INTERNATIONAL ACCOUNTING>CUSTOM<

5th Edition

ISBN: 9781307409376

Author: Doupnik

Publisher: MCG/CREATE

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 11EP

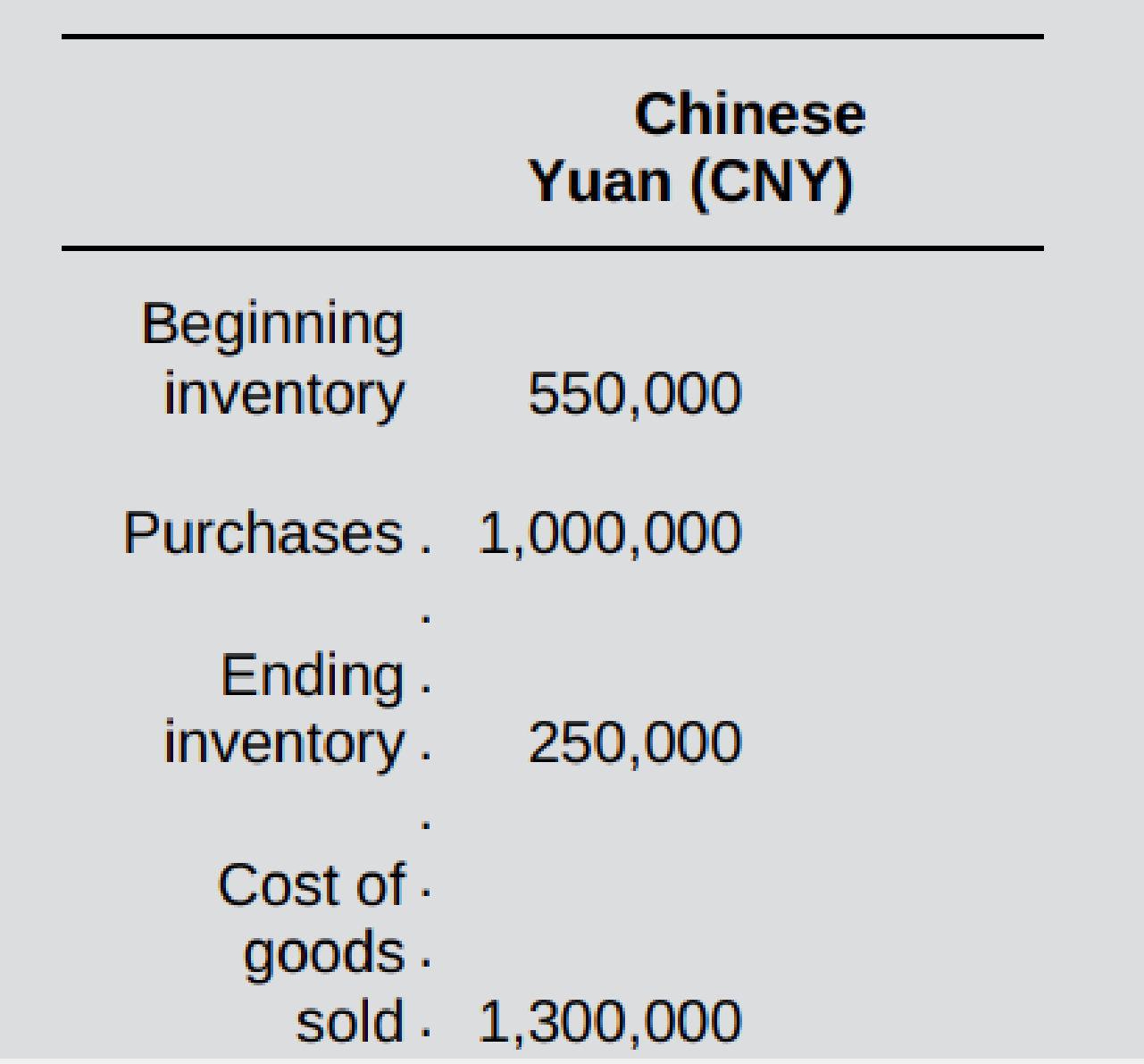

The Year 1 financial statements of the Chinese subsidiary of Singcom Limited (a Singapore-based company) revealed the following:

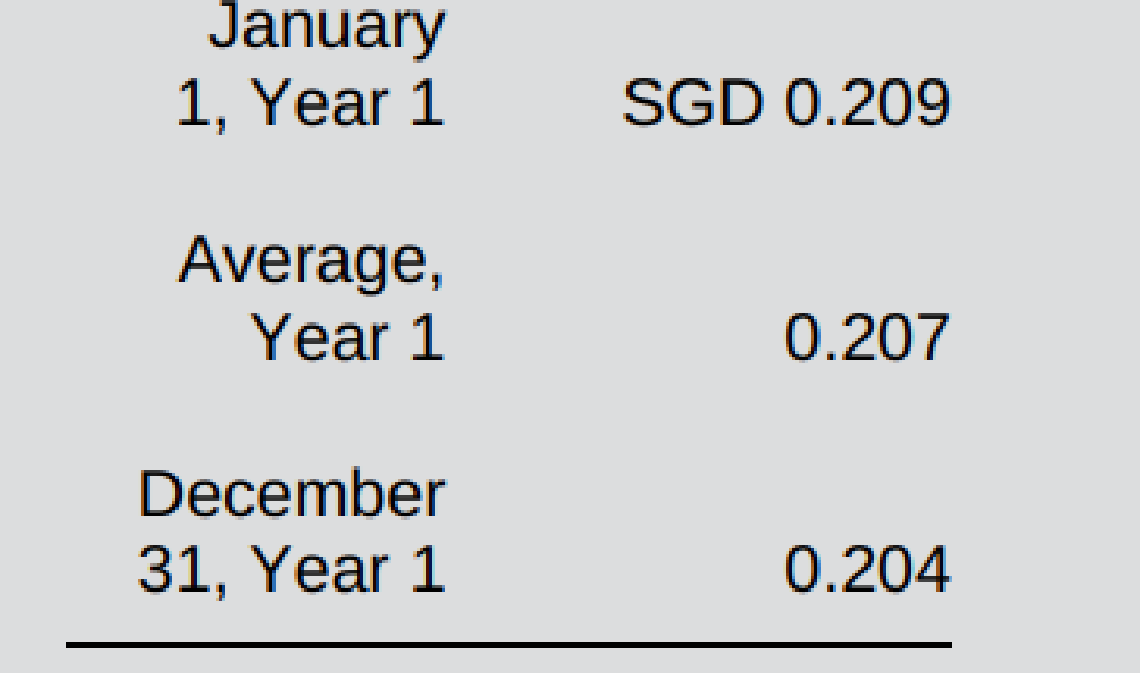

Singapore dollar (SGD) exchange rates for 1 CNY are as follows:

The beginning inventory was acquired in the last quarter of the previous year, when the exchange rate was SGD 0.210 = CNY 1; ending inventory was acquired in the last quarter of the current year, when the exchange rate was SGD 0.205 = CNY 1.

Required:

- a. Assuming that the current rate method is the appropriate method of translation, determine the amounts at which the Chinese subsidiary’s ending inventory and cost of goods sold should be included in Singcom’s Year 1 consolidated financial statements.

- b. Assuming that the temporal method is the appropriate method of translation, determine the amounts at which the Chinese subsidiary’s ending inventory and cost of goods sold should be included in Singcom’s Year 1 consolidated financial statements.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

I am trying to find the accurate solution to this financial accounting problem with the correct explanation.

I need help with this general accounting problem using proper accounting guidelines.

Required: a. Determine the profit margin.

Chapter 7 Solutions

INTERNATIONAL ACCOUNTING>CUSTOM<

Ch. 7 - Prob. 1QCh. 7 - Prob. 2QCh. 7 - Prob. 3QCh. 7 - Prob. 4QCh. 7 - Prob. 5QCh. 7 - 6. What are the major differences between IFRS and...Ch. 7 - Prob. 7QCh. 7 - 8. Which translation method does U.S. GAAP require...Ch. 7 - Prob. 9QCh. 7 - 10. How are gains and losses on foreign currency...

Ch. 7 - Prob. 11QCh. 7 - Prob. 12QCh. 7 - Prob. 1EPCh. 7 - Prob. 2EPCh. 7 - Prob. 3EPCh. 7 - Prob. 4EPCh. 7 - 4. Which of the following best explains how a...Ch. 7 - In the translated financial statements, which...Ch. 7 - Prob. 7EPCh. 7 - Prob. 8EPCh. 7 - Prob. 9EPCh. 7 - Prob. 10EPCh. 7 - The Year 1 financial statements of the Chinese...Ch. 7 -

10. Simga Company's Turkish subsidiary repented...Ch. 7 - Prob. 13EPCh. 7 - Prob. 14EPCh. 7 - Prob. 15EPCh. 7 - Prob. 16EPCh. 7 - Prob. 17EPCh. 7 - Prob. 18EPCh. 7 - 16. Access the most recent annual report for a...Ch. 7 - Prob. 21EPCh. 7 - Prob. 22EPCh. 7 - Prob. 1CCh. 7 - Prob. 2C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ankit's Manufacturing has a total contribution margin of $75,600 on sales of $180,000. Their fixed costs amount to $43,200 per month. If sales were to increase by 15% without any change in fixed costs or contribution margin ratio, what would be the new monthly operating income? Calculate this using the contribution margin approach. Helparrow_forwardI need assistance with this general accounting question using appropriate principles.arrow_forwardPlease explain the correct approach for solving this general accounting question.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

The Exchange Rate and the Foreign Exchange Market [AP Macroeconomics Explained]; Author: Heimler's History;https://www.youtube.com/watch?v=JsKLBpy6cEc;License: Standard Youtube License