a.

To determine: The expected dividends for year 1, 2 and 3.

a.

Answer to Problem 12QP

The expected dividends for year 1 are $1.04, year 2 are $1.08 and year 3 are $1.12.

Explanation of Solution

Determine the expected dividends for year 1, 2 and 3

Therefore, the expected dividends for year 1 are $1.04, year 2 are $1.08 and year 3 are $1.12.

b.

To determine: The selling price of stock.

b.

Answer to Problem 12QP

The selling price of stockis $13.

Explanation of Solution

Determine the selling price of stock

Therefore, the selling price of stockis $13.

c.

To determine: The projected stock price three years from now.

c.

Answer to Problem 12QP

The projected stock price three years from nowis $14.62.

Explanation of Solution

Determine the projected stock price three years from now

Therefore, the projected stock price three years from nowis $14.62.

d.

To determine: The projectedcash flows for years 1, 2 and 3.

d.

Answer to Problem 12QP

The projectedcash flows for years 1 are $1.04, year 2 are $1.08 and year 3 are $15.75.

Explanation of Solution

Determine the projected cash flows for years 1, 2 and 3

The cash flows for year 1 and 2 will remain same as $1.04 and $1.08 respectively since the purchase happens only in year 3. The cash flow for year 3 is calculated below,

Therefore, the cash flows for year 3 is $15.75.

e.

To determine: The

e.

Answer to Problem 12QP

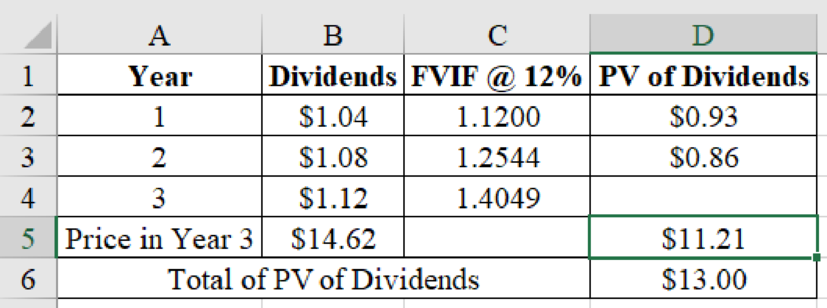

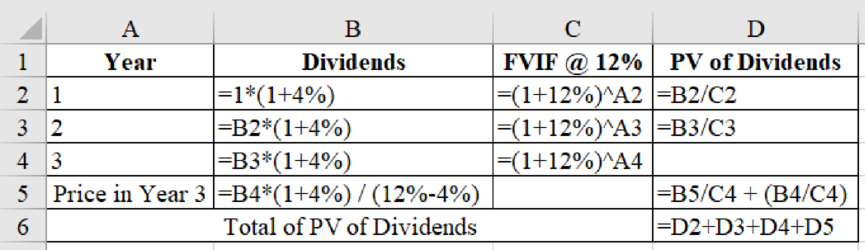

The present value of stream of payments for year 1 are $0.93, year 2 are $0.86 and year 3 are $11.21.

Explanation of Solution

Determine the cash flows for year 1, 2 and 3

Excel Spreadsheet:

Excel Workings:

Therefore, the present value of stream of payments for year 1 are $0.93, year 2 are $0.86 and year 3 are $11.21.

Want to see more full solutions like this?

Chapter 7 Solutions

FUNDAMENTALS OF CORP.FIN.(LL)-W/CONNECT

- You invest $5,000 in a project, and it generates $1,250 annually. How long will it take to recover your investment? Exparrow_forwardThe value of an investment grows from $10,000 to $15,000 in 3 years. What is the CAGR?Soovearrow_forwardSuppose that the treasurer of IBM has an extra cash reserve of $100,000,000 to invest for six months. The six-month interest rate is 9 percent per annum in the United States and 8 percent per annum in Germany. Currently, the spot exchange rate is €1.07 per dollar and the six-month forward exchange rate is €1.05 per dollar. The treasurer of IBM does not wish to bear any exchange risk. Where should they invest to maximize the return? Required: The maturity value in six months if the extra cash reserve is invested in Germany:arrow_forward

- The value of an investment grows from $10,000 to $15,000 in 3 years. What is the CAGR?arrow_forwardYou invest $5,000 in a project, and it generates $1,250 annually. How long will it take to recover your investment?arrow_forwardA company pays an annual dividend of $3 per share, and the current stock price is $50. What is the dividend yield?arrow_forward

- You invest $1,000 in a stock, and after 2 years, it grows to $1,200. What is the annual return?arrow_forwardYou invest $1,000 in a stock, and after 2 years, it grows to $1,200. What is the annual return? Exparrow_forwardWells and Associates has EBIT of $ 72800. Interest costs are $ 18400, and the firm has 15600 shares of common stock outstanding. Assume a 40 % tax rate. a. Use the degree of financial leverage (DFL) formula to calculate the DFL for the firm. b. Using a set of EBIT -EPS axes, plot Wells and Associates' financing plan. c. If the firm also has 1200 shares of preferred stock paying a $ 5.75 annual dividend per share, what is the DFL? d. Plot the financing plan, including the 1200 shares of $ 5.75 preferred stock, on the axes used in part (b). e. Briefly discuss the graph of the two financing plans.arrow_forward

- You invest $5,000 for 3 years at an annual interest rate of 6%. The interest is compounded annually. Need helparrow_forwardWhat is the future value of $500 invested for 3 years at an annual compound interest rate of 4%? Explarrow_forwardYou invest $5,000 for 3 years at an annual interest rate of 6%. The interest is compounded annually.arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education