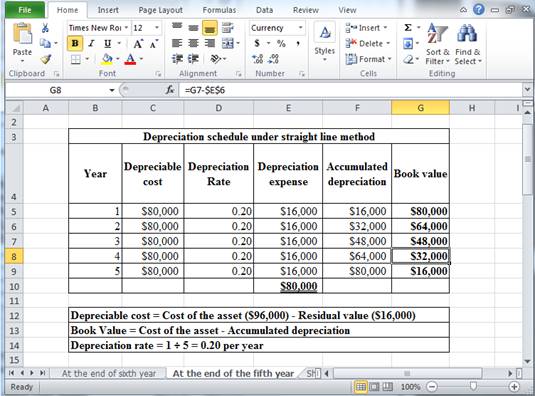

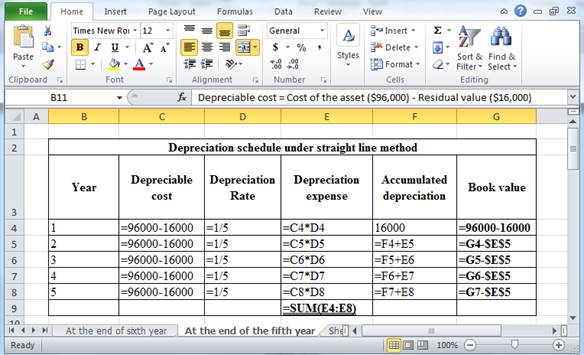

Determine depreciation expense, accumulated depreciation, and book value at the end of sixth year under straight line depreciation method.

Table (10)

Hence, the depreciation expense, accumulated depreciation, and book value at the end of the sixth year, under straight line method are $16,000, $80,000 and $16,000 respectively.

Record the adjusting entry for depreciation expense at the end of the third year under straight line depreciation method.

| Date | Accounts title and explanation | Post Ref. |

Debit ($) |

Credit ($) |

| Depreciation expense – Equipment (Refer table (10)) | 16,000 | |||

| Accumulated depreciation -Equipment | 16,000 | |||

| (To record the depreciation expense) |

Table (11)

To record the adjusting entry for depreciation expense at the end of the third year:

- Depreciation expense is an expense (decreases the stockholders’ equity) and it is increased by $16,000. Therefore, debit depreciation account with $16,000.

- Accumulated depreciation is a contra-asset. Increase in the accumulated depreciation account decreases the related asset account. Therefore, credit accumulated depreciation account with $16,000.

Working Note:

The above calculation is computed using spreadsheet as follows:

Table (12)

(b)

Double-declining-balance method: The depreciation method which assumes that the consumption of economic benefits of long-term asset is high in the early years but gradually declines towards the end of its useful life is referred to as double-declining-balance method.

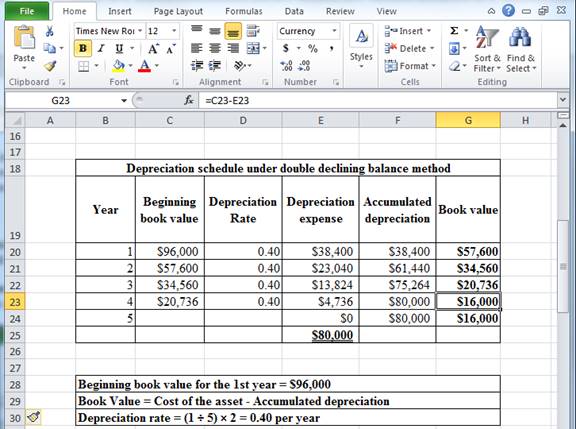

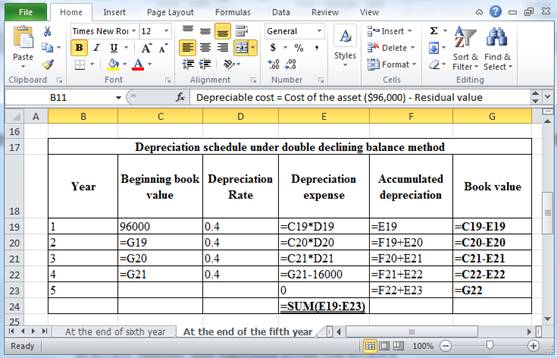

Determine depreciation expense, accumulated depreciation, and book value at the end of sixth year under double declining balance method.

Table (13)

Hence, the depreciation expense, accumulated depreciation, and book value at the end of the fifth year, under s double declining balance method are $0, $80,000 and $16,000 respectively.

Record the adjusting entry for depreciation expense at the end of the third year under double declining balance method.

| Date | Accounts title and explanation | Post Ref. |

Debit ($) |

Credit ($) |

| Depreciation expense – Equipment (Refer table (13)) | 13,824 | |||

| Accumulated depreciation -Equipment | 13,824 | |||

| (To record the depreciation expense) |

Table (14)

To record the adjusting entry for depreciation expense at the end of the third year:

- Depreciation expense is an expense (decreases the stockholders’ equity) and it is increased by $13,824. Therefore, debit depreciation account with $13,824.

- Accumulated depreciation is a contra-asset. Increase in the accumulated depreciation account decreases the related asset account. Therefore, credit accumulated depreciation account with $13,824.

Working Note:

The above calculation is computed using spreadsheet as follows:

Table (15)

(c)

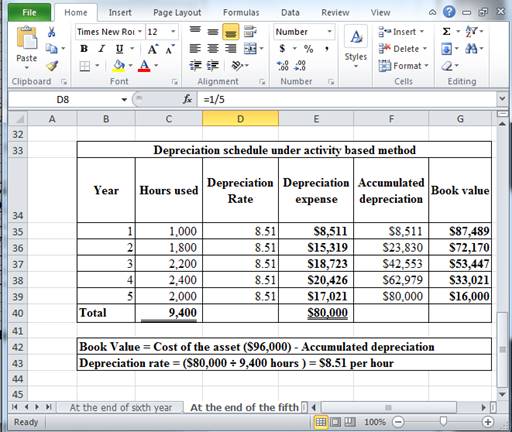

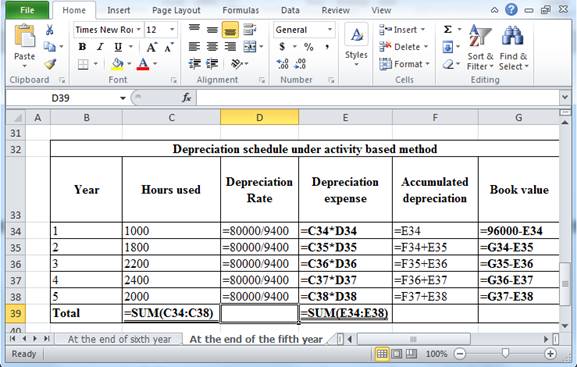

Activity based method: In this method of depreciation, the amount of depreciation is charged based on the units of production each year.

Determine depreciation expense, accumulated depreciation, and book value at the end of sixth year under activity based method.

Table (16)

Hence, the depreciation expense, accumulated depreciation, and book value at the end of the fifth year, under activity based method are $17,021, $80,000 and $16,000 respectively.

Record the adjusting entry for depreciation expense at the end of the third year under activity based method.

| Date | Accounts title and explanation | Post Ref. |

Debit ($) |

Credit ($) |

| Depreciation expense – Equipment (Refer table (16)) | 18,723 | |||

| Accumulated depreciation -Equipment | 18,723 | |||

| (To record the depreciation expense) |

Table (17)

To record the adjusting entry for depreciation expense at the end of the third year:

- Depreciation expense is an expense (decreases the stockholders’ equity) and it is increased by $18,723. Therefore, debit depreciation account with $18,723.

- Accumulated depreciation is a contra-asset. Increase in the accumulated depreciation account decreases the related asset account. Therefore, credit accumulated depreciation account with $18,723.

Working Note:

The above calculation is computed using spreadsheet as follows:

Table (18)

Want to see more full solutions like this?

Chapter 7 Solutions

FINANCIAL ACCOUNTING

- On November 10 of year 1, Javier purchased a building, including the land it was on, to assemble his new equipment. The total cost of the purchase was $1,200,000; $300,000 was allocated to the basis of the land, and the remaining $900,000 was allocated to the basis of the building. (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) Note: Do not round intermediate calculations. Round your answers to the nearest whole dollar amount. Problem 10-51 Part e (Static) e. What would be the depreciation for 2024, 2025, and 2026 if the property were nonresidential property purchased and placed in service November 10, 2007 (assume the same original basis)?arrow_forwardI am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forwardCan you explain the process for solving this general accounting question accurately?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education