a.

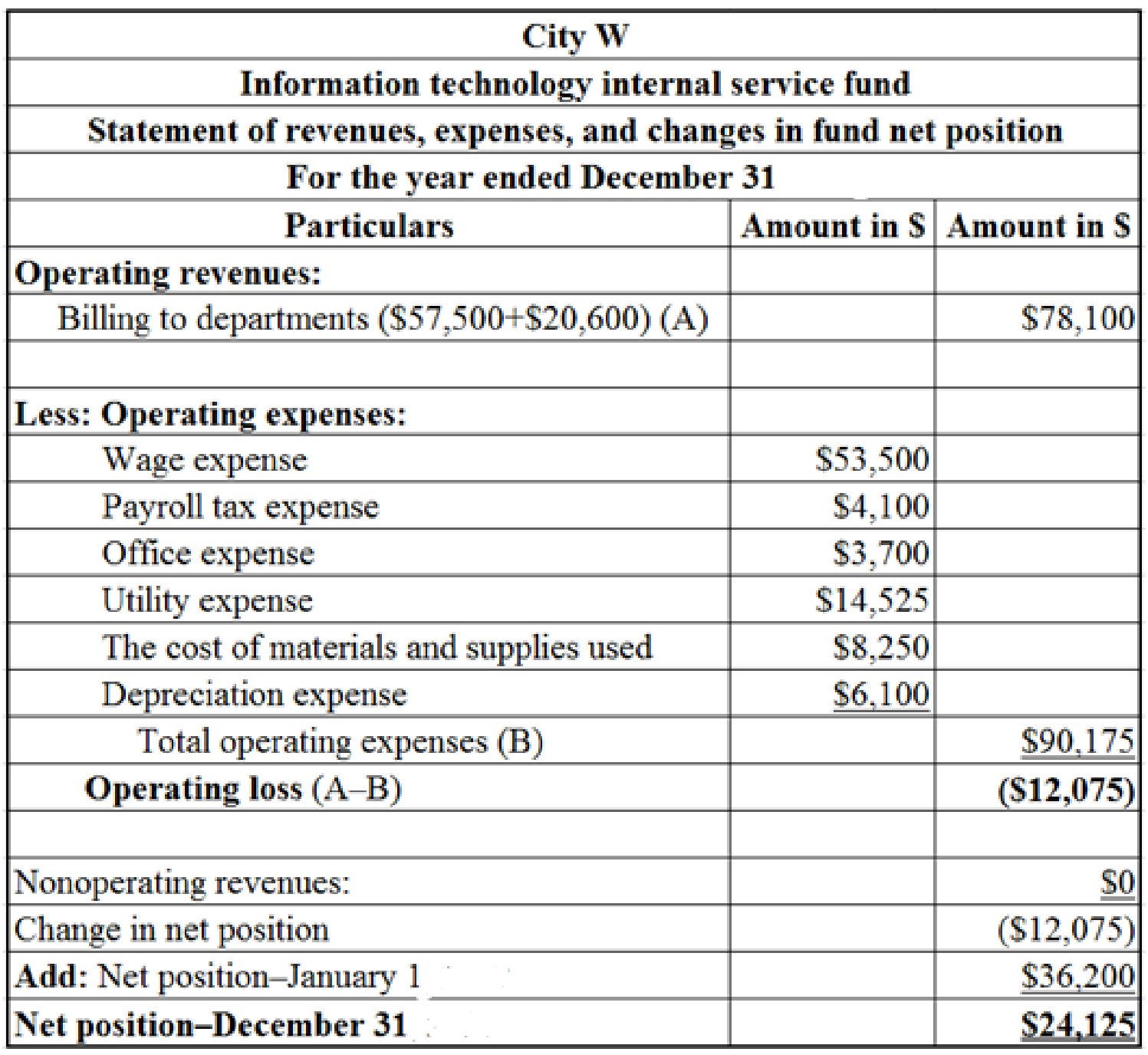

Prepare a “statement of revenues, expenses, and changes in fund net position” for information technology internal service fund of City W.

a.

Explanation of Solution

Statement of revenues, expenses and changes in net position: Statement of activities is the operating statement that reports revenues, expenses, and changes in net position during the year.

Prepare a “statement of revenues, expenses, and changes in fund net position” for information technology internal service fund of City W.

Table (1)

Working notes:

- Determine the wage expense.

- Determine the net position on January 1.

The net position of net investment is capital assets are $23,500 and the unrestricted net position is $12,700 on January 1. Hence, the total net position on January 1 is $36,200

(b)

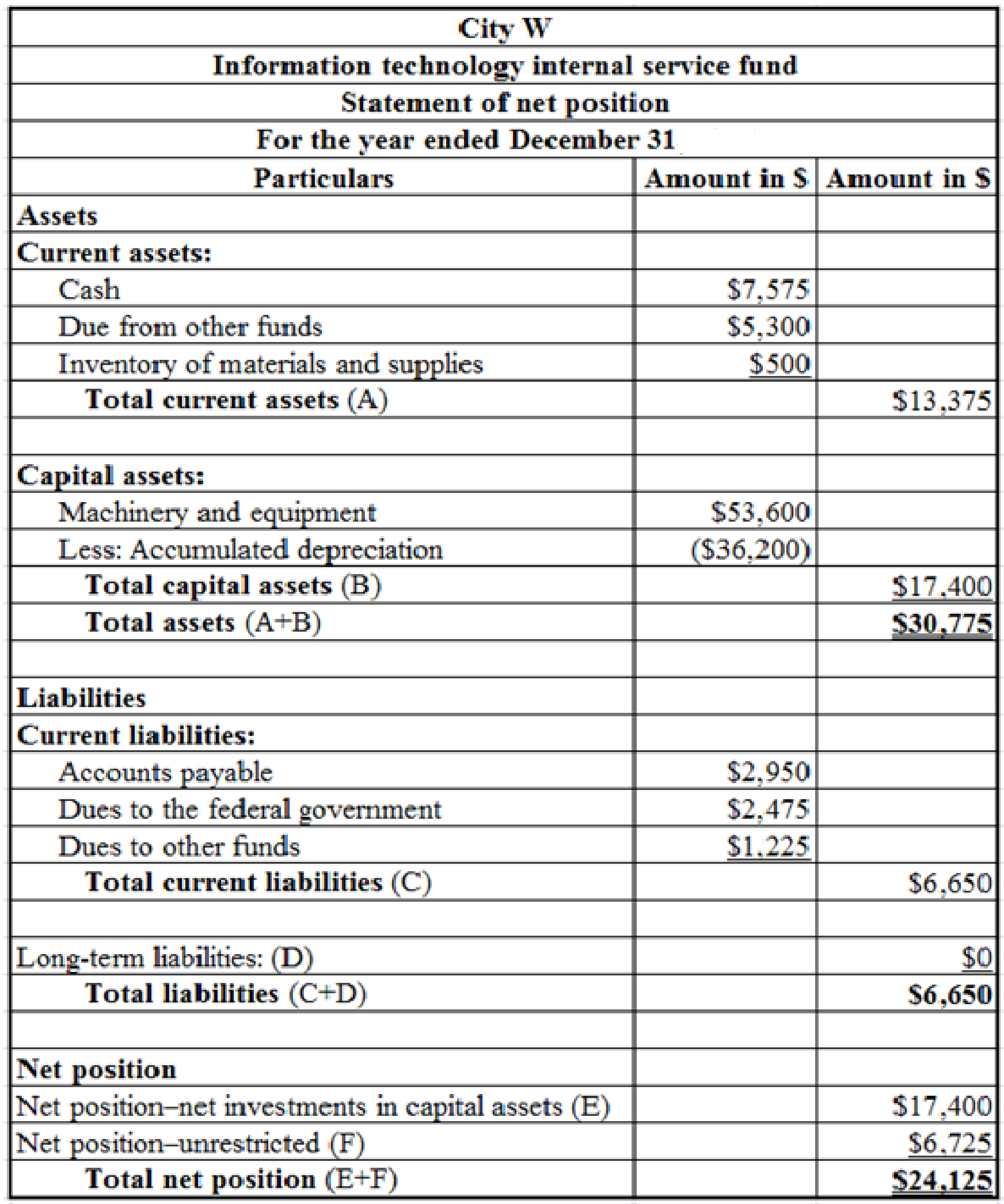

Prepare a “statement of net position” for information technology internal service fund of City W as of December 31.

(b)

Explanation of Solution

Statement of net position:

Prepare a “statement of net position” for information technology internal service fund of City W as of December 31.

Table (2)

Working notes:

- Determine the closing balance of cash on December 31.

Step 1: Determine the amount of cash paid as wages.

Step 2: Determine the amount of cash receipts from other funds.

Step 3: Determine the amount cash paid to accounts payable.

Step 4: Determine the closing balance of cash on December 31.

- Determine the closing balance of dues from other funds.

- Determine the closing balance of inventory.

- Determine the accumulated depreciation for the year ended December 31.

- Determine the closing balance of dues to federal government.

| Due to federal government | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) | |

| Cash payment towards federal taxes | 23,000 | Payroll taxes payable, January 1 | 2,650 | |||

| Closing balance, December 31 | 2,475 | Payroll taxes for the year | 4,100 | |||

| Federal income and social security taxes withheld for the year | 18,725 | |||||

| Total | 25,475 | Total | 25,475 | |||

Table (3)

Hence, the closing balance of dues to the federal government is $2,475.

- Determine the closing balance of dues to other funds.

| Due to other funds | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) | |

| Cash payment towards utility expenses | 14,500 | Opening balance, January 1 | 1,200 | |||

| Closing balance, December 31 | 1,225 | Utility expenses | 14,525 | |||

| Total | 15,725 | Total | 15,725 | |||

Table (4)

Hence, the closing balance of dues to other funds is $1,225.

- Determine the net position of “net investments in capital assets” as on December 31.

- Determine the net position of unrestricted assets as on December 31.

Step 1: Calculate decrease in net investment in capital assets.

Step 2: Calculate the net position of unrestricted assets.

(c)

Prepare “a statement of

(c)

Explanation of Solution

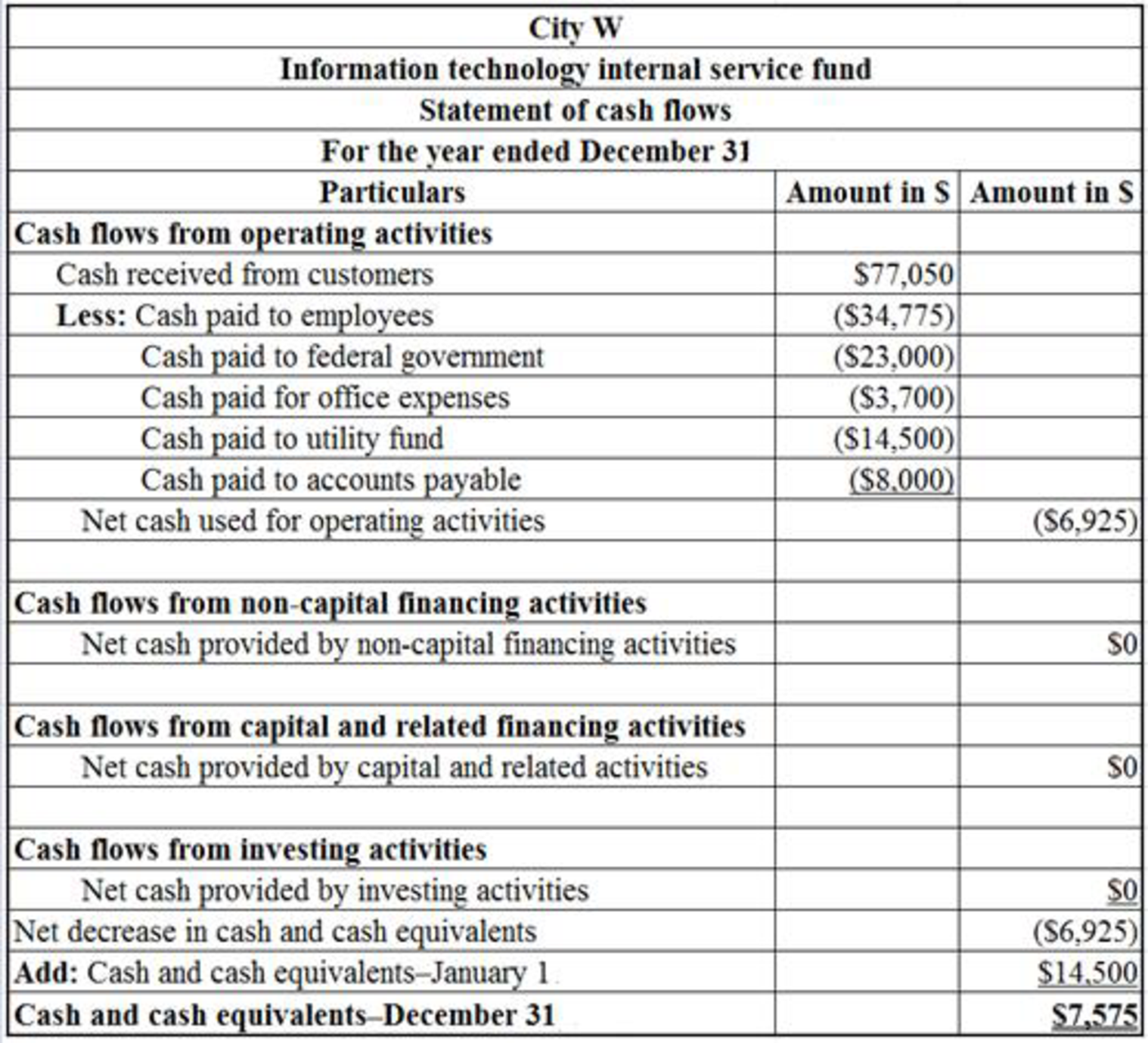

Statement of cash flows: Statement of cash flow is a financial statement that shows the cash and cash equivalents of a company for a particular period of time. It shows the net changes in cash, by reporting the sources and uses of cash as a result of operating, investing, and financing activities of a company.

Prepare “a statement of cash flows” for information technology internal service fund of City W for the year ended December 31.

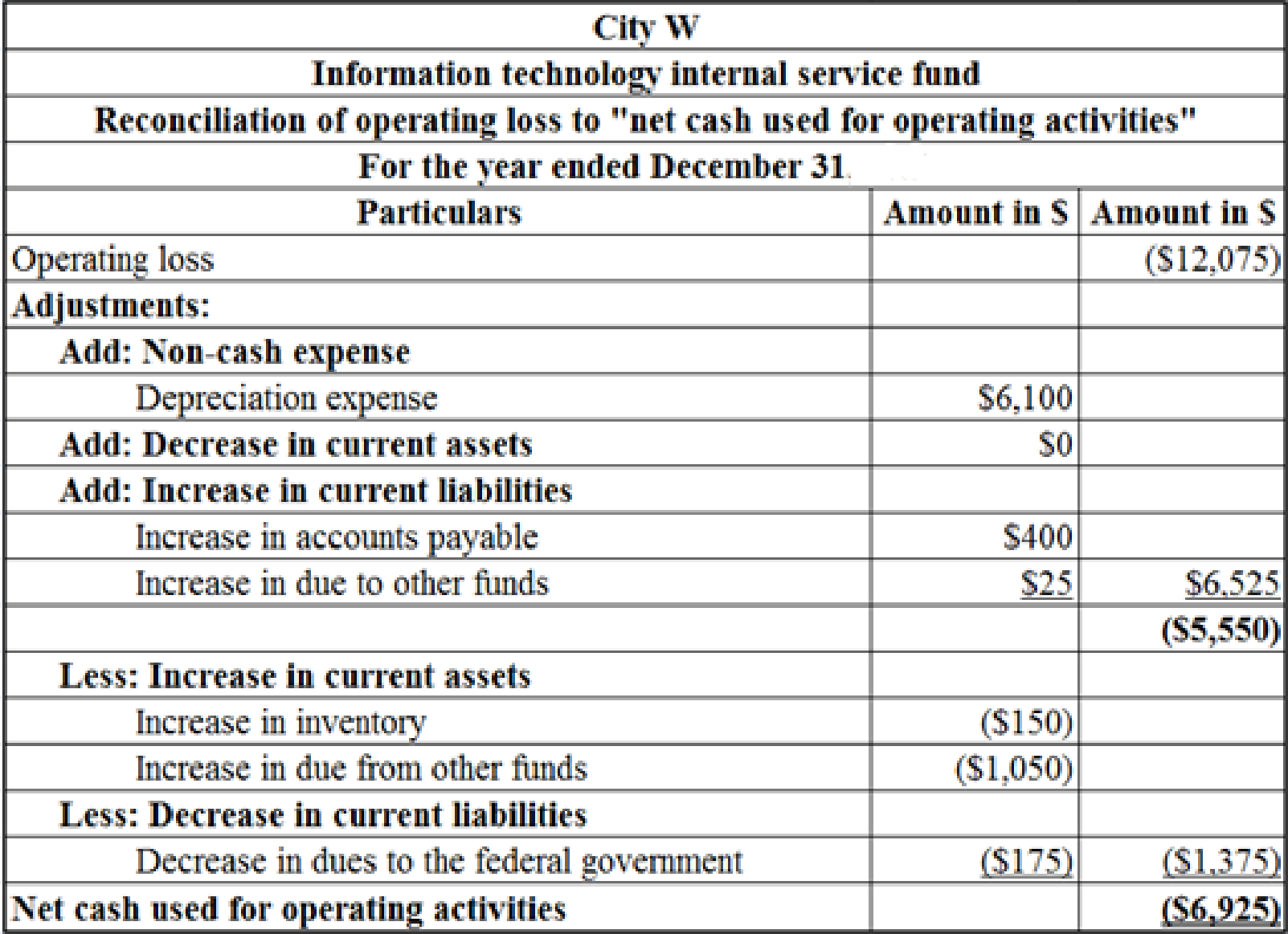

Step 1: Prepare the

Table (5)

Working notes:

- Determine the increase in accounts payable.

The opening balance of accounts payable is $2,550 and the closing balance of accounts payable is $2,950. Hence, the accounts payable increased by$400

- Determine the increase in “due to other funds”.

The opening balance of “dues to other funds” is $1,200 and the closing balance of “due to other funds” is $1,225. Hence, the “due to other funds” increased by$25

- Determine the increase in inventory.

The opening balance of inventory is $350 and the closing balance of inventory is $500. Hence, the inventory increased by $150

- Determine the increase in “due from other funds”.

The opening balance of “due from other funds” is $4,250 and the closing balance of “due from other funds” is $5,300. Hence, the “due from other funds” increased by$1,050

- Determine the decrease in “due to the federal government”.

The opening balance of “due to the federal government” is $2,650 and the closing balance of “due to the federal government” is $2,475. Hence, the “due to the federal government” increased by $175

Step 2: Prepare “a statement of cash flows”.

Table (6)

(d)

Evaluate the manager’s performance.

(d)

Explanation of Solution

The “statement of revenues, expenses, and changes in fund net position” shows an operating loss of $12,075. The charges collected by the information technology fund are not sufficient to meet its operating expenses.

The manager has not addressed the “user charges policy” of the department. Hence, the fund is incurring a loss. Hence, the manager should estimate the costs of the fund and fix a reasonable user charge to cover the fund’s expenses.

Want to see more full solutions like this?

Chapter 7 Solutions

Accounting For Governmental & Nonprofit Entities

- Lawrence Industries plans to produce 30,000 units next period at a denominator activity of 45,000 direct labor hours. The direct labor wage rate is $16.00 per hour. The company's standards allow 2.2 yards of direct materials for each unit of product; the material costs $8.50 per yard. The company's budget includes a variable manufacturing overhead cost of $3.25 per direct labor hour and fixed manufacturing overhead of $270,000 per period. Using 45,000 direct labor hours as the denominator activity, compute the predetermined overhead rate and break it down into variable and fixed elements.arrow_forwardWhat are adjusting journal entries and why are they necessary?arrow_forwardNo Ai What is a trial balance and what is its purpose?arrow_forward

- Accurate answerarrow_forwardMandeep Bakery believes its marketing expenditures are too high and wants to cut $450,000 from the budget. Management estimates that this decision will result in a loss of 7,500 units in sales. If the gross margin per unit is $65, does cutting the marketing budget make sense?arrow_forwardSolve this MCQarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education