Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 16PA

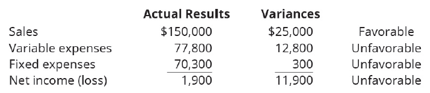

Titanium Blades refines titanium for use in all brands of razor blades. It prepared a static budget for the sales of 5,000 units. These variances were observed:

Determine the static budget and use the information to prepare a flexible budget and analysis for the 6,000 units actually sold.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Can you explain the correct methodology to solve this general accounting problem?

Can you solve this general accounting problem using accurate calculation methods?

Can you help me solve this general accounting question using valid accounting techniques?

Chapter 7 Solutions

Principles of Accounting Volume 2

Ch. 7 - Which of the following is not a part of budgeting?...Ch. 7 - Which of the following is an operating budget? A....Ch. 7 - Which of the following is a finance budget? A....Ch. 7 - Which approach is most likely to result in...Ch. 7 - Which approach requires management to justify all...Ch. 7 - Which of the following is true in a bottom-up...Ch. 7 - The most common budget is prepared for a...Ch. 7 - Which of the operating budgets is prepared first?...Ch. 7 - The direct materials budget is prepared using...Ch. 7 - Which of the following is not an operating budget?...

Ch. 7 - Which of the following statements is not correct?...Ch. 7 - The units required in production each period are...Ch. 7 - The cash budget is part of which category of...Ch. 7 - Which is not a section of the cash budget? cash...Ch. 7 - Which budget is the starting point in preparing...Ch. 7 - Which of the following includes only financial...Ch. 7 - Which budget evaluates the results of operations...Ch. 7 - What is the main difference between static and...Ch. 7 - What is a budget and what are the different types...Ch. 7 - What is the difference between budgeting and...Ch. 7 - What are the advantages and disadvantages of the...Ch. 7 - Why might a rolling budget require more management...Ch. 7 - What information is necessary for the operating...Ch. 7 - What operating budget exists for manufacturing but...Ch. 7 - What is the process for developing a budgeted...Ch. 7 - Which of the financial budgets is the most...Ch. 7 - A company has prepared the operating budget and...Ch. 7 - Fill in the blanks: A flexible budget summarizes...Ch. 7 - What information is included in the capital asset...Ch. 7 - Why does budget planning typically begin with the...Ch. 7 - What steps should be considered it a budget is to...Ch. 7 - Blue Book printing is budgeting sales of 25,000...Ch. 7 - How many units are in beginning inventory it...Ch. 7 - Navigator sells GPS trackers for $50 each. It...Ch. 7 - One Device makes universal remote controls and...Ch. 7 - Sunrise Poles manufactures hiking poles and is...Ch. 7 - Given the following information from Rowdy...Ch. 7 - Each unit requires direct labor of 2.2 hours. The...Ch. 7 - How many units are estimated to be sold it...Ch. 7 - Cash collections for Wax On Candles found that 60%...Ch. 7 - Nonnas Re-Appliance Store collects 55% of its...Ch. 7 - Dream Big Pillow Co. pays 65% of its purchases in...Ch. 7 - Desiccate purchases direct materials each month....Ch. 7 - What is the amount of budgeted cash payments if...Ch. 7 - Halifax Shoes has 30% of its sales in cash and the...Ch. 7 - Cold X, Inc. uses this information when preparing...Ch. 7 - Using the provided budgeted information for...Ch. 7 - The production cost for a waterproof phone case is...Ch. 7 - Lovely Wedding printing is budgeting sales of...Ch. 7 - How many units are in beginning inventory if...Ch. 7 - Barnstormer sells airplane accessories for $20...Ch. 7 - Rehydrator makes a nutrition additive and expects...Ch. 7 - Cloud Shoes manufactures recovery sandals and is...Ch. 7 - Given the following information from Power...Ch. 7 - Each unit requires direct labor of 4.1 hours. The...Ch. 7 - How many units are estimated to be sold if Kino,...Ch. 7 - Cash collections for Renew Lights found that 65%...Ch. 7 - My Aunts Closet Store collects 60% of its accounts...Ch. 7 - Gear Up Co. pays 65% of its purchases in the month...Ch. 7 - Drainee purchases direct materials each month. Its...Ch. 7 - What is the amount of budgeted cash payments if...Ch. 7 - Earthies Shoes has 55% of its sales in cash and...Ch. 7 - Judges Gavel uses this information when preparing...Ch. 7 - Using the following budgeted information for...Ch. 7 - The production cost for UV protective sunglasses...Ch. 7 - Lens Junction sells lenses for $45 each and is...Ch. 7 - The data shown were obtained from the financial...Ch. 7 - Echo Amplifiers prepared the following sales...Ch. 7 - Prepare a budgeted income statement using the...Ch. 7 - Spree Party Lights overhead expenses are: Prepare...Ch. 7 - Relevant data from the Poster Companys operating...Ch. 7 - Fill in the missing information from the following...Ch. 7 - Direct labor hours are estimated as 2,000 in...Ch. 7 - Fitbands estimated sales are: What are the...Ch. 7 - Sports Socks has a policy of always paying within...Ch. 7 - Prepare a flexible budgeted income for 120,000...Ch. 7 - Before the year began, the following static budget...Ch. 7 - Caribbean Hammocks currently sells 75.000 units at...Ch. 7 - Total Pops data show the following information:...Ch. 7 - Identify the document that contains the...Ch. 7 - Titanium Blades refines titanium for use in all...Ch. 7 - Lens & Shades sells sunglasses for $37 each and is...Ch. 7 - The following data were obtained from the...Ch. 7 - TIB makes custom guitars and prepared the...Ch. 7 - Prepare a budgeted income statement using the...Ch. 7 - Prepare a budgeted income statement using the...Ch. 7 - Relevant data from the operating budget of The...Ch. 7 - Fill in the missing information from the following...Ch. 7 - Mesa Aquatics, Inc. estimated direct labor hours...Ch. 7 - Amusement tickets estimated sales are: What are...Ch. 7 - All Temps has a policy of always paying within the...Ch. 7 - Prepare a flexible budgeted income statement for...Ch. 7 - Before the year began, the following static budget...Ch. 7 - Artic Camping Gears currently sells 35,000 units...Ch. 7 - Prob. 14PBCh. 7 - Identify the document that contains the...Ch. 7 - Replenish sells shampoo that removes chlorine from...Ch. 7 - Why is a clear understanding of managements goals...Ch. 7 - It is proper budgeting procedure to begin with...Ch. 7 - How would a human resources department use...Ch. 7 - How would maintenance departments use information...Ch. 7 - How might service industries predict revenue?Ch. 7 - The management of Hess, Inc., is developing a...Ch. 7 - When would a static budget be effective in...Ch. 7 - If management is being evaluated on their ability...Ch. 7 - If management is being evaluated on their ability...

Additional Business Textbook Solutions

Find more solutions based on key concepts

(Record inventory transactions in the periodic system) Wexton Technologies began the year with inventory of 560...

Financial Accounting (12th Edition) (What's New in Accounting)

An experimental composite engine block for an automobile will trim 20 pounds of weight compared with a traditio...

Engineering Economy (17th Edition)

Interest paid on commercial paper. Introduction: Commercial papers are the safest modes of investment. It is th...

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Quick ratio (Learning Objective 7) 510 min. Calculate the quick assets and the quick ratio for each of the foll...

Financial Accounting, Student Value Edition (5th Edition)

E8-16 Understanding internal control, components, procedures, and laws

Learning Objectives 1, 2, 3

Match ...

Horngren's Accounting (12th Edition)

•• B.4. Consider the following linear programming problem:

Operations Management

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please provide the accurate answer to this general accounting problem using appropriate methods.arrow_forwardPlease help me solve this general accounting question using the right accounting principles.arrow_forwardPlease provide the accurate answer to this general accounting problem using valid techniques.arrow_forward

- I need guidance with this general accounting problem using the right accounting principles.arrow_forwardI need guidance with this general accounting problem using the right accounting principles.arrow_forwardCan you explain the correct methodology to solve this general accounting problem?arrow_forward

- Can you help me solve this general accounting question using the correct accounting procedures?arrow_forwardI need help with this general accounting question using the proper accounting approach.arrow_forwardCan you explain the correct approach to solve this general accounting question?arrow_forward

- I am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forwardPlease help me solve this general accounting problem with the correct financial process.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning  Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

What is Risk Management? | Risk Management process; Author: Educationleaves;https://www.youtube.com/watch?v=IP-E75FGFkU;License: Standard youtube license