Concept explainers

(a)

Calculate

(a)

Explanation of Solution

Straight-line method: Under the straight-line method of depreciation, the same amount of depreciation is allocated every year over the estimated useful life of an asset. The following is the formula to calculate the depreciation.

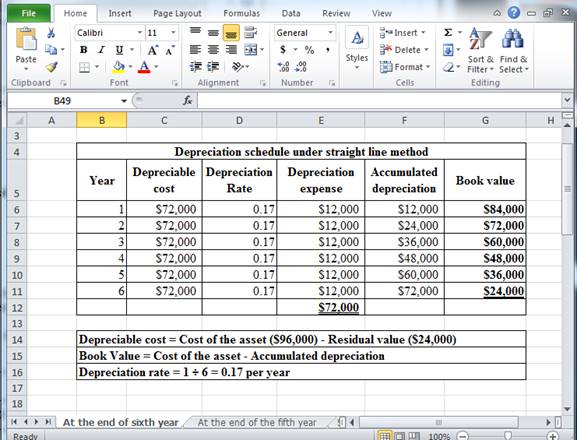

Determine depreciation expense, accumulated depreciation, and book value at the end of sixth year under straight line depreciation method.

Table (1)

Hence, the depreciation expense, accumulated depreciation, and book value at the end of the sixth year, under straight line method are $12,000, $72,000 and $24,000 respectively.

Record the adjusting entry for depreciation expense at the end of the third year under straight line depreciation method.

| Date | Accounts title and explanation | Post Ref. |

Debit ($) |

Credit ($) |

| Depreciation expense – Equipment (Refer table (1)) | 12,000 | |||

| Accumulated depreciation -Equipment | 12,000 | |||

| (To record the depreciation expense) |

Table (2)

To record the adjusting entry for depreciation expense at the end of the third year:

- Depreciation expense is an expense (decreases the

stockholders’ equity ) and it is increased by $12,000. Therefore, debit depreciation account with $12,000. - Accumulated depreciation is a contra-asset. Increase in the accumulated depreciation account decreases the related asset account. Therefore, credit accumulated depreciation account with $12,000.

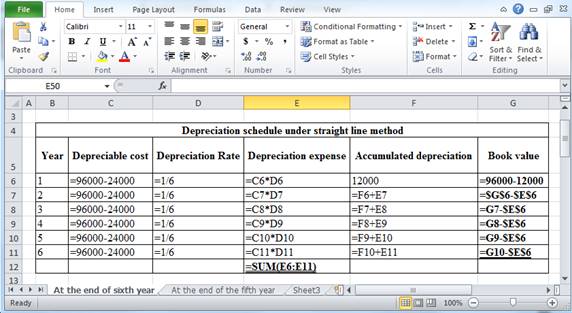

Working Note:

The above calculation is computed using spreadsheet as follows:

Table (3)

(b)

Calculate depreciation expense, accumulated depreciation, and book value for each of the six years using double-declining-balance method and record the adjusting entry for depreciation expense at the end of the third year under each method.

(b)

Explanation of Solution

Double-declining-balance method: The depreciation method which assumes that the consumption of economic benefits of long-term asset is high in the early years but gradually declines towards the end of its useful life is referred to as double-declining-balance method.

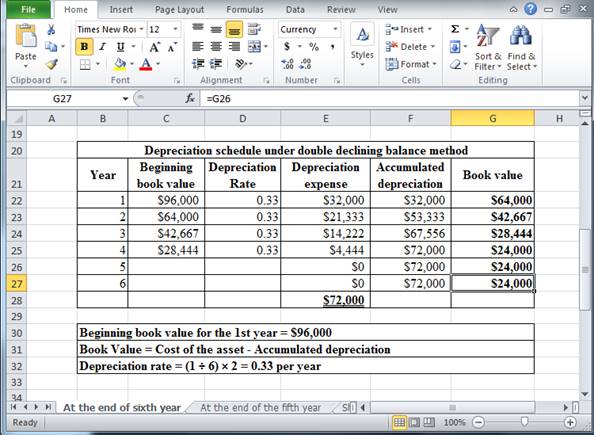

Determine depreciation expense, accumulated depreciation, and book value at the end of sixth year under double declining balance method.

Table (4)

Hence, the depreciation expense, accumulated depreciation, and book value at the end of the sixth year, under double declining balance method are $0, $72,000 and $24,000 respectively.

Record the adjusting entry for depreciation expense at the end of the third year under double declining balance method.

| Date | Accounts title and explanation | Post Ref. |

Debit ($) |

Credit ($) |

| Depreciation expense – Equipment (Refer table (4)) | 14,222 | |||

| Accumulated depreciation -Equipment | 14,222 | |||

| (To record the depreciation expense) |

Table (5)

To record the adjusting entry for depreciation expense at the end of the third year:

- Depreciation expense is an expense (decreases the stockholders’ equity) and it is increased by $14,222. Therefore, debit depreciation account with $14,222.

- Accumulated depreciation is a contra-asset. Increase in the accumulated depreciation account decreases the related asset account. Therefore, credit accumulated depreciation account with $14,222.

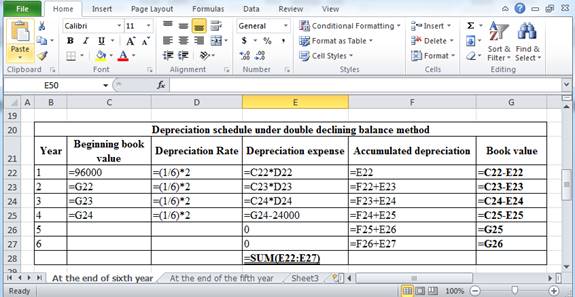

Working Note:

The above calculation is computed using spreadsheet as follows:

Table (6)

(c)

Calculate depreciation expense, accumulated depreciation, and book value for each of the six years using activity-based method and record the adjusting entry for depreciation expense at the end of the third year under each method.

(c)

Explanation of Solution

Activity based method: In this method of depreciation, the amount of depreciation is charged based on the units of production each year.

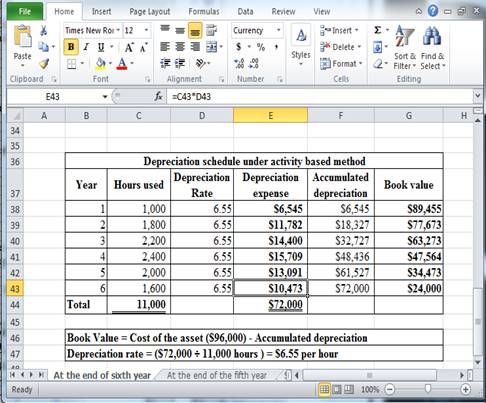

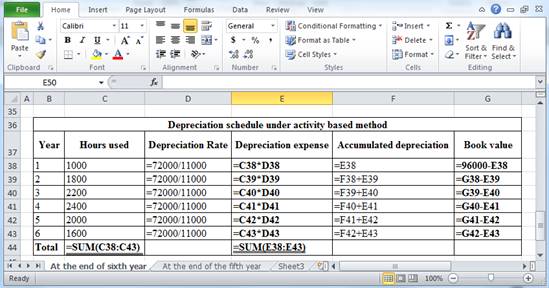

Determine depreciation expense, accumulated depreciation, and book value at the end of sixth year under activity based method.

Table (7)

Hence, the depreciation expense, accumulated depreciation, and book value at the end of the sixth year, under activity based method are $10,473, $72,000 and $24,000 respectively.

Record the adjusting entry for depreciation expense at the end of the third year under activity based method.

| Date | Accounts title and explanation | Post Ref. |

Debit ($) |

Credit ($) |

| Depreciation expense – Equipment (Refer table (7)) | 14,400 | |||

| Accumulated depreciation -Equipment | 14,400 | |||

| (To record the depreciation expense) |

Table (8)

To record the adjusting entry for depreciation expense at the end of the third year:

- Depreciation expense is an expense (decreases the stockholders’ equity) and it is increased by $14,400. Therefore, debit depreciation account with $14,400.

- Accumulated depreciation is a contra-asset. Increase in the accumulated depreciation account decreases the related asset account. Therefore, credit accumulated depreciation account with $14,400.

Working Note:

The above calculation is computed using spreadsheet as follows:

Table (9)

Calculate depreciation expense, accumulated depreciation, and book value for each of the fifth years using (a) straight-Line, (b) double-declining-balance, and (c) activity-based if the company had initially estimated the residual value to be $16,000 and the useful life to be five years.

Explanation of Solution

(a)

Straight-line method: Under the straight-line method of depreciation, the same amount of depreciation is allocated every year over the estimated useful life of an asset. The following is the formula to calculate the depreciation.

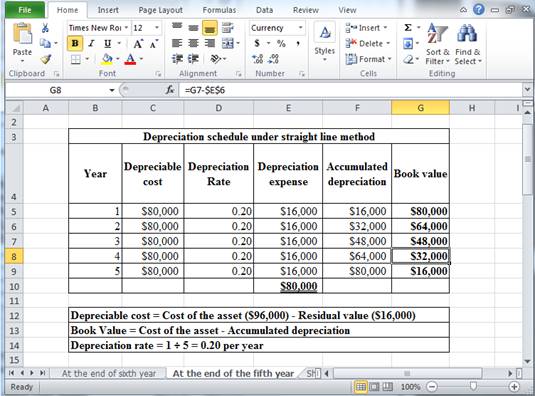

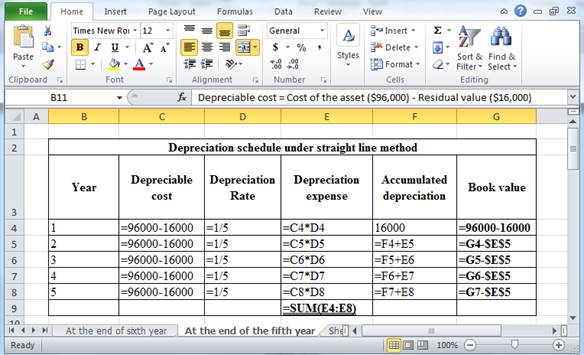

Determine depreciation expense, accumulated depreciation, and book value at the end of sixth year under straight line depreciation method.

Table (10)

Hence, the depreciation expense, accumulated depreciation, and book value at the end of the sixth year, under straight line method are $16,000, $80,000 and $16,000 respectively.

Record the adjusting entry for depreciation expense at the end of the third year under straight line depreciation method.

| Date | Accounts title and explanation | Post Ref. |

Debit ($) |

Credit ($) |

| Depreciation expense – Equipment (Refer table (10)) | 16,000 | |||

| Accumulated depreciation -Equipment | 16,000 | |||

| (To record the depreciation expense) |

Table (11)

To record the adjusting entry for depreciation expense at the end of the third year:

- Depreciation expense is an expense (decreases the stockholders’ equity) and it is increased by $16,000. Therefore, debit depreciation account with $16,000.

- Accumulated depreciation is a contra-asset. Increase in the accumulated depreciation account decreases the related asset account. Therefore, credit accumulated depreciation account with $16,000.

Working Note:

The above calculation is computed using spreadsheet as follows:

Table (12)

(b)

Double-declining-balance method: The depreciation method which assumes that the consumption of economic benefits of long-term asset is high in the early years but gradually declines towards the end of its useful life is referred to as double-declining-balance method.

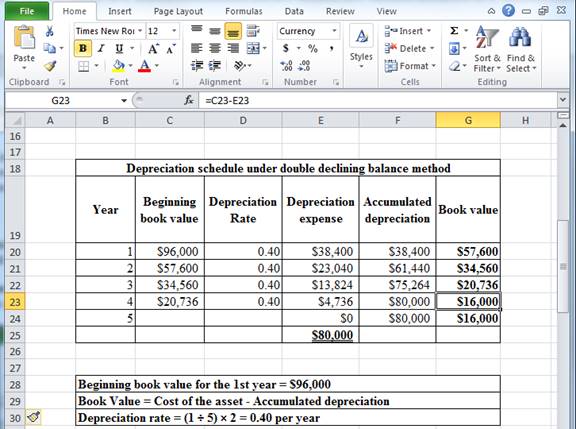

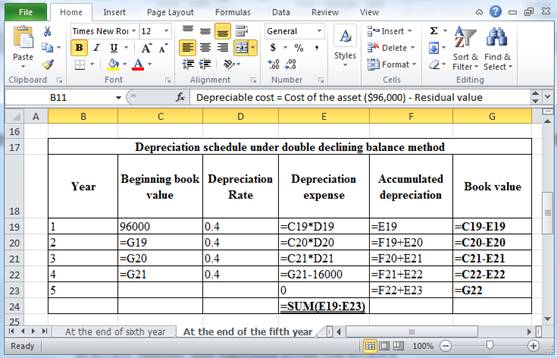

Determine depreciation expense, accumulated depreciation, and book value at the end of sixth year under double declining balance method.

Table (13)

Hence, the depreciation expense, accumulated depreciation, and book value at the end of the fifth year, under s double declining balance method are $0, $80,000 and $16,000 respectively.

Record the adjusting entry for depreciation expense at the end of the third year under double declining balance method.

| Date | Accounts title and explanation | Post Ref. |

Debit ($) |

Credit ($) |

| Depreciation expense – Equipment (Refer table (13)) | 13,824 | |||

| Accumulated depreciation -Equipment | 13,824 | |||

| (To record the depreciation expense) |

Table (14)

To record the adjusting entry for depreciation expense at the end of the third year:

- Depreciation expense is an expense (decreases the stockholders’ equity) and it is increased by $13,824. Therefore, debit depreciation account with $13,824.

- Accumulated depreciation is a contra-asset. Increase in the accumulated depreciation account decreases the related asset account. Therefore, credit accumulated depreciation account with $13,824.

Working Note:

The above calculation is computed using spreadsheet as follows:

Table (15)

(c)

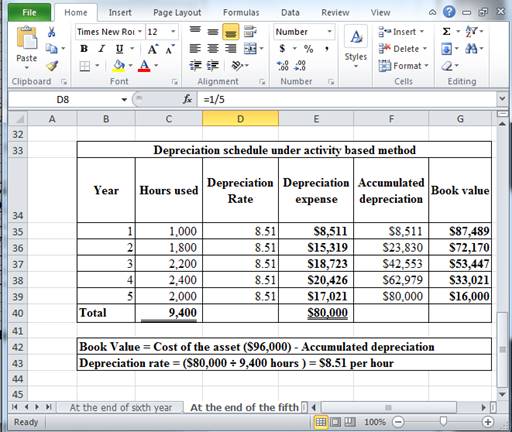

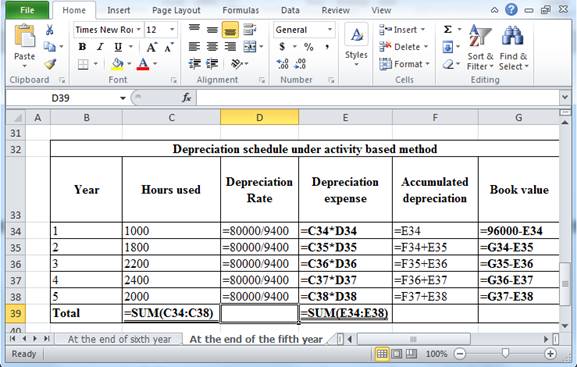

Activity based method: In this method of depreciation, the amount of depreciation is charged based on the units of production each year.

Determine depreciation expense, accumulated depreciation, and book value at the end of sixth year under activity based method.

Table (16)

Hence, the depreciation expense, accumulated depreciation, and book value at the end of the fifth year, under activity based method are $17,021, $80,000 and $16,000 respectively.

Record the adjusting entry for depreciation expense at the end of the third year under activity based method.

| Date | Accounts title and explanation | Post Ref. |

Debit ($) |

Credit ($) |

| Depreciation expense – Equipment (Refer table (16)) | 18,723 | |||

| Accumulated depreciation -Equipment | 18,723 | |||

| (To record the depreciation expense) |

Table (17)

To record the adjusting entry for depreciation expense at the end of the third year:

- Depreciation expense is an expense (decreases the stockholders’ equity) and it is increased by $18,723. Therefore, debit depreciation account with $18,723.

- Accumulated depreciation is a contra-asset. Increase in the accumulated depreciation account decreases the related asset account. Therefore, credit accumulated depreciation account with $18,723.

Working Note:

The above calculation is computed using spreadsheet as follows:

Table (18)

Want to see more full solutions like this?

Chapter 7 Solutions

Financial Accounting

- Madison Industries uses the FIFO (first-in, first-out) method in its process costing system. The mixing department had $4,800 in material cost in its beginning work in process inventory, and $68,000 in material cost was added during the period. The equivalent units of production for materials during the period were 17,000 units. What is the cost per equivalent unit for materials?arrow_forwardAt the end of the year, the company has Assets of $180,000 and Liabilities of $140,000. At the beginning of the year, the company had Owners' Equity of $60,000. How much did Owners' Equity change by the end of the year? Did Owners' Equity increase or decrease? HELParrow_forwardOn January 1, 2020, Acme Corporation leased equipment to Zenith Company. The lease term is 10 years. The first payment of $850,000 was made on January 1, 2020. The equipment cost Acme Corporation $6,250,000. The present value of the minimum lease payments is $7,150,000. The lease is appropriately classified as a sales-type lease. Assuming the interest rate for this lease is 8%, how much interest revenue will Acme record in 2021 on this lease? a. $500,000 b. $504,000 c. $572,000 d. $624,000arrow_forward

- How many units were completedarrow_forwardFor the fiscal year, sales were $8,300,000, sales discounts were $100,000, sales returns and allowances were $45,000, and the cost of merchandise sold was $5,000,000. What was the amount of net sales? Accurate Answerarrow_forwardXYZ Corporation reports the following amounts for the fiscal year: Account Amount Assets $9,800 Liabilities $3,500 Stockholders' equity $6,300 Dividends $800 Revenues $7,200 Expenses $4,900 What amount should be reported for net income?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education