a.

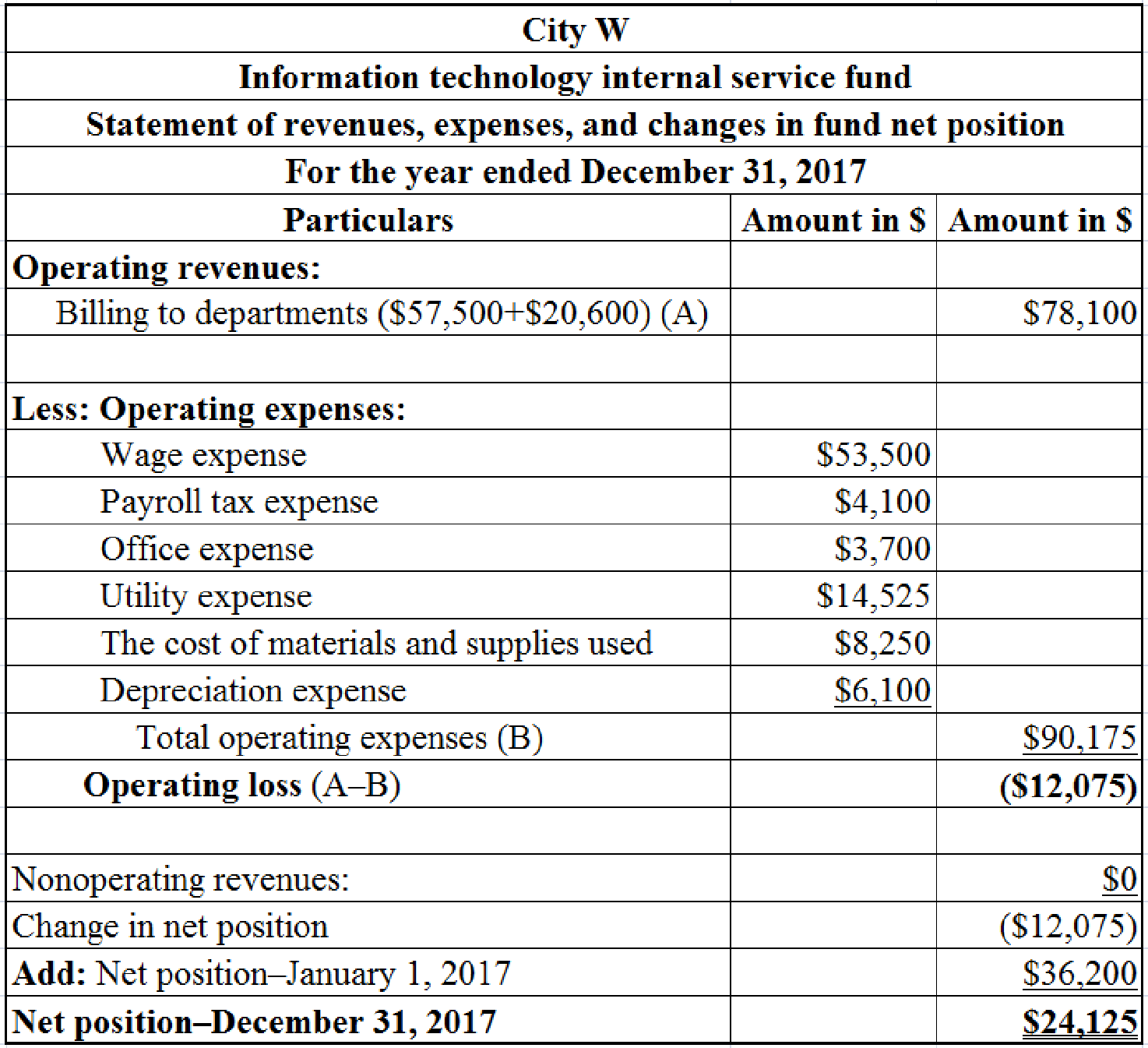

Prepare a “statement of revenues, expenses, and changes in fund net position” for information technology internal service fund of City W for the year ended December 31, 2017.

a.

Explanation of Solution

Statement of revenues, expenses and changes in net position: Statement of activities is the operating statement that reports revenues, expenses, and changes in net position during the year.

Prepare a “statement of revenues, expenses, and changes in fund net position” for information technology internal service fund of City W for the year ended December 31, 2017.

Table (1)

Notes to the above table:

- Determine the wage expense.

- Determine the net position on January 1, 2017.

The net position of net investment is capital assets are $23,500 and the unrestricted net position is $12,700 on January 1. Hence, the total net position on January 1, 2017 is $36,200

(b)

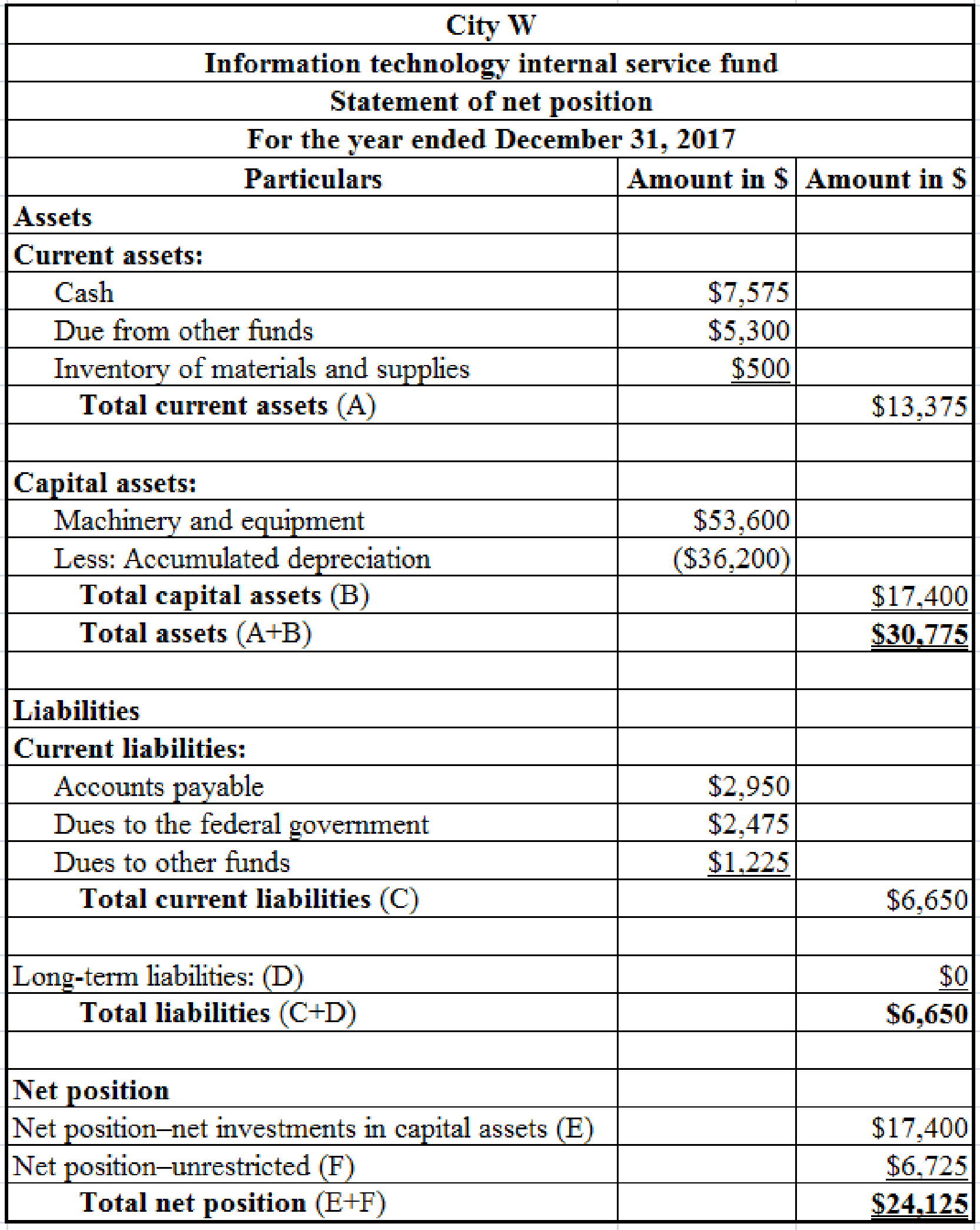

Prepare a “statement of net position” for information technology internal service fund of City W as of December 31, 2017.

(b)

Explanation of Solution

Statement of net position:

Prepare a “statement of net position” for information technology internal service fund of City W as of December 31, 2017.

Table (2)

Notes to the above table:

- Determine the closing balance of cash on December 31, 2017.

Step 1: Determine the amount of cash paid as wages.

Step 2: Determine the amount of cash receipts from other funds.

Step 3: Determine the amount cash paid to accounts payable.

Step 4: Determine the closing balance of cash on December 31, 2017.

- Determine the closing balance of dues from other funds.

- Determine the closing balance of inventory.

- Determine the accumulated depreciation for the year ended December 31, 2017.

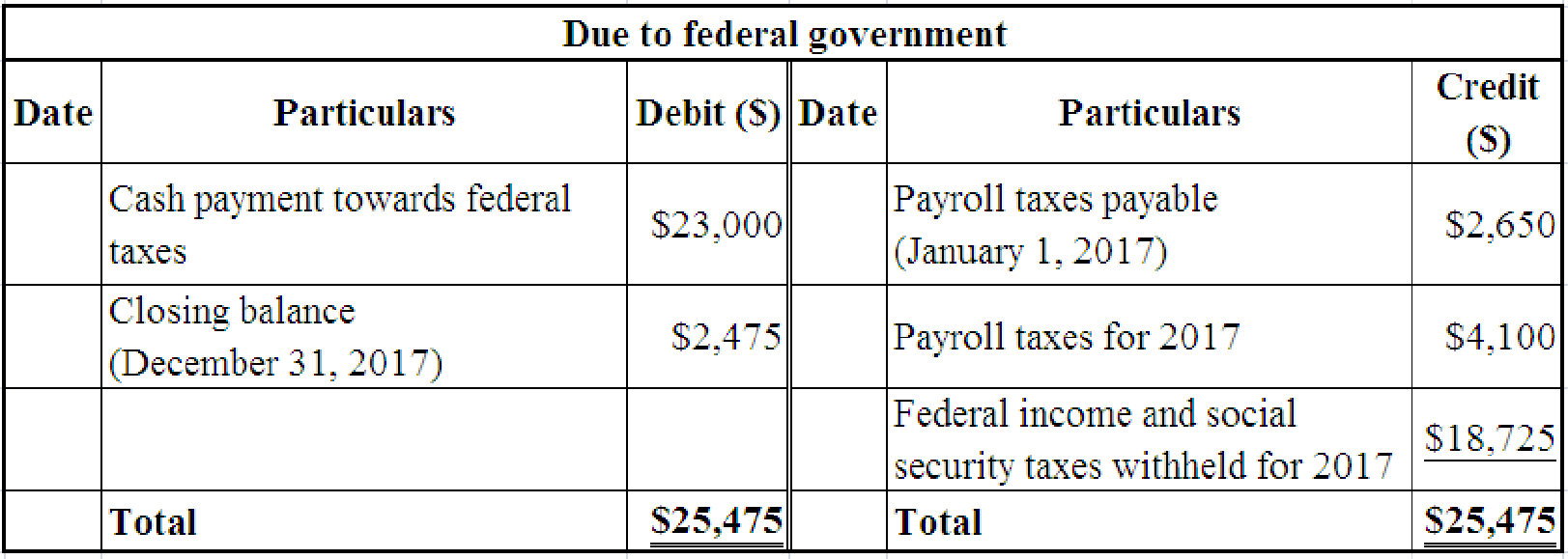

- Determine the closing balance of dues to federal government.

Table (3)

Hence, the closing balance of dues to the federal government is $2,475.

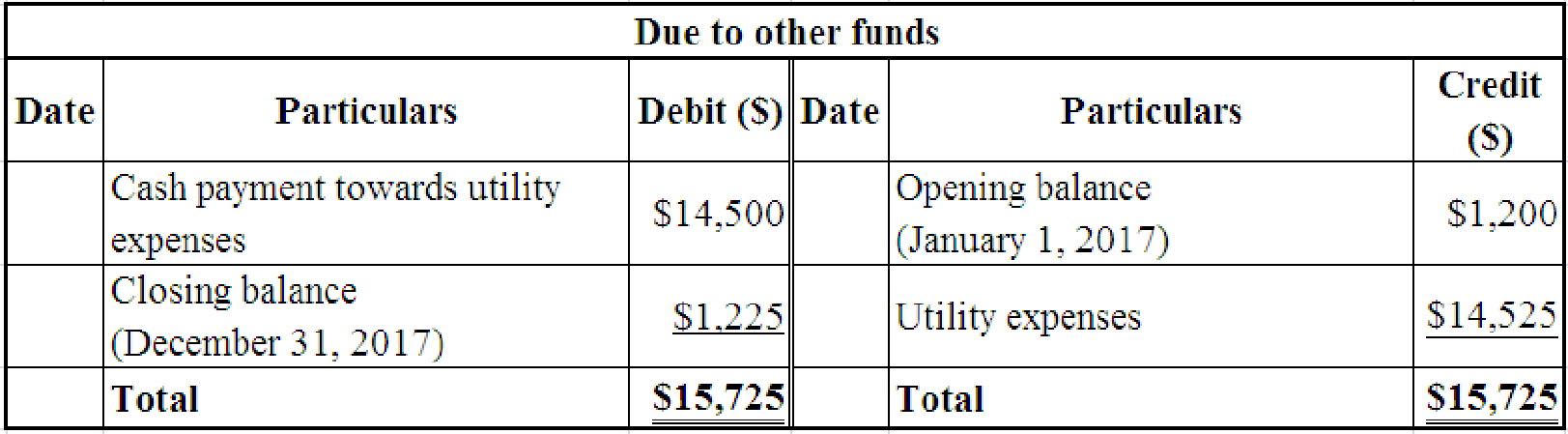

- Determine the closing balance of dues to other funds.

Table (4)

Hence, the closing balance of dues to other funds is $1,225.

- Determine the net position of “net investments in capital assets” as on December 31, 2017.

- Determine the net position of unrestricted assets as on December 31, 2017.

Step 1: Calculate decrease in net investment in capital assets.

Step 2: Calculate the net position of unrestricted assets.

(c)

Prepare “a statement of

(c)

Explanation of Solution

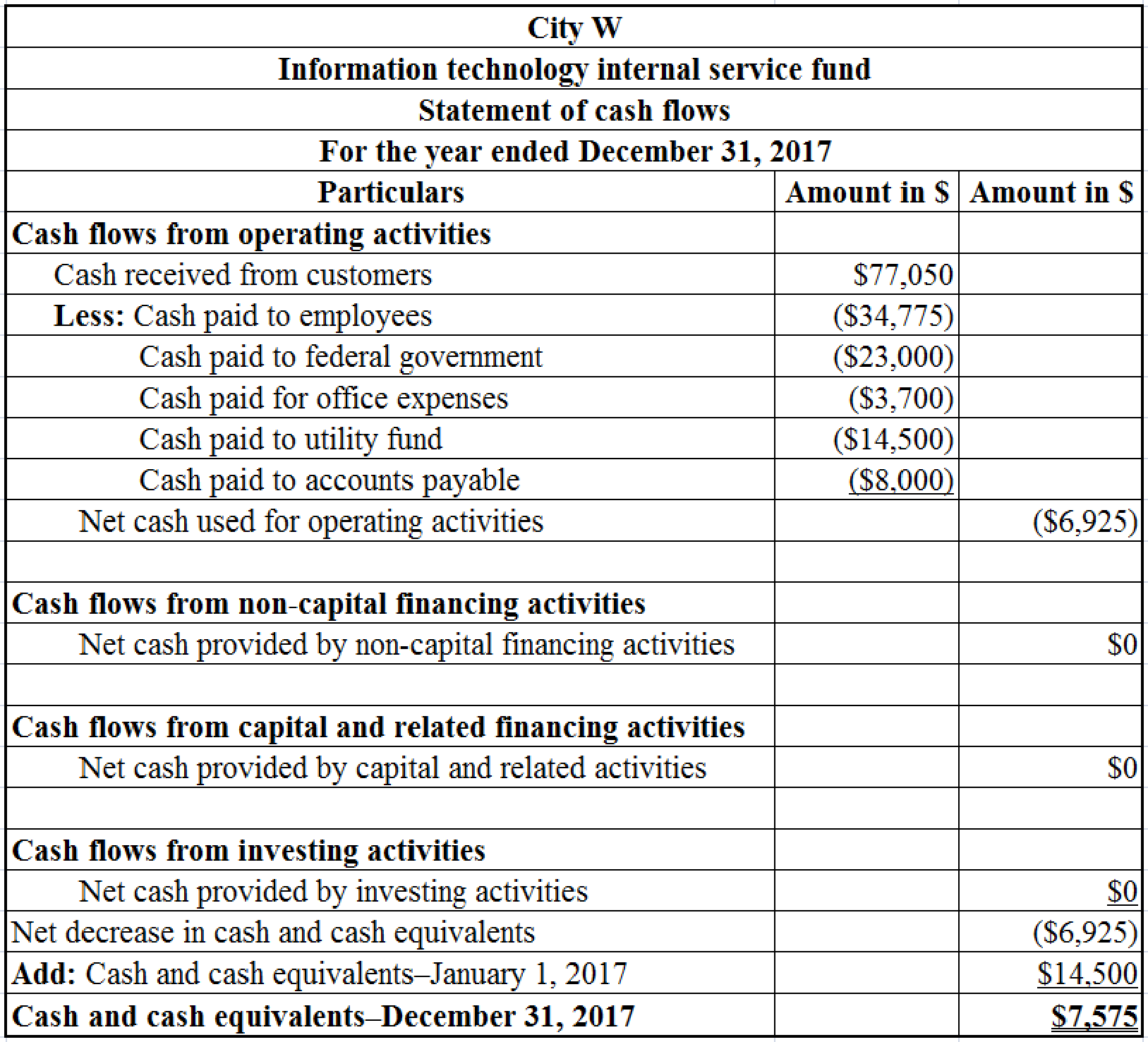

Statement of cash flows: Statement of cash flow is a financial statement that shows the cash and cash equivalents of a company for a particular period of time. It shows the net changes in cash, by reporting the sources and uses of cash as a result of operating, investing, and financing activities of a company.

Prepare “a statement of cash flows” for information technology internal service fund of City W for the year ended December 31, 2017.

Step 1: Prepare the

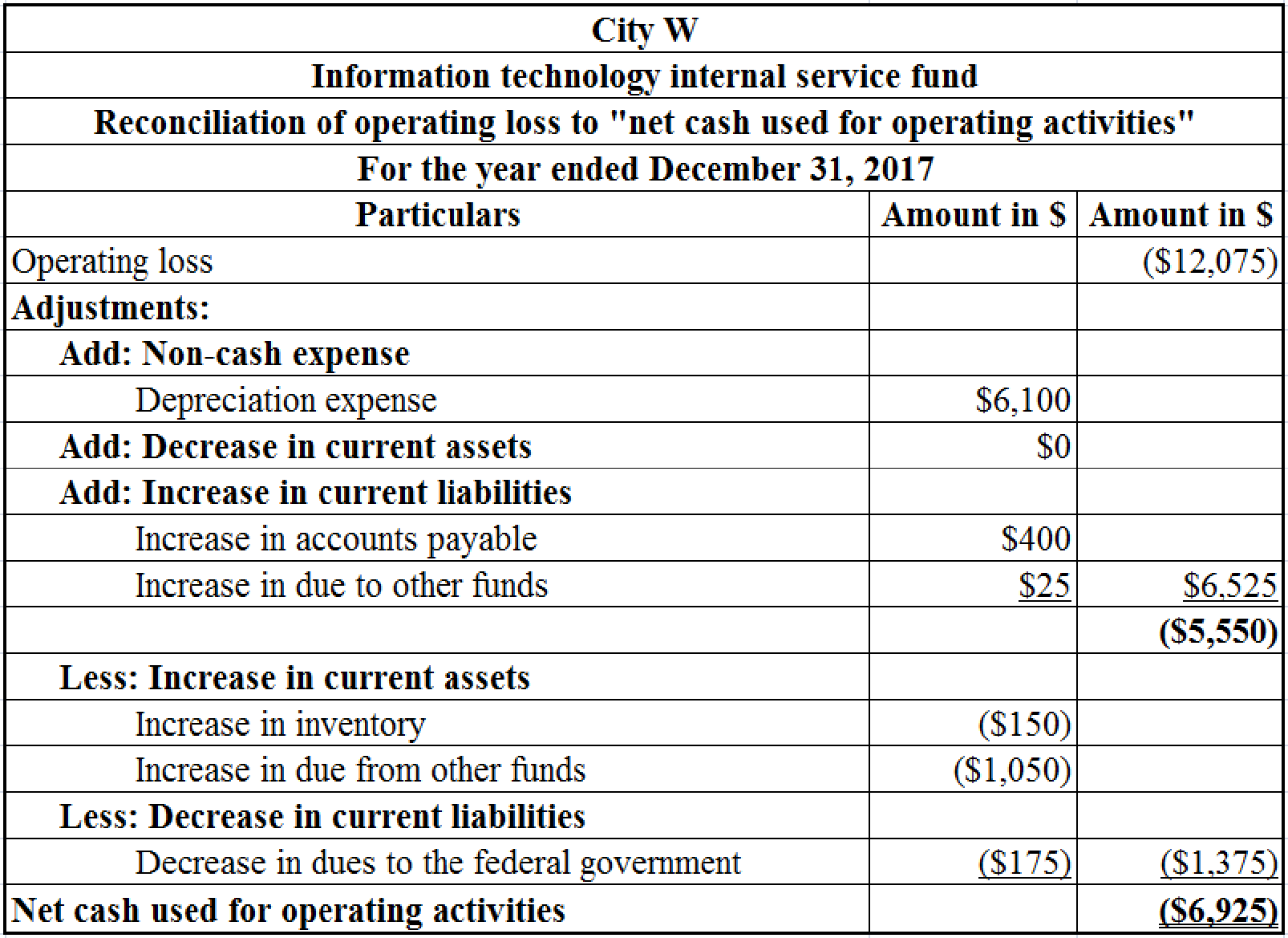

Table (5)

Notes to the above table:

- Determine the increase in accounts payable.

The opening balance of accounts payable is $2,550 and the closing balance of accounts payable is $2,950. Hence, the accounts payable increased by$400

- Determine the increase in “due to other funds”.

The opening balance of “dues to other funds” is $1,200 and the closing balance of “due to other funds” is $1,225. Hence, the “due to other funds” increased by$25

- Determine the increase in inventory.

The opening balance of inventory is $350 and the closing balance of inventory is $500. Hence, the inventory increased by $150

- Determine the increase in “due from other funds”.

The opening balance of “due from other funds” is $4,250 and the closing balance of “due from other funds” is $5,300. Hence, the “due from other funds” increased by$1,050

- Determine the decrease in “due to the federal government”.

The opening balance of “due to the federal government” is $2,650 and the closing balance of “due to the federal government” is $2,475. Hence, the “due to the federal government” increased by $175

Step 2: Prepare “a statement of cash flows”.

Table (6)

(d)

Evaluate the manager’s performance.

(d)

Explanation of Solution

The “statement of revenues, expenses, and changes in fund net position” shows an operating loss of $12,075. The charges collected by the information technology fund are not sufficient to meet its operating expenses.

The manager has not addressed the “user charges policy” of the department. Hence, the fund is incurring a loss. Hence, the manager should estimate the costs of the fund and fix a reasonable user charge to cover the fund’s expenses.

Want to see more full solutions like this?

Chapter 7 Solutions

Accounting for Governmental & Nonprofit Entities

- Don't use ai given answer general accountingarrow_forwardArdor Ltd. purchased a new equipment that is expected to be used in operations for 6 years for $60,000. The salvage value of the equipment after 6 years is $6,000. Assume the equipment was purchased on the first day of the fiscal year so no partial-year depreciation is needed. Using the Straight-Line Depreciation Method, what is the value of accumulated depreciation at the end of year 4?arrow_forwardGeneral Accountingarrow_forward

- Accountingarrow_forwardI am trying to find the accurate solution to this financial accounting problem with the correct explanation.arrow_forwardKD Industries has 30 million shares outstanding with a market price of $20 per share and no debt. KD has had consistently stable earnings and pays a 35% tax rate. Management plans to borrow $200 million on a permanent basis through a leveraged recapitalization in which they would use the borrowed funds to repurchase outstanding shares. The present value of KD's interest tax shield is closest to a. $130 million b. $200 million c. $400 million d. $70 millionarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education